Why the death of North Sea oil is a disaster for Britain

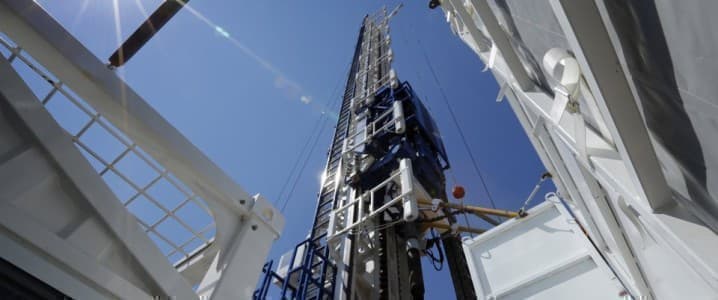

Far out in the North Sea a deserted but massive oil platform awaits its fate. Brent Charlie is the last remainder of the Brent field – a resource so big it once provided a third of the UK’s daily oil needs.

Discovered in the 1970s, the Brent field at one point produced 184 million barrels of oil a year, earning billions for Shell, its owner, plus £20bn in tax revenues for the Exchequer. It was so big it needed four massive platforms to extract its riches – Brent Charlie, Alpha, Bravo and Delta.

Today Alpha, Bravo and Delta have gone, cut from their supports and taken to the scrapyards.

Later this year Brent Charlie will also have its legs cut from under it and be lifted on to Pioneering Spirit – a giant ship specially designed to rip apart decaying oil and gas installations.

Pioneering Spirit and the growing fleet of similar oil rig-slaughtering vessels are set for some busy years. In the waters around the UK, hundreds more oil and gas installations are falling silent. Fifty years after the North Sea bonanza began, the final decline is upon us.

As well as hauling the retired rigs to shore, nearly 8,000 wells that were drilled deep into the seabed must also be plugged.

The decline of the North Sea has implications not just for energy policy and tax income, but public finances more broadly.

We face a huge bill – potentially up to £60bn –

to clean up the North Sea.

More:

gcaptain.com

gcaptain.com