swissaustrian

Yellow Jacket

- Messages

- 2,049

- Reaction score

- 0

- Points

- 156

Sorry swissaustrian,

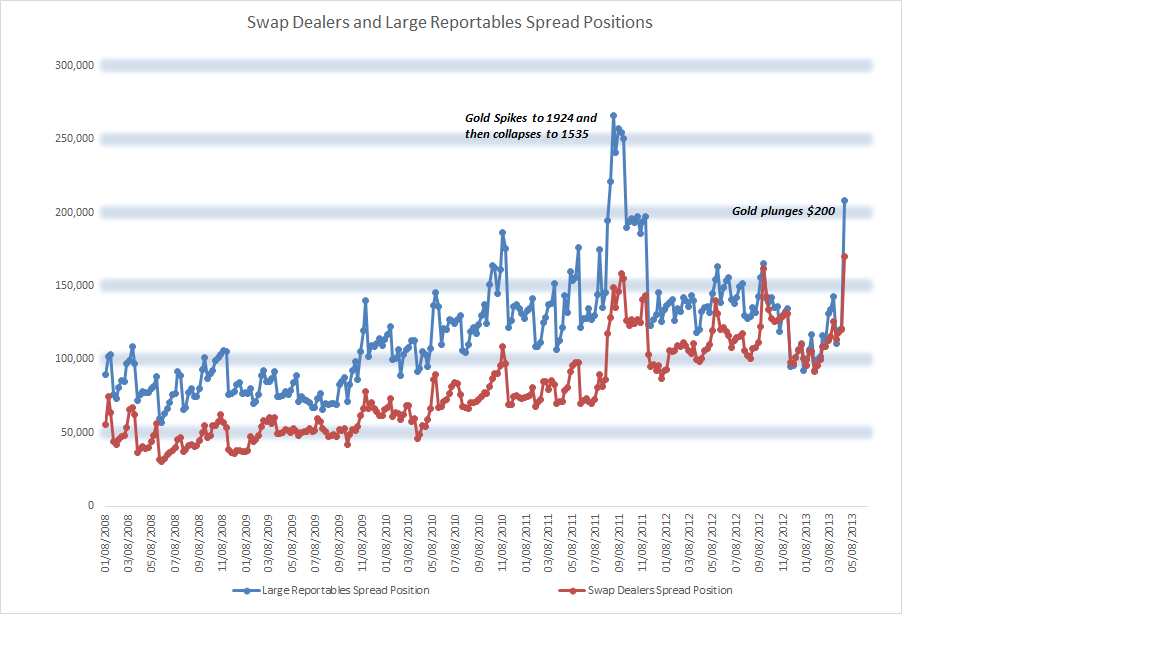

as I think you are gonna see one more major dip on Monday. This will start Sunday night. For what ever reason the stock futures will get Hammered before the open on Monday (Thats why they goosed the market today) (You would think the opposite would happen market down metals up. But we are dealing with criminal intent here and they have conditioned the masses that when the market deflates so do the metals. You know the old saying ? (Tell or telegraph a lie long enough and the masses will begin to believe it) Precious metals will take one more "MONSTER" plunge before the options expiry at the close of the market on Monday. Then Tuesday I still think you will see some pressure because that will be notice day (notice from the option holder that they elect to exersise the option and take physical delivery) The key for the Comex is to stop people from taking physical delivery. (I know the Comex does not settle in metal, but in cash. It's the psyc that counts) Then on Wednesday I see a start of a rebound. This whole paper market is a scam and I really think people are starting to see it. Buy half over the weekend, and half after Tueday would be my recommendation "Spread the Love" so you don't get smoked by the pressman in control of the printing press.

Good luck and thanks for the data ! :wave:

I respect your opinion, but let me provide you the link to the gold op/ex thread: http://www.pmbug.com/forum/f2/options-expiry-manipulation-gold-price-one-chart-229/

As you can see there, op/ex manipulations are usually finished before the day of the expiry. Historically, price management has been undertaken during the 5 prior trading days. I don't think that it's gonna be different this time. High Volatility at op/ex days is dangerous because it might trigger panic liquidations or short squeezes which both lead to higher costs of price manipulations. Additionally, op/ex days usually have high trading volumes, requiring a larger number of contracts to move prices. Mild volatility is therefore the cheapest way to achieve pre-managed prices at op/ex.

We could very well see a stock market plunge on Monday. The UK just got downgraded by Moody's. That has strenghtened the dollar afterhours. I don't think that it's going to rock markets like the US downgrade did, though.

.

.