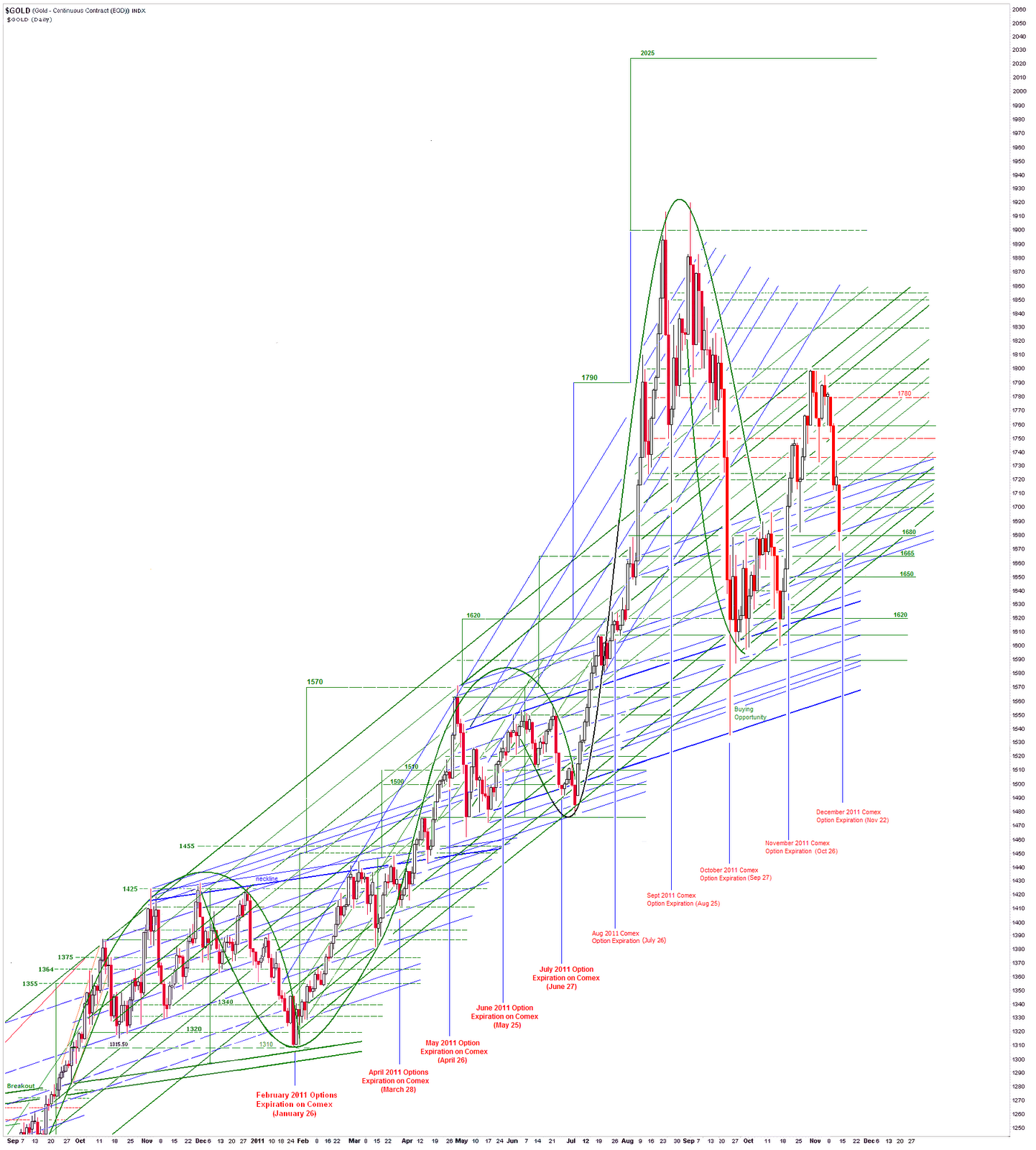

Gold may struggle to make gains over the coming trading session ahead of the expiry of monthly US options. However,

sharp gains could be seen after option expiration – as has often been the case in recent years.

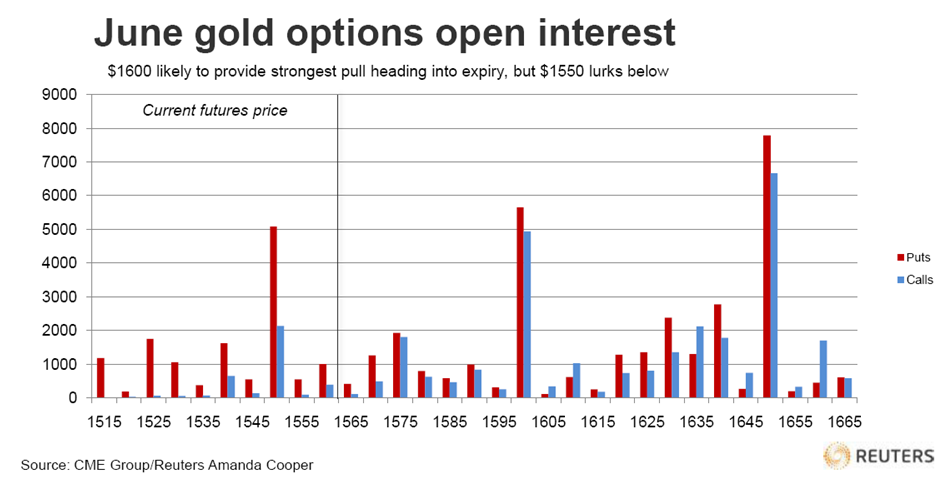

Reuters report that traders said that because the underlying June futures price was trading roughly

between $1,550 and $1,600, where most at-the-money open interest was clustered, it was not clear which would exert a greater “gravitational pull” on the gold price.

Most open interest, which reflects investor positioning, is located at $1,550 and $1,600, with

a firm bias towards the $1,550 level where gold may be guided towards.

Puts, options that give the holder the right, but not the obligation to sell a predetermined amount of an asset at a set price by a certain date,

outnumber calls, or buy options, by nearly 2:1

:

: