You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Silicon Valley Bank failure political tangents

- Thread starter Goldhedge

- Start date

Welcome to the Precious Metals Bug Forums

Welcome to the PMBug forums - a watering hole for folks interested in gold, silver, precious metals, sound money, investing, market and economic news, central bank monetary policies, politics and more.

Why not register an account and join the discussions? When you register an account and log in, you may enjoy additional benefits including no Google ads, market data/charts, access to trade/barter with the community and much more. Registering an account is free - you have nothing to lose!

- Messages

- 18,195

- Reaction score

- 10,964

- Points

- 288

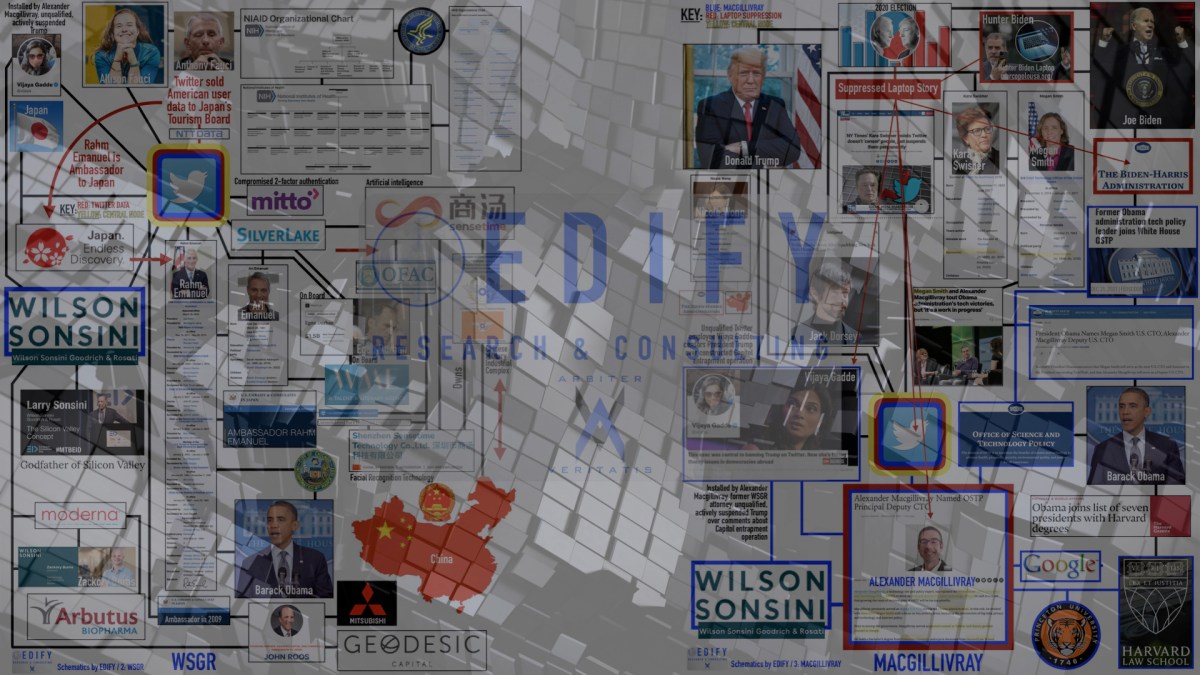

Silicon Valley Bank, Wilson Sonsini Goodrich & Rosati and Larry W. Sonsini

The linkage between Silicon Valley Bank, Wilson Sonsini Goodrich & Rosati and Larry W. Sonsini as resting on existing analysis from EDIFY Research & Consulting.By Political Moonshine

Mar 11, 2023 05:14 PM

View original

Silicon Valley Bank has become insolvent. How much do you know about Silicon Valley Bank, Larry W. Sonsini, Wilson Sonsini Goodrich & Rosati, Twitter, China, the 2020 election, Hunter Biden’s laptop, COVID-19, censorship, the FBI, Obama & Biden? They’re all intricately linked in problematic ways. It all falls back on old analysis from September 2022.

Here’s how beginning with partner and founder of Wilson Sonsini Goodrich & Rosati and the Godfather of Silicon Valley, Larry W. Sonsini.

THIS ARTICLE IS TO RECONCILE LOW RESOLUTION IMAGES IN THE ORIGINAL TWITTER THREAD:

moreHow much do you know about Silicon Valley Bank, Larry W. Sonsini, Wilson Sonsini Goodrich & Rosati, Twitter, China, the 2020 election, Hunter Biden's laptop, COVID-19, censorship, the FBI, Obama & Biden? They're all intricately linked in problematic ways.

Here's how.

.@elonmusk pic.twitter.com/rVIXb09Jpk

— Political Moonshine (@PoliticalMoons2) March 11, 2023

Silicon Valley Bank, Wilson Sonsini Goodrich & Rosati and Larry W. Sonsini

The linkage between Silicon Valley Bank, Wilson Sonsini Goodrich & Rosati and Larry W. Sonsini as resting on existing analysis from EDIFY Research & Consulting.

politicalmoonshine.com

politicalmoonshine.com

Yep, they went woke and then broke. Didn't even have a Risk Management person.

Fatal Distraction? Senior SVB Risk Manager Oversaw Woke LGBT Programs | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

Viking

Yellow Jacket

one of the few times he actually had no problems leaving the podium, he knew exactly where to go and he didn't hesitate or stumble

- Messages

- 18,195

- Reaction score

- 10,964

- Points

- 288

We were forewarned by a certain letter of the alphabet that the financial system was running on fumes and the PTB needed a war to obfuscate the coming crash in the financial sector... because that's what EVERY world war accomplished for the PTB.

(Remember? Ron Paul told us "All Wars Are Banker's Wars!")

The Plan was:

We were supposed to get into a war with Russia, lose said war, and lose our Constitution, but SHE LOST the election!!

That's why it's always been "Russia! Russia! Russia! interference" from the gitgo. We always need a 'bad guy' enemy to pit the people against. Trump got in the way and now we're witnessing their last ditch attempt to create a world war using Ukraine as the patsy.

I think Putin and Trump actually are on the same page. That's why the Deep State went apoplectic when he met with Putin in private for an hour. The (Congress critters) wanted to subpoena the translator even to learn what was discussed between the two leaders.

It's also why Putin handed Trump the soccer ball, i.e., "The ball is in your court."

FFWD to today and everything is going according to plan. Just look at what is being exposed for all to see!

The PTB is FREAKING out and the banking sector is revealing just how fragile their debt-money-system is.

(Remember? Ron Paul told us "All Wars Are Banker's Wars!")

The Plan was:

We were supposed to get into a war with Russia, lose said war, and lose our Constitution, but SHE LOST the election!!

That's why it's always been "Russia! Russia! Russia! interference" from the gitgo. We always need a 'bad guy' enemy to pit the people against. Trump got in the way and now we're witnessing their last ditch attempt to create a world war using Ukraine as the patsy.

I think Putin and Trump actually are on the same page. That's why the Deep State went apoplectic when he met with Putin in private for an hour. The (Congress critters) wanted to subpoena the translator even to learn what was discussed between the two leaders.

It's also why Putin handed Trump the soccer ball, i.e., "The ball is in your court."

FFWD to today and everything is going according to plan. Just look at what is being exposed for all to see!

The PTB is FREAKING out and the banking sector is revealing just how fragile their debt-money-system is.

Last edited:

Cigarlover

Yellow Jacket

- Messages

- 1,684

- Reaction score

- 1,941

- Points

- 283

So where exactly is the money coming from to bail out these banks? They said taxpayers wouldn't be bailing the out but now they are being bailed out. They have a 1/4 trillion just sitting around that they claim doesn't belong to the taxpayer? Where exactly did it come from?

Never mind I see now. Looks like the fed is backstopping everything.

Never mind I see now. Looks like the fed is backstopping everything.

Last edited:

Cigarlover

Yellow Jacket

- Messages

- 1,684

- Reaction score

- 1,941

- Points

- 283

I just don't give a f what people do in their private life. The key word there is private of course. Before this whole alphabet gender movement took shape there wasn't any programs at anyplace I ever worked promoting straight sex between a man and a woman. When did it become normal to promote sex of any type in the workplace?

I do think this chick spent way to much time worrying about hers and others va jay jays and not enough time worrying about the risk management part of her job. Hopefully her next job is at 7-11 restocking the slurpy cups.

I imagine her parents must be super proud too. 1st they find out their offspring is a lesbian and then the same offspring takes down a bank with a 1/4 trillion in assets because she didn't do her job.

The government has pretty much nationalized all banks. So get back to work and pay your taxes in order to reward inept bankers for their poor decisions.

You may want to use electronic banking so you don't have to interact with the transvestite teller hired to show the institutions diversity though.

It is very clear that shit is pretty much OVER.

You may want to use electronic banking so you don't have to interact with the transvestite teller hired to show the institutions diversity though.

It is very clear that shit is pretty much OVER.

- Messages

- 18,195

- Reaction score

- 10,964

- Points

- 288

So where exactly is the money coming from to bail out these banks?

EP. 3019A - [DS] SYSTEM BEING DESTROYED, FED ON THE HOOK FOR ALL BANKS, PUT AN END TO THE ENDLESS

Forbes rated SVB America's best bank, that didn't age well. The [DS]/[CB] banking system is being destroyed. The Fed has now taken control of all deposits for all banks. The setup is complete. Trump said we are entering a 1929 type of crash, the Fed will print and print which will push inflation sky high. In the end gold will destroy the Fed.37m

The Fed, Treasury and FDIC have built a SPV that will provide loans to banks against their Treasuries and MBS collateral at mark to par (mark to fantasy). Essentially, the Fed is raising rates for everyone (markets) but the banks now (who can now get "backdoor" loans to mitigate interest rate exposure).So where exactly is the money coming from to bail out these banks? ... Looks like the fed is backstopping everything.

That statement is nowhere near correct. Hyperbole does not contribute to understanding.... The Fed has now taken control of all deposits for all banks. ...

Last edited:

- Messages

- 34,166

- Reaction score

- 5,800

- Points

- 288

As for political tangents you'll have people pointing fingers at each other, putting the blame on whoever they want to disparage, beating their chests and claiming their sides way of fixing it is better than the other side. After the smoke clears, things will die down and get back to normal - until the next time.

You can say it was the dereg crap in 2018 (dodd-frank, etc.) that caused it. That did have a hand in it (and both sides were involved) but when you get down to the nitty gritty it was greed and bad moves by the banks that caused it.

________________________________________

This is an opinion piece but I think it's worth a read.

www.nakedcapitalism.com

www.nakedcapitalism.com

You can say it was the dereg crap in 2018 (dodd-frank, etc.) that caused it. That did have a hand in it (and both sides were involved) but when you get down to the nitty gritty it was greed and bad moves by the banks that caused it.

________________________________________

This is an opinion piece but I think it's worth a read.

US Officials Make Non-Bailout Bailout of Silicon Valley and Signature Bank and Continue Class Warfare | naked capitalism

An over-zealous Fed pushed a few banks, including the big and super connected Silicon Valley Bank, over the edge. A bailout was a given.

Sen. Warren has sunk her teeth into this event and will take every opportunity to grandstand.

www.zerohedge.com

www.zerohedge.com

Senator Elizabeth Warren tweeted Tuesday morning that Federal Reserve Chairman Jerome Powell "must recuse himself" from the Fed's investigation into the demise of Silicon Valley Bank.

...

Meanwhile, many folks on Twitter responded negatively to the senator's tweet, indicating blame resides on lawmakers.

...

Senator Warren Calls For Powell's Recusal From Fed's Bank Failure Investigation | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

Bold emphasis is mine:

www.reuters.com

www.reuters.com

Bolded comment relates to my comment about narrow banking.

U.S. regulators may have stemmed a banking crisis by guaranteeing deposits of collapsed Silicon Valley Bank (SVB), but some experts warn that the move has encouraged bad investor behaviour.

...

Yet by guaranteeing that depositors would lose no money, authorities have again raised the question of moral hazard - removal of people's incentive to guard against financial risk.

"This is a bailout and a major change of the way in which the U.S. system was built and its incentives," said Nicolas Veron, senior fellow at the Peterson Institute for International Economics in Washington. "The cost will be passed on to everyone who uses banking services."

"If all bank deposits are now insured, why do you need banks?"

...

"... If the Fed is now backstopping anyone facing asset/rates pain, then they are de facto allowing a massive easing of financial conditions as well as soaring moral hazard," Rabobank bank strategists Michael Every and Ben Picton wrote in a note to clients.

...

Experts flag moral hazard risk as U.S. intervenes in SVB crisis

U.S. regulators may have stemmed a banking crisis by guaranteeing deposits of collapsed Silicon Valley Bank (SVB), but some experts warn that the move has encouraged bad investor behaviour.

Bolded comment relates to my comment about narrow banking.

Savage. Just savage...

public.substack.com

public.substack.com

EXCLUSIVE: Senator Mark Kelly Called For Social Media Censorship To Prevent Bank Runs

Democrats are demanding ever-more censorship in a widening social media panic

- Messages

- 34,166

- Reaction score

- 5,800

- Points

- 288

You can say it was the dereg crap in 2018 (dodd-frank, etc.) that caused it.

Not the exact cause but like I said earlier - it did help. Whole lotta people involved.

From the link:

Republicans and Democrats in both chambers of Congress approved a rollback of financial regulations in 2018 that may have contributed to the failure of Silicon Valley Bank.