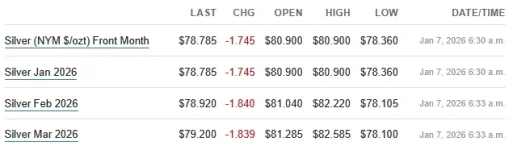

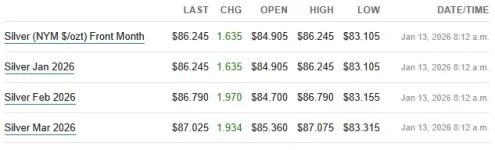

Monday morning 1-5 in silver. Silver spot jumped to ~$76 Sunday night as China wakes up for trading in the New Year. 2026 begins in earnest ...

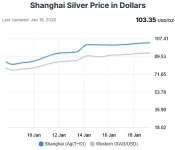

SGE silver holds above $81. It looks like China is dictating the price now.

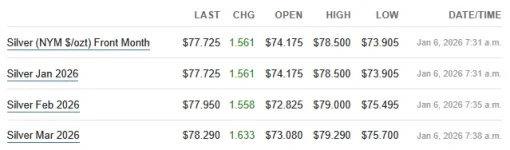

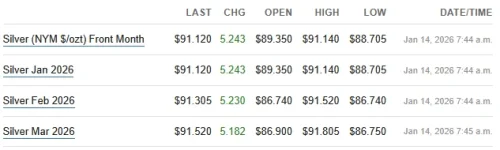

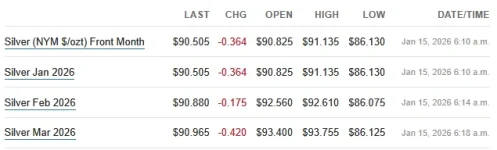

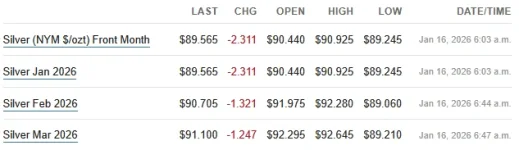

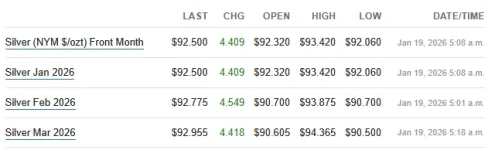

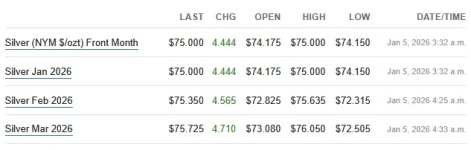

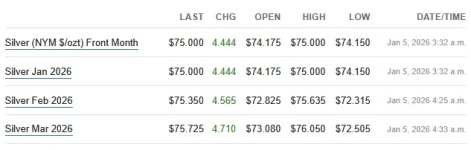

With a current spot price of $76.16, EFP spreads:

Jan26 = -$1.16 vs -$2.29 Saturday

Feb26 = -$0.81 vs -$2.06

Mar26 = -$0.43 vs -$1.83

EFP spreads have narrowed greatly overnight as China trading re-opens. Will the EFP spreads be sufficient to encourage COMEX silver to flow to London now?

Feb26 is at $85.25/ozt

Mar26 is at $84.52/ozt

$0.73/ozt backwardation vs $0.94/ozt Saturday

Backwardation narrowed, but still in the $0.70-$1.00 range. Seems like both China and India are hungry for silver.

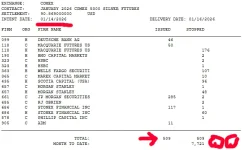

Silver stock report due Jan 8 and will probably be a ridiculous number, but we can estimate what it likely really is:

(previous post)

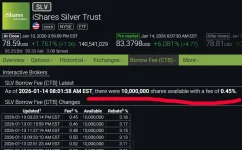

- Negative EFP spread narrowing, waiting to see if COMEX is sending silver to London

- SGE/SFE at >$81 silver, maintains big premium to LBMA spot

- Indian futures backwardation >$.0.70

- LBMA free float likely ~3,554 metric tons (114M ozt) or just ~4M ozt liquid

China

SGE silver holds above $81. It looks like China is dictating the price now.

EFP spread

With a current spot price of $76.16, EFP spreads:

Jan26 = -$1.16 vs -$2.29 Saturday

Feb26 = -$0.81 vs -$2.06

Mar26 = -$0.43 vs -$1.83

EFP Commentary

EFP spreads have narrowed greatly overnight as China trading re-opens. Will the EFP spreads be sufficient to encourage COMEX silver to flow to London now?

Indian MCX Futures

Feb26 is at $85.25/ozt

Mar26 is at $84.52/ozt

$0.73/ozt backwardation vs $0.94/ozt Saturday

Backwardation narrowed, but still in the $0.70-$1.00 range. Seems like both China and India are hungry for silver.

LBMA

Silver stock report due Jan 8 and will probably be a ridiculous number, but we can estimate what it likely really is:

(previous post)

Big Picture

- Negative EFP spread narrowing, waiting to see if COMEX is sending silver to London

- SGE/SFE at >$81 silver, maintains big premium to LBMA spot

- Indian futures backwardation >$.0.70

- LBMA free float likely ~3,554 metric tons (114M ozt) or just ~4M ozt liquid