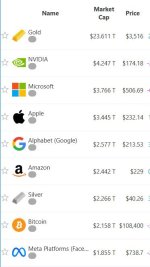

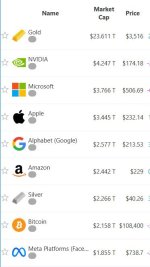

Occasionally, I see folks referring to silver flipping bitcoin or bitcoin flipping silver and usually with a screenshot of a list like this one:

8marketcap.com

8marketcap.com

In the fine print near the bottom of the page they explain:

$2.266T @ $40.26/toz implies an available supply of 56,284,153,005.46448 troy ounces or 1,750,633 metric tons. Their methodology is clearly orders of magnitude outside of reality. They should be estimating the measure of silver that is available to the market that determines the price. In the case of silver, that would be the measure of available London Good Delivery silver bars. As of the end of July, the total vaulted silver in the LBMA + COMEX + SGE/SFE + PSLV was 48,554.95 metric tons. That includes metal owned by ETFs, so it's the total measure, not just free float actually available to markets for trade. If we only consider free float, we're looking at 19,745.532 metric tons. Using their $40.26/toz price (which isn't current spot, so I'm not sure where it came from), that gives us a range for a more realistic "market cap" at:

634,833,600 toz * $40.26 = $25,558,400,736 (free float ~ $25.5B)

1,561,078,000 toz * $40.26 = $62,849,000,280 (total vaulted silver ~ $62.8B)

Infinite Market Cap

Infinite Market Cap ranks the world's top assets by Market Cap. Including precious metals such as Gold, Stocks, ETFs and cryptocurrencies

In the fine print near the bottom of the page they explain:

...

What is the market capitalization of an asset?

The Market Cap of an asset is an estimate of its total value according to its current market price. Depending on the asset type it is calculated in different ways:...

- For precious metals the Market Cap is calculated by multiplying the its price with an estimation of the quantity of metal that has been mined so far. These estimations are updated annualy

$2.266T @ $40.26/toz implies an available supply of 56,284,153,005.46448 troy ounces or 1,750,633 metric tons. Their methodology is clearly orders of magnitude outside of reality. They should be estimating the measure of silver that is available to the market that determines the price. In the case of silver, that would be the measure of available London Good Delivery silver bars. As of the end of July, the total vaulted silver in the LBMA + COMEX + SGE/SFE + PSLV was 48,554.95 metric tons. That includes metal owned by ETFs, so it's the total measure, not just free float actually available to markets for trade. If we only consider free float, we're looking at 19,745.532 metric tons. Using their $40.26/toz price (which isn't current spot, so I'm not sure where it came from), that gives us a range for a more realistic "market cap" at:

634,833,600 toz * $40.26 = $25,558,400,736 (free float ~ $25.5B)

1,561,078,000 toz * $40.26 = $62,849,000,280 (total vaulted silver ~ $62.8B)