- Messages

- 471

- Reaction score

- 305

- Points

- 168

Craig Hemke, I came to know him when he was known as chartist Turd Ferguson, a successful blog writer with a lively community of enthusiastic followers.

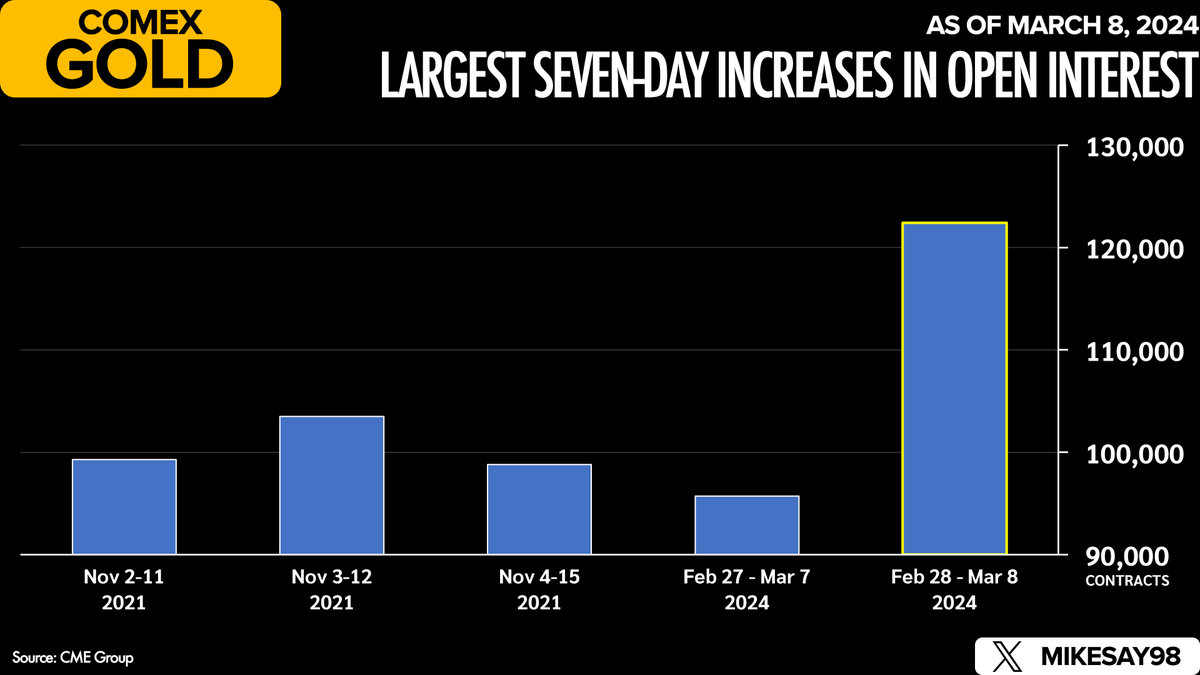

After finishing 2023 on an uptick, the COMEX precious metal prices are once again moving lower and dragging down investor sentiment. Last year we endured similar periods, and most were followed by significant price rallies. As such, are we on the doorstep of the first rally of 2024?

Where are we currently in terms of RSI? COMEX gold is at 46, but COMEX silver and the GDX are at 33. So, we're not yet screaming "OVERSOLD" and "BOTTOM" but we're getting close.

What other signs are out there? Let's look at a couple of other indicators and "fundamentals".

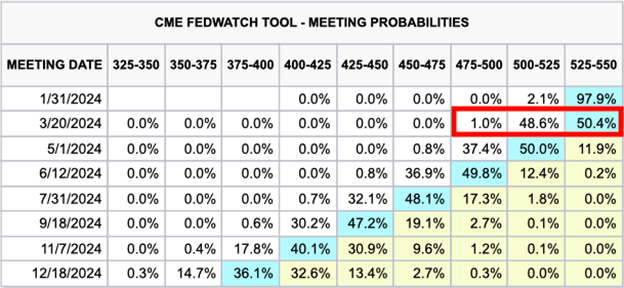

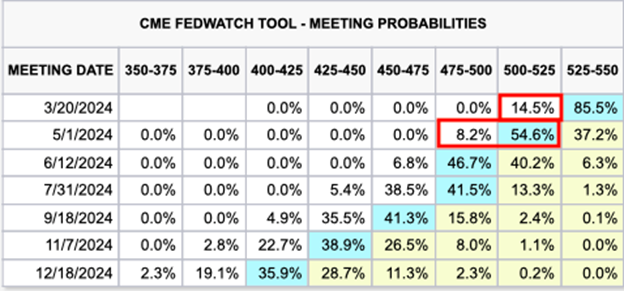

First, as we wrote last week, the markets and the investing public were in major need of a reset of their rate cut expectations as the year began. That has now taken place. Where "the markets" had been almost 90% certain of a fed funds rate cut in March, the consensus is now a more reasonable 40%.

Another factor that has been hindering price the first three weeks of the new year has been a rally in the dollar index.

Take a look below. Yes, this has been a solid bounce in the index, but for now it's just that—a bounce within an ongoing downtrend. Until it makes a new "higher high" above 104.50, technical analysts will note that the current pattern can be interpreted as simply another "bear flag" consolidation before the downtrend resumes. If the index rolls over here and begins dropping toward 101 again, the COMEX metals will catch a sustained bid.

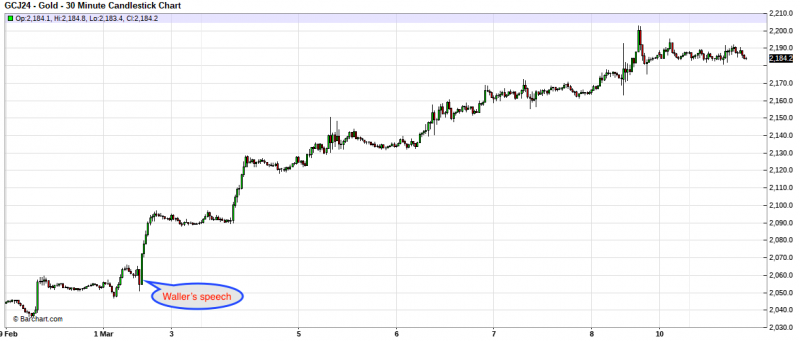

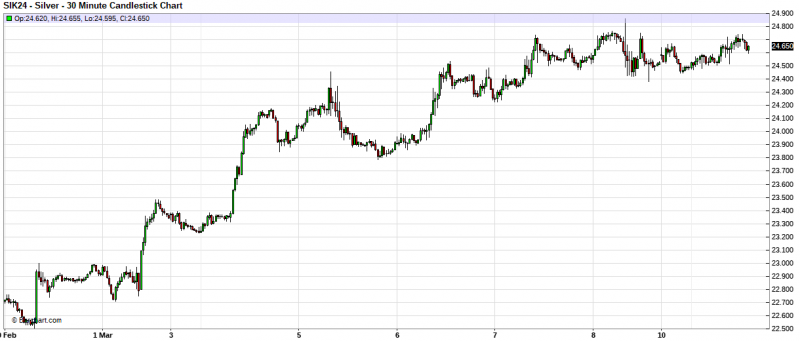

The prices of COMEX gold and silver have also moved into areas where we should expect some support. You might expect this after the losses we've seen over the past three weeks. Of course, the charts can never fully tell the tale and lower prices might still be coming, but $2000 gold and $22 silver have been significant support levels before, and I expect that to continue.

Read More

Searching for a Low in Gold

After finishing 2023 on an uptick, the COMEX precious metal prices are once again moving lower and dragging down investor sentiment. Last year we endured similar periods, and most were followed by significant price rallies. As such, are we on the doorstep of the first rally of 2024?

Where are we currently in terms of RSI? COMEX gold is at 46, but COMEX silver and the GDX are at 33. So, we're not yet screaming "OVERSOLD" and "BOTTOM" but we're getting close.

What other signs are out there? Let's look at a couple of other indicators and "fundamentals".

First, as we wrote last week, the markets and the investing public were in major need of a reset of their rate cut expectations as the year began. That has now taken place. Where "the markets" had been almost 90% certain of a fed funds rate cut in March, the consensus is now a more reasonable 40%.

Another factor that has been hindering price the first three weeks of the new year has been a rally in the dollar index.

Take a look below. Yes, this has been a solid bounce in the index, but for now it's just that—a bounce within an ongoing downtrend. Until it makes a new "higher high" above 104.50, technical analysts will note that the current pattern can be interpreted as simply another "bear flag" consolidation before the downtrend resumes. If the index rolls over here and begins dropping toward 101 again, the COMEX metals will catch a sustained bid.

The prices of COMEX gold and silver have also moved into areas where we should expect some support. You might expect this after the losses we've seen over the past three weeks. Of course, the charts can never fully tell the tale and lower prices might still be coming, but $2000 gold and $22 silver have been significant support levels before, and I expect that to continue.

Read More