- Messages

- 37,645

- Reaction score

- 6,478

- Points

- 288

Interesting vid by Nick (FA)

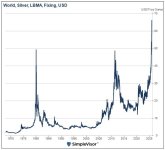

With the price of silver blasting through $60 an ounce, how far can silver go? I look at many different indicators to get an idea of what price you might want to sell silver. I look back at the silver futures charts from 1980, 2011, and today to see the similarities. Are we in another silver bubble right now?

I also look back at videos from Mike Maloney of GoldSilver.com before the 2011 run up in silver and after when silver sold off. I show what the experts were saying on the way up and what they were saying when the price of silver was crashing. If you followed their advice, you were underwater for about 14 years on your silver purchases.

26:23

Will SILVER Prices Above $60 Repeat the 2011 Crash?

Dec 10, 2025With the price of silver blasting through $60 an ounce, how far can silver go? I look at many different indicators to get an idea of what price you might want to sell silver. I look back at the silver futures charts from 1980, 2011, and today to see the similarities. Are we in another silver bubble right now?

I also look back at videos from Mike Maloney of GoldSilver.com before the 2011 run up in silver and after when silver sold off. I show what the experts were saying on the way up and what they were saying when the price of silver was crashing. If you followed their advice, you were underwater for about 14 years on your silver purchases.

26:23