For years critics of U.S. central-bank policy have been dismissed as Negative Nellies, but the ugly truth is staring us in the face: Stock-market advances remain a game of artificial liquidity and central-bank jawboning, not organic growth. And now the jig is up.

...

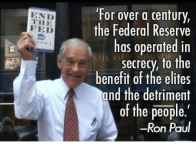

What’s the larger message here? Free-market price discovery would require a full accounting of market bubbles and the realities of structural problems, which remain unresolved. Central banks exist to prevent the consequences of excess to come to fruition and give license to politicians to avoid addressing structural problems. And by preventing these market forces from playing out at each sign of trouble, the can gets kicked further and further down the road. Each successive recovery keeps the illusion alive, but “accommodation” requires ever-lower rates before the monsters return. In the meantime, debt keeps expanding, while each recovery produces less and less organically driven growth, and ever-higher wealth inequality. This is what this system produces.

...

https://www.marketwatch.com/story/stock-market-investors-its-time-to-hear-the-ugly-truth-2019-01-05