Give up on ETF's. They are a MAJOR way they control prices.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

2025 crypto trading and market thread

- Thread starter searcher

- Start date

Welcome to the Precious Metals Bug Forums

Welcome to the PMBug forums - a watering hole for folks interested in gold, silver, precious metals, sound money, investing, market and economic news, central bank monetary policies, politics and more.

Why not register an account and join the discussions? When you register an account and log in, you may enjoy additional benefits including no Google ads, market data/charts, access to trade/barter with the community and much more. Registering an account is free - you have nothing to lose!

- Messages

- 34,774

- Reaction score

- 5,909

- Points

- 288

Coinbase shares slide after posting Q4 revenue surge: CNBC Crypto World

Feb 14, 2025 #CNBC #cnbctvOn today's episode of CNBC Crypto World, bitcoin closes the week trading at the $97,000 level. Shares of Coinbase drop after reporting a surge of more than 130% in revenue from last year. Also, Tether CEO Paolo Ardoino reacts to a recent JPMorgan research report suggesting the stablecoin issuer may have to sell its bitcoin to comply with new U.S. proposals.

10:51

Chapters

00:00 - CNBC Crypto World, Feb 14, 2025

0:25 - Bitcoin climbs

0:54 - The headlines

3:16 - Tether's Paolo Ardoino

- Messages

- 34,774

- Reaction score

- 5,909

- Points

- 288

Came across this by accident. Thought it was neat,

More:

Different dude.

www.ladbible.com

www.ladbible.com

More:

12-Year-Old’s Lost Video Has Resurfaced, Discussing Bitcoin at $8 and the Power of Peer-to-Peer Transactions

Different dude.

Incredible life man who told people to buy $1 of Bitcoin in 2013 now lives 12 years later

Davinci Jeremie is the bloke who urged everyone to take a chance on Bitcoin back in 2013 and he's now reaping the rewards of taking a chance on crypto.

- Messages

- 34,774

- Reaction score

- 5,909

- Points

- 288

Interesting look at crypto.

goldseek.com

goldseek.com

Bitcoin Has No Value; Neither Does Ethereum, XRP, Etc.

How do you determine a value for nothing, i.e., Bitcoin? A house has value. Companies that produce and provide goods and services have value. Real money (i.e. gold) has value.

Interesting look at crypto. ...

Author confused the three functions of money with the characteristics of money. He also fails acknowledge that value is subjective. He does not find value in BTC, but that doesn't mean everyone agrees - else markets wouldn't be trading it for near $100k after 10+ years of existence. There are a lot of valid criticisms of Bitcoin, but it's a stretch to claim it has zero value given a decade plus trading history with institutional and nation state interest.

Also, the author briefly opens his umbrella to all crypto, but limits his commentary to just Bitcoin. There are a lot of interesting use cases for different crypto platforms including (but not limited to) Real World Asset (RWA) tokenization, web3 gaming, DePIN, decentralized finance (DeFI) and enabling decentralized governance organizations (DUNAs, DAOs) . The author really needs to evaluate each project on it's own merits.

What's going on with Eth overnight? Seems to be rallying esp vs Solana.

I'm not sure. Checking CMC, I see Ethereum (ETH) up 4.33% over the last 24h. I see Cardano (ADA) up 7.29%. Many others I keep tabs on up between 2% and 4%. Looks to me like Solana (SOL) is the outlier (and laggard). Might be some meme coin hangover/contagion from LIBRA (which like TRUMP and MELANIA were launched on the Solana blockchain).

- Messages

- 34,774

- Reaction score

- 5,909

- Points

- 288

EXCLUSIVE: Bitcoin Has 'Capacity' To Become Legal Tender In Europe, Says EU Member Of Parliament Sarah Knafo: 'I Am Going To Fight The Digital Euro' And The Totalitarian ECB

Within the first week of his inauguration, President Donald Trump signed an executive order that included a directive to evaluate the creation of a "strategic national digital assets stockpile." The Federal Reserve has also shunned plans to create a central bank digital currency, setting a conducive ecosystem for cryptocurrencies to grow.More:

https://www.msn.com/en-us/money/oth...tal-euro-and-the-totalitarian-ecb/ar-AA1z9DPV

- Messages

- 34,774

- Reaction score

- 5,909

- Points

- 288

You guys have seen (and posted) Michael Bordenaro's vids about real estate a good number of times on the forum. Today he's talking about bitcoin with a guy by the name of Matt Barnes. I had no clue who Barnes is nor what he does so I dug around a bit.

markets.businessinsider.com

markets.businessinsider.com

Matt seems like an interesting character, and I like Mike's vids, so I figured why not. Just posting as some food for thought and entertainment. It's an hour long. May seem boring at first but it's pretty interesting......imo.

Today I am talking to someone who has millions of dollars invested into Bitcoin and believes it will be the future of money. As more people realize they are being ripped off by fiat currencies, more people will likely gravitate towards gold, silver and possibly even bitcoin.

Watch my first video with Matt here: • PROOF! The Housing Market HAS ALREADY...

• PROOF! The Housing Market HAS ALREADY...

CEO of Go VIP Worldwide, Matthew Barnes, Inks Deal with Mortgage Company Founder Robert Lombardo of the Florida Money Network, LLC.

Go VIP Worldwide, a company founded by business titan Matt Barnes, is excited to announce their latest partnership with Florida Money Network, L...

Matt seems like an interesting character, and I like Mike's vids, so I figured why not. Just posting as some food for thought and entertainment. It's an hour long. May seem boring at first but it's pretty interesting......imo.

Bitcoin: A SCAM? OR THE FUTURE OF MONEY

Feb 17, 2025Today I am talking to someone who has millions of dollars invested into Bitcoin and believes it will be the future of money. As more people realize they are being ripped off by fiat currencies, more people will likely gravitate towards gold, silver and possibly even bitcoin.

Watch my first video with Matt here:

What's going on with Eth overnight? Seems to be rallying esp vs Solana.

Looks like Solana is going down...... Looks to me like Solana (SOL) is the outlier (and laggard). ...

BREAKING: SolanaFloor has obtained exclusive video evidence exposing a $200M+ memecoin extraction scheme tied to

@KelsierVentures, @MeteoraAG and @WEAREM3M3_ .

The footage, featuring DeFi Tuna Founder @CavemanDhirk and Ben Chow, lends further credibility to allegations of coordinated market manipulation.

- Messages

- 34,774

- Reaction score

- 5,909

- Points

- 288

Metaplanet Now Holds 2,100 BTC, Purchases a Further 68 BTC

Metaplanet reaches a milestone of 0.01% of the total bitcoin supply.

- Messages

- 34,774

- Reaction score

- 5,909

- Points

- 288

U.S. Senators Push for SEC to Rethink Crypto Staking in Exchange Funds

The Securities and Exchange Commission blocked staking when crypto exchange-traded funds were granted, but the lawmakers suggest the SEC may have been off-base.

U.S. Marshals Service, Managing Billions of Seized Assets, Can't Say How Much Crypto It Holds

The agency has been plagued with procedural and organizational issues for years.

- Messages

- 34,774

- Reaction score

- 5,909

- Points

- 288

Coinbase says SEC will end lawsuit against the exchange: CNBC Crypto World

Feb 21, 2025 #CNBC #cnbctvOn today’s episode of CNBC Crypto World, Solana plunges on the week as meme coin mania subsides. Plus, Coinbase says the SEC is planning to drop its lawsuit against the crypto exchange, pending commissioner approval. And Andrew Fierman of Chainalysis discusses the rise of pig butchering in 2024.

8:38

Chapters

00:00 - CNBC Crypto World, Feb 21, 2025

0:21 - Bitcoin flat

0:50 - The headlines

3:12 - Andrew Fierman of Chainalysis

Deribit's options market for Solana's SOL token has become active, with whales engaging in bearish bets as the token's price continues to decline ahead of an impending multi-billion dollar unlock.

...

"Solana (SOL) will have a major token unlock event on March 1, releasing 11.2 million SOL tokens, valued at approximately $2.07 billion. This represents 2.29% of the total supply. A significant portion of the unlock comes from the FTX estate and a foundation sale," Chen said.

Chen explained that the large unlock could breed market volatility as it accounts for nearly 59% of SOL's daily spot trading volume. Hence, its natural to see a lot of hedging flow in put options in anticipation of a potential extended SOL price slide.

"Many traders would also take this opportunity to long Vol[atility] to generate good yield," Chen noted.

Solana News: SOL Meltdown and Impending Token Unlock Spark Whale Engagement in Bearish Options Plays on Deribit

SOL put options accounted for most of the block trades that crossed the tape on Deribit last week.

Sounds like choppy waters ahead for SOL trading.

Citadel Securities, the leading financial services provider and trading firm, is setting its eyes on the crypto market-making business. Sources told Bloomberg that the firm plans to become a liquidity provider on major exchanges like Coinbase, Binance, and Crypto.com.

The market-making giant initially plans to establish trading teams outside the US once approved on exchanges, the people said. The firm’s commitment level may vary depending on how new regulations develop in the coming months.

This marks a shift from Citadel Securities’ previously cautious approach to crypto market-making. The firm has maintained limited involvement in crypto trading, avoiding retail-focused exchanges due to regulatory uncertainty in the US.

...

More:

Market-making giant Citadel Securities to explore crypto liquidity services, spurred by Trump's support

Citadel Securities plans to offer crypto liquidity services on major exchanges, marking a shift in its cautious crypto market approach.

cryptobriefing.com

cryptobriefing.com

Cryptos getting smacked a bit after hours. Bitcoin nearing its danger support line. Would really like to pick up some maybe Theta and Sol here soon.

No I think there are big liquidity issues lurking around the corner and dark places.

Kolbeissi Letter said:Did liquidity in crypto just dry up?

Crypto markets have now erased -$325 BILLION of market cap since Friday morning.

At 5:00 PM ET today, crypto lost -$100 billion in 1 HOUR without any major headlines.

What is happening with crypto? Let us explain.

Over the last 24 hours alone, we have seen ~$150 billion liquidated from the crypto market.

Selling has broadened with just about all crypto assets falling sharply.

Even the memecoin market appears to have lost a significant portion of its liquidity.

So, what's happening?

It appears to have all began with Solana which is now down -22% since Friday.

Amid the memecoin frenzy, Solana saw extreme relative strength.

However, as memecoins began to fade, Solana also began to fade.

For a while, selling in Solana was largely isolated from Bitcoin.

However, as the S&P 500 began selling off on Friday, Bitcoin joined the downward move.

As seen below, the drop in the S&P 500 came with an acceleration of selling in Bitcoin.

Now, Bitcoin is losing its relative strength after breaking below $98,000 support today.

It's rather strange that this comes hours after Citadel made a major pivot on their crypto stance.

Today, Bloomberg announced that $65 billion Citadel Securities is looking to become a liquidity provider for Bitcoin and crypto.

Markets took this as a "sell the news" event.

It also seems that the Bybit hack on February 21st has dampened sentiment in the market.

Arkham Intelligence has declared this hack the "largest financial heist in history."

The closest competitor is the theft from the Central Bank of Iraq, which lost $1B in March 2003.

In fact, the Bybit hack more than DOUBLED the 2nd largest hack in crypto history.

PolyNetwork's $611M hack in August 2021 was previous largest crypto hack.

Weakness seen in Ethereum has also put more pressure on broader crypto markets.

Hacks deteriorate confidence.

The technical picture also appears to have lost momentum.

However, this also does not mean that crypto markets are set for a prolonged bear market.

We have seen countless -10% pullbacks in Bitcoin over the course of this bull run.

Technical pullbacks are healthy.

...

Lastly, as volatility returns to equity markets, risky assets like Bitcoin are pulling back.

We saw historic levels of risk appetite in 2024 and heading into 2025.

A pullback in risk appetite means less liquidity for crypto markets.

This has certainly happened before.

Overall, there really isn't one specific factor pushing crypto lower right now.

Rather, its a combination of factors which have resulted in reduced liquidity.

Crypto markets need LIQUIDITY to thrive.

Thread by @KobeissiLetter on Thread Reader App

@KobeissiLetter: Did liquidity in crypto just dry up? Crypto markets have now erased -$325 BILLION of market cap since Friday morning. At 5:00 PM ET today, crypto lost -$100 billion in 1 HOUR without any major...…

... Michael Saylor and MSTR. ... I say this thing blows to all hell with BTC under 90k.

...

Dekabank, a prominent German investment bank, has reportedly launched cryptocurrency trading and custody services for institutional clients after nearly two years of development. ... According to Bloomberg, Dekabank is promoting its new offering with a strong emphasis on security and regulatory compliance.

Report: German Investment Bank Dekabank Launches Institutional Crypto Services – News Bytes Bitcoin News

Dekabank, a prominent German investment bank, has reportedly launched cryptocurrency trading and custody services for institutional clients after nearly

The ByBit hack came at a good time for them I guess.

Etherum looks weak again here and breaking a Fib level. I think there is strong support just below $2,000. That might be a good buy entry I will look towards.

- Messages

- 34,774

- Reaction score

- 5,909

- Points

- 288

Bank of America CEO says it could launch stablecoin if regulations allow: CNBC Crypto World

Feb 26, 2025 #CNBC #cnbctvOn today's episode of CNBC Crypto World, bitcoin and ether add to Tuesday's losses while XRP rises. Plus, Bank of America CEO Brian Moynihan tells the Economic Club of Washington D.C. that the bank could launch a stablecoin if regulations are passed. And, Thomas Mattimore of ABC Labs discusses fostering Wall Street blockchain adoption through on-chain indexes.

9:16

Chapters

00:00 - CNBC Crypto World, Feb 26, 2025

0:25 - Bitcoin falls

0:35 - The headlines

2:15 - Thomas Mattimore of ABC Labs

- Messages

- 34,774

- Reaction score

- 5,909

- Points

- 288

Crypto Daybook Americas: Buying the Drop or Trying to Catch a Falling Knife? Take Your Pick

The day ahead in crypto: Feb. 27, 2025

- Messages

- 34,774

- Reaction score

- 5,909

- Points

- 288

Bitcoin (BTC) Price Set for Worst Month Since June 2022, Worst Week Since November 2022

This year's average purchase price is around $97,880, leaving investors facing an almost 20% unrealized loss at current prices.

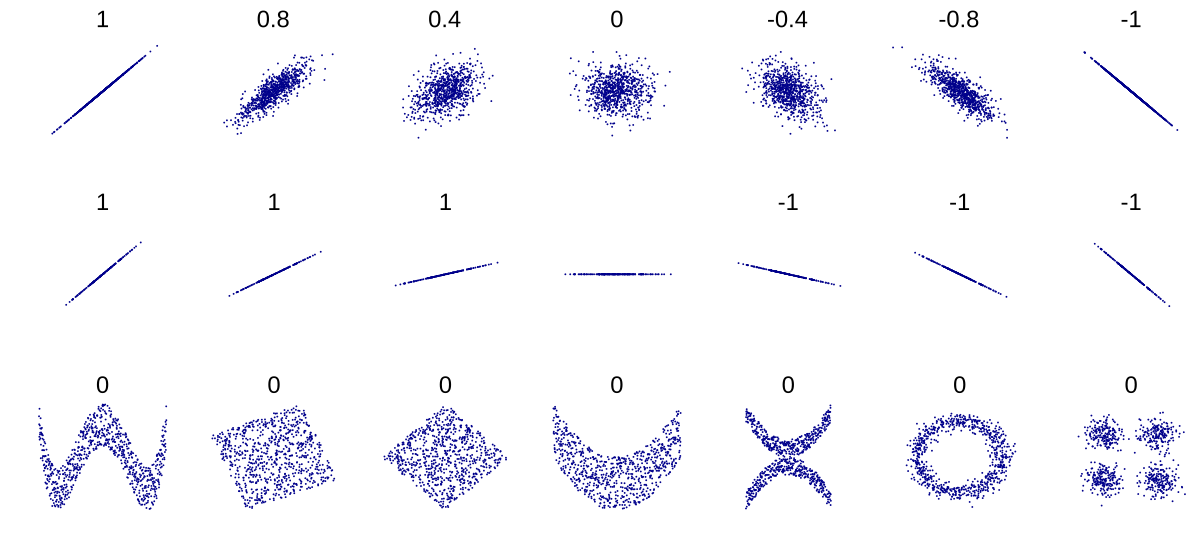

In statistics, the Pearson correlation coefficient (PCC)[a] is a correlation coefficient that measures linear correlation between two sets of data. It is the ratio between the covariance of two variables and the product of their standard deviations; thus, it is essentially a normalized measurement of the covariance, such that the result always has a value between −1 and 1. As with covariance itself, the measure can only reflect a linear correlation of variables, and ignores many other types of relationships or correlations. As a simple example, one would expect the age and height of a sample of children from a school to have a Pearson correlation coefficient significantly greater than 0, but less than 1 (as 1 would represent an unrealistically perfect correlation).

...

Pearson correlation coefficient - Wikipedia

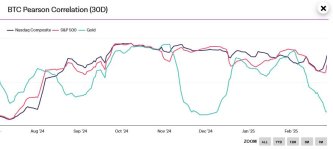

BTC, S&P500 and gold Pearson correlation 30 day chart:

Snapshot:

Last edited:

Except they forgot to actually put Bitcoin into the graph. Oops.

BTC is the baseline. The closer the data tracks to 1 (the top of the graph), the more they are correlated. So NASDAQ + S&P500 are highly correlated (since October '24 anyway). Gold does it's own thing.

Ah I get it, so its all three on the graph correlation to BTC. So stonks and Bitcoin are pretty highly correlated and just an indication of liquidity. Gold avoided any dips as I think the bankers were purposely running it up.

- Messages

- 34,774

- Reaction score

- 5,909

- Points

- 288

What the SEC's new crypto strategy means for the industry: CNBC Crypto World

Feb 28, 2025 #CNBC #cnbctvOn today's episode of CNBC Crypto World, bitcoin dips under $80,000 before recovering back to the $84k level following a week of volatility. Also, the SEC provides guidance on meme coins, saying most are not securities and don't fall under the regulator's scope. Kit Addleman of Haynes Boone shares how crypto firms should operate given the recent SEC shakeup.

11:25

Chapters

00:00 - CNBC Crypto World, Feb 28, 2025

0:21 - Bitcoin battles $80k

1:03 - The headlines

2:36 - Kit Addleman of Haynes Boone

Donald J. Trump said:A U.S. Crypto Reserve will elevate this critical industry after years of corrupt attacks by the Biden Administration, which is why my Executive Order on Digital Assets directed the Presidential Working Group to move forward on a Crypto Strategic Reserve that includes XRP, SOL, and ADA. I will make sure the U.S. is the Crypto Capital of the World. We are MAKING AMERICA GREAT AGAIN!

Not thrilled about USA buying XRP. Will Trump's tweet end the recent Crypto market downturn?

Seems that Trump's post is affecting the crypto market right now.

XRP up 33%, SOL up 24%, and ADA up 67% (over the last 24 hours - they are up 14%, 12% and 32% respectively over the last hour).

XRP up 33%, SOL up 24%, and ADA up 67% (over the last 24 hours - they are up 14%, 12% and 32% respectively over the last hour).

Just noticed the huge surge... of course on a Sunday. They needed to end that drawdown. Didn't hit my buy targets yet either.

It's also Highly likely this got planned and leaked on Friday and explains the melt-up in stocks late in the day. It's all fraud.

It's also Highly likely this got planned and leaked on Friday and explains the melt-up in stocks late in the day. It's all fraud.

Last edited:

Sure looks like he's working for the bankers and moving towards the tokenization of everything economy. Not good.

I wonder if Trump is going to periodically follow up with more posts naming other coins. The 3 mentioned in today's post are not an exclusive list. Reminder:

The new Trump era begins this coming week. Trump has stated his intent to promote the crypto industry broadly and "made in USA" specifically. His campaign rhetoric has included statements indicating that he wants to eliminate taxes on "made in USA" crypto. There is speculation swirling that he might push for a "strategic reserve" of "made in USA" crypto. But what exactly is "made in USA" crypto?

... Crunchbase lists a total of 2,965 companies with cryptocurrency as their main business, with most founded as far back as 2018.

The list includes Avalanche (AVAX), Cardano (ADA)...

- Messages

- 34,774

- Reaction score

- 5,909

- Points

- 288

Bitcoin Analysis: BTC $100K Plays Back in Vogue after 10% Price Surge from 'Trump Put'

The Deribit-listed $100K strike call has seen the biggest jump in open interest in the past 24 hours.