You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

2025 Lunatic Fringe - Market and Trade Chat

- Thread starter pmbug

- Start date

Welcome to the Precious Metals Bug Forums

Welcome to the PMBug forums - a watering hole for folks interested in gold, silver, precious metals, sound money, investing, market and economic news, central bank monetary policies, politics and more.

Why not register an account and join the discussions? When you register an account and log in, you may enjoy additional benefits including no Google ads, market data/charts, access to trade/barter with the community and much more. Registering an account is free - you have nothing to lose!

- Status

- Not open for further replies.

- Messages

- 19,188

- Reaction score

- 11,502

- Points

- 288

Bill's Holter's Commentary:

"This is SO BAD... failure to deliver from here is a very real possibility! "

Oct 10, 2025

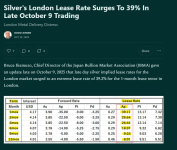

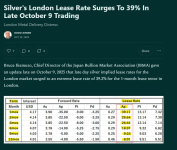

The silver market just witnessed a seismic event: On the evening of October 9, Bruce Ikemizu, Chief Director of the Japan Bullion Market Association (JBMA), confirmed that the 1-month implied lease rate for physical silver in London erupted to a jaw-dropping 39.2%. This extraordinary spike, captured in recent market data, signals acute physical supply distress—metal in the vaults is running out, and lenders are demanding a premium for any silver that remains.

thesilverindustry.substack.com

thesilverindustry.substack.com

"This is SO BAD... failure to deliver from here is a very real possibility! "

Physical Panic: Lease Rate Hits 39%--London in Crisis

SILVER MARKET MELTDOWN: LONDON LEASE RATES SKYROCKET, SHORT SELLERS FEEL THE HEAT

The Silver AcademyOct 10, 2025

The silver market just witnessed a seismic event: On the evening of October 9, Bruce Ikemizu, Chief Director of the Japan Bullion Market Association (JBMA), confirmed that the 1-month implied lease rate for physical silver in London erupted to a jaw-dropping 39.2%. This extraordinary spike, captured in recent market data, signals acute physical supply distress—metal in the vaults is running out, and lenders are demanding a premium for any silver that remains.

Physical Panic: Lease Rate Hits 39%—London in Crisis

SILVER MARKET MELTDOWN: LONDON LEASE RATES SKYROCKET, SHORT SELLERS FEEL THE HEAT

- Messages

- 1,821

- Reaction score

- 2,151

- Points

- 283

Anyone know how to unload your silver from a silver mine? I assume you give it to the refiner who is authorized to deliver silver to the Comex but how does that process work? Comex doesn't just lay out cash for silver bars I assume so the mechanism is in the contracts. I am making a lot of assumptions here but am truly curious to know how the market works.

I'm no expert, but I believe the mining companies do some minimal ore processing to produce "dore". That's sold to refiners that refine the metal. The refiner might also be a Mint or they sell the refined metal to a Mint which then produces bars/coins or whatever.

It was huge news a while back when China made a deal with South American miners to buy silver dore directly - jumping the supply chain to acquire silver before refiners got it.

It was huge news a while back when China made a deal with South American miners to buy silver dore directly - jumping the supply chain to acquire silver before refiners got it.

- Messages

- 1,821

- Reaction score

- 2,151

- Points

- 283

Yea I remember when the news about China hit. Pretty big news IMO. Still not sure how the metal gets to the Comex though. Does someone like JPM buy it from the refiner and then deposit it maybe?

- Messages

- 19,188

- Reaction score

- 11,502

- Points

- 288

I hope y'all are well stocked with popcorn for this week. It's likely going to be a wild ride.

- Messages

- 19,188

- Reaction score

- 11,502

- Points

- 288

Bill's Commentary:

"The chart on lease rates is a day old... they closed out on Friday at 200% to borrow silver. Also, you will notice the futures in NY are now $3 below spot in London. Jim used to always ask the question; 'what is the value of a contract that cannot perform'. Are futures just now beginning to display what they are actually worth? Think about that...!"

Silver Traders Rush Bars to London as Historic Squeeze Rocks Market

(Bloomberg) -- The London silver market has been thrown into turmoil by a massive short squeeze, driving prices above $50 an ounce for only the second time in history and stirring memories of the billionaire Hunt brothers’ notorious attempt to corner the market in 1980.

Benchmark prices in London have soared to near-unprecedented levels over New York. Traders described a market where liquidity has almost entirely dried up, leaving anyone short spot silver struggling to source metal and forced to pay crippling borrowing costs to roll their positions to a later date.

Read more here...

"The chart on lease rates is a day old... they closed out on Friday at 200% to borrow silver. Also, you will notice the futures in NY are now $3 below spot in London. Jim used to always ask the question; 'what is the value of a contract that cannot perform'. Are futures just now beginning to display what they are actually worth? Think about that...!"

Silver Traders Rush Bars to London as Historic Squeeze Rocks Market

(Bloomberg) -- The London silver market has been thrown into turmoil by a massive short squeeze, driving prices above $50 an ounce for only the second time in history and stirring memories of the billionaire Hunt brothers’ notorious attempt to corner the market in 1980.

Benchmark prices in London have soared to near-unprecedented levels over New York. Traders described a market where liquidity has almost entirely dried up, leaving anyone short spot silver struggling to source metal and forced to pay crippling borrowing costs to roll their positions to a later date.

Read more here...

Ruh Roh Shaggy.

- Messages

- 1,821

- Reaction score

- 2,151

- Points

- 283

Sounds like he needs a new supplier. Maybe work out a deal with SD bullion. They have millions worth of inventory. about 30,000 random silver rounds alone.

Bank of America on Monday raised its price forecasts for precious metals, lifting its 2026 outlook for gold to $5,000 an ounce, with an average of $4,400, and for silver to $65 an ounce, averaging $56.25.

...

Silver might be above $65 by the end of this year.

APMEX seems to have a ton of stock as well. But they are charging dearly for it.

Dealers should be stocking up on 90% junk silver to sell later. Personally, I was never a fan of 90% silver because it's usually dirty and common. I really don't mind the 90% gold however.

Dealers should be stocking up on 90% junk silver to sell later. ...

Most dealers have a turn and burn business model. They don't want to be holding inventory. They want cash flow.

- Messages

- 19,188

- Reaction score

- 11,502

- Points

- 288

Never mind that 90% junk really is 'cash'...Most dealers have a turn and burn business model. They don't want to be holding inventory. They want cash flow.

- Messages

- 19,188

- Reaction score

- 11,502

- Points

- 288

I asked GROK: Who is shorting silver?

Overview of Silver Short PositionsAs of the latest available U.S. Commodity Futures Trading Commission (CFTC) Commitments of Traders (COT) report (data as of September 23, 2025, released September 26, 2025—delayed due to a brief federal government shutdown), short positions in COMEX silver futures are predominantly held by commercial traders, who use shorts primarily for hedging against price risks in their businesses (e.g., mining, refining, jewelry manufacturing, and industrial use). These aggregate to 115,036 contracts (out of a total open interest of 165,805 contracts), representing about 69% of the market's short side. In contrast, non-commercial traders (speculators like hedge funds and managed money) hold only 20,042 short contracts while being heavily net long (+52,276 net), indicating they're betting on higher prices rather than shorting.No updated COT report has been released for October data (as of October 8 positions, typically out by October 11) due to ongoing processing delays from the shutdown, but market commentary suggests commercial shorts remain dominant amid the recent price surge.Key Players Shorting SilverWhile COT data is anonymized and aggregated, public reports and analyses point to major banks and financial institutions as the primary commercial shorts, often acting on behalf of clients or for proprietary hedging. These entities control the lion's share of commercial short positions (net -72,755 for commercials overall). Here's a breakdown of the most frequently cited large short holders:

Overview of Silver Short PositionsAs of the latest available U.S. Commodity Futures Trading Commission (CFTC) Commitments of Traders (COT) report (data as of September 23, 2025, released September 26, 2025—delayed due to a brief federal government shutdown), short positions in COMEX silver futures are predominantly held by commercial traders, who use shorts primarily for hedging against price risks in their businesses (e.g., mining, refining, jewelry manufacturing, and industrial use). These aggregate to 115,036 contracts (out of a total open interest of 165,805 contracts), representing about 69% of the market's short side. In contrast, non-commercial traders (speculators like hedge funds and managed money) hold only 20,042 short contracts while being heavily net long (+52,276 net), indicating they're betting on higher prices rather than shorting.No updated COT report has been released for October data (as of October 8 positions, typically out by October 11) due to ongoing processing delays from the shutdown, but market commentary suggests commercial shorts remain dominant amid the recent price surge.Key Players Shorting SilverWhile COT data is anonymized and aggregated, public reports and analyses point to major banks and financial institutions as the primary commercial shorts, often acting on behalf of clients or for proprietary hedging. These entities control the lion's share of commercial short positions (net -72,755 for commercials overall). Here's a breakdown of the most frequently cited large short holders:

| Entity | Role in Shorting | Estimated Exposure/Notes |

|---|---|---|

| JPMorgan Chase | Largest commercial short holder; hedges for mining clients and proprietary trades. | Faces potential $2-3B losses from 2025 price spike; historically fined $920M for silver manipulation (2020). |

| HSBC | Global bullion bank; shorts via futures for industrial clients. | Part of "London Fix" group; holds significant COMEX shorts. |

| Deutsche Bank | Hedging for European industrial users. | Active in OTC and futures; net short exposure in billions. |

| Bank of Nova Scotia (Scotiabank) | Canadian mining hedge specialist. | Shorts ~10-15% of commercial positions; tied to silver producers. |

| UBS | Swiss bank hedging for jewelers and ETFs. | Involved in SLV ETF shorts (~2,000 tons equivalent, or ~10% of float). |

- Managed Money/Hedge Funds: Their short positions have declined to 14,126 contracts (as of early October estimates), down from 15,453 the prior week—far below historical extremes, signaling reduced bearish bets from speculators. Funds like those tracked by YCharts show this group pivoting to longs amid supply squeezes.

- Other Commercials: Producers (e.g., miners like Pan American Silver) and end-users (e.g., solar panel makers) add to the short pile for risk management, but banks dominate the volume.

- Hedging Needs: Commercials short to lock in prices against future deliveries, especially with industrial demand (e.g., solar, EVs) outpacing supply for the fifth straight year.

- Market Dynamics: Backwardation (spot > futures prices) has triggered short squeezes, forcing some covers and amplifying the rally, but commercials maintain positions for stability.

- Risks: With silver at ~$50/oz (up 80% YTD), these shorts face mounting losses—potentially billions for the top five U.S. banks—prompting speculation of further unwinds.

- Messages

- 19,188

- Reaction score

- 11,502

- Points

- 288

This time it really IS different....Market Sniper said do not sell. I did not and it proved you cannot time the market. What a day!

Looks like around 2AM last night (central time), silver crashed from near $54 to just below $50 and then bounced back to $52 almost immediately. That's some crazy volatility. But also shows that dips/crashes will be bought.

I would put this in the crypto thread, but it's really a signal for the broader (stock) market so caveat emptor:

BREAKING:

TheU.S. government just moved 667 BTC (~$75M) to a fresh address.

Some are speculating they might dump it, history suggests gov-transfers like this often precede sales.

Meanwhile, the “insider whale” behind Friday’s flash crash has pushed his short to a whopping ~$500M+ as he expects markets to plunge further.

All of this is happening just before Powell’s 4:20 PM UTC speech.

Something big might be coming.

That uncle Powell is ending QT.... possibly after just a little Friday scare.

- Messages

- 19,188

- Reaction score

- 11,502

- Points

- 288

Everyone’s staring at the spot price pretending silver’s $50 an ounce.

But step into the real world. China’s top bullion marketplace is now posting $128/oz for physical silver.

That’s not a typo. That’s four times the 2020 price and double today’s “official” rate.

The global silver shortage isn’t coming. It’s already here.

Perth Mint has halted all silver product sales.

India’s dealers have vanished or defaulted on shipments.

Amazon sellers are taking money and not delivering metal.

Even the Royal Canadian Mint and TD Bank show “out of stock” on nearly every bar.

This isn’t a paper disconnect. It’s a total breakdown in physical supply.

In Japan, Asahi Fine, a world-class refiner, is out of ingots.

In London, lease rates have exploded to 39 percent, panic levels not seen in decades.

Banks can’t locate metal and are being forced to cover or buy back futures just to stay solvent.

It’s chaos.

And through all of this, China quietly sets the new world price.

Their retail bars are fetching between $108 and $128 an ounce, and that’s for the small bars retail investors can actually hold.

Sellers always move to where they’re treated best.

If a refiner or trader can earn twice as much shipping to China, why would they sell into New York or London at half the rate?

The result: China’s premiums become the new global standard.

Silver goes where it’s valued highest, and right now the East is valuing it like gold.

Meanwhile, the West is still obsessed with “spot” prices that no longer mean anything. Futures, ETFs, and “paper silver” are detached from reality. IOUs trading in a system that can’t deliver.

For those holding physical, this is the moment the market has been building toward for years, when scarcity becomes undeniable and the paper façade cracks.

What happens next?

Expect those $128 Chinese premiums to ripple outward fast.

Dealers in the US and Canada will raise quotes just to restock.

Industrial users will panic-buy to secure supply.

And small investors who mocked silver stackers will suddenly realize the shelves are empty.

This is what a global repricing looks like.

The shortage is systemic, and silver is finally being priced like the strategic, irreplaceable metal it truly is.

The age of cheap silver is over.

Last edited:

For that price I could fly to Asia sell a few bars and load up. I don't think that one post is really setting a spot price.

- Messages

- 19,188

- Reaction score

- 11,502

- Points

- 288

that post isn't setting spot price, merely commenting on China's top bullion marketplace.For that price I could fly to Asia sell a few bars and load up. I don't think that one post is really setting a spot price.

It remains to be seen, however I've followed Bill Holter for 10 years and he's of the same mind with regards to the price of PM's... more zeros will be added....

- Status

- Not open for further replies.