You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

2025 Lunatic Fringe - Market and Trade Chat

- Thread starter pmbug

- Start date

Welcome to the Precious Metals Bug Forums

Welcome to the PMBug forums - a watering hole for folks interested in gold, silver, precious metals, sound money, investing, market and economic news, central bank monetary policies, politics and more.

Why not register an account and join the discussions? When you register an account and log in, you may enjoy additional benefits including no Google ads, market data/charts, access to trade/barter with the community and much more. Registering an account is free - you have nothing to lose!

- Status

- Not open for further replies.

Bank forecasts are always low on gold and silver (click image to enlarge):

View attachment 17138

The ENTIRE "forecasts" or analyst reports are ALL a SCAM. It's all paid for by the companies. For instance, the LAST company that officially covers Gamestop, their analyst came out and basically quit (had a $13 price target for years) saying you can't rely on our shit anymore cause, blah blah blah.

Looks as if they got the hammer...

Maxwell's Silver Hammer

I could actually see it coming this morning. They were spiking the price But the EFP spreads were shrinking and then went negative 10-20 cents.

I'll take what I can get (and I did actually BTD this morning).Not much of a dip for me , looks like a us$ movement more than a metals move …

- Messages

- 19,188

- Reaction score

- 11,503

- Points

- 288

Rumor has it the hedge funds are pumping and getting ready to short it after they get the FOMO suckers in the game.I could actually see it coming this morning. They were spiking the price But the EFP spreads were shrinking and then went negative 10-20 cents.

In Michael Oliver’s latest MSA assessment dated September 28th and sent to his subscribers he revises sharply upward expectations for silver over the coming months and into the first quarter of next year. The report identifies both price and long-term momentum as signaling a phase of vertical acceleration. The character of this move is described as “massive and jolting,” reflecting a full repricing of silver as a monetary and industrial asset. Her is our breakdown and analysis of a portion of that report.

...

Michael Oliver: Silver Entering a New Price Reality | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

‘No one should want reserves in dollars,’ says Catalyst Funds’s Miller; why gold’s surge has staying power | Kitco News https://share.google/LpgLqRPJoSHVfY9A0

I think the jig is Up. How many times have we seen them be able to Slam silver for $2?

AND then it gains it back a day later And with China on Holiday.

AND then it gains it back a day later And with China on Holiday.

- Messages

- 19,188

- Reaction score

- 11,503

- Points

- 288

I think people are waking up to the reality that real money doesn't lose buying power.I think the jig is Up. How many times have we seen them be able to Slam silver for $2?

AND then it gains it back a day later And with China on Holiday.

A $2 smackdown was treated like it was a Flash sale for Pokemon cards. People lined up and disappointed like Is that Really all ya Got?

China retail:

www.scmp.com

www.scmp.com

...

“Gold prices are soaring, and I can’t decide whether to buy or sell,” Li said. “I sold too early, and now prices keep climbing; it’s hard to know what to do next.

“It’s so frustrating that I’ve switched to investing in silver instead.”

...

China’s gold fever: record prices spark excitement and FOMO – buy, sell or hold?

As Goldman Sachs predicts gold will hit US$4,000 an ounce, a nuanced picture emerges on the ground in China, revealing a complex relationship with the precious metal.

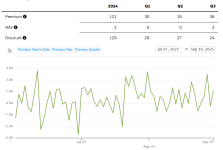

SLV borrow fee is almost 10% now:

It looks like we are in the end game now as SLV can't create shares willy nilly expecting to back them with LBMA silver (LBMA doesn't have sufficient free float).

It looks like we are in the end game now as SLV can't create shares willy nilly expecting to back them with LBMA silver (LBMA doesn't have sufficient free float).

What's the Premium on SLV right now. Answer below. It's not trading at any big premium so I don't think they are having trouble creating shares. Whereas the PSLV is trading at a discount to its NAV and clearly the superior buy if not for that reason alone. I'm not sure on this SLV though. So much accounting gimmickry.

- Messages

- 19,188

- Reaction score

- 11,503

- Points

- 288

SLV borrow fee is almost 10% now:

It looks like we are in the end game now as SLV can't create shares willy nilly expecting to back them with LBMA silver (LBMA doesn't have sufficient free float).

Who'd be crazy enuf to own SLV with no silver backing it?

- Messages

- 19,188

- Reaction score

- 11,503

- Points

- 288

AU $4005.90!

Huge drop in silver “free float” in London in September

Huge drop in silver “free float” in London in September

LBMA just released their September numbers, where they claim silver inventories fell by 65 metric tons last month. And as showed earlier ETFs/ETCs added 824 metric tons.

That means “free float” fell by 888 metric tons in September, and is starting to get critical low, down to 3,429 metric tons. Will this trigger a further run on the physical silver in London?

---

“Free float” higher?

LBMA consider all the silver in their vaults as “free float” including the silver held by the ETFs, as you can hear as you can hear 27:00 into this video at LBMA's own page https://lbma.org.uk/videos/gold-market-dynamics-london-ny

“Free float” lower?

Me and others would argue that the real free float is lower. Why? Just because customers choose to keep their silver inside the LBMA vaults, does not mean that they want to sell at today’s prices. LBMA might treat it as it is their silver and part of the “Free float”, but in reality, it is owned by someone who don’t want their silver used for trading.

Also, there is much controversy about LBMA’s numbers, and there have been several cases with market manipulation.

---

Disclaimer:

I don’t take any responsibility for any mistakes in these numbers or misunderstandings. It is only my contribution as an amateur trying to understand the markets.

Sources: I want to thank Nick Laird @GoldFishCharts

(http://goldchartsrus.com) who helped me with the grey numbers. An amazing guy that everyone should follow!

The table was originally inspired by @InProved_Metals, but my numbers will diverge slightly from his ones, as we use different cutoff dates. I also want to thank him for finding a case with WisdomTree’s numbers, where the information page diverges 1.3 Moz from the bar list.

I have collected the white numbers from the ETF’s daily bar lists, so my numbers can potentially diverge slightly from others’ if they used the information pages (and not the bar lists).

There is much talk these days about free float, so I tag some of people who are important in this work

@GoldSilver_com

@ArcadiaEconomic

@Sorenthek

@MakeGoldGreat

@KingKong9888

@profitsplusid

@pmbug

@silverguru22

LBMA just released their September numbers, where they claim silver inventories fell by 65 metric tons last month. And as showed earlier ETFs/ETCs added 824 metric tons.

That means “free float” fell by 888 metric tons in September, and is starting to get critical low, down to 3,429 metric tons. Will this trigger a further run on the physical silver in London?

---

“Free float” higher?

LBMA consider all the silver in their vaults as “free float” including the silver held by the ETFs, as you can hear as you can hear 27:00 into this video at LBMA's own page https://lbma.org.uk/videos/gold-market-dynamics-london-ny

“Free float” lower?

Me and others would argue that the real free float is lower. Why? Just because customers choose to keep their silver inside the LBMA vaults, does not mean that they want to sell at today’s prices. LBMA might treat it as it is their silver and part of the “Free float”, but in reality, it is owned by someone who don’t want their silver used for trading.

Also, there is much controversy about LBMA’s numbers, and there have been several cases with market manipulation.

---

Disclaimer:

I don’t take any responsibility for any mistakes in these numbers or misunderstandings. It is only my contribution as an amateur trying to understand the markets.

Sources: I want to thank Nick Laird @GoldFishCharts

(http://goldchartsrus.com) who helped me with the grey numbers. An amazing guy that everyone should follow!

The table was originally inspired by @InProved_Metals, but my numbers will diverge slightly from his ones, as we use different cutoff dates. I also want to thank him for finding a case with WisdomTree’s numbers, where the information page diverges 1.3 Moz from the bar list.

I have collected the white numbers from the ETF’s daily bar lists, so my numbers can potentially diverge slightly from others’ if they used the information pages (and not the bar lists).

There is much talk these days about free float, so I tag some of people who are important in this work

@GoldSilver_com

@ArcadiaEconomic

@Sorenthek

@MakeGoldGreat

@KingKong9888

@profitsplusid

@pmbug

@silverguru22

- Messages

- 19,188

- Reaction score

- 11,503

- Points

- 288

I was studying other times in history when gold prices more than doubled in the reserve currency of the time, as they did in the past year: it's rare and almost always a sign of a profound loss of confidence in the existing monetary and political order, going all the way back to the Roman empire (the so-called "Crisis of the Third Century").

And it often marked the transition from one era of power to the next: the fall of Rome, Spain's decline from world power, the French Revolution and Terror, the end of Bretton Woods, etc.

Interestingly, it's often actually as much a cause as a sign of these episodes, as this is effectively a transfer of real wealth from the poor to the rich elites who protect themselves with gold - this being what ignites the political upheaval.

The weird aspect of the current episode is the relative silence around it: we're witnessing what may be one of the great pivotal moments in financial history yet it's being barely discussed.

- Status

- Not open for further replies.