You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Argentina foibles (inflation, currency and potential anarcho-capitalist experiments)

- Thread starter pmbug

- Start date

Welcome to the Precious Metals Bug Forums

Welcome to the PMBug forums - a watering hole for folks interested in gold, silver, precious metals, sound money, investing, market and economic news, central bank monetary policies, politics and more.

Why not register an account and join the discussions? When you register an account and log in, you may enjoy additional benefits including no Google ads, market data/charts, access to trade/barter with the community and much more. Registering an account is free - you have nothing to lose!

- Messages

- 24,647

- Reaction score

- 4,511

- Points

- 288

Explainer: Argentina could again use yuan to evade IMF default

Time is running out for Argentina to secure the next tranche of a $44 billion loan with the International Monetary Fund, which it could use to repay the fund older debt due in coming days.

- Messages

- 24,647

- Reaction score

- 4,511

- Points

- 288

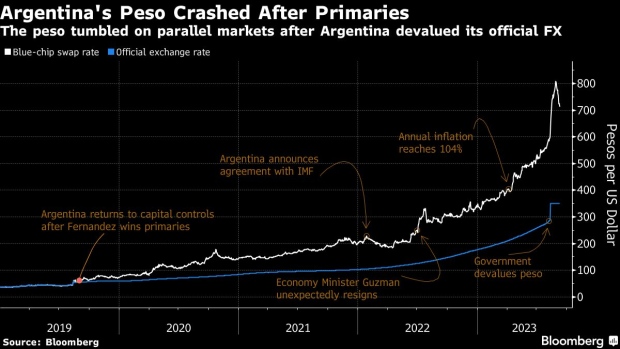

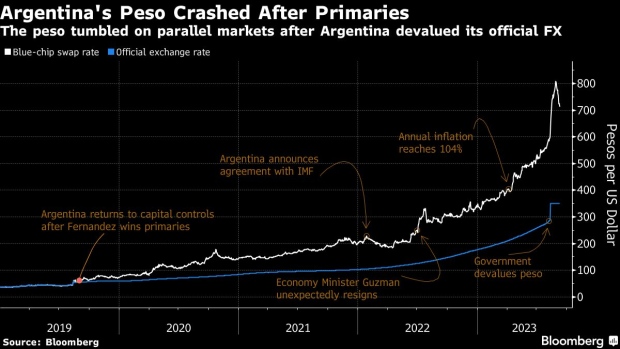

Argentina devalues peso, raises rates after shock primary | The World

Aug 21, 20232:00

Inflation has hit 113 percent in Argentina this year, leading to soaring consumer prices and plunging 40 percent of its population below the poverty line. The situation has worsened as the currency fell off the back of a shock primary election result. Madeline Lobooth reports.

...

The peso currency is now in the crosshairs of the country's dark horse presidential front-runner, libertarian radical Javier Milei, who has pledged to eventually scrap the central bank and dollarize the economy, Latin America's third largest.

Milei - facing a tight three-way battle with traditional political candidates on the right and left ahead of an Oct. 22 vote ...

...

Milei's dollarization plan has sharply divided opinion: his backers argue it is the solution to inflation near 115% while detractors say it an impractical idea that would sacrifice the country's ability to set interest rates, control how much money is in circulation and serve as the lender of last resort.

"The argument for dollarization is that there is no price stability and the independence of the central bank is an illusion," said Juan Napoli, a Senate candidate for Milei's Liberty Advances party.

Napoli admitted Argentina was not yet ready for full dollarization. Milei and advisers have talked about a nine-month to two-year time frame.

"It requires a great political agreement between us and also having sufficient reserves," Napoli said. The central bank's current net foreign currency reserves are deep in negative territory. "It will take a while, it won't happen immediately."

...

More (long):

Argentina, in dollar love affair, agonizes over divorcing the peso

María Barro, a 65-year-old domestic worker in Buenos Aires, buys a few dollars each month with her peso salary, a hedge against Argentina's persistent inflation now running at over 100% and a steady devaluation of the little-loved local peso.

... analysts, investors, as well as the usual army of cynics (almost always based in wealthy countries), have been debating which country, if any, would be next to make Bitcoin legal tender after El Salvador.

For example, I wrote for City AM previously that it could be Panama, Paraguay, Guatemala, or Honduras.

But there’s a new nation that is gaining an increasing amount of speculation on this issue: Argentina, a country that’s fighting against triple digit inflation, its highest in over three decades, and that could climb to near 200% by the end of the year.

...

https://www.msn.com/en-gb/money/oth...-to-adopt-bitcoin-as-legal-tender/ar-AA1gxMVP

First I've heard of any noise about BTC in Argentina - I'm not sure that Milei has mentioned this like he has talked about dollarization.

Some commentary on dollarization in Latin America with an eye towards Argentina's potential move:

More (long):

...

The success of dollarization in Latin America has gone under the radar because the dollarized trio are relatively small countries, Ecuador being the largest with a population of 18 million. Were Argentina to dollarize, however, it hardly would be feasible to ignore or hide its benefits — monetary stability, low inflation, low interest rates, longer loan terms, built‐in hard budget constraints — in one of the region’s largest and most influential countries.

...

More (long):

More discussion on the dollarization issue (with some discussion of Ecuador's experience):

More:

www.bnnbloomberg.ca

www.bnnbloomberg.ca

Argentina has essentially no dollars. Which, as critics see it, is a major impediment to presidential front-runner Javier Milei’s plan to dollarize the crisis-ravaged economy. Even Milei’s own advisers are starting to get fidgety about how barren the vaults are.

But ask economist Francisco Zalles about this problem and he scoffs. Just go ahead and make the dollar the country’s official tender, he says, and do it fast. The faster the move, the faster inflation steadies. Then interest rates can come down, and dollars can start flowing in, paving the way for growth.

Zalles is no ordinary economist. He’s one of the few in the world who’s got experience carrying out such a process, having done so in his native Ecuador two decades ago. Conditions then — soaring inflation, plunging currency, stagnant growth — were broadly similar to those in Argentina today. And while Ecuador’s economic record has been uneven since, one thing is certain: The runaway inflation that was making people poorer month after month has disappeared.

“For Milei’s plan to work, he needs nothing,” Zalles, who’d go on to do a stint at Greylock Capital Management, said in an interview. “He just needs to dollarize.”

To many skeptics, Zalles’s vision is dangerously optimistic, even reckless. With no dollars to defend the exchange rate — Argentina has an estimated negative $10 billion in net international reserves — ditching the peso risks sparking a collapse in the currency that could lead to hyperinflation, a possible run on the banks and social unrest as savings vanish.

“Dollarizing without dollars is like saying you want the entire population to wear Nike sneakers, even though you don’t make them and you don’t have the resources to buy them,” said Alejandro Werner, a former IMF director for the Western Hemisphere. “It’s impossible.”

Zalles — and Milei — recognize dollarizing is a drastic move, but argue it’s the cure for what is, after all, a dire situation.

Inflation data Wednesday showed prices rising 12.4% on a monthly basis in August, the fastest pace since Argentina exited hyperinflation three decades ago. The economy is on the brink of its sixth recession in a decade; 40% of the population lives below the poverty line. The peso has tumbled almost 30% on the parallel market in the past month.

Since his surprise win in the August primaries, which prompted the government to devalue the peso by 18%, Milei’s radical plans have monopolized Wall Street’s attention. But key details, including exactly how those measures are going to play out, are still lacking. Some of his advisers have begun walking back some aspects of the proposals amid a barrage of criticism, saying he would not dollarize right away if there are no greenbacks in the central bank — which Milei doesn’t actually intend to shut either, they say.

Zalles shrugs off major concerns. There are gross reserves to tap, he says, and the growing use of dollars will help smooth the process. While Argentines haven’t yet resorted to paying for daily transactions in US dollars, large purchases — anything from apartments to cars, furniture, electronics and home appliances — are increasingly done in greenbacks. People are estimated to hold as much as $200 billion in cash outside the banking system within the country and hoard an additional $250 billion in overseas accounts.

Once you dollarize, that money will flow into the system, Zalles argues, and assuage fears over a potential bank run, similar to what happened in Ecuador in early 2000 when Zalles and two other economists oversaw the switch from sucres to greenbacks.

...

More:

Milei Should Dollarize at Once, Says Man Who Did It in Ecuador - BNN Bloomberg

Argentina has essentially no dollars. Which, as critics see it, is a major impediment to presidential front-runner Javier Milei’s plan to dollarize the crisis-ravaged economy. Even Milei’s own advisers are starting to get fidgety about how barren the vaults are.

- Messages

- 24,647

- Reaction score

- 4,511

- Points

- 288

The Buenos Aires barber's books: a history of 19,900% inflation

BUENOS AIRES (Reuters) - The hand-written entries in the two dozen notebooks - date, haircut, price - chronicle decades of a Buenos Aires barber's working life. But they tell another story too, Argentina's most important: a tale of 19,900% inflation and its crippling impact.In his small barbershop with sandy wooden floorboards and a fishbowl glass window to the street outside, Ruben Galante has for some four decades watched presidents come and go, myriad economic crises, and fast-rising prices.

More:

https://www.msn.com/en-us/money/mar...ooks-a-history-of-19900-inflation/ar-AA1hQgXj

Last edited by a moderator:

- Messages

- 24,647

- Reaction score

- 4,511

- Points

- 288

Argentina central bank raises interest rate to 133% as peso falters

BUENOS AIRES (Reuters) -Argentina's central bank raised the country's benchmark interest rate to 133% from 118% on Thursday, it said in a statement, as the South American country battles triple-digit annual inflation.It came after a last minute decision not to raise the rate to 145% "following a leak," after Reuters reported the higher figure, citing a source close to the bank.

More:

Argentina needs to default and then start over like Iceland. Open up the economy that has low taxes and is business friendly. Right now Uruguay is the financial capital of South America. Argentina has much more infrastructure, but the political landscape and economy are a shambles. Brazil is the agri capital of the region.

- Messages

- 24,647

- Reaction score

- 4,511

- Points

- 288

Argentina prosecutes presidential front-runner Javier Milei for teaching basic economics

With inflation accelerating to 138% annually in Argentina, or prices more than doubling multiple times per year, classical monetarist Javier Milei is slated to win the South American nation's presidency thanks to his radical promise to replace its peso with the United States dollar. The ruling regime, correctly terrified that Milei will end Argentina's ability to fund its Peronist policies at the expense of its citizens's savings, has launched an eleventh-hour attack on Milei, prosecuting the economist for the crime of telling the truth.At the behest of Peronist President Alberto Fernandez, prosecutors have charged Milei and his party, La Liberdad Avanza, with "inciting public fear," a crime that faces a penalty of up to six years in prison if convicted. How have these classical economists supposedly wronged the public? Fernandez cited Milei's assertion that the "peso is the currency issued by the Argentine politician, and therefore it is not worth crap," and his party's warning that Argentines should not save in pesos.

More:

- Messages

- 24,647

- Reaction score

- 4,511

- Points

- 288

Sergio Massa: can Argentine political wheeler-dealer save Peronism?

Argentina's Economy Minister Sergio Massa has a titanic task ahead of him: convincing voters to back a Peronist coalition that has overseen inflation top 138% and a painful cost-of-living crisis push two-fifths of the population into poverty.

- Messages

- 24,647

- Reaction score

- 4,511

- Points

- 288

Argentina braces for election with economy in 'intensive care'

As Argentina prepares for a crunch presidential election, the old adage rings true: 'it's the economy, stupid'. Inflation is at 138%, net reserves of foreign currency are in the red, savers are ditching the peso, and a recession is looming. The country goes to the polls on Sunday in a...

^^^ From the link:

...

The country goes to the polls on Sunday in a three-way race between shock libertarian front-runner , Peronist economy minister and conservative Patricia Bullrich, with voters angry amid a harsh cost-of-living crisis.

...

- Messages

- 24,647

- Reaction score

- 4,511

- Points

- 288

In Argentina's icy south, a political dynasty fades and a new power rises

Alicia Kirchner, an elder of Argentina's most powerful political dynasty, recalls with fondness helping build homes, schools and the first hospital in Rio Gallegos, a small city in the country's windswept Patagonian south.

- Messages

- 552

- Reaction score

- 722

- Points

- 273

This is astounding. He is facing prosecution for telling people not to save in Pesos which devaluing at an (official) inflation rate of 140%.Argentina prosecutes presidential front-runner Javier Milei for teaching basic economics

With inflation accelerating to 138% annually in Argentina, or prices more than doubling multiple times per year, classical monetarist Javier Milei is slated to win the South American nation's presidency thanks to his radical promise to replace its peso with the United States dollar. The ruling regime, correctly terrified that Milei will end Argentina's ability to fund its Peronist policies at the expense of its citizens's savings, has launched an eleventh-hour attack on Milei, prosecuting the economist for the crime of telling the truth.

At the behest of Peronist President Alberto Fernandez, prosecutors have charged Milei and his party, La Liberdad Avanza, with "inciting public fear," a crime that faces a penalty of up to six years in prison if convicted. How have these classical economists supposedly wronged the public? Fernandez cited Milei's assertion that the "peso is the currency issued by the Argentine politician, and therefore it is not worth crap," and his party's warning that Argentines should not save in pesos.

More:

...

The ballot is likely to roil financial markets, set a new political and social path for the nation and impact its ties with trade partners including China and Brazil. ...

...

To win outright on Sunday, a candidate will need over 45% of the vote or 40% and a 10-point lead over rivals.

Any run-off would be held on Nov. 19.

...

https://www.msn.com/en-us/news/worl...-radical-frontrunner-in-spotlight/ar-AA1iERO2

They are voting now. I suppose we'll see reports of the results tomorrow.

Sergio Massa and the far-right Javier Milei in a run-off vote next month, partial results from Sunday's presidential election suggest.

With most ballots now counted, no candidate has received more than 45% of votes - the threshold to be elected.

...

Front-runner Mr Milei was leading in the polls prior to the vote, but Mr Massa has received 36.2% of ballots so far.

Mr Milei has received 30.2% of the votes, according to partial results.

...

Argentina presidential election: Javier Milei and Sergio Massa head for run-off vote

Partial results from Sunday's election suggest the country will have to vote again next month.

www.bbc.com

...

Massa goes into the second round with the momentum, but there's plenty to play for. Milei could pick up more of conservative Bullrich's 6.3 million voters, who are often highly critical of the big-government Peronist model.

Given Bullrich was in the middle of the three politically, both may have to moderate their stance to win her votes over. Juan Schiaretti, who got a higher-than-expected vote share of nearly 7%, could also play an important king-maker role.

There is likely to be a heated campaign over the next month as the two remaining candidates pitch opposing plans for the economy. Massa pledges to protect the country's social safety net while Milei wants to "chainsaw" through a system that has left the country in its worst economic crisis in decades.

...

https://www.msn.com/en-us/news/othe...y-takeaways-from-first-round-vote/ar-AA1iHsoi

It took 10 years for former president Mauricio Macri to turn his party, Pro, into a leading political force. And less than 24 hours to destroy it. Pro is part of the Juntos por Cambio (Together for Change) coalition, which brought Macri to power in 2015. This coalition chose Patricia Bullrich as its presidential candidate, but she was knocked out of the race on Sunday, after winning just 24% of the vote in the first round of the election. That vote was won by Sergio Massa, Argentina’s economy minister and the candidate for the left-wing Peronism political movement, with the far-right leader Javier Milei coming in second place.

With the runoff scheduled for November 19, both Milei and Massa are hoping to win over the 6.2 million Argentines who voted for Bullrich.

Bullrich and Macri publicly endorsed Milei on Wednesday, but the move was met with a fierce backlash from the Together for Change coalition, which also includes the century-old Radical Civic Union (UCR) and other centrist parties, such as Civic Coalition. Pro was the hardest hit of all: moderates in the party felt betrayed, while hardliners said they would not abide by a “unilateral” decision that was made without prior consultation.

...

More:

Patricia Bullrich’s decision to endorse right-wing candidate Javier Milei throws Argentina’s opposition into disarray

The moderate sectors of Together for Change, the coalition that brought Mauricio Macri to power in 2015, warn that they will not support the endorsement of the radical libertarian

~~~

FWIW (apparently not much as Argentine polls missed badly on predicting the first election vote:

... according to a poll released on Thursday.

The survey from pollster Analogias put support for Massa, the outgoing government's economy chief, at about 42% versus 34% for Milei, a combative self-described anarco-capitalist.

Political polling has been wildly off in Argentina in recent years, including ahead of last Sunday's first-round vote, when Milei led in nearly all polls but ultimately came in second to Massa by about six points.

...

Argentina poll shows ruling party hopeful Massa leading Milei

The presidential standard-bearer for Argentina's ruling Peronists, Sergio Massa, has opened up a lead over his far-right rival Javier Milei with less than a month to go before the decisive run-off vote, according to a poll released on Thursday.

Argentina election polls are showing an increasingly tight race between Peronist economy minister Sergio Massa and radical libertarian Javier Milei ahead of a runoff ballot on Nov. 19.

...

Argentina polls show election race tightening; winner hard to call

Argentina election polls are showing an increasingly tight race between Peronist economy minister Sergio Massa and radical libertarian Javier Milei ahead of a runoff ballot on Nov. 19.

- Messages

- 552

- Reaction score

- 722

- Points

- 273

Another situation where the candidate with obviously the most visible support and momentum is significantly defeated by someone with little to no visibly enthusiastic supporters. (a la Kari Lake, Donald Trump, and that dude Futterman beat) This is a purely modern "phenomenon." Historically visible enthusiasm like this translated into landslide victory.

Another situation where the candidate with obviously the most visible support and momentum is significantly defeated by someone with little to no visibly enthusiastic supporters. ...

Rabid support doesn't always mean broad based support. It's a lesson I learned circa 2007 with Ron Paul.

I have relatives and acquaintances in Argentina and none of them like either candidate. I suspect the body of the unseen iceberg holds this view.

Argentina has complied with the payment of interests to the International Monetary Fund for US$ 790 million, it was reported Tuesday in Buenos Aires.

The South American country made a new payment worth the equivalent of SDR (Special Drawing Rights) 600 million to the IMF Monday, thus denting the Central Bank’s (BCRA) reserves, which stood at around US$ 21.1 billion, the lowest since 2006 when then-President Néstor Kirchner paid up all of Argentina’s debt to the Fund.

Monday’s payment was made in yuan stemming from the extension of the currency swap with China for a sum tantamount to US$ 6.5 billion.

...

Argentina makes payment to IMF in yuan

Argentina has complied with the payment of interests to the International Monetary Fund for US$ 790 million, it was reported Tuesday in Buenos Aires.

Are they broke yet?

...

Most of the latest polls show Milei with a slight edge over Massa. However, pollsters Reuters spoke to said it was a "wide open" race and that either candidate could triumph.

...

https://www.msn.com/en-gb/news/worl...h-presidential-election-wide-open/ar-AA1jHTvx

None of the polling companies has confidence in predicting this race.

- Messages

- 24,647

- Reaction score

- 4,511

- Points

- 288

BUENOS AIRES, Nov 13 (Reuters) - Hard-up Argentines, tightening their purse strings with inflation at 140% and rising, are increasingly turning to second-hand clothing markets, both to find affordable bargains and to raise extra cash from selling old garments.

The South American nation, the region's no. 2 economy and a major grains exporter, is facing its worst crisis in decades. Two-fifths of people live in poverty and a looming recession is shaking up Argentina's presidential election run-off next Sunday.

www.reuters.com

www.reuters.com

The South American nation, the region's no. 2 economy and a major grains exporter, is facing its worst crisis in decades. Two-fifths of people live in poverty and a looming recession is shaking up Argentina's presidential election run-off next Sunday.

'Can't buy new jeans': Argentina's 100% inflation draws crowds to used clothes markets

Hard-up Argentines, tightening their purse strings with inflation at 140% and rising, are increasingly turning to second-hand clothing markets, both to find affordable bargains and to raise extra cash from selling old garments.

Election is 4 days away. I'm sure the timing is purely coincidental...

https://www.msn.com/en-us/money/mar...eaken-for-first-time-since-august/ar-AA1jYpEm

Argentina's central bank allowed the peso to weaken slightly on Wednesday to 353 per dollar, traders said, reactivating its 'crawling peg' for the currency that has been frozen at 350 per dollar since a primary election in mid-August.

...

The Secretary of Economic Policy, Gabriel Rubinstein, had said last month on social network X, previously Twitter, that from Nov. 15 the peso would be put back on a crawling peg, ultimately allowing it to devalue by around 3% monthly.

...

https://www.msn.com/en-us/money/mar...eaken-for-first-time-since-august/ar-AA1jYpEm

- Messages

- 24,647

- Reaction score

- 4,511

- Points

- 288

NEW YORK, Nov 16 (Reuters) - Global investors expect a large amount of financial pain out of Argentina no matter who voters pick on Sunday as their next president, with social unrest as top of mind as a much-needed fiscal adjustment will likely trigger even more inflation.

Economy minister Sergio Massa and populist outsider Javier Milei go head-to-head in the Nov. 19 presidential election run-off, a choice between sticking with the current Peronist government or a sharp swerve to a right-wing libertarian.

www.reuters.com

www.reuters.com

Economy minister Sergio Massa and populist outsider Javier Milei go head-to-head in the Nov. 19 presidential election run-off, a choice between sticking with the current Peronist government or a sharp swerve to a right-wing libertarian.

Argentina investors brace for financial pain no matter who wins presidency

The winning candidate would need to fix an economy with inflation of 143%, a messy array of capital controls, a looming recession and net foreign currency reserves JPMorgan pegs at minus $15.3 billion.

Election is tomorrow. Some commentary from CATO"

More:

The signatories:

Jorge Tuto Quiroga

Expresidente de Bolivia

Iván Duque

Expresidente de Colombia

Sebastián Piñera E.

Expresidente de Chile

Mauricio Macri

Expresidente de Argentina

Jeanine Áñez

Expresidenta de Bolivia

Mariano Rajoy

Expresidente de España

Luis Fortuño

Exgobernador de Puerto Rico

Andrés Pastrana

Expresidente de Colombia

Felipe Calderón

Expresidente de México

Vicente Fox

Expresidente de México

Juan Guaido

Expresidente de Venezuela

... Peruvian novelist Mario Vargas Llosa, along with nine ex‐presidents from Latin America, and numerous other pro‐democracy leaders, activists, and intellectuals issued a statement today in support of Javier Milei. The only way out of Argentina’s crisis, they write, is through political and economic freedom, rather than the populist path the country has been on. Below, I offer an English translation of the statement. ...

More:

The signatories:

Jorge Tuto Quiroga

Expresidente de Bolivia

Iván Duque

Expresidente de Colombia

Sebastián Piñera E.

Expresidente de Chile

Mauricio Macri

Expresidente de Argentina

Jeanine Áñez

Expresidenta de Bolivia

Mariano Rajoy

Expresidente de España

Luis Fortuño

Exgobernador de Puerto Rico

Andrés Pastrana

Expresidente de Colombia

Felipe Calderón

Expresidente de México

Vicente Fox

Expresidente de México

Juan Guaido

Expresidente de Venezuela

An irony of the BRICS summit in South Africa last August, which included “de‐dollarization” in the official agenda, was the touting of Argentina as one of the group’s new members. Argentina, of course, is on the brink of a presidential run‐off in which the candidate who leads most polls, free‐market economist Javier Milei, vows to shut down the central bank and officially dollarize the country.

...

If Milei wins the election on Sunday, Argentina’s dollarization can be a major step toward an enlarged, Latin American “dollar zone,” which can spur extraordinary opportunities for wealth creation across the region. ...

Bloomberg is posting live updates on the election here:

www.bloomberg.com

www.bloomberg.com

Sounds like Milei is doing well and turnout has been strong.

Updates on Argentina’s Presidential Runoff Election Results

Sounds like Milei is doing well and turnout has been strong.

- Messages

- 24,647

- Reaction score

- 4,511

- Points

- 288

BUENOS AIRES, Nov 19 (Reuters) - Argentina elected libertarian outsider Javier Milei as its new president on Sunday, rolling the dice on an outsider with radical views to fix an economy battered by triple-digit inflation, a looming recession and rising poverty.

Official results have not been released, but his rival, Peronist Economy Minister Sergio Massa, conceded in a speech. His candidacy was hampered by the country's worst economic crisis in two decades while he has been at the helm.

www.reuters.com

www.reuters.com

Official results have not been released, but his rival, Peronist Economy Minister Sergio Massa, conceded in a speech. His candidacy was hampered by the country's worst economic crisis in two decades while he has been at the helm.

Argentina elects 'shock therapy' libertarian Javier Milei as president

Whoever wins the presidency will have to deal with the empty coffers of the government and central bank, a creaking $44 billion IMF debt program and inflation nearing 150%.

Now that's some good news. That's like Ron Paul getting elected, as a Libertarian.

- Messages

- 24,647

- Reaction score

- 4,511

- Points

- 288

Will be interesting to follow his term in office. I wish him good luck.

BUENOS AIRES, Nov 20 (Reuters) - Argentina's libertarian President-elect Javier Milei has won a closely fought election. Now comes the hard part: dealing with economic crises.

www.reuters.com

www.reuters.com

BUENOS AIRES, Nov 20 (Reuters) - Argentina's libertarian President-elect Javier Milei has won a closely fought election. Now comes the hard part: dealing with economic crises.

Argentina's next president Milei must tame inflation, turn around economy

Argentina's libertarian President-elect Javier Milei has won a closely fought election. Now comes the hard part: dealing with economic crises.