...

Javier Milei has in the past endorsed Bitcoin as a possible solution to the broken central bank monetary system, alongside gold. However, Milei has not expressed any intention to push BTC as a legal tender in Argentina. Instead, Milei’s campaign policy centered around dollarizing the Argentinian economy in order to tackle rampant inflation, which is currently running at 143%.

Nonetheless, given Milei’s other radical plans, which include reducing the size of government with a 15% cut to public spending, cutting ties with the world’s workshop, China, and shutting down the Central Bank of Argentina, Bitcoiners are hopeful that BTC as legal tender is at least on the agenda for discussion.

Keen to strike while positive sentiment is running high, Bitcoin bull Max Keiser requested permission from El Salvador’s President Bukele to arrange Bitcoin talks with Argentina’s newly elected president to drive the issue forward. El Salvador was the first country to make BTC legal tender following the ratification of the Bitcoin Law in September 2021.

...

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Argentina foibles (inflation, currency and potential anarcho-capitalist experiments)

- Thread starter pmbug

- Start date

Welcome to the Precious Metals Bug Forums

Welcome to the PMBug forums - a watering hole for folks interested in gold, silver, precious metals, sound money, investing, market and economic news, central bank monetary policies, politics and more.

Why not register an account and join the discussions? When you register an account and log in, you may enjoy additional benefits including no Google ads, market data/charts, access to trade/barter with the community and much more. Registering an account is free - you have nothing to lose!

- Messages

- 34,846

- Reaction score

- 5,928

- Points

- 288

LONDON/BUENOS AIRES, Nov 21 (Reuters) - Argentina's black market peso slid nearly 10% on Tuesday to over 1,000 per dollar after a libertarian who favors dollarization won the country's presidential election, while stocks and bonds jumped on hopes of tighter economic policy.

Argentina's local markets reopened after a holiday on Monday, giving the clearest idea yet of how investors would respond to the weekend's presidential election win of radical libertarian outsider Javier Milei.

www.reuters.com

www.reuters.com

Argentina's local markets reopened after a holiday on Monday, giving the clearest idea yet of how investors would respond to the weekend's presidential election win of radical libertarian outsider Javier Milei.

Argentina's black market peso slides after Milei win; local equities soar

Argentina's black market peso slid nearly 10% on Tuesday to over 1,000 per dollar after a libertarian who favors dollarization won the country's presidential election, while stocks and bonds jumped on hopes of tighter economic policy.

- Messages

- 34,846

- Reaction score

- 5,928

- Points

- 288

Looking through my news feed and I've seen several claims that Milei is planning to claim Argentina's sovereignty over the Malvinas Islands. That won't go over too well in Blighty. Will be following.

Edit to add:

www.forces.net

www.forces.net

Edit to add:

Javier Milei: Argentina's new president a fan of Margaret Thatcher but wants Falklands back

Nicknamed 'El Loco', or 'Crazy' in English, Javier Milei said Thatcher was one of the "great leaders" in history.

On my phone, so won't search and link source, but I read reports that quoted him on this matter specifying that he will seek a diplomatic resolution. He not going to instigate a military conflict over this.

- Messages

- 34,846

- Reaction score

- 5,928

- Points

- 288

^^^^^

There were several sentences in the video I liked. The politicians are not above the people who elected them, the party is over and the thieves are out of business (my take/my wording.)

But some of the speech reminded me of two politicians who gave similar speeches. Will be very interesting to see what happens once he's in office.

There were several sentences in the video I liked. The politicians are not above the people who elected them, the party is over and the thieves are out of business (my take/my wording.)

But some of the speech reminded me of two politicians who gave similar speeches. Will be very interesting to see what happens once he's in office.

- Messages

- 34,846

- Reaction score

- 5,928

- Points

- 288

From the link:

By Jorgelina do Rosario and Jorge Otaola

BUENOS AIRES (Reuters) - Argentine former central banker Luis Caputo, frontrunner to be the new economy minister, met local and international bank officials on Friday to lay out the economic plans of President-elect Javier Milei, three sources and a banking group said.

The meeting at the La Rural conference center in Buenos Aires comes as Milei, who has pledged "shock therapy" for the embattled economy, races to put together his economic team. Caputo has been tipped as a front-runner for the role.

finance.yahoo.com

finance.yahoo.com

By Jorgelina do Rosario and Jorge Otaola

BUENOS AIRES (Reuters) - Argentine former central banker Luis Caputo, frontrunner to be the new economy minister, met local and international bank officials on Friday to lay out the economic plans of President-elect Javier Milei, three sources and a banking group said.

The meeting at the La Rural conference center in Buenos Aires comes as Milei, who has pledged "shock therapy" for the embattled economy, races to put together his economic team. Caputo has been tipped as a front-runner for the role.

Argentina's economy chief frontrunner pitches Milei's 'shock' therapy to banks - sources

Argentine former central banker Luis Caputo, frontrunner to be the new economy minister, met local and international bank officials on Friday to lay out the economic plans of President-elect Javier Milei, three sources and a banking group said. The meeting at the La Rural conference center in...

- Messages

- 986

- Reaction score

- 1,405

- Points

- 278

Doug Casey on How Milei Could Make Argentina a Beacon of Freedom and Prosperity

International Man: Javier Milei made history by becoming the world’s first anarcho-capitalist president.

What is the historical significance of his victory? Are you optimistic?

Doug Casey: Milei’s election is a big deal—potentially a very, very big deal. He’s the first declared anarcho-capitalist in history to head any country. And not by stealth. He, all the while, said that the State is the enemy and should be abolished. Anarcho-capitalists believe that society can run itself without a State, which is a formalized instrument of coercion.

It’s unprecedented for somebody to be elected to run a State that he wants to abolish. And propose that if it continues to exist, it should only have the police, military, and the courts. And even those should be privatized.

Am I optimistic?

Looking at it from a long-term point of view, for the last hundred years, individual freedom has been diminishing, and State power has grown hugely all over the world. What’s worse is that the trend is accelerating. Many countries are on the ragged edge of turning into socialist or fascist dictatorships.

That includes the US. Since Reagan left office, all of our presidents have been disasters of various types, with the current regime being the worst yet. In Argentina, the Peronists have run the country completely into the ground over the last 75 years.

Of course, maybe Milei’s election is just an uptick in a continuing downtrend because you can’t change a country’s national philosophy overnight. But destroying a State apparatus infested by Peronists, socialists, fascists, and other horrible parasites is a good start. If he can pull the apparatus of the State out by its roots, not just trim it back, the result might last for quite a while.

I’m encouraged by the fact that young people and poor people are among his biggest supporters. They recognize that they’re the ones who the State damages the most. Could Argentina be the start of a worldwide trend towards free minds and free markets?

Since I prefer to believe humans are basically decent, I can’t help being optimistic—even if cautiously. He’s going to get lots of resistance from the Deep State, unions, the media, welfare queens, and other "usual suspects."

International Man: Perhaps there is no issue more important in Argentina than money.

Milei has promised to "burn down the central bank" and replace the peso with the US dollar. He has made statements favorable to eliminating all legal tender laws and allowing whatever commodity the free market would choose as money—though he hasn’t articulated his exact plans.

What do you think Milei should do regarding the money issue? What are the risks of adopting the US dollar and not having any monetary alternatives?

Doug Casey: First of all, he totally understands the government shouldn’t be in the money business. I know that shocks most people to hear, but trusting the government with money is like trusting a teenager with a Corvette and a bottle of Jack Daniels.

Milei correctly believes the government should be basically just a night watchman. It should have nothing to do with the economy or money because they’ll inevitably use regulations and fiat currency to corrupt the society and steal from their subjects. The Argentine government is especially notorious for printing money. That’s the root cause of inflation. Inflation makes it much harder for poor people to save and elevate themselves.

And it’s not just inflation. They have multiple exchange rates, which make it very convenient for government officials to buy money at an artificially low exchange rate while everybody else pays perhaps twice as much. And who can risk paying 100% interest rates? And how can you conduct business when your currency is a laughing stock, worthless outside the country?

Americans don’t really understand the importance of a sound currency because they’re used to a relatively stable dollar. Not so long ago, we used to have expressions like "sound as a dollar" and "the dollar is as good as gold." A sound currency is a major reason why America has prospered. An unsound currency is a major reason Argentina is a basket case.

So, yes, money is the number one issue in Argentina. Going from the peso to the dollar is a positive move, but regrettably, it only amounts to jumping out of a raging fire into a frying pan.

The ideal Argentine currency would be gold or silver coinage. Under Milei, Argentines can use any currency that they wish—gold, silver, Bitcoin, or US dollars. Initially, it will largely be dollars, if only because Argentines have hundreds of billions of them hidden abroad and under their mattresses.

Argentina also suffers from a perennial lack of capital, which is a huge problem since capital is critical to prosperity. Few people want to put serious capital into the country. Not just because of the insane currency problems we’ve just discussed but also because of onerous economic regulations and very high taxes. That’s why Argentinians hide their money out of the country. And why foreigners don’t want to invest there.

Milei is looking to freemarketize the country. With sound money, free banking, the abolition of most all regulations, and a very radical reduction in taxes, Argentina could become a gigantic version of Dubai or pre-takeover Hong Kong. It would draw capital in from anywhere and everywhere. It would be an investment magnet rather than a sinkhole for money.

International Man: Javier Milei made history by becoming the world’s first anarcho-capitalist president.

What is the historical significance of his victory? Are you optimistic?

Doug Casey: Milei’s election is a big deal—potentially a very, very big deal. He’s the first declared anarcho-capitalist in history to head any country. And not by stealth. He, all the while, said that the State is the enemy and should be abolished. Anarcho-capitalists believe that society can run itself without a State, which is a formalized instrument of coercion.

It’s unprecedented for somebody to be elected to run a State that he wants to abolish. And propose that if it continues to exist, it should only have the police, military, and the courts. And even those should be privatized.

Am I optimistic?

Looking at it from a long-term point of view, for the last hundred years, individual freedom has been diminishing, and State power has grown hugely all over the world. What’s worse is that the trend is accelerating. Many countries are on the ragged edge of turning into socialist or fascist dictatorships.

That includes the US. Since Reagan left office, all of our presidents have been disasters of various types, with the current regime being the worst yet. In Argentina, the Peronists have run the country completely into the ground over the last 75 years.

Of course, maybe Milei’s election is just an uptick in a continuing downtrend because you can’t change a country’s national philosophy overnight. But destroying a State apparatus infested by Peronists, socialists, fascists, and other horrible parasites is a good start. If he can pull the apparatus of the State out by its roots, not just trim it back, the result might last for quite a while.

I’m encouraged by the fact that young people and poor people are among his biggest supporters. They recognize that they’re the ones who the State damages the most. Could Argentina be the start of a worldwide trend towards free minds and free markets?

Since I prefer to believe humans are basically decent, I can’t help being optimistic—even if cautiously. He’s going to get lots of resistance from the Deep State, unions, the media, welfare queens, and other "usual suspects."

International Man: Perhaps there is no issue more important in Argentina than money.

Milei has promised to "burn down the central bank" and replace the peso with the US dollar. He has made statements favorable to eliminating all legal tender laws and allowing whatever commodity the free market would choose as money—though he hasn’t articulated his exact plans.

What do you think Milei should do regarding the money issue? What are the risks of adopting the US dollar and not having any monetary alternatives?

Doug Casey: First of all, he totally understands the government shouldn’t be in the money business. I know that shocks most people to hear, but trusting the government with money is like trusting a teenager with a Corvette and a bottle of Jack Daniels.

Milei correctly believes the government should be basically just a night watchman. It should have nothing to do with the economy or money because they’ll inevitably use regulations and fiat currency to corrupt the society and steal from their subjects. The Argentine government is especially notorious for printing money. That’s the root cause of inflation. Inflation makes it much harder for poor people to save and elevate themselves.

And it’s not just inflation. They have multiple exchange rates, which make it very convenient for government officials to buy money at an artificially low exchange rate while everybody else pays perhaps twice as much. And who can risk paying 100% interest rates? And how can you conduct business when your currency is a laughing stock, worthless outside the country?

Americans don’t really understand the importance of a sound currency because they’re used to a relatively stable dollar. Not so long ago, we used to have expressions like "sound as a dollar" and "the dollar is as good as gold." A sound currency is a major reason why America has prospered. An unsound currency is a major reason Argentina is a basket case.

So, yes, money is the number one issue in Argentina. Going from the peso to the dollar is a positive move, but regrettably, it only amounts to jumping out of a raging fire into a frying pan.

The ideal Argentine currency would be gold or silver coinage. Under Milei, Argentines can use any currency that they wish—gold, silver, Bitcoin, or US dollars. Initially, it will largely be dollars, if only because Argentines have hundreds of billions of them hidden abroad and under their mattresses.

Argentina also suffers from a perennial lack of capital, which is a huge problem since capital is critical to prosperity. Few people want to put serious capital into the country. Not just because of the insane currency problems we’ve just discussed but also because of onerous economic regulations and very high taxes. That’s why Argentinians hide their money out of the country. And why foreigners don’t want to invest there.

Milei is looking to freemarketize the country. With sound money, free banking, the abolition of most all regulations, and a very radical reduction in taxes, Argentina could become a gigantic version of Dubai or pre-takeover Hong Kong. It would draw capital in from anywhere and everywhere. It would be an investment magnet rather than a sinkhole for money.

- Messages

- 986

- Reaction score

- 1,405

- Points

- 278

Part two:

International Man: Milei has vowed to privatize state-owned companies.

How would you suggest he does this while ensuring it doesn’t create a new class of oligarchs as it did in Russia in the 1990s?

Doug Casey: For years, I have proposed to many governments that when they privatize, not to do so by selling State assets but by distributing them in the form of shares directly to the people. After all, the people theoretically own all State assets. Make it a reality with share ownership. That plan is pure capitalism but is also about "power to the people."

How can you give people more power than giving them direct tradeable share ownership?

They tried something similar in Eastern Europe in the 1990s. But it was complicated; the people didn’t understand what they were getting and typically sold their ownership rights for pennies on the dollar to would-be oligarchs.

To avoid that problem, Argentina should distribute shares pro-rata to all citizens. The shares would be "lettered" and unsalable for a couple of years while prices stabilize, then saleable at perhaps 5% per year over 20 years. Many people would keep them because the dividends should be attractive, and the share prices should go up radically as the economy booms in an inflation-free, regulation-free, and largely tax-free environment.

This is the ideal way to privatize. If the industries are sold, they’d be bought cheaply (perhaps due to corrupt payoffs) by foreigners and the well-connected rich, creating antagonism. At some point in the future, they’d be subject to nationalization again for some reason. However, a future government won’t be easily able to re-nationalize these businesses if the people own all the shares. Ownership by the public would, in addition, help defang the unions, which are a major impediment to prosperity in Argentina.

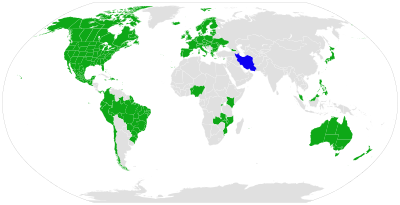

International Man: Historically, Argentina has stayed out of large global conflicts and remained relatively neutral.

In recent years, Argentina joined the BRICS+ countries and became more geopolitically aligned with Russia and China. Milei has said he will reorient Argentina towards the US and Europe geopolitically.

What is your advice to Milei on how he should conduct Argentina’s foreign affairs?

Doug Casey: I hope Milei comes to recognize that America today is not what it once was. America, the ideal, is wonderful. But America, the current nation-state, is very different. Henry Kissinger once said something to the effect of: "It’s dangerous being America’s enemy, but it’s even more dangerous being America’s friend." He’s right.

Foreign policy-wise, Milei ought to emulate the example of Singapore, Switzerland, or Dubai and be completely neutral. As Jefferson said, a friend to all, but allied to none. An Argentine ambassador should do no more than make small talk and be friendly.

Quite frankly, the country doesn’t need a foreign policy. It should be up to 45 million individual Argentinians to decide who they do or don’t want to deal with.

International Man: If Milei succeeds and his reforms stick, what are the investment or speculative implications for Argentine assets?

What are the lifestyle and other international diversification implications?

Doug Casey: If Milei’s reforms stick, within a decade, Argentina could become the most prosperous country in the world. Look at what Pinochet’s limited reforms did for Chile. It changed from a backward mining province into the most advanced and prosperous country on the continent. Milei’s reforms could transform Argentina into both the freest and the most prosperous country on the planet.

Argentina has many advantages. It’s geographically isolated, away from the winds of war which might blow in the Northern Hemisphere. It’s a giant country almost the size of Western Europe but with only 45 million people. It’s got absolutely everything in the way of resources, climate, and scenery. Argentina is the perfect country whose only real problem is its insane government. But that’s about to change.

If he succeeds, I think there will be a rush of millions of Europeans who will see that Argentina has got everything that Europe does—including the favorable aspects of its culture, but none of the disadvantages.

It’ll draw the best kind of immigrants, people with capital and education that are anxious for freedom and are self-supporting. Very unlike the migrants currently overwhelming North America and Europe.

What’s just happened is something of world historic importance. I urge you to get on a plane and investigate firsthand. It’s summer there now, and the weather is beautiful. The prices of everything from steak dinners to estancias are at giveaway levels. They won’t be for much longer.

International Man: Milei has vowed to privatize state-owned companies.

How would you suggest he does this while ensuring it doesn’t create a new class of oligarchs as it did in Russia in the 1990s?

Doug Casey: For years, I have proposed to many governments that when they privatize, not to do so by selling State assets but by distributing them in the form of shares directly to the people. After all, the people theoretically own all State assets. Make it a reality with share ownership. That plan is pure capitalism but is also about "power to the people."

How can you give people more power than giving them direct tradeable share ownership?

They tried something similar in Eastern Europe in the 1990s. But it was complicated; the people didn’t understand what they were getting and typically sold their ownership rights for pennies on the dollar to would-be oligarchs.

To avoid that problem, Argentina should distribute shares pro-rata to all citizens. The shares would be "lettered" and unsalable for a couple of years while prices stabilize, then saleable at perhaps 5% per year over 20 years. Many people would keep them because the dividends should be attractive, and the share prices should go up radically as the economy booms in an inflation-free, regulation-free, and largely tax-free environment.

This is the ideal way to privatize. If the industries are sold, they’d be bought cheaply (perhaps due to corrupt payoffs) by foreigners and the well-connected rich, creating antagonism. At some point in the future, they’d be subject to nationalization again for some reason. However, a future government won’t be easily able to re-nationalize these businesses if the people own all the shares. Ownership by the public would, in addition, help defang the unions, which are a major impediment to prosperity in Argentina.

International Man: Historically, Argentina has stayed out of large global conflicts and remained relatively neutral.

In recent years, Argentina joined the BRICS+ countries and became more geopolitically aligned with Russia and China. Milei has said he will reorient Argentina towards the US and Europe geopolitically.

What is your advice to Milei on how he should conduct Argentina’s foreign affairs?

Doug Casey: I hope Milei comes to recognize that America today is not what it once was. America, the ideal, is wonderful. But America, the current nation-state, is very different. Henry Kissinger once said something to the effect of: "It’s dangerous being America’s enemy, but it’s even more dangerous being America’s friend." He’s right.

Foreign policy-wise, Milei ought to emulate the example of Singapore, Switzerland, or Dubai and be completely neutral. As Jefferson said, a friend to all, but allied to none. An Argentine ambassador should do no more than make small talk and be friendly.

Quite frankly, the country doesn’t need a foreign policy. It should be up to 45 million individual Argentinians to decide who they do or don’t want to deal with.

International Man: If Milei succeeds and his reforms stick, what are the investment or speculative implications for Argentine assets?

What are the lifestyle and other international diversification implications?

Doug Casey: If Milei’s reforms stick, within a decade, Argentina could become the most prosperous country in the world. Look at what Pinochet’s limited reforms did for Chile. It changed from a backward mining province into the most advanced and prosperous country on the continent. Milei’s reforms could transform Argentina into both the freest and the most prosperous country on the planet.

Argentina has many advantages. It’s geographically isolated, away from the winds of war which might blow in the Northern Hemisphere. It’s a giant country almost the size of Western Europe but with only 45 million people. It’s got absolutely everything in the way of resources, climate, and scenery. Argentina is the perfect country whose only real problem is its insane government. But that’s about to change.

If he succeeds, I think there will be a rush of millions of Europeans who will see that Argentina has got everything that Europe does—including the favorable aspects of its culture, but none of the disadvantages.

It’ll draw the best kind of immigrants, people with capital and education that are anxious for freedom and are self-supporting. Very unlike the migrants currently overwhelming North America and Europe.

What’s just happened is something of world historic importance. I urge you to get on a plane and investigate firsthand. It’s summer there now, and the weather is beautiful. The prices of everything from steak dinners to estancias are at giveaway levels. They won’t be for much longer.

- Messages

- 34,846

- Reaction score

- 5,928

- Points

- 288

An opinion piece podcast here. Nothing to see, can listen in one tab, surf the forum in a different tab.

www.americasquarterly.org

www.americasquarterly.org

AQ Podcast: Javier Milei’s Challenges

Since being elected on November 19, Javier Milei has changed the tone of some of the more radical policy proposal he campaigned on. He has backtracked on his aggressive rhetoric toward some of Argentina’s largest trading partners, such as Brazil. He has suggested that dollarization will not soon, if at all. And he had a cordial conversation with Pope Francis, whom he had described as the devil’s man on earth. What does this about-face mean? Is a more pragmatic Milei emerging? And if that is the case, what are the circumstances he will face once in office — what are his key tests ahead? In this episode, a conversation with Eduardo Levy Yeyati, professor at the School of Government at Torcuato di Tella University in Buenos Aires, on near-term political scenarios as well as a big-picture view of Argentina’s long-term challenges.

AQ Podcast: Javier Milei's Challenges

Javier Milei has already backtracked on some of his more radical policy positions. What does this mean, and what are his key challenges?

www.americasquarterly.org

www.americasquarterly.org

- Messages

- 34,846

- Reaction score

- 5,928

- Points

- 288

From the link:

By Jorgelina do Rosario and Jorge Otaola

BUENOS AIRES (Reuters) - Argentine former central banker Luis Caputo, frontrunner to be the new economy minister, met local and international bank officials on Friday to lay out the economic plans of President-elect Javier Milei, three sources and a banking group said.

The meeting at the La Rural conference center in Buenos Aires comes as Milei, who has pledged "shock therapy" for the embattled economy, races to put together his economic team. Caputo has been tipped as a front-runner for the role.

Argentina's economy chief frontrunner pitches Milei's 'shock' therapy to banks - sources

Argentine former central banker Luis Caputo, frontrunner to be the new economy minister, met local and international bank officials on Friday to lay out the economic plans of President-elect Javier Milei, three sources and a banking group said. The meeting at the La Rural conference center in...finance.yahoo.com

Argentina's libertarian president-elect picks a former Central Bank chief as his economy minister

Argentina’s President-elect Javier Milei says he's chosen Luis Caputo, a former finance minister and Central Bank chief who is known as an expert in markets, to lead the Economy Ministry when the right-wing leader takes office on Dec. 10.

Kitco anchor talks to bitcoin bro about Argentina:

00:00 - Intro: Argentina and Javier Milei’s Campaign Promises

02:29 - New trend: Central banks are a scam

07:02 - The Path to Dollarization and Its Challenges

09:33 - Bitcoin's Role in Argentina's Future

12:33 - Argentina's Global Standing and BRICS Membership

00:00 - Intro: Argentina and Javier Milei’s Campaign Promises

02:29 - New trend: Central banks are a scam

07:02 - The Path to Dollarization and Its Challenges

09:33 - Bitcoin's Role in Argentina's Future

12:33 - Argentina's Global Standing and BRICS Membership

- Messages

- 34,846

- Reaction score

- 5,928

- Points

- 288

With soy and lithium trade in the balance, Argentina's Milei has a China conundrum

BUENOS AIRES/BEIJING, Dec 7 (Reuters) - Argentina's President-elect Javier Milei has a China conundrum.The libertarian economist insulted communist-run China in a fiery campaign, but takes office on Sunday needing the country's second-largest trade partner more than ever as a recession looms and foreign currency reserves run dry.

Since he won the Nov. 19 election, Milei's team have taken a more diplomatic tone, reflecting complex ties with China, the top buyer of Argentine soybeans and beef, a key investor in its lithium, and the provider of an $18 billion currency swap - effectively, a form of credit provision that has helped Argentina avoid default.

More:

With soy and lithium trade in the balance, Argentina's Milei has a China conundrum

Argentina's President-elect Javier Milei has a China conundrum.

- Messages

- 34,846

- Reaction score

- 5,928

- Points

- 288

DW News commentary

10:40

Replacing the Peso with US dollars and getting rid of the central bank, that’s what Javier Milei, Argentina’s recently elected president, has proposed as part of his radical economic agenda. We speak to two experts who give us details on what could be Argentina’s road ahead.

What experts think of ‘anarcho-capitalist’ Milei’s plan to dollarize the Argentinian economy?

Dec 4, 202310:40

Replacing the Peso with US dollars and getting rid of the central bank, that’s what Javier Milei, Argentina’s recently elected president, has proposed as part of his radical economic agenda. We speak to two experts who give us details on what could be Argentina’s road ahead.

- Messages

- 34,846

- Reaction score

- 5,928

- Points

- 288

BUENOS AIRES, Dec 11 (Reuters) - Argentine voters may have cause to worry about new President Javier Milei's pledge for painful economic shock therapy, but markets are keen, hoping the libertarian will give the economy a "firm kick" when he lays out his plan this week.

The outsider economist on Sunday reaffirmed plans for tough spending cuts to address the country's worst economic crisis in two decades and bring down inflation nearing 150%, though he warned the situation would get worse before getting better.

The outsider economist on Sunday reaffirmed plans for tough spending cuts to address the country's worst economic crisis in two decades and bring down inflation nearing 150%, though he warned the situation would get worse before getting better.

Javier Milei was sworn in as president of Argentina on Sunday. ...

...

There is no room left for a gradualist approach to work, Milei suggested. Argentina does not "have margin for sterile discussions. Our country demands action and immediate action."

Milei acknowledged that this would have negative short-term effects. "There will be stagflation, it is true," he said, "but it is not very different from what has happened in the last 12 years." And after the short term is over, he promised, "we will see the fruits of our effort, having created the base for solid and sustainable growth."

One of his first actions, Milei declared, would be a 5 percent cut in public spending. He did not share any other details in his speech, but he is expected soon to submit a wide-ranging package of reforms to the legislature. His proposals will face an uphill battle, as his party, La Libertad Avanza, has only a small number of seats.

Milei's 35-minute speech ended with a call for liberty and a return to embrace the ideas of freedom: "Just as the fall of the Berlin Wall marked the end of a tragic era for the world, these elections have marked the turning point in our history." Years of failure cannot be undone at once. But change, Milei said, "begins in a day, and today is that day."

Javier Milei sworn in as president of Argentina

"Just as the fall of the Berlin Wall marked the end of a tragic era for the world," he said, "these elections have marked the turning point in our history."

Argentina’s new president Javier Milei took his incoming cabinet’s oaths on Sunday afternoon at the Casa Rosada. Unlike the previous government, there were only nine new ministers instead of 18 and for the first time, the ceremony took place behind closed doors — no press, no livestream.

Earlier on Sunday the new administration revealed its first “Decree of Necessity and Urgency” (Decreto de Necesidad y Urgencia, or DNU) — a type of presidential decree which allows them to legislate without going through Congress first. The 76-page document confirmed that the Milei government is halving the number of ministries from the previous government, leaving only nine. The drastic reduction was a staple proposal of his electoral platform known as the “Chainsaw Plan.”

...

More:

Milei’s reduced cabinet sworn in without press present - Buenos Aires Herald

The administration’s first decree confirmed that the Milei is cutting Argentina’s number of ministries by half, with only nine taking their oath on Sunday

buenosairesherald.com

Argentina on Tuesday announced a sharp devaluation of its currency and cuts to energy and transportation subsidies as part of shock adjustments that new President Javier Milei says are needed to deal with an economic “emergency.”

Economy Minister Luis Caputo said in a televised message that the Argentine peso will be devalued by 50%, from 400 pesos to the U.S. dollar to 800 pesos to the dollar.

...

Argentina devalues currency, cuts subsidies under new President Javier Milei

Argentina on Tuesday announced a sharp devaluation of its currency and cuts to energy and transportation subsidies as part of shock adjustments that new...

- Messages

- 34,846

- Reaction score

- 5,928

- Points

- 288

^^^^^^

BUENOS AIRES, Dec 12 (Reuters) - Argentina will weaken its peso over 50% to 800 per dollar, cut energy subsidies, and cancel tenders of public works, new Economy Minister Luis Caputo said on Tuesday, economic shock therapy aimed at fixing the country's worst crisis in decades.

Caputo said the plan would be painful in the short-term but was needed to cut the fiscal deficit and bring down triple-digit inflation, as he unveiled a package of measures after libertarian President Javier Milei took office on Sunday.

More:

Argentina devalues peso, cuts spending to treat fiscal deficit 'addiction'

BUENOS AIRES, Dec 12 (Reuters) - Argentina will weaken its peso over 50% to 800 per dollar, cut energy subsidies, and cancel tenders of public works, new Economy Minister Luis Caputo said on Tuesday, economic shock therapy aimed at fixing the country's worst crisis in decades.

Caputo said the plan would be painful in the short-term but was needed to cut the fiscal deficit and bring down triple-digit inflation, as he unveiled a package of measures after libertarian President Javier Milei took office on Sunday.

More:

- Messages

- 34,846

- Reaction score

- 5,928

- Points

- 288

****Do not think it can't happen here. It can. From Proverbs: Be diligent to know the state of thy flock — That thou mayest preserve and improve what thou hast, and take care that thy expenses do not exceed thy income.

WARNING for Americans

17:00

WARNING for Americans This is what LIFE is like After an Economic Collapse

This is what LIFE is like After an Economic Collapse

17:00

- Messages

- 34,846

- Reaction score

- 5,928

- Points

- 288

Milei's mission improbable for Argentina has investors daring to dream

- Economic shock therapy has seen Argentina's markets rally

- Investors hope Milei plan can finally lift the country

- Threat of a 10th debt default looms if new approach fails

Javier Milei is putting South America's second biggest economy and serial debt defaulter into shock therapy, kicking off by halving the value of the peso and slashing its spending.

And in an indication of how investor sentiment has turned since Milei burst on the scene, Argentina's bonds have surged by around 25% in the last week and 40% since he won the presidency.

More:

Thousands of people are expected to take to the streets of Buenos Aires on Wednesday to protest against the government's economic shock measures, in the first real test for Argentina's new libertarian President Javier Milei.

...

The protests are being called by groups that represent the unemployed who are expected to gather in the city center later on Wednesday to demand greater financial support for the poor.

"It is a peaceful mobilization. We do not want any type of confrontation. We do not want any type of clash," Eduardo Belliboni who leads a leftist protest group, Polo Obrero, that first called the demonstration, told local radio.

...

https://www.msn.com/en-us/news/worl...ups-react-to-milei-austerity-plan/ar-AA1lNMsZ

- Messages

- 34,846

- Reaction score

- 5,928

- Points

- 288

How do the Poor in Argentina Survive the Economic Collapse?

Dec 21, 202321:13

Channel: https://www.youtube.com/@TheModernSurvivalist/videos

Argentina affirms the right of actors to settle contracts with crypto:

www.zerohedge.com

www.zerohedge.com

"In Argentina, Contracts Can Be Settled In Bitcoin", Foreign Minister Affirms | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

- Messages

- 34,846

- Reaction score

- 5,928

- Points

- 288

Argentina's president announces economy deregulation as thousands protest austerity

President Javier Milei has announced sweeping initiatives to transform Argentina’s struggling economy, including easing government regulation and allowing privatization of state-run industries as a bid to boost exports and investment.The right-wing libertarian announced the moves for South America's second-biggest economy just hours after thousands of Argentines took to the streets of the capital to protest against austerity and deregulation actions taken last week by Milei.

The demonstrations went off relatively peacefully Wednesday, after a government warning against blocking streets.

Around the start of the protest, which drew thousands of marchers, police briefly scuffled with some demonstrators and two men were arrested. But the event concluded without widespread street blockages that have been frequent in past years.

More:

Argentina's president announces economy deregulation as thousands protest austerity

President Javier Milei has announced sweeping initiatives to transform Argentina’s struggling economy, including easing government regulation and allowing privatization of state-run industries as a bid to boost exports and investment.

The right-wing libertarian announced the moves for South America's second-biggest economy just hours after thousands of Argentines took to the streets of the capital to protest against austerity and deregulation actions taken last week by Milei.

The demonstrations went off relatively peacefully Wednesday, after a government warning against blocking streets.

Around the start of the protest, which drew thousands of marchers, police briefly scuffled with some demonstrators and two men were arrested. But the event concluded without widespread street blockages that have been frequent in past years.

More:

That's exactly what has to happen. I wonder if there is a way to easily invest in Argentina's turn around. Will clearly take time so no rush.

Milei kills China deals:

www.voanews.com

www.voanews.com

Milei's Government Pays IMF Without Tapping China Currency Swap

Move declared "first major victory" by Milei's government

www.voanews.com

www.voanews.com

- Messages

- 34,846

- Reaction score

- 5,928

- Points

- 288

Argentina's new president lays off 5,000 government employees hired in 2023, before he took office

The administration of Argentine President Javier Milei says the government won’t renew contracts for more than 5,000 employees hired this year before he took office.

- Messages

- 34,846

- Reaction score

- 5,928

- Points

- 288

Javier Milei Is Preparing a Nice Little New Year’s Gift for the World’s Richest Man, Elon Musk

Musk is “extremely interested” in Argentina’s vast lithium deposits, according to Milei. So too, apparently, is the US Government and many other US companies. Milei will happily oblige.

Argentina’s President Javier Milei has been in power for less than a month but he is already causing quite a stir. The omnibus bill his government has sent to the National Congress will, if passed, have major ramifications for the economy, politics and society. Workers’ rights will be pulverised; up to 41 state-owned companies, including the YPF oil company, will be privatised; the right to protest will be severely curtailed; taxes will increase, especially for the working and middle classes; public salaries, pensions and other benefits will be frozen as official annual inflation reaches 220%; and environmental laws and regulators will be put to the chainsaw.

This is austerity not on steroids but on angel dust. Rather than reverting Argentina’s decades-long economic malaise, it is likely to make it a whole lot worse.

More:

Javier Milei Is Preparing a Nice Little New Year's Gift for the World's Richest Man, Elon Musk | naked capitalism

Musk is "extremely interested" in Argentina's vast lithium deposits, according to Milei. So too, apparently, is the US Government and many other US companies. Milei will happily oblige.

- Messages

- 34,846

- Reaction score

- 5,928

- Points

- 288

Argentina takes unwelcome Latin America inflation crown from Venezuela

Argentina has taken the unwelcome regional inflation crown from Venezuela, becoming the Latin American country with the highest inflation rate in 2023 after prices rose over 200% last year, the highest level in three decades. In Venezuela, dogged by years of economic crisis and where inflation...

Argentine President Javier Milei raised the stake on Thursday, announcing plans to dismantle “sooner or later” the country’s central bank. This radical remark, revealed in an interview with Radio La Red, aligns with Milei’s ultra-libertarian ideology and fulfills a bold campaign promise that could push Argentina’s economic landscape towards the dollarization.

“They voted us to govern and put the Argentine economy in check. Surveys on the image and government measures are accompanying us. We have set a course and we are fulfilling it,” Milei stated. This declaration comes amidst a backdrop of soaring inflation and significant economic challenges.

...

The International Monetary Fund (IMF) announced Wednesday to have reached a staff-level agreement with Argentine authorities on the seventh review under Argentina’s EFF arrangement, totaling $44 billion. Pending approval by the IMF Executive Board, Argentina could access approximately US$4.7 billion.

The IMF has praised President Milei’s quick and decisive actions to implement a robust policy package aimed at restoring macroeconomic stability.

They anticipate that the initial stages, including the elimination of legacy price controls and the correction of FX misalignment, will lead to inflationary pressure and a deeper contraction in activity.

However, they expect a gradual disinflation process, accompanied by a strengthening external position and eventual recovery in output, demand, and real wages.

Milei is scheduled to attend the World Economic Forum in Davos, Switzerland, from Jan. 15-19, 2024. This event brings together political and business leaders from around the globe, offering Milei a platform to showcase his unconventional economic strategies on the world stage.

Argentine President Milei Shocks With Plan To Dismantle Central Bank Amid Skyrocketing Inflation, IMF Backs Move

They voted us to govern and put the Argentine economy in check. Surveys on the image and government measures are accompanying us. We have set a course and we are fulfilling it," Milei stated.

When President Javier Milei defended the adoption of the dollar through a "free competition of currencies" in Argentina, few foresaw a brand-new legal tender coming out of the middle of the country.

The legislature of La Rioja, a small, landlocked province known for its olives, approved the creation of a new quasi-currency this week, defying Milei's austerity push to end the nation's chronic fiscal deficit.

La Rioja's move evokes similar provincial currencies issued during past economic crises that ended infamously.

La Rioja Governor Ricardo Quintela -- from the opposition Peronist coalition -- requested authorization to launch the so-called bocade to pay part of public servants' salaries after a strike by La Rioja’s local police force and protests from health workers. The legislature approved issuing as much as 22.5 billion pesos ($27.5 million) worth of bocades to complement workers' paychecks in the national currency. ...

Milei, who has put plans to replace the peso with the U.S. dollar on hold to prioritize budget austerity, sarcastically welcomed La Rioja's decision.

"Provincial currencies are welcome to compete," Milei wrote on social media. But "unlike what happened in the past, in no way are they going to be rescued by the national government."

I wonder if Milei would consider going GAULT or S(ilver)AULT.

...

“We are very close to being able to dollarize,” Milei said in an interview with Colombian journalist Patricia Jainot uploaded on Thursday to her You Tube account. The President stated that, under his administration, the Central Bank bought “a little more than US$5 billion,“ adding that the country’s monetary base is US$7.5 billion.

“If we could clear all the interest-bearing liabilities, Argentina would be in a position to dollarize [its economy] with very little money. That way, we would exterminate inflation,” the president said.

...

Argentina is 'very close' to being able to dollarize the economy, Milei says - Buenos Aires Herald

The president stated that the elimination of the Central Bank is also still on the table

buenosairesherald.com

- Messages

- 559

- Reaction score

- 727

- Points

- 283