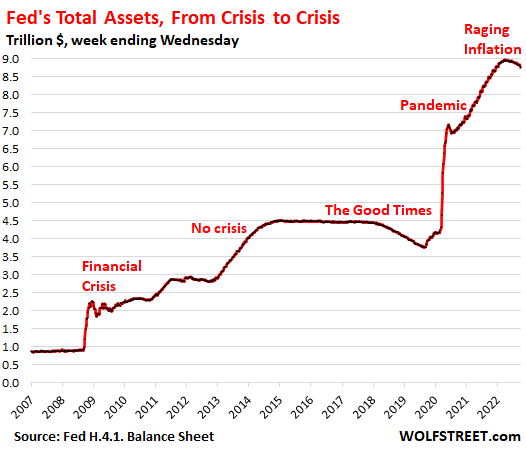

The Bank of England today, as part of its quantitative tightening (QT), sold £750 million in UK government bonds (gilts) at auction. These bonds were part of the holdings the BOE had acquired during the QE program since 2009. The bonds it sold today had a remaining maturity ranging from about three years to seven years.

And so the BOE became the first major central bank to sell bonds outright as part of its QT.

The bond sales come on top of the classic QT of letting maturing bonds roll off the balance sheet without replacement, which is what the Fed and the Bank of Canada are now doing.

...

Bank of England Sold Bonds Outright Today to Speed up QT, Will Sell More at Regular Auctions: First Major Central Bank to Sell Bonds Outright

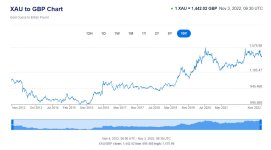

It went fine. Gilt yields are way down from panic highs. Another dream of the “pivot” mongers goes to heck.

wolfstreet.com