ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zerowww.zerohedge.com

This has to be the SLOWEST bank crash ever. Shoot, SVB disappears $200 Billion in 3 days and CS has been on this fall for decades.

Welcome to the PMBug forums - a watering hole for folks interested in gold, silver, precious metals, sound money, investing, market and economic news, central bank monetary policies, politics and more.

Why not register an account and join the discussions? When you register an account and log in, you may enjoy additional benefits including no Google ads, market data/charts, access to trade/barter with the community and much more. Registering an account is free - you have nothing to lose!

ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zerowww.zerohedge.com

Remember! Time slows down when you are on the cusp of a black (financial) hole.This has to be the SLOWEST bank crash ever. Shoot, SVB disappears $200 Billion in 3 days and CS has been on this fall for decades.

Remember! Time slows down when you are on the cusp of a black (financial) hole.

But seriously, how the heck is CS still even around or are the feds waiting for Friday at 5PM?

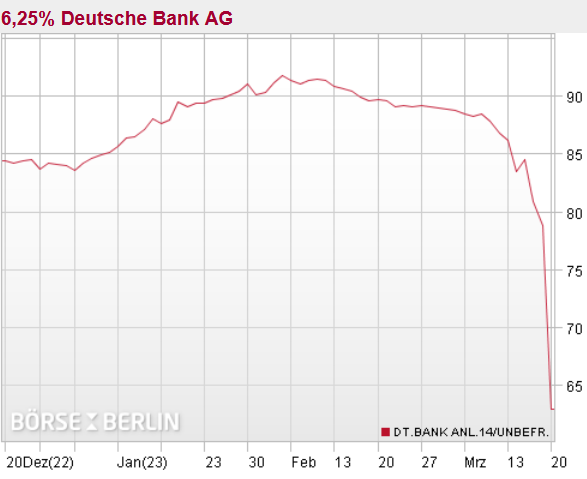

Ruh roh. CS no longer has a financial lifeline. Stock down 25% after multiple halts.

What kind of person/company still has deposits with them?

Saw they just filed to raise about $9B.I've wondered that about Wells Fargo for a long time now. Then I find out my brother still has an account with them.

...

After the dramatic drop in the stock price, Credit Suisse appealed to the Swiss National Bank and federal regulators for public support, FT reported. Meanwhile, the European Central Bank contacted EU lenders and asked them to disclose their exposures to the Swiss lender, according to the same report.

The Credit Suisse situation is much more dangerous than a failure of a couple of U.S. regional banks, warned Capital Economics Wednesday.

"Credit Suisse has a much larger balance sheet than SVB and is much more globally inter-connected, with multiple subsidiaries outside Switzerland, including in the US. It is also a U.S. primary broker. Credit Suisse is not just a Swiss problem but a global one," said Capital Economics chief Europe economist Andrew Kenningham.

Also, the Credit Suisse predicament could impact the European Central Bank's policy decision scheduled for Thursday.

...

Credit Suisse shares soared more than 30% at Thursday's market open after the bank said it will borrow up to 50 billion Swiss francs ($54 billion) from the Swiss National Bank.

...

taking on more future debt to cover today's debt, isn't that a really bad idea? like borrowing from your VISA to pay your MC

CS got a loan and all US depositors are backstopped by the fed reserve. Nasdaq way up. Happy days are here again.

Make no mistake. Credit Suisse is FINISHED, it's just a matter of time and how much more money is thrown at them to keep kicking the can.

...

Neil Shearing, group chief economist at Capital Economics, said a complete takeover of Credit Suisse may have been the best way to end doubts about its viability as a business, but the "devil will be in the details" of the UBS buyout agreement.

"One issue is that the reported price of $3,25bn (CHF0.5 per share) equates to ~4% of book value, and about 10% of Credit Suisse's market value at the start of the year," he highlighted in a note Monday.

"This suggests that a substantial part of Credit Suisse's $570bn assets may be either impaired or perceived as being at risk of becoming impaired. This could set in train renewed jitters about the health of banks."

... this morning the entire universe of riskiest bonds of European lenders - those in the AT1 tier - plunged after UBS agreed to buy the bank in a historic, government-enforced deal aimed at containing a crisis of confidence that had started to spread across global financial markets. It was the biggest loss yet for Europe’s AT1 market, which was created after the financial crisis to ensure losses would be borne by investors not taxpayers.

...

Realizing that the chaos and fury among AT1 investors could spark the next leg of market contagion, on Monday morning European regulators rushed to reassure investors that shareholders should face losses before bondholders after the takeover of Credit Suisse Group AG wiped the bank’s Additional Tier 1 debt while preserving over $3 billion in equity value.

Junior creditors should bear losses only after equity holders have been fully wiped out, according to a joint statement from the Single Resolution Board, the European Banking Authority and the ECB Banking Supervision, who apparently were not consulted on Sunday during the whirlwind decisions that preserved some equity value at CS while wiping out its entire AT1 tranche.

...

If the AT1 new-issue market reopens, equity conversion may become the dominant loss-absorption mechanism to reassure investors that they won’t be wiped out ahead of shareholders, BI’s Julius said.

Yet, judging by the market action, investors aren’t sticking around to find out. All kinds of risky bank debt tumbled on Monday and analysts predicted far-reaching consequences to Europe’s funding market. The market for new AT1 bonds will likely go into deep freeze, traders said.

...

Do you like clown shows? The markets don't...

ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zerowww.zerohedge.com

Edit: More context:

One of the elements in the takeunder by UBS of Credit Suisse was that CHF 16 billion (about $17.3 billion) in CoCo bonds got wiped out totally, while shareholders got wiped out only almost totally. Swiss regulator FINMA, when announcing the deal on Sunday, said that CoCo bonds would be written down to zero, in a sense subordinating bondholders to shareholders, which is like a total no-no very-bad-boy thing to do, because normally, shareholders would get totally wiped out first, and then bond holders would start taking their turn.

Turns out, there were some clauses in the documents of the CoCo bonds, issued in Switzerland, that allowed this under certain conditions and triggers. But no one ever reads any clauses, and so it came as a surprise, shaking up the $275 billion market for these creatures that came out of the swamp of the Financial Crisis.

...

What tripped folks up was that shares of Credit Suisse didn’t get totally wiped out first. The buyout offer by UBS was an exchange of one UBS share for 22.48 Credit Suisse shares, which valued Credit Suisse shares at roughly CHF 0.76 (down 99% from the peak in 2007) and down 60% from the close on Friday. Maybe this was a nod toward institutional investors in the Middle East that had poured so much money into Credit Suisse.

So shareholders are getting some peanuts. CoCo bondholders had been under the impression – not having read the clauses – that their CoCos would be senior to common shares, and that they’d get some peanuts, if shareholders get peanuts. But now, they aren’t getting anything, not even a single peanut. ...

Ambrose Evans-Pritchard said:...

The justification for selling Credit Suisse at 7pc of book value and vaporising its bonds is that the bank is in worse trouble than supposed. Either Swiss regulators are exaggerating - in order to expropriate $17bn (3pc of Swiss GDP) - or global monetary tightening has already done widespread systemic damage.

...