Credit Suisse is too big to fail (and cause systemic distress). Central banks won't let that happen (if they can help it). It may get broken up and sold off. Debts may get moved around the grand shell game table. But we aren't going to see a catastrophic collapse. The show must go on (until it can't).

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Credit Suisse (now UBS) on borrowed time?

- Thread starter russell.cabbage

- Start date

-

- Tags

- black swan credit suisse ubs

Welcome to the Precious Metals Bug Forums

Welcome to the PMBug forums - a watering hole for folks interested in gold, silver, precious metals, sound money, investing, market and economic news, central bank monetary policies, politics and more.

Why not register an account and join the discussions? When you register an account and log in, you may enjoy additional benefits including no Google ads, market data/charts, access to trade/barter with the community and much more. Registering an account is free - you have nothing to lose!

- Messages

- 1,607

- Reaction score

- 2,245

- Points

- 298

OBOY. Lookit this... they are even a bit ahead of 2008:

Oh, dear... I am not able to link/paste yet.

Anyway, it shows Credit Suisse on a vertical slope quickly passing the 35X leverage mark. Lehman collapsed at just under 40X

Oh, dear... I am not able to link/paste yet.

Anyway, it shows Credit Suisse on a vertical slope quickly passing the 35X leverage mark. Lehman collapsed at just under 40X

I told my wife and kids that all will be known in October. They will try to contain a calamity until after the midterms, but I don't think the market can make it that long. It's getting dicey.

- Messages

- 1,607

- Reaction score

- 2,245

- Points

- 298

That is a recipe for near-instant hyperinflation. Lehman Bros. wound up with nothing to be broken up and sold off... that was their problem. And there aren't any banks big enough to stop the interconnections from cascading.Credit Suisse is too big to fail (and cause systemic distress). Central banks won't let that happen (if they can help it). It may get broken up and sold off. Debts may get moved around the grand shell game table. But we aren't going to see a catastrophic collapse. The show must go on (until it can't).

You are spot on, IMO. This is volatile. It is also being kept out of the news (sorta like 2008, IIRC).I told my wife and kids that all will be known in October. They will try to contain a calamity until after the midterms, but I don't think the market can make it that long. It's getting dicey.

ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zerowww.zerohedge.com

- Messages

- 552

- Reaction score

- 722

- Points

- 273

Saudis take 10% stake - $1.5B.

cheka

Ground Beetle

bingo. they would kill all of us to 'save' (their) criminal enterprises (they) call 'banks'Credit Suisse is too big to fail (and cause systemic distress). Central banks won't let that happen (if they can help it). It may get broken up and sold off. Debts may get moved around the grand shell game table. But we aren't going to see a catastrophic collapse. The show must go on (until it can't).

That $4 billion capital raise that was supposed to shore up confidence in global banking behemoth Credit Suisse turns out to have been too little, too late. Yesterday, 5-year Credit Default Swaps (CDS) on Credit Suisse blew out to 446 basis points. That’s up from 55 basis points in January and more than five times where CDS on its peer Swiss bank, UBS, are trading.

...

Things don’t look any brighter this morning for Credit Suisse. Its shares are trading in Europe at 2.67 Swiss Francs or approximately $2.82 – an all-time low. Year-to-date, shares of Credit Suisse have lost 66 percent of their value as of yesterday’s close on the New York Stock Exchange.

...

Credit Default Swaps Blow Out on Credit Suisse as its Stock Price Hits an All-Time Low of $2.82

By Pam Martens and Russ Martens: December 1, 2022 ~ That $4 billion capital raise that was supposed to shore up confidence in global banking behemoth

wallstreetonparade.com

- Messages

- 24,693

- Reaction score

- 4,522

- Points

- 288

From the link above:

According to an historical timeline on the Credit Suisse website, it was previously known as Schweizerische Kreditanstalt, which was eventually shorted to SKA. The timeline notes that SKA’s New York Branch was granted a license to accept deposits in 1964. Credit Suisse’s New York branch has continued for decades to accept deposits, but they are not insured. In the resolution plan for Credit Suisse that it filed with the Federal Reserve in 2020, it writes:

“Our New York Branch is not a member of, and its deposits are not insured by, the FDIC. CS’ biggest U.S. presence is through its broker-dealer related businesses. Typically broker-dealer activities are resolved with a rapid runoff of the businesses as long as the resolution strategy is supported by adequate operational capabilities, such as the ability to transfer client accounts to peer institutions while causing minimal disruptions to the broader financial markets.”

Wall Street trading houses accepting uninsured deposits resulted in the banking crisis of the early 1930s when thousands of banks failed and people rushed to pull their money from uninsured banks. Congress passed the 1933 Glass-Steagall Act banning the combination of investment banks/brokerage firms with federally-insured banks. (Federal deposit insurance was also created under the Glass-Steagall Act to restore confidence in the U.S. banking system.) The Glass-Steagall Act served the nation well for 66 years until its repeal under the Bill Clinton administration in 1999, allowing trading firms to merge with federally-insured, deposit-taking banks. It took just nine years without Glass-Steagall for Wall Street to collapse in a replay of the crash of 1929.

Despite both Democrats and Republicans promising in their 2016 campaign platforms to restore the Glass-Steagall Act, the idea quickly bit the dust once the Trump administration took office. (See Mnuchin Says Trump Administration Never Intended to Restore Glass-Steagall Act.) Instead of Congress removing the Wall Street trading casino from the nation’s federally-insured banks, Congress has sat back and allowed the crypto circus to spread its risk directly into federally-insured banks.

___________________________________________________________________________________________

finance.yahoo.com

finance.yahoo.com

According to an historical timeline on the Credit Suisse website, it was previously known as Schweizerische Kreditanstalt, which was eventually shorted to SKA. The timeline notes that SKA’s New York Branch was granted a license to accept deposits in 1964. Credit Suisse’s New York branch has continued for decades to accept deposits, but they are not insured. In the resolution plan for Credit Suisse that it filed with the Federal Reserve in 2020, it writes:

“Our New York Branch is not a member of, and its deposits are not insured by, the FDIC. CS’ biggest U.S. presence is through its broker-dealer related businesses. Typically broker-dealer activities are resolved with a rapid runoff of the businesses as long as the resolution strategy is supported by adequate operational capabilities, such as the ability to transfer client accounts to peer institutions while causing minimal disruptions to the broader financial markets.”

Wall Street trading houses accepting uninsured deposits resulted in the banking crisis of the early 1930s when thousands of banks failed and people rushed to pull their money from uninsured banks. Congress passed the 1933 Glass-Steagall Act banning the combination of investment banks/brokerage firms with federally-insured banks. (Federal deposit insurance was also created under the Glass-Steagall Act to restore confidence in the U.S. banking system.) The Glass-Steagall Act served the nation well for 66 years until its repeal under the Bill Clinton administration in 1999, allowing trading firms to merge with federally-insured, deposit-taking banks. It took just nine years without Glass-Steagall for Wall Street to collapse in a replay of the crash of 1929.

Despite both Democrats and Republicans promising in their 2016 campaign platforms to restore the Glass-Steagall Act, the idea quickly bit the dust once the Trump administration took office. (See Mnuchin Says Trump Administration Never Intended to Restore Glass-Steagall Act.) Instead of Congress removing the Wall Street trading casino from the nation’s federally-insured banks, Congress has sat back and allowed the crypto circus to spread its risk directly into federally-insured banks.

___________________________________________________________________________________________

Exclusive-Credit Suisse looks to speed up cuts as revenue outlook worsens

ZURICH (Reuters) -Credit Suisse is accelerating cost cuts announced just weeks ago, Chairman Axel Lehmann said on Friday, as client outflows and a slowdown in activity weigh on the Swiss bank's revenue outlook. Credit Suisse said in October it intends to reduce its cost base by around 2.5...

Reports that Saudi Crown Prince MbS is looking to invest $500 million in Credit Suisse along with other investors for a total $1B investment have stopped the stock slide.

Credit Suisse is "definitely stable," Chairman Axel Lehmann told Swiss broadcaster SRF on Monday, adding that the embattled bank had seen a stabilisation in the outflows of client funds.

The bank has reported sharp outflows as wealthy clients move assets elsewhere, while the bank battles to recover from a string of scandals by focusing more on its flagship wealth management franchise and pruning back investment banking.

"Thankfully, the outflows have stabilised," Lehman told SRF in an interview to be broadcast on Monday.

Funds were also starting to return to the bank, he said, particularly in its Swiss home market.

...

Reports that Saudi Crown Prince MbS is looking to invest $500 million in Credit Suisse along with other investors for a total $1B investment have stopped the stock slide.

Throwing good money after bad. The derivatives book is $17 Trillion. Good luck with that. Actually no, I will enjoy watching it implode.

Brave or stupid IDK . Catching a falling knife IMO.Reports that Saudi Crown Prince MbS is looking to invest $500 million in Credit Suisse along with other investors for a total $1B investment have stopped the stock slide.

cheka

Ground Beetle

i've seen this show before. they play it every 5 years or so

credit shemitah?

credit shemitah?

- Messages

- 1,607

- Reaction score

- 2,245

- Points

- 298

What kind of an avalanche of Trillions can be stopped by a single Billion? 1/17000Throwing good money after bad. The derivatives book is $17 Trillion. Good luck with that. Actually no, I will enjoy watching it implode.

I think a good analogy would be a bug on the windshield. Din' stop the car.

What kind of an avalanche of Trillions can be stopped by a single Billion? 1/17000

I think a good analogy would be a bug on the windshield. Din' stop the car.

This was a pretty good video on these Derivatives. AND it is THESE Derivatives that are driving the entire world economy. Yet, barely understood and far too ignored. It also makes sense, anything with that kind of size is going to drive the bus, it just has the most momentum so to speak. These are the black hole of financialization.

Credit Suisse is the latest bank - out of many this year - coming out and considering a large cut to its bonus pool. The bank, which has been under intense criticism amidst ongoing questions about its liquidity, and has been spending its money suing its critics, is considering a 50% cut to its bonus pool, Bloomberg reported Wednesday morning.

...

More:

Credit Suisse Considers 50% Cut To Bonus Pool | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

...

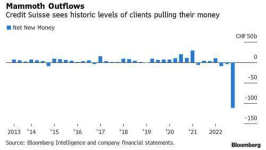

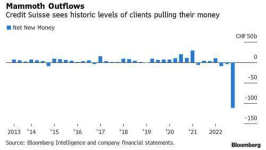

On Thursday, Credit Suisse shares tumbled as much as 12%, after the Swiss bank unexpectedly posted a bigger-than-expected loss for the fourth quarter and even more unprecedented client outflows, exacerbating the difficulty for new CEO Ulrich Koerner in returning to profitability by next year.

The second-largest Swiss bank (although it's probably far smaller now) posted a fifth-straight quarterly loss of 1.39 billion Swiss francs ($1.5 billion), worse than consensus estimates of a 1.14 billion loss as revenue of 3.06 billion Swiss francs also handily missed expectations of 3.35 billion. But while the operating loss was hardly a shock for a bank which has been in a constant state of chaos and turmoil, what stunned analysts was what KBW analysts called a “quite staggering” level of customer capital outflows which hit a record 110.5 billion francs in the quarter, and although the bank said that some money has been coming back, it also concedes it’s now at a worse starting point for 2023.

That was also the big reason why Credit Suisse gave an outlook for the first quarter and the full year that one analyst has labeled as “bleak.” The bank said it will post a “substantial” pretax loss in 2023; the fact that it knows this just one month into the year is very concerning, and as Bloomberg Intelligence analysts said, the scale of outflows and a plunge in investment-bank revenue “frame the difficulties ahead.”

...

Credit Suisse Craters After "Staggering" Bank Run And Warning Of Continued Losses | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

Jump pluckers Jump already.

Credit Suisse continued its long death spiral yesterday, losing 15.64 percent of its market value in one trading session to close at $3.02 on the New York Stock Exchange. The trading action came on the heels of an earnings report that was excruciatingly bad – even for Credit Suisse.

The Global Systemically Important Bank (G-SIB), which means it’s interconnected to other G-SIBs that could bring down the global financial system, reported yesterday that its clients had yanked over $100 billion in just the fourth quarter — which was more than eight times the outflow in the third quarter. Its pre-tax loss for the quarter was $1.51 billion, marking its fifth consecutive earnings loss.

...

Credit Suisse Tanks Yesterday to $3.02; It’s Lost Over 90 Percent of Its Market Value Since 2007; It’s Not Alone

By Pam Martens and Russ Martens: February 10, 2023 ~ Credit Suisse continued its long death spiral yesterday, losing 15.64 percent of its market value in

wallstreetonparade.com

^ Documents a bit of the history of Credit Suisse's financial troubles over the last few years.

If we started a Dead Pool on the first Major Bank to go belly up I'm pretty sure that Credit Suisse is the odds on favorite.

HSBC probably near the top, what others?

HSBC probably near the top, what others?

Deutsche Bank... what others?

- Messages

- 1,607

- Reaction score

- 2,245

- Points

- 298

If I had money wrapped in Credit Suisse... I would most ricky-tick have it out by sundown today. <-- Somehow I get the feeling I am not alone in this choice, looking at the bleeding going on.

There's ONE pie for 100 inmates. First one to get a mouthful wins.

There's ONE pie for 100 inmates. First one to get a mouthful wins.

Fears are growing for Credit Suisse’s Irish business, the Sunday Times reported. The crisis-hit bank is preparing to shut its prime brokerage unit, the sole focus of its Dublin branch. The move will result in the loss of 50 jobs and comes amid a radical restructuring of the Zurich-based lender, the report said.

Credit Suisse reported its biggest loss since 2008 last week. The bank signalled in November 2021 that it intended closing its Irish prime brokerage desk, which serves hedge funds, but did not say when. The bank has also remained silent about the strategy for the Dublin branch, raising fears it does not intend to replace the prime brokerage business, which was set up in 2016 to much fanfare, the Sunday Times added.

Fears growing over future of Credit Suisse’s Irish business

Seen & Heard: Deliveroo drivers and tax, a BP-backed company plans for a refinery in Cork, and a hotel’s plans to build apartments in Dublin also in the headlines

...

Citing sources, Reuters notes that the Swiss bank is offering a 6.5% annual rate on new three-month deposits of $5 million or above - and a rate as high as 7% for one-year deposits - far above matched maturity Bills, and suggesting that to attract a client, the bank is forced to eat a loss. ...

Credit Suisse Crashes To All Time Low After Boosting Deposit Rates To Reverse Bank Run | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

Credit Suisse stock falls again as they announce a delay to the publication of their annual report:

www.credit-suisse.com

www.credit-suisse.com

Credit Suisse announces technical delay of publication of 2022 Annual Report

Ad hoc announcement pursuant to Art. 53 LR

...

Credit Suisse Group AG is one bank that caught our attention this morning. The shares of this troubled bank, trading in Switzerland, plunged as much as 15%, hitting a new record low. ...

The selling pressure on Credit Suisse shares returned thanks to the collapse of SVB, sparking a crisis of confidence throughout the banking industry in the Western world. As a result, the Zurich-based lender's five-year credit default swaps jumped to a record high of 448 basis points, data compiled by Bloomberg show.

...

Credit Suisse CDS Hits Record High As Silicon Valley Banking Crisis Spreads To Europe | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

Credit Suisse appears to be THE lynchpin to this whole thing just disintegrating.

- Messages

- 1,607

- Reaction score

- 2,245

- Points

- 298

Contagion is showing. And this is not going to go away quietly -- ALL banks are being hit.:

Plain and simple, Grasshoppers -- this has happened before. If you have wealth in a bank, get it out TODAY (if you still can) and convert it to something of real value.

If you delay from this point, your burned arse is on you.

Plain and simple, Grasshoppers -- this has happened before. If you have wealth in a bank, get it out TODAY (if you still can) and convert it to something of real value.

If you delay from this point, your burned arse is on you.

Credit Suisse Group AG published its annual report, slated for release last Thursday but was delayed by the US Securities and Exchange Commission over "material weaknesses" in its internal controls over financial reporting.

In the annual report on Tuesday, the embattled Swiss lender said, "management did not design and maintain an effective risk assessment process to identify and analyze the risk of material misstatements in its financial statements."

...

Despite initiating a campaign to regain clients, Credit Suisse reported that client deposit outflows continued this month. As a consequence of the outflows, the bank also admitted that it had utilized its liquidity buffers. It warned these circumstances have "exacerbated and may continue to exacerbate" liquidity risks.

...

ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero