I've been monitoring a discussion on another forum about this for roughly four months now. It's a legit thing. I recently signed up for an account and am now sufficiently confident in it to mention it here.

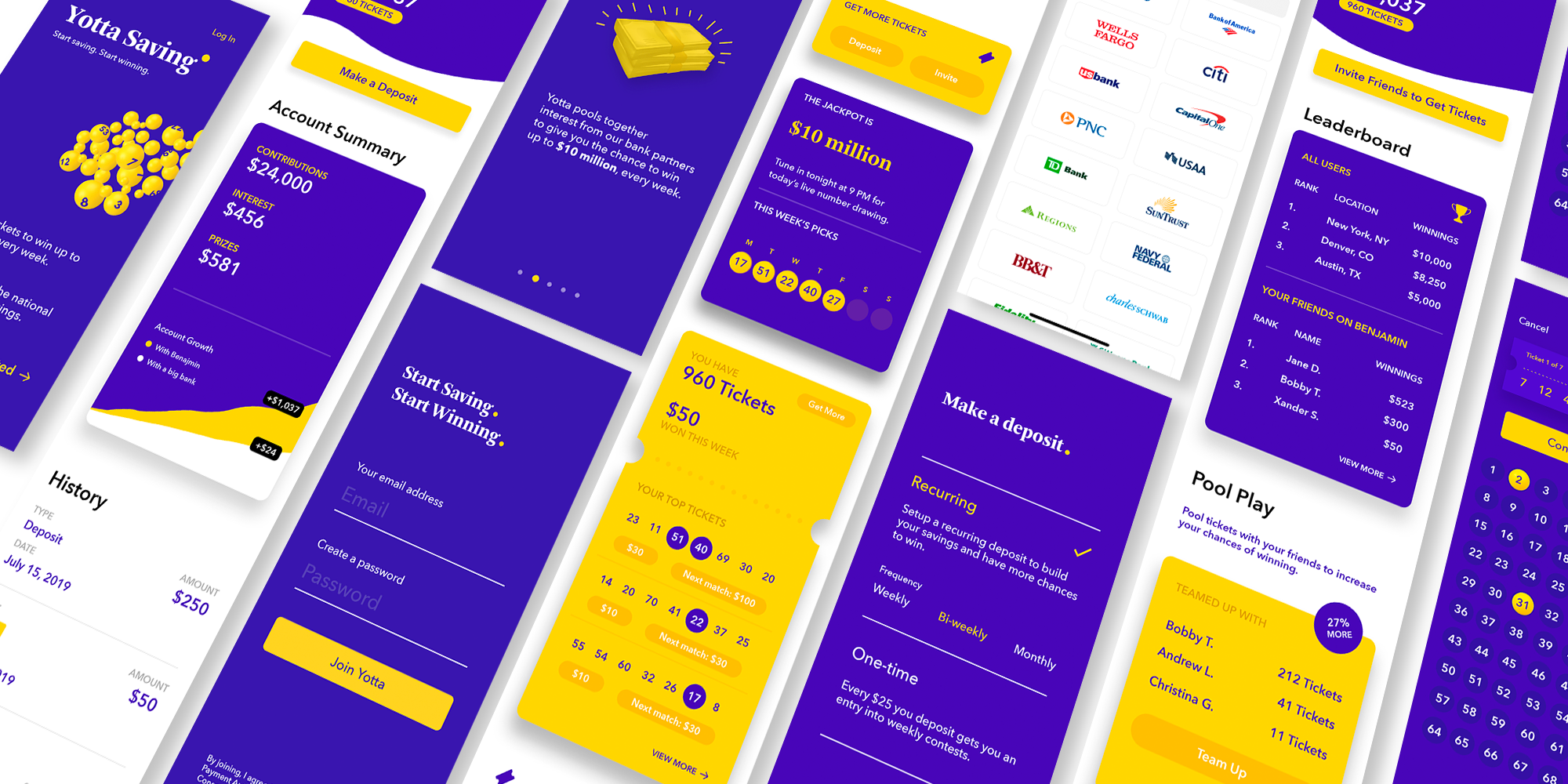

It's an FDIC insured online savings account that gives you lottery tickets every week based upon how much you have on deposit (1 ticket for every $25 deposited). Lottery winnings can range from $0.10 to $10million. The annual percentage yield including guaranteed interest plus average expected lottery winnings seems to run around 1.4% right now. Not too bad for a no risk, liquid cash position.

They have an affiliate program so opening an account with the following link gets you and I both 100 free prize tickets for a week:

withyotta.page.link

withyotta.page.link

Feel free to join on your own without an affiliate link.

It's an FDIC insured online savings account that gives you lottery tickets every week based upon how much you have on deposit (1 ticket for every $25 deposited). Lottery winnings can range from $0.10 to $10million. The annual percentage yield including guaranteed interest plus average expected lottery winnings seems to run around 1.4% right now. Not too bad for a no risk, liquid cash position.

They have an affiliate program so opening an account with the following link gets you and I both 100 free prize tickets for a week:

Yotta - A chance to win every day

Play free games on Yotta, climb to the top of the leaderboard, win tokens and tickets to redeem for life-changing prizes.

Feel free to join on your own without an affiliate link.