You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Has the BoJ Just Triggered a Global Sovereign Debt Crisis?

- Thread starter Goldbrix

- Start date

Welcome to the Precious Metals Bug Forums

Welcome to the PMBug forums - a watering hole for folks interested in gold, silver, precious metals, sound money, investing, market and economic news, central bank monetary policies, politics and more. You can visit the forum page to see the list of forum nodes (categories/rooms) for topics.

Why not register an account and join the discussions? When you register an account and log in, you may enjoy additional benefits including no Google ads, market data/charts, access to trade/barter with the community and much more. Registering an account is free - you have nothing to lose!

Global markets were jolted overnight after the Bank of Japan unexpectedly widened its target range for 10-year Japanese government bond yields, sparking a sell-off in bonds and stocks around the world.

The central bank caught markets off guard by tweaking its yield curve control (YCC) policy to allow the yield on the 10-year Japanese government bond (JGB) to move 50 basis points either side of its 0% target, up from 25 basis points previously, in a move aimed at cushioning the effects of protracted monetary stimulus measures.

...

The BOJ — an outlier compared with most major central banks — also left its benchmark interest rate unchanged at -0.1% on Tuesday and vowed to significantly increase the rate of its 10-year government bond purchases, retaining its ultra-loose monetary policy stance. In contrast, other central banks around the world are continuing to hike rates and tighten monetary policy aggressively in an effort to rein in sky-high inflation.

...

"The decision is being read as a sign of testing the water, for a potential withdrawal of the stimulus which has been pumped into the economy to try and prod demand and wake up prices," said Susannah Streeter, senior investment and markets analyst at Hargreaves Lansdown.

"But the Bank is still staying firmly plugged into its bond purchase program, claiming this is just fine tuning, not the start of a reversal of policy."

That sentiment was echoed by Mizuho Bank, which said in an email Tuesday that the market moves reflect a sudden flurry of bets on a hawkish policy pivot from the BOJ, but argued that the "popular bet does not mean that is the policy reality, or the intended policy perception."

...

It's a global casino betting on Central Bank machinations.

arminius

Ground Beetle

- Messages

- 524

- Reaction score

- 822

- Points

- 203

The stock, bond markets have been nothing but a casino for many years now. I had a bit of a tiff once with a fellow who played the stock market. He got obstinate, and angry when I called what he did as playing the casino. Didn't like that at all. This casino is part and parcel of the deep state.

AEP talks about the potential impact of the BoJ move:

Jim Grant Warns "Japan Is Perhaps The Most Important Risk In The World" | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

"Nothing Short Of Unsustainable": Futures Soar, Yen Tumbles After BOJ Maintains Yield Curve Control | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

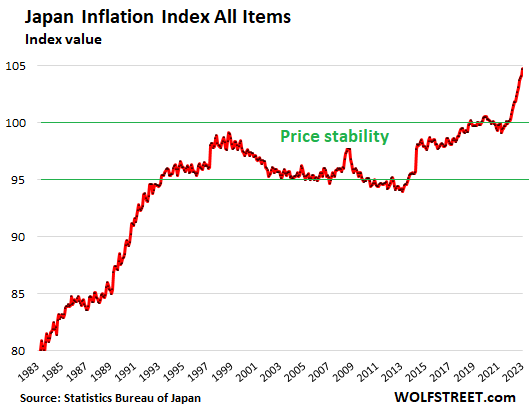

The outgoing boss of the Bank of Japan, Haruhiko Kuroda, and the incoming boss, Kazuo Ueda, sang from the same hymn as the worst inflation figures since 1981 came to light on Friday: This inflation will go away on its own, and we’re going to keep the reckless negative interest-rate and money-printing policies.

Kuroda stakes his entire tenure at the BOJ on these policies and cannot now back off, no matter what inflation does, and inflation is doing it; and Ueda cannot contradict Kuroda. He will become boss in April, and until then, he will sing from the same hymn. Then eventually, there will be a monetary policy review, which will find that these policies worked great but maybe it’s time to adjust them a little. All this will take till the second half of this year, and until then, the BOJ will fuel this inflation with all its might.

Japan’s “core” Consumer Price Index for all items less fresh food, which the BOJ uses for its 2% inflation targeting, jumped by 4.2% in January from a year ago, the worst rate since 1981, according to data from Japan’s Statistics Bureau today. ...

As Inflation Spikes to 41-Year High, Bank of Japan Promises to Let her Rip

A political decision to solve Japan’s horrid fiscal mess by fueling inflation, and forget that 2% target.

wolfstreet.com