one thing that cheers me up:

Philosophically, whenever one tries to achieve his goals, by the use of force/violence, his efforts are bringing exactly the opposite results. That is the LAW, not some New Age dreamy-eyes thing, someone could draw the connections to the 2nd law of thermodynamics even (ie. things are naturally trying to get back to the mean, via the path of the least resistance). Therefore, since governments are in essence a state's monopoly on force/violence, all they try to do, turns into shit - when they do not really have their people's backing on the issue. Examples are plenty. So I could really stop right here

.

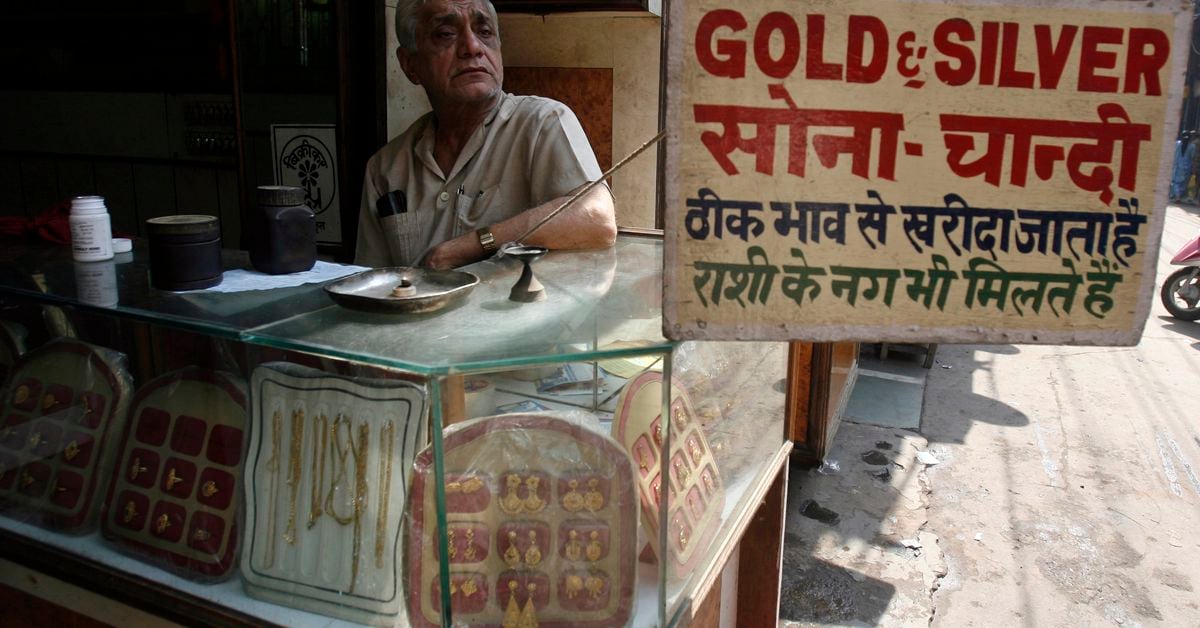

OK, high tone off. Why I think it doesn't matter that much, what % of the import duty is imposed on retail market in India (ie little man on the street there), for the grander scheme of things: Indians are still, relatively speaking, dirt poor. While there is a lot of them, I am not sure if it matters that much, when price of PMs (and gold specifically), goes really high (I mean, couple of times higher from today's) - IDK if gold will be still affordable for majority of them? I don't think so (on the side note, that is why I think that eventually, public buying pressure will be on Silver more rather than Gold).

But it will be still affordable for investing community. I believe, that the ongoing crises (that we will have plenty of, one after another, and there's no doubt about that), will bring more & more conservative approach to portfolio management, more & more people will add 2 + 2 themselves, and realize that the "official story" does not really make 4. Therefore, ultimately safe investments will play bigger & bigger role in their portfolios.

Now, according to what I know, average gold position (it includes all gold, paper as well) in the global, average portfolio, is slightly below 1%. Read that again: less than 1% of global financial assets are invested in Gold (ah, "Gold is a bubble waiting to burst" my arse!)

If/when perception shifts, and this global average portfolio starts getting rearranged, say, some more conservative investors will want 10% of their portfolio exposed to gold. Lets assume, that the global average portfolio will jump ONLY to a tiny 3%, on average. That is three times demand, over practically flat supply. If we take into account Chinese frantic hoarding, the supply is probably getting tighter, for everyone else. And this is purely investment demand, maybe not so much speculation driven, but fear-driven. I think that price of gold will meet that up-going demand somewhere in the middle (rising prices of gold, would mean only smaller amount of OZs would be required, to cover higher % of the portfolio, therefore I don't think that the price will reflect demand increase 1:1, but rather less than that. Which still is plenty - remember, here's considered that average portfolio will increase Gold exposure from almost non-existing sub-1%, to a still minuscule 3% - but what if by some freak accident, it jumps to 10%

).

Price would not matter that much for these guys, as the peace of mind/perceived security of their holdings.

It is just a matter of time, not IF, but WHEN.

In the meantime, they can tax Indians as much as they want. What happens when they do that? Perceived scarcity of Gold in India, even increases = perceived VALUE to the folks increases as well. That encourages imports, despite higher prices on the street - as long as someone can still afford it. They all know that they are racing against the government, with their depreciating Rupias, and ever-increasing import duties. The gov't was rather clear with that message.

Next thing, how many of India's newly formed and rapidly growing middle class, is sophisticated enough, and has access to places like BullionVault, etc.? Will they be willing to invest in foreign holdings of physical gold/silver, instead of home country, to sidestep the import duties? I don't know, I know I surely would, if that means I could get a nice 6% discount over my street price (and likely to grow further).

My (usually long) $.02