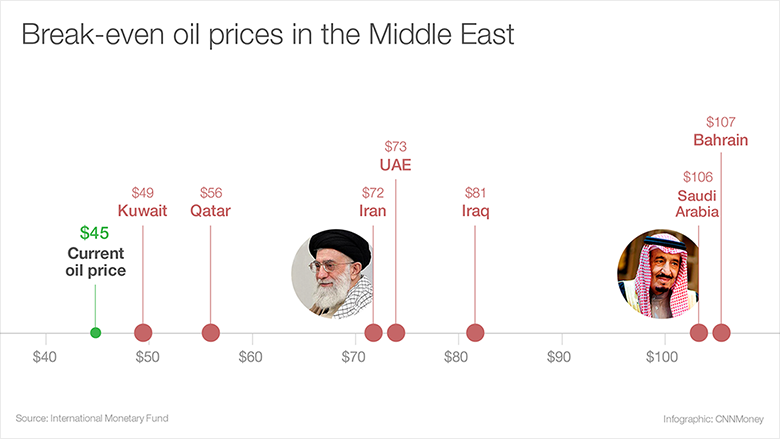

If oil stays around $50 a barrel, most countries in the region will run out of cash in five years or less, warned a dire report from the International Monetary Fund this week. That includes OPEC leader Saudi Arabia as well as Oman and Bahrain.

...

Saudi Arabia, the world's largest oil producer, needs to sell oil at around $106 to balance its budget, according to IMF estimates. The kingdom barely has enough fiscal buffers to survive five years of $50 oil, the IMF said.

...

...

Iran's break-even oil price is estimated at $72 and it could survive cheap oil for less than 10 years, the IMF estimates. It's a rosier outlook compared to its neighbors. But Iran's outlook is clouded by potential sanctions relief (which hasn't come yet) and a surge in oil production from its nuclear deal with the West.

Iraq has virtually no fiscal buffer remaining, according to the IMF. The country is grappling with internal strife and has lost large swaths of land to ISIS.

"Violence increasingly affects civilians, and has a particularly adverse effect on confidence and expectations, and consequently on economic activity," the IMF warned.

Bahrain is also under great financial pressure, with the likelihood of also running out of options in less than five years. The country already has lots of debt and has been running deficits for several years in a row.

"They are in a relatively tight spot. They are going to have to undertake a more significant tightening," said Jason Tuvey, a Middle East economist at Capital Economics.

However, a handful of countries are well positioned to face the storm. Topping that list are Kuwait, Qatar and the United Arab Emirates. That's partially because these countries don't need sky-high oil prices to balance their budgets.

Kuwait's break-even oil price is estimated by the IMF at just $49, or just a tad higher than current levels. The magic number is believed to be $56 in Qatar, the host of the 2022 World Cup, while the UAE needs $73 oil.

But these three countries have built up mountains of oil money that protect them during the leaner times. The IMF said the UAE has enough fiscal buffers to withstand $50 oil for nearly 30 years. Qatar and Kuwait can sustain cheap oil for almost 25 years.