cash settlements replacing delivery

schiffgold.com

COMEX: Silver Registered Ratio Falls to 11.1% – Lowest in 22 Years

December 17, 2022 by

SchiffGold 0 0

The drainage since the start of the year has been nothing short of spectacular. 48.5M ounces have left Registered since Jan 1. That represents more than 50% of the balance of 82M ounces last Dec 31.

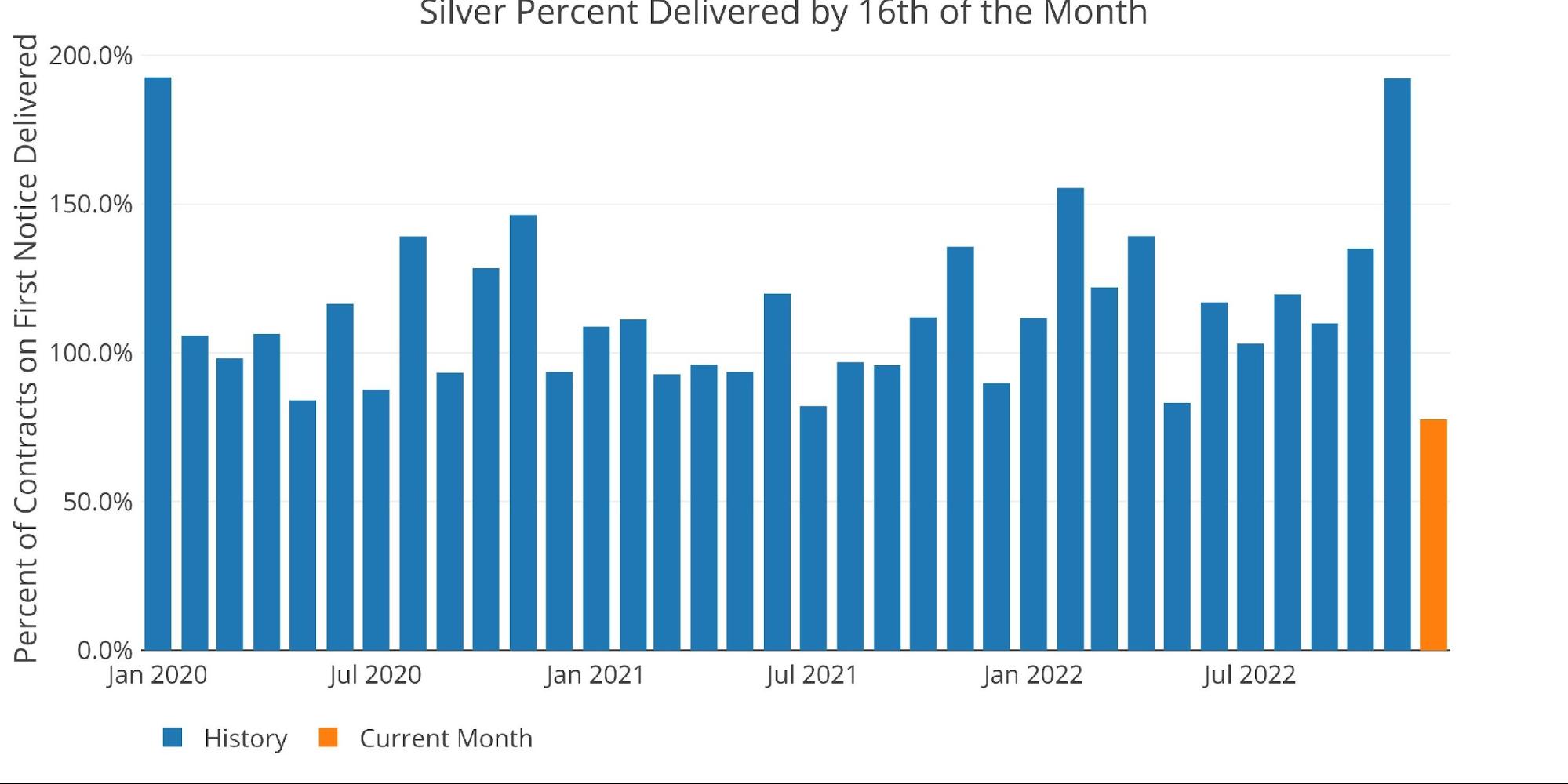

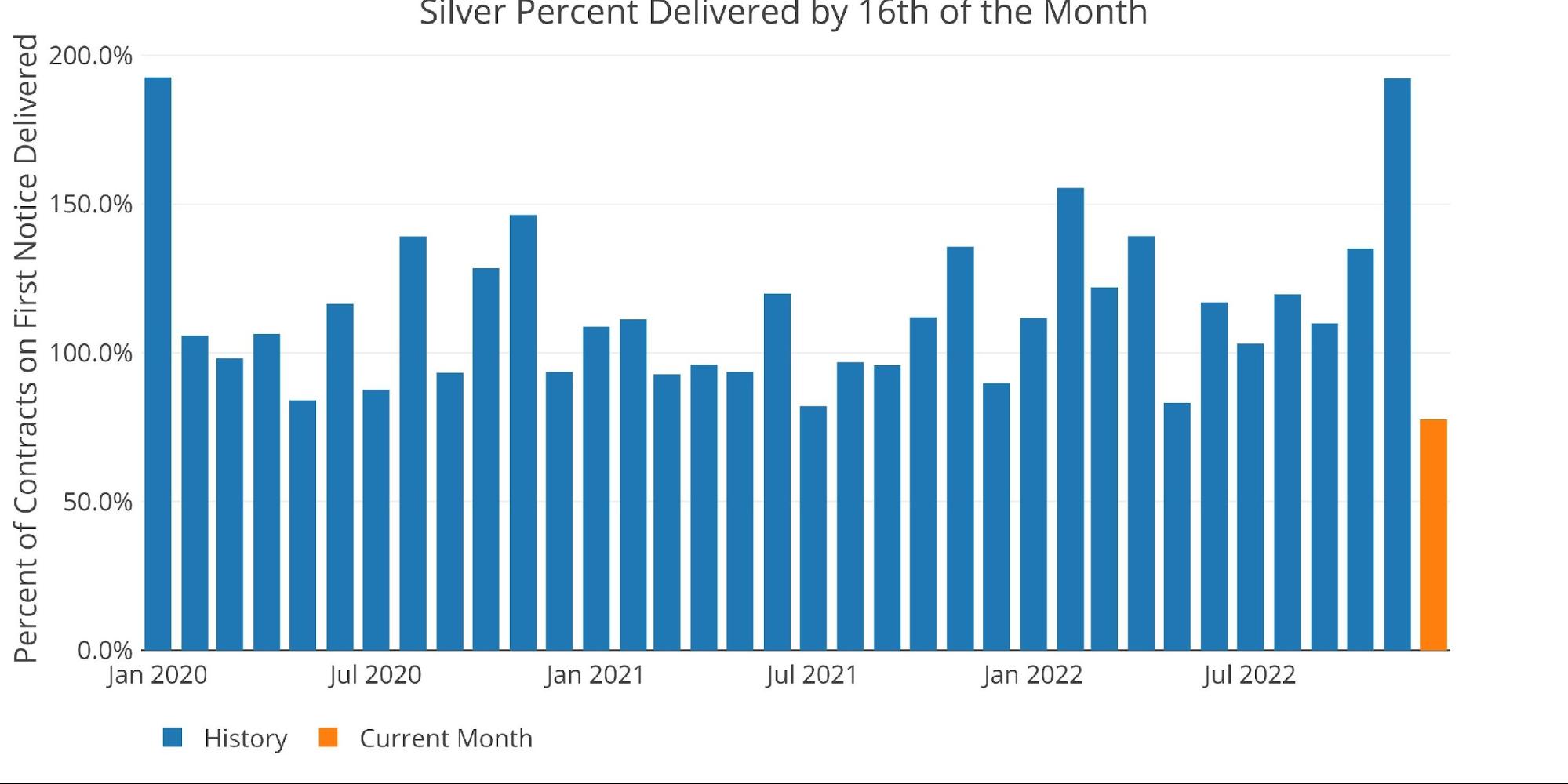

There is another major indication that shows inventory might be much smaller than is reported. As of yesterday, only 77.6% of contracts standing for delivery have actually had their metal delivered. Shorts are on the hook for deciding when to deliver the metal, so why are they dragging their feet? Through the 16th, this is the least amount of metal delivered as a percent of Open Interest on First Notice back to at least Jan 2020.

Figure: 6 Delivery Volume After First Notice

Figure: 6 Delivery Volume After First Notice

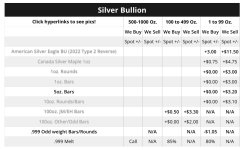

Another odd data point is the number of net new contracts after first position. There have been some months, like last July, where net new contracts are negative throughout the month. However, while this month is still positive, it went up and then reversed back down. This means that

there are cash settlements happening way late in the contract.

more at link....