Not a real thing. Unless you just want to extend inflation into a Real Estate crisis. There is NO shortage of housing. Except, maybe, in a few areas like Commiefornia that just won't let anyone build.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Real Estate and foreclosure thread

- Thread starter BackwardsEngineer

- Start date

Welcome to the Precious Metals Bug Forums

Welcome to the PMBug forums - a watering hole for folks interested in gold, silver, precious metals, sound money, investing, market and economic news, central bank monetary policies, politics and more.

Why not register an account and join the discussions? When you register an account and log in, you may enjoy additional benefits including no Google ads, market data/charts, access to trade/barter with the community and much more. Registering an account is free - you have nothing to lose!

- Messages

- 37,001

- Reaction score

- 6,363

- Points

- 288

What Tom Selleck Didn’t Tell You About Reverse Mortgages!

Jun 28, 2025

Reverse mortgages are promoted as a retirement lifeline to senior citizens who may not have the means to easily pay for their cost of living in retirement. However, one thing Tom Selleck didn't tell you about getting a reverse mortgage is that, this is the type of person who probably should not get one. In this video, I will go over everything that pertains to reverse mortgages. What they are who can get One reasons to get one reasons not to get one and everything in between. I want this to be the most comprehensive reverse Mortgage video on YouTube.

27:49

0:00 Did Tom Selleck sell you a reverse mortgage?

1:55 What is a reverse mortgage?

3:05 The costs of having a reverse mortgage

7:43 How is a reverse mortgage loan paid back?

8:10 Who can get a reverse mortgage?

9:27 Most common real world scenario of getting a reverse mortgage

11:25 Reasons not to get a reverse mortgage

16:58 You can cancel your reverse mortgage within 3 days of signing

17:42 Using reverse mortgage as tax strategy

22:00 Are there any benefits to getting a reverse mortgage?

23:28 Viewer comments on reverse mortgages

26:08 Final Thoughts

More on reverse mortgages.

‘The only place I’ve ever called home’: Walton County family sues after home sold using forged deed

James and Lucretia Klucken say their nightmare began in 2019, when they started receiving letters about a $50,000 reverse mortgage debt tied to a home that had been in their family for generations.James Klucken had been appointed power of attorney over the property after his grandmother died and said something about the documents didn’t look right.

More:

https://www.msn.com/en-us/money/rea...sing-forged-deed/ar-AA1JsMfu?ocid=socialshare

Couple Loses Home in Reverse Mortgage Scam

Aug 1, 2025This continues to happen.

9:48

Welcome to the New Normal.

Moving from a high-trust society, into one where no one can be trusted, and law is merely a reflection of who is politically connected, and who is not.

The Left has long felt guilty because white societies had industry, food, private homes, ownership of real estate...and none of that was in, say, Ethopia or Niger. "Africa," they would say - not realizing Africa is not a nation.

Well, this is why. You cannot have private property without Rule of Law and a high level of trust in people you don't know and are not related to...people like, county clerks, sheriffs, insurance agents and the companies that underwrite policies you buy.

Ever drive to Mexico? You have to buy a Mexican auto-insurance policy...and not just any. You have to be CAREFUL, and even with the "best" companies, you may find them denying coverage when you need it.

I have never done that but looked into riding a motorcycle into Mexico. But the pitfalls you can so-easily step into, is all part of life in a society that lacks honesty or trust or rule-of-law.

Moving from a high-trust society, into one where no one can be trusted, and law is merely a reflection of who is politically connected, and who is not.

The Left has long felt guilty because white societies had industry, food, private homes, ownership of real estate...and none of that was in, say, Ethopia or Niger. "Africa," they would say - not realizing Africa is not a nation.

Well, this is why. You cannot have private property without Rule of Law and a high level of trust in people you don't know and are not related to...people like, county clerks, sheriffs, insurance agents and the companies that underwrite policies you buy.

Ever drive to Mexico? You have to buy a Mexican auto-insurance policy...and not just any. You have to be CAREFUL, and even with the "best" companies, you may find them denying coverage when you need it.

I have never done that but looked into riding a motorcycle into Mexico. But the pitfalls you can so-easily step into, is all part of life in a society that lacks honesty or trust or rule-of-law.

Never, EVER, EVVVVEEERR will I buy into a property with an HOA. They have Zero criminal jurisdiction yet, here they go, with the petty tyrants.

Also note, homeowners, SUE the fucking crap out of the board members and management company and lawyers. That's harassment, discrimination and clearly a violation of all kinds of your rights.

Those lawyers WORK FOR the god damn HOA. The HOA is responsible for the fees. I would bet at least until they win a lawsuit against you.

Also note, homeowners, SUE the fucking crap out of the board members and management company and lawyers. That's harassment, discrimination and clearly a violation of all kinds of your rights.

Those lawyers WORK FOR the god damn HOA. The HOA is responsible for the fees. I would bet at least until they win a lawsuit against you.

Last edited:

More on reverse mortgages.

‘The only place I’ve ever called home’: Walton County family sues after home sold using forged deed

James and Lucretia Klucken say their nightmare began in 2019, when they started receiving letters about a $50,000 reverse mortgage debt tied to a home that had been in their family for generations.

James Klucken had been appointed power of attorney over the property after his grandmother died and said something about the documents didn’t look right.

More:

https://www.msn.com/en-us/money/rea...sing-forged-deed/ar-AA1JsMfu?ocid=socialshare

Couple Loses Home in Reverse Mortgage Scam

Aug 1, 2025

This continues to happen.

9:48

Really need to do better, how can we protect ourselves?

Luckily its not that hard. Just find your local county thief, er I mean assessor site. Just check on your home address once in awhile.

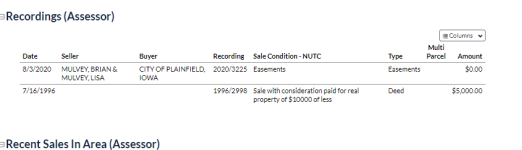

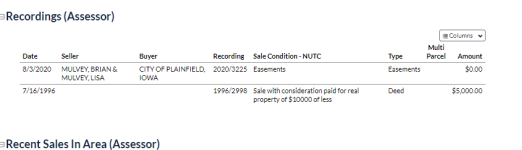

I just picked a random home in Iowa.

It should have a category for recording any sales and other transactions. So it looks like this parcel last sold in 1996. Someone did file and easement with the town there in 2020. Since the public recorder has to record things it will show up with the assessor. Some are faster than others.

I just picked a random home in Iowa.

It should have a category for recording any sales and other transactions. So it looks like this parcel last sold in 1996. Someone did file and easement with the town there in 2020. Since the public recorder has to record things it will show up with the assessor. Some are faster than others.

Housing is clearly now seeing what I've been saying will happen for a couple years. However, they still don't get it. They still want to sell this as a "great opportunity". Lol, when guys like this are really, really sad/mad, then it might be time to give it a look.

Also for the topic previously, watch out Especially for any Quit Claim Deeds filed. Those are the easiest to file and somewhat Suspect anyway... So pay close attention to those.

- Messages

- 37,001

- Reaction score

- 6,363

- Points

- 288

Boston ‘professional tenants’ face 50-plus charges for alleged 20-year scam swindling dozens out of $100K

Russell and Linda Callahan have bounced around from rental to rental over the past two decades. But it’s not because they keep switching jobs or moving for work, it’s because they could only get away with not paying rent for so long at each place.

As NBC 10 Boston reported, the couple was recently indicted in Worcester Superior Court on 28 criminal counts for allegedly scamming landlords over the last 20 years. Not only did they fail to pay rent, but they also lied and forged documents to get approved for the properties they moved into.

More:

https://www.msn.com/en-us/money/rea...zens-out-of-100k/ar-AA1Kbn8p?ocid=socialshare

- Messages

- 37,001

- Reaction score

- 6,363

- Points

- 288

HOAs Just LOST THEIR POWER - New Law CHANGES EVERYTHING

Aug 9, 2025Hoa communities have been getting away with murder in terms of how much money they've been able to fine their residents for petty violations of the rules and regulations. Sometimes it even gets to the point where the fines add up so much they're able to put a lien on your property and eventually foreclose on your home. But new California law AB 130 is changing that.

23:30

00:00 HOA Horror Stories and Potential Abuse of Power

03:17 California's New HOA Law: Capping Fines and Protecting Homeowners

05:18 Loopholes and Reactions: HOAs Seek Ways to Recoup Revenue

07:26 Personal Experience with HOA Regulations in Miami

08:24 Home Warranty Horror Story: Dealing with American Home Shield

11:46 Common Issues and Complaints Against Home Warranty Companies

13:58 Key Questions to Ask Before Purchasing a Home Warranty

17:23 The Rising Cost of Living in Florida

19:45 The Benefits of Living Near the Coast: Health and Inspiration

Articles Mentioned in the Video

- https://www.yahoo.com/news/articles/s...

- https://www.investigatetv.com/2025/07...

- https://www.floridarealtors.org/news-...

- https://www.floridarealtors.org/news-...

Keeping Fines in Check: HOAs Face $100 Cap as AB 130 is Signed into Law

On June 30, 2025, AB 130 was passed by the California Legislature and signed into law by Governor Newsom. This law is effective immediately! The overall goal of the bill was to expedite housing ...

- Messages

- 37,001

- Reaction score

- 6,363

- Points

- 288

Trump Admin Planning IPOs For Fannie Mae And Freddie Mac: Official | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

All by design.

We're to be Mao-ized. We'll be herded into Workers' dormitories in our 15-minute prison-cities...made to work 12-18 hours a day, fed bugs and Gates' not-meat, and prevented from having families. Africa will become the Davos Globalists' breeding-farm. And our world will be dumbed down to where Somalians and Haitians can function.

And anyone who doesn't like it, will find is JBMC "Stablecoin" account to be Cancelled.

We're to be Mao-ized. We'll be herded into Workers' dormitories in our 15-minute prison-cities...made to work 12-18 hours a day, fed bugs and Gates' not-meat, and prevented from having families. Africa will become the Davos Globalists' breeding-farm. And our world will be dumbed down to where Somalians and Haitians can function.

And anyone who doesn't like it, will find is JBMC "Stablecoin" account to be Cancelled.

- Messages

- 37,001

- Reaction score

- 6,363

- Points

- 288

Innocent Property Owner Asks Supreme Court to Hear Case Challenging New York City’s ‘Unreviewable’ Code Fines - Institute for Justice

WASHINGTON—Today, an innocent New York property owner—who was fined for a code violation he did not commit and had no way to appeal—is asking the […]

Only for people with no money, or only people with nearly worthless FRN's.

- Messages

- 37,001

- Reaction score

- 6,363

- Points

- 288

Real Estate Newsletter Articles this Week

At the Calculated Risk Real Estate Newsletter this week: Click on graph for larger image. • Part 1: Current State of the Housing Market;...

- Messages

- 37,001

- Reaction score

- 6,363

- Points

- 288

When ‘invest like the 1%’ fails: How Yieldstreet’s real estate bets left customers with massive losses

- Yieldstreet is one of the best-known examples of American startups with the stated mission of democratizing access to assets such as real estate, litigation proceeds and private credit.

- But some Yieldstreet customers who participated in its real estate deals face huge losses on investments that they say turned out to be far riskier than they thought.

- Of 30 deals that CNBC reviewed information on, four have been declared total losses by Yieldstreet. Of the rest, 23 are deemed to be on “watchlist” by the startup as it seeks to recoup value for investors, sometimes by raising more funds from members.

- Yieldstreet said some of its real estate funds were “significantly impacted” by rising interest rates and market conditions.

“Invest like the 1%,” the startup said.

The ad spoke to his desire to build wealth and diversify away from stocks, which were then in freefall, Klish said. Yieldstreet says it gives retail investors such as Klish access to the types of deals that were previously only the domain of Wall Street firms or the ultrarich.

So Klish, a 46-year-old financial services worker living in Miami, logged on to Yieldstreet’s platform, where a pair of offerings jumped out to him.

More:

- Messages

- 37,001

- Reaction score

- 6,363

- Points

- 288

Young Homebuyers Making SAME CRITICAL MISTAKE AS THEIR PARENTS

Aug 16, 2025Young homebuyers today are falling for the same old tricks as their parents did, only at a higher rate when in comes to home ownership. The old adage of "marry the house, date the rate" is a common term used by real estate professionals to convince people to buy today with higher interest rates in hopes of being able to refinance later down the road. Although by taking a look at today's refinancing activity it is pretty clear that method often does not work as expected.

21:19

00:00 Repeating Past Mistakes: The Perils of 'Marry the House, Date the Rate'

02:00 Why Refinancing Isn't a Guaranteed Solution: Risks and Roadblocks

05:19 Social Media Influence: The Dangers of Easy Home Buying Advice

07:05 Refinancing Trends: Lower Rates, Higher Debt, and Risky Mortgages

11:30 Home Sellers Delisting Properties: Miami's Market Struggles

14:22 Price Cuts and Market Realities: The Need for Significant Adjustments

16:49 New Homes vs. Existing Homes: Price Declines and Buyer Trends

18:35 Mortgage Rate Buydowns: Short-Term Savings, Long-Term Risks

Articles Mentioned in the Video

- https://www.miaminewtimes.com/news/mi...

- https://apple.news/AnZ468xV9TQSUWNGZu...

- https://apple.news/AXdb24LE7QKONGc2MB...

- https://apple.news/AojbaqpiiRsahZFnwF...

- Messages

- 37,001

- Reaction score

- 6,363

- Points

- 288

California legislature passes bill that gives interest on insurance payouts to homeowners

- A California bill ensures homeowners receive at least some of the interest on insurance payouts held in escrow accounts after catastrophic losses.

- The bill — which would apply to both existing insurance payouts that are still being held in escrow accounts and to any new escrow accounts — heads to Gov. Gavin Newsom’s desk for his signature.

- California Assemblymember John Harabedian said he authored the legislation after hearing from his constituents about their struggles following the historic fires that ripped through Los Angeles in January.

More:

- Messages

- 37,001

- Reaction score

- 6,363

- Points

- 288

The senior living market can’t keep up with demand as boomers age

- More than 4 million boomers will hit 80 in the next five years, and occupancy at both active adult and assisted living communities is already rising fast.

- Ventas, a senior living real estate investment trust with a $31 billion market cap, is betting big on what CEO Deb Cafaro calls the longevity economy.

- There will be just about 4,000 new senior living units developed this year and next year, but demand growth would necessitate 100,000 new beds each year through 2040, according to data from the National Investment Center for Seniors Housing and Care.

Senior living has long been a somewhat under-the-radar real estate play, with a somewhat unappealing reputation. But it is on the edge of a boom — a baby boom to be exact.

More:

It's not the rates that's keeping me from buying.The old adage of "marry the house, date the rate" is a common term used by real estate professionals to convince people to buy today with higher interest rates in hopes of being able to refinance later down the road

Not even the price, although that is a major concern. It's how the Tax Assessor (all of them) is/are raping the stragglers of the former Middle Class, who somehow managed to escape being corralled and herded into the slaughterhouse.

Getting taxed off your land is now a very, very real possibility. Land that 15 years ago sold for barely six figures, has now increased, in Montana, about fivefold.

- Messages

- 37,001

- Reaction score

- 6,363

- Points

- 288

CNBC Property Play: Aging boomers could mean big business for senior living

Aug 20, 2025 CNBC Property PlayCNBC’s Diana Olick sits down with Debra Cafaro, CEO of Ventas, one of the world’s largest owners of senior housing and a $30 billion real estate investment trust. They discuss how the “silver tsunami” could become the next big play in real estate.

16:57

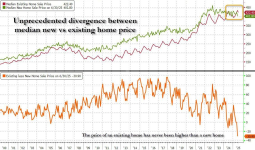

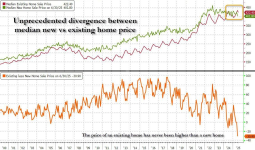

Good luck trying to sell your home if you have any New Home competition. I think this just shows that the Builders are more aggressive in hitting the bid. Retail is too stubborn to see what is happening and will be holding more bags.

www.zerohedge.com

www.zerohedge.com

Broken Market: In Unprecedented Inversion, It Has Never Cost More To Buy An Existing Home Over A New One | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

But are the shoddy, cookie-cutter new homes, truly equivalent?Good luck trying to sell your home if you have any New Home competition. I think this just shows that the Builders are more aggressive in hitting the bid. Retail is too stubborn to see what is happening and will be holding more bags.

Broken Market: In Unprecedented Inversion, It Has Never Cost More To Buy An Existing Home Over A New One | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zerowww.zerohedge.com

View attachment 16900

Anyone who watches JB's news-and-editorial stuff, has already seen this.

There's lots of problem older homes too. There is no good reason for Avg/Med new home prices to dip below used. Would it make any sense at all to go buy a Used Toyota Tacoma for more than a brand New one? AND its like Toyota will pay down your rate to buy that new one now as well. This is a Serious indication of market problems.

A decent chart from Maneco64 showing how homes are NOT really an investment, just a place to live.

You could have tried to trade it but timing is hard, and with Real Estate its slow to turnover.

This is a very good but Very in-depth dive into property taxes and how they work in a county in Texas. However, it seems to be very similar to how its configured here as well.

- Messages

- 37,001

- Reaction score

- 6,363

- Points

- 288

Stealing Grandma's Home: The Reverse Mortgage Scam (PART 2)

Aug 30, 2025Reverse mortgages have gotten a pretty nasty reputation after many senior citizens have been taken advantage of and many have been lost their homes due to desperate financials and not fully understanding what they were getting into at the time of signing up for the wall. These are some red flags and warning signs. You need to watch out for if you are planning to get a reverse mortgage.

20:00

00:00 Reverse Mortgages: Red Flags and Viewer Experiences

00:55 Red Flag #1: High-Pressure Sales Tactics & Rush Timelines

03:07 Red Flag #2: Unclear or Hidden Fees & Closing Costs

04:42 Red Flag #3: Skipping HUD-Approved Counseling

05:39 Viewer Warning: Unnecessary Upgrades

07:29 Viewer Comments: Risks and Real-World Examples

09:58 Clarifying Reverse Mortgages: Addressing Misconceptions

15:42 Positive Reverse Mortgage Experiences & Tax Benefits

Articles Mentioned in the Video

https://apple.news/A9dhzUD94QNK95Zhy5...

Stealing Grandma's Home: The Reverse Mortgage Scam (PART 1)

- Messages

- 37,001

- Reaction score

- 6,363

- Points

- 288

SHOCKING New Rule - Cash Buyers Using Entities MUST REPORT

Sep 3, 2025 #realestateinvesting #reporting #fincenIn this video, Toby Mathis from Anderson Business Advisors breaks down a major federal rule that takes effect on December 1, 2025—one that will transform how cash real estate deals are handled when LLCs, trusts, or corporations are involved.

Starting December 1, 2025, the Financial Crimes Enforcement Network (FinCEN) will implement a new rule requiring reporting on certain all-cash residential real estate transfers to legal entities or trusts.

Did you know that if you buy or transfer property in the name of an entity—even a living trust—you may now be required to report the deal to the federal government? And the penalties for missing this reporting requirement are no joke.

You’ll also learn how this ties into past laws like the Corporate Transparency Act, and why staying informed is critical as these regulations evolve.

Whether you’re an investor, business owner, or advisor, this episode gives you the knowledge you need to stay compliant and avoid costly mistakes under the new FinCEN reporting rules.

19:23

- Messages

- 37,001

- Reaction score

- 6,363

- Points

- 288

Mortgage rates see biggest one-day drop in over a year

- The average rate on the 30-year fixed mortgage dropped 16 basis points to 6.29% Friday.

- This is a major change from May, when the rate on the 30-year fixed peaked at 7.08%.

- Homebuilder stocks Lennar, DR Horton and Pulte gained ground.

It marks the lowest rate since October 3 and the biggest one-day drop since August 2024. Rates are finally breaking out of the high 6% range, where they’ve been stuck for months.

More:

Lol 0.7% is HARDLY a frelling major change. Its a god damn drop in the bucket that isn't saving shit.

- Messages

- 37,001

- Reaction score

- 6,363

- Points

- 288

"FOMO Made Me Buy a House in 48 HOURS" Now I CAN'T SELL IT...

Sep 11, 2025So many people who bought homes between 2021 and 2024 have been hit with major assessments, unexpected expenses, and increased tax bills on their property all while seeing the value of their property go down. And now that they realize they made a mistake buying a property that they shouldn't have, they are selling at a loss. But this doesn't have to happen to you. You can learn from others mistakes and find out where they went wrong.

21:23

Articles Mentioned in the Video

- https://apple.news/AY2yYapZbQeC6Vpo4z...

- https://apple.news/AE1Hnt_55S7uvyqu2u...

- https://apple.news/AgreUiDUORBu3qxRTK...

- https://www.floridarealtors.org/news-...

- https://www.floridarealtors.org/news-...

LMAO"FOMO Made Me Buy a House in 48 HOURS" Now I CAN'T SELL IT..

I sometimes watch Michael, but he tends to flog a dead horse a bit long. I guess I'm not his target market, which is real-estate professionals and house-flippers.

- Messages

- 37,001

- Reaction score

- 6,363

- Points

- 288

The Biggest Single-Family Rental Landlords and Multifamily Landlords in the US: Big Shifts Underway

The top six single-family rental landlords own 422,000 single-family properties; the top six multifamily landlords own 660,000 rental apartments; and mom-and-pop landlords own 11 million single-family rentals, out of nearly 50 million total rental units.Big multifamily landlords and mom-and-pop single-family landlords are classic elements of the rental market. But the single-family giants are a new creature that came out of the Housing Bust after home prices had plunged.

More:

- Messages

- 37,001

- Reaction score

- 6,363

- Points

- 288

Somewhat related.

www.sfgate.com

www.sfgate.com

Hawaiians organize to buy back ancestral land from billionaire

The price tag is astronomical, but residents are determined.

- Messages

- 37,001

- Reaction score

- 6,363

- Points

- 288

Foreclosure Crisis Begins "Help With Mortgage" EXPLODES On Google Trends

Sep 20, 2025Recent Google trends search help with Mortgage has been exploding, which could be an early warning sign that people are tapped out and can no longer pay their mortgage. I've already been seeing delinquencies pickup over the past few months and this could be assigned that delinquencies are about to explode even further.

23:18

00:00 Google Search Data Reveals Mortgage Struggles

03:38 Rising Mortgage Delinquency Rates: Warning Signs

05:08 The Impact of FHA Loans and Government Intervention

06:22 Foreclosure Filings on the Rise: Echoes of 2008?

07:36 Cash-Out Refinances and Adjustable Rate Mortgages Surge

09:43 Real Estate as an Inflation Hedge: Is it a Good Idea?

12:30 Meeting Sabrina Deliver For Amazon Flex and the REAL Economy

14:01 Evaluating Real Estate as a Hedge Against Inflation

16:20 The Reality of Homeownership Costs and Inflation

17:45 Long-Term Mortgage Payments vs. Rent: A Comparison

18:44 Homeowners Losing Equity: A Widespread Trend

- Messages

- 37,001

- Reaction score

- 6,363

- Points

- 288

"House from Hell" — How America’s Largest Homebuilders Shift the Cost of Shoddy Construction to Buyers

Hunterbrook Media’s investment affiliate, Hunterbrook Capital, does not have any positions related to this article at the time of publication. Positions may change at any time. Hunterbrook Media is working with litigators on potential lawsuits based on our investigation. If you are a victim, we...

hntrbrk.com

hntrbrk.com