- Messages

- 256

- Reaction score

- 190

- Points

- 113

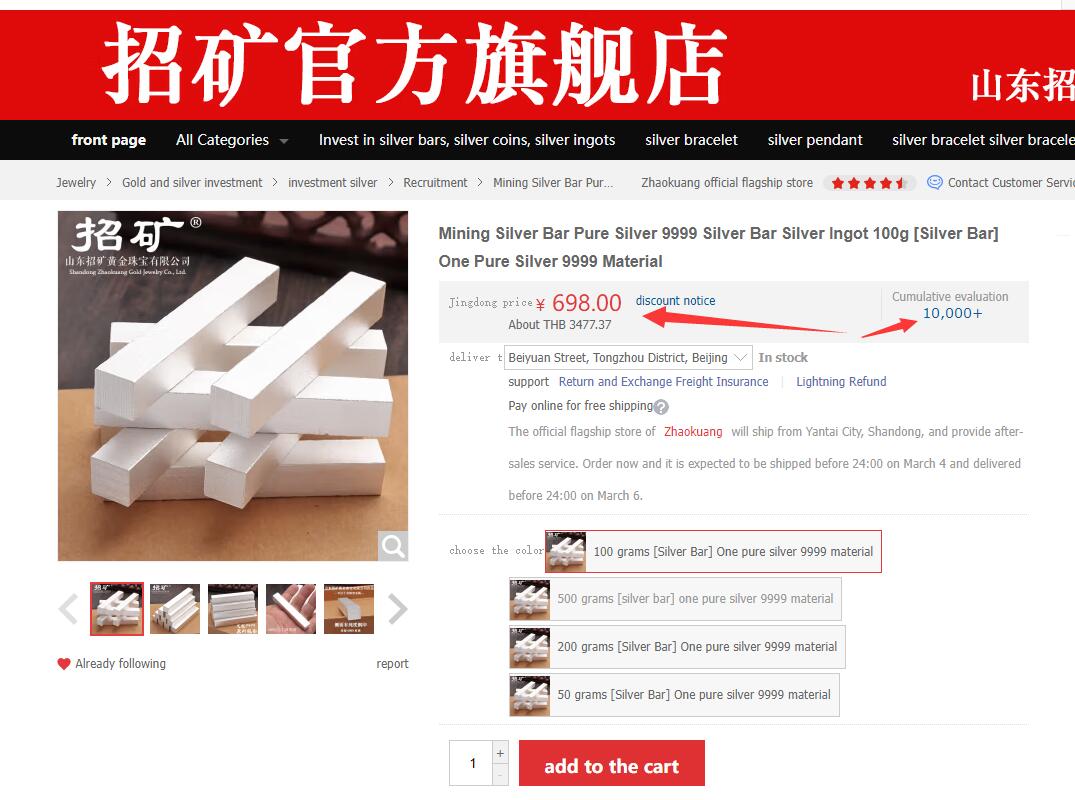

Silver bars of raw material of the largest state-owned silver seller Zhaokuang on http://JD.com is now at a price of ¥6.98/gram today, equivalent to $30.15/ounce

©Bai Xiaojun

$30/oz

raw silver should be of lower purity than lmba approved bars, i.e. lower price, i.e. under spot

$20?

that would be a 50% premium!

©Bai Xiaojun

$30/oz

raw silver should be of lower purity than lmba approved bars, i.e. lower price, i.e. under spot

$20?

that would be a 50% premium!