...

Monday, the World Platinum Investment Council released its quarterly supply and demand trend report, announcing that in the first quarter of 2024, the platinum market recorded a deficit of 369,000 ounces; at the same time, the council has revised the annual expected deficit to 476,000 ounces, which follows an 85,000 deficit in 2023.

The increase in the market deficit comes as the council expects to see total demand drop by 5% this year as record industrial demand cools slightly.

In an interview with Kitco News, Edward Sterck, Director of Research at the council, said that while platinum demand is healthy this year, a lack of supply is driving this year’s deficit.

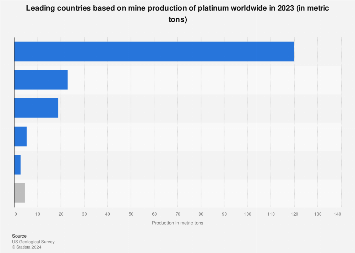

“Platinum supply is forecasted to come to 7.1 million ounces this year, which would be the weakest year for total supply in our time series going back to 2014,” he said.

Sterck added that the total mine supply is expected to drop 3% this year, and while recycling is forecasted to rise 5%, it remains fairly constrained.

“It's an improvement, but it's not a big number. We're still running around, around 15% below long-run levels.”

...

sdbullion.com

sdbullion.com