You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Silver Demand Drivers (and vault totals)

- Thread starter pmbug

- Start date

- Featured

-

- Tags

- physical demand

Welcome to the Precious Metals Bug Forums

Welcome to the PMBug forums - a watering hole for folks interested in gold, silver, precious metals, sound money, investing, market and economic news, central bank monetary policies, politics and more.

Why not register an account and join the discussions? When you register an account and log in, you may enjoy additional benefits including no Google ads, market data/charts, access to trade/barter with the community and much more. Registering an account is free - you have nothing to lose!

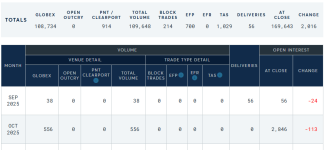

There was 1 Platinum Sep contract that traded yesterday. So apparently this happens if there is just zero activity.

Last week in silver:

SGE silver vault - loses 35.4 metric tons

SFE silver vault - loses 87.1 metric tons

SLV London vault - adds 145.4 metric tons

PSLV silver vault - adds 37.3 metric tons

COMEX silver stock - loses 101.7 metric tons

LBMA silver stock - ??? (no daily or weekly data because LBMA is run by dinosaurs)

Global net change (less LBMA):

Sep 15-19 = -41.5 metric tons

Sep 8-12 = +124.81 metric tons

Sep 1-5 = +2.45 metric tons

Aug 25-29 = +409.75 metric tons

Aug 18-22 = +230.8 metric tons

...

Last week there was a net drain on global vaults for the first time since early August. The COMEX vaults reported the first week of net loss/drain since August 8 after reporting some large inflows over the previous three weeks.

None of the drain on COMEX silver last week came out of JPM's vault. I mention this because COMEX September contract is reporting over 13,000 contracts standing for delivery and so far, 5,500+ were stopped (settled) by JPM (on first day notice). I haven't reviewed every daily report in September to be sure, but I suspect that very little silver has actually left the JPM vault this month.

SLV has been reporting large swings in their inventory lately. They reported a loss/drain of 116.1 tons and 134.1 tons in the previous two weeks before last week's addition of 145.4 tons. It's very likely that the previous week's losses were the result of some actors redeeming borrowed shares to raid their vault stock. SLV shares available to borrow were near zero all last week with the lease rate jacked up to ~5% as well. With no shares available for borrowing, SLV seemed to add back some of the inventory it had lost over the previous weeks. Yesterday, SLV reportedly added back a monster 276.7 tons (in one day)! SLV has now added back more than what was lost over the previous weeks and SLV's gain is the LBMA's (liquid free float) loss.

It seems that the refineries in Switzerland are busy trying to send silver to the UK right now, but given the SLV (and other ETFs which I have not tracked closely, but @mypreciousilver has) vault stock additions, it seems that the Swiss refineries sending the UK ~42 tons over the course of a month isn't near enough to satisfy London's ETF appetites (over 100 tons a week or maybe a day) much less whatever is happening in the LBMA's opaque OTC spot market.

Without considering the LBMA, global free float of vaulted silver would appear to have taken a massive hit last week as the COMEX and SFE/SGE both drained over 100 tons each and SLV and PSLV both added significant tonnage (taking 1,000 ozt LGD silver bars out of the liquid market). If this pattern continues, it won't be long before there is a technical default in the LBMA or COMEX!

Curiously, the silver EFP spread appears to have shrunk over the course of last week. Whatever reason caused the spread to blow out early this month appears to have abated. The EFP spread appears to be ~$0.27 at the moment as I compose this report.

One can only imagine what chaos might be unfolding in the LBMA's London vault system right now. We can only imagine because the dinosaurs at the LBMA do not provide daily/weekly reporting of their vault stock like every other market and major fund in the world.

Swiss silver exports to the UK:

SLV monster day:

London ETFs:

Technical default in LBMA/COMEX? Vote: https://www.pmbug.com/threads/silver-delivery-default-poll.8445/

SGE silver vault - loses 35.4 metric tons

SFE silver vault - loses 87.1 metric tons

SLV London vault - adds 145.4 metric tons

PSLV silver vault - adds 37.3 metric tons

COMEX silver stock - loses 101.7 metric tons

LBMA silver stock - ??? (no daily or weekly data because LBMA is run by dinosaurs)

Global net change (less LBMA):

Sep 15-19 = -41.5 metric tons

Sep 8-12 = +124.81 metric tons

Sep 1-5 = +2.45 metric tons

Aug 25-29 = +409.75 metric tons

Aug 18-22 = +230.8 metric tons

...

Last week there was a net drain on global vaults for the first time since early August. The COMEX vaults reported the first week of net loss/drain since August 8 after reporting some large inflows over the previous three weeks.

None of the drain on COMEX silver last week came out of JPM's vault. I mention this because COMEX September contract is reporting over 13,000 contracts standing for delivery and so far, 5,500+ were stopped (settled) by JPM (on first day notice). I haven't reviewed every daily report in September to be sure, but I suspect that very little silver has actually left the JPM vault this month.

SLV has been reporting large swings in their inventory lately. They reported a loss/drain of 116.1 tons and 134.1 tons in the previous two weeks before last week's addition of 145.4 tons. It's very likely that the previous week's losses were the result of some actors redeeming borrowed shares to raid their vault stock. SLV shares available to borrow were near zero all last week with the lease rate jacked up to ~5% as well. With no shares available for borrowing, SLV seemed to add back some of the inventory it had lost over the previous weeks. Yesterday, SLV reportedly added back a monster 276.7 tons (in one day)! SLV has now added back more than what was lost over the previous weeks and SLV's gain is the LBMA's (liquid free float) loss.

It seems that the refineries in Switzerland are busy trying to send silver to the UK right now, but given the SLV (and other ETFs which I have not tracked closely, but @mypreciousilver has) vault stock additions, it seems that the Swiss refineries sending the UK ~42 tons over the course of a month isn't near enough to satisfy London's ETF appetites (over 100 tons a week or maybe a day) much less whatever is happening in the LBMA's opaque OTC spot market.

Without considering the LBMA, global free float of vaulted silver would appear to have taken a massive hit last week as the COMEX and SFE/SGE both drained over 100 tons each and SLV and PSLV both added significant tonnage (taking 1,000 ozt LGD silver bars out of the liquid market). If this pattern continues, it won't be long before there is a technical default in the LBMA or COMEX!

Curiously, the silver EFP spread appears to have shrunk over the course of last week. Whatever reason caused the spread to blow out early this month appears to have abated. The EFP spread appears to be ~$0.27 at the moment as I compose this report.

One can only imagine what chaos might be unfolding in the LBMA's London vault system right now. We can only imagine because the dinosaurs at the LBMA do not provide daily/weekly reporting of their vault stock like every other market and major fund in the world.

Swiss silver exports to the UK:

SLV monster day:

London ETFs:

Technical default in LBMA/COMEX? Vote: https://www.pmbug.com/threads/silver-delivery-default-poll.8445/

Last week in silver:

SGE silver vault - ??? (no report yet - probably will see tomorrow)

SFE silver vault - loses 1.2 metric tons

SLV London vault - adds 156.7 metric tons

PSLV silver vault - adds 31 metric tons

COMEX silver stock - adds 221 metric tons

LBMA silver stock - ??? (no daily or weekly data because LBMA is run by dinosaurs)

Global net change (less LBMA and SGE):

Sep 22-26 = +407.5 metric tons

Sep 15-19 = -41.5 metric tons

Sep 8-12 = +124.81 metric tons

Sep 1-5 = +2.45 metric tons

Aug 25-29 = +409.75 metric tons

Aug 18-22 = +230.8 metric tons

...

Last week there was some huge movements in global vault stock. As of this morning, I did not see a report for SGE vault data for last week. I'll post an addendum when the data is available.

The COMEX vaults rebounded from a net loss/drain two weeks ago and posted a huge inflow for last week. We are nearing the end of the month and there seems to be more movement in the vaults lately as they wrap up the September contract settlements or prepare for the October contract settlements. While this report covers last week, I will note that on Monday this week, there were some big movements of metal from registered to eligible vault stock.

Last week I mentioned that there hasn't been any report of silver leaving JPM's COMEX vault all month even though JPM was the one that stopped (settled) 5,500+ contracts on first day notice for the September contract. That did not change last week as nothing was withdrawn from the JPM vault.

SLV reported a huge inflow on Monday last week and smaller outflows throughout the rest of the week for a large net weekly inflow. Once again Monday this week, SLV reported another huge inflow. SLV's vault stock gain is the LBMA's (liquid free float) loss. Also, share borrowing/leasing rates continue to signal tightness.

The LBMA's monthly vault stock "report" is due on October 7. We have some mostly complete ETF vault stock data (beyond just SLV) indicating that the LBMA vault stock has likely taken a big hit this month. I'm eager to see what they report and if it makes any sense given the ETF reports and the still to come UK silver import data.

PSLV has been busy adding ~31 tons per week for the last two weeks. There are reports lately indicating that trading volume (and short interest) has picked up in the last week or so. Maybe it is related to @SemperVigilant1 's PSLV Short Suppression Theory, but if so, it doesn't appear to be working (yet?) as PSLV has added ~1.7M new units on Thursday and Friday which should mean they will be acquiring additional silver stock to back them. Every LGD bar that PSLV acquires is 1,000 ozt that is not available to global free float for trade settlement.

Global free float of vaulted silver* would appear to have grown last week as the COMEX added a massive 221 tons, but it's likely that ETF inflows have had a similar depletion of LBMA vault stock.

* Special note: Yesterday @oriental_ghost said that two companies in China are sitting on 30,000 metric tons of silver in private vaults. That's more than all the silver held in the LBMA vault system (including ETF holdings). Massive!

Curiously, the silver EFP spread has continued to remain subdued over the course of last week. The EFP spread appears to be ~$0.26 at the moment as I compose this report (It was ~$0.27 when I composed last week's report). Looks to me like the "silver tariff" question has been settled (as I advocated previously).

One can only imagine what chaos might be unfolding in the LBMA's London vault system right now. We can only imagine because the dinosaurs at the LBMA do not provide daily/weekly reporting of their vault stock like every other market and major fund in the world.

Monday COMEX silver vault movements:

SLV tightness signals:

Preliminary look at ETFs impact on LBMA free float for September:

PSLV Short Suppression Theory

PSLV new units:

China companies hoarding 30,000 tons of silver:

https://x.com/oriental_ghost/status/1972827324778492148

Silver tariff question (thread):

https://x.com/pmbug/status/1972030139438657963

SGE silver vault - ??? (no report yet - probably will see tomorrow)

SFE silver vault - loses 1.2 metric tons

SLV London vault - adds 156.7 metric tons

PSLV silver vault - adds 31 metric tons

COMEX silver stock - adds 221 metric tons

LBMA silver stock - ??? (no daily or weekly data because LBMA is run by dinosaurs)

Global net change (less LBMA and SGE):

Sep 22-26 = +407.5 metric tons

Sep 15-19 = -41.5 metric tons

Sep 8-12 = +124.81 metric tons

Sep 1-5 = +2.45 metric tons

Aug 25-29 = +409.75 metric tons

Aug 18-22 = +230.8 metric tons

...

Last week there was some huge movements in global vault stock. As of this morning, I did not see a report for SGE vault data for last week. I'll post an addendum when the data is available.

The COMEX vaults rebounded from a net loss/drain two weeks ago and posted a huge inflow for last week. We are nearing the end of the month and there seems to be more movement in the vaults lately as they wrap up the September contract settlements or prepare for the October contract settlements. While this report covers last week, I will note that on Monday this week, there were some big movements of metal from registered to eligible vault stock.

Last week I mentioned that there hasn't been any report of silver leaving JPM's COMEX vault all month even though JPM was the one that stopped (settled) 5,500+ contracts on first day notice for the September contract. That did not change last week as nothing was withdrawn from the JPM vault.

SLV reported a huge inflow on Monday last week and smaller outflows throughout the rest of the week for a large net weekly inflow. Once again Monday this week, SLV reported another huge inflow. SLV's vault stock gain is the LBMA's (liquid free float) loss. Also, share borrowing/leasing rates continue to signal tightness.

The LBMA's monthly vault stock "report" is due on October 7. We have some mostly complete ETF vault stock data (beyond just SLV) indicating that the LBMA vault stock has likely taken a big hit this month. I'm eager to see what they report and if it makes any sense given the ETF reports and the still to come UK silver import data.

PSLV has been busy adding ~31 tons per week for the last two weeks. There are reports lately indicating that trading volume (and short interest) has picked up in the last week or so. Maybe it is related to @SemperVigilant1 's PSLV Short Suppression Theory, but if so, it doesn't appear to be working (yet?) as PSLV has added ~1.7M new units on Thursday and Friday which should mean they will be acquiring additional silver stock to back them. Every LGD bar that PSLV acquires is 1,000 ozt that is not available to global free float for trade settlement.

Global free float of vaulted silver* would appear to have grown last week as the COMEX added a massive 221 tons, but it's likely that ETF inflows have had a similar depletion of LBMA vault stock.

* Special note: Yesterday @oriental_ghost said that two companies in China are sitting on 30,000 metric tons of silver in private vaults. That's more than all the silver held in the LBMA vault system (including ETF holdings). Massive!

Curiously, the silver EFP spread has continued to remain subdued over the course of last week. The EFP spread appears to be ~$0.26 at the moment as I compose this report (It was ~$0.27 when I composed last week's report). Looks to me like the "silver tariff" question has been settled (as I advocated previously).

One can only imagine what chaos might be unfolding in the LBMA's London vault system right now. We can only imagine because the dinosaurs at the LBMA do not provide daily/weekly reporting of their vault stock like every other market and major fund in the world.

Monday COMEX silver vault movements:

SLV tightness signals:

Preliminary look at ETFs impact on LBMA free float for September:

PSLV Short Suppression Theory

PSLV new units:

China companies hoarding 30,000 tons of silver:

https://x.com/oriental_ghost/status/1972827324778492148

Silver tariff question (thread):

https://x.com/pmbug/status/1972030139438657963

Be sure to look at:

Are you offering investing advice or suggesting I include them in my "last week in silver" reports? If the latter, they don't maintain silver vault stock AFAIK.

I offer no investing advice. I am only suggesting looking at them for educational purposes.

AGQ is a 2x bullion ETN

The other two are miner ETFs.

I do recommend stacking Ag, especially if you speculate with paper. When silver does pop and gain value among Au, Pt & S&P, then I can explain what happened.

AGQ is a 2x bullion ETN

The other two are miner ETFs.

I do recommend stacking Ag, especially if you speculate with paper. When silver does pop and gain value among Au, Pt & S&P, then I can explain what happened.

Last week in silver:

SGE silver vault - ??? (no report yet)

SFE silver vault - ??? (no report yet)

SLV London vault - adds 53.7 metric tons

PSLV silver vault - adds 21.9 metric tons

COMEX silver stock - loses 17.1 metric tons

LBMA silver stock - ??? (no daily or weekly data because LBMA is run by dinosaurs)

Global net change (less LBMA and SGE):

Sep 29-Oct3 = +58.5 metric tons

Sep 22-26 = +407.5 metric tons

Sep 15-19 = -41.5 metric tons

Sep 8-12 = +124.81 metric tons

Sep 1-5 = +2.45 metric tons

...

Last week we only got a partial update of SFE (just Monday) as @oriental_ghost took vacation and did not post updates to X. I'm eager to see what has happened with their vault stock when he resumes posting updates as there is a lot of anecdotal reports of retail silver shortages in China recently.

The COMEX vaults had a yo-yo week adding and draining every other day with a relatively small net outflow overall (but very busy movements amongst individual vaults in the system). The magnitude of the daily stock changes seemed to moderate last week as ~1.4M ozt was the highest daily net change all week (compared to over 2.4M ozt max daily net change in the preceding ~5 weeks).

There has been a lot of action happening with SLV - the canary in the silver mine. See comments below for more details.

The LBMA's monthly vault stock "report" is due tomorrow. We have some mostly complete ETF vault stock data (beyond just SLV) indicating that the LBMA vault stock has likely taken a big hit this month. I'm eager to see what they report and if it makes any sense given the ETF reports and the still to come UK silver import data.

PSLV added another 21.9 tons last week - a third less than previous weeks. While the metal additions have slowed down, the addition of new units has not, so it's possible that PSLV will be adding more silver soon (if they can find it!).

Global free float of vaulted silver* would appear to have shrunk last week as the COMEX lost a bit and ETF inflows have grown (which deplete LBMA vault stock). We'll have to wait to see what happened with China's SFE/SGE vaults.

Anecdotally, there are indications that LBMA Good Delivery Refineries may be struggling to supply LGD silver bars for the LBMA and COMEX. We may be very close to the silversqueeze event horizon!

One can only imagine what chaos might be unfolding in the LBMA's London vault system right now. We can only imagine because the dinosaurs at the LBMA do not provide daily/weekly reporting of their vault stock like every other market and major fund in the world.

SLV canary singing:

PSLV units:

LGD refineries:

LGD refineries part 2 (thread):

SGE silver vault - ??? (no report yet)

SFE silver vault - ??? (no report yet)

SLV London vault - adds 53.7 metric tons

PSLV silver vault - adds 21.9 metric tons

COMEX silver stock - loses 17.1 metric tons

LBMA silver stock - ??? (no daily or weekly data because LBMA is run by dinosaurs)

Global net change (less LBMA and SGE):

Sep 29-Oct3 = +58.5 metric tons

Sep 22-26 = +407.5 metric tons

Sep 15-19 = -41.5 metric tons

Sep 8-12 = +124.81 metric tons

Sep 1-5 = +2.45 metric tons

...

Last week we only got a partial update of SFE (just Monday) as @oriental_ghost took vacation and did not post updates to X. I'm eager to see what has happened with their vault stock when he resumes posting updates as there is a lot of anecdotal reports of retail silver shortages in China recently.

The COMEX vaults had a yo-yo week adding and draining every other day with a relatively small net outflow overall (but very busy movements amongst individual vaults in the system). The magnitude of the daily stock changes seemed to moderate last week as ~1.4M ozt was the highest daily net change all week (compared to over 2.4M ozt max daily net change in the preceding ~5 weeks).

There has been a lot of action happening with SLV - the canary in the silver mine. See comments below for more details.

The LBMA's monthly vault stock "report" is due tomorrow. We have some mostly complete ETF vault stock data (beyond just SLV) indicating that the LBMA vault stock has likely taken a big hit this month. I'm eager to see what they report and if it makes any sense given the ETF reports and the still to come UK silver import data.

PSLV added another 21.9 tons last week - a third less than previous weeks. While the metal additions have slowed down, the addition of new units has not, so it's possible that PSLV will be adding more silver soon (if they can find it!).

Global free float of vaulted silver* would appear to have shrunk last week as the COMEX lost a bit and ETF inflows have grown (which deplete LBMA vault stock). We'll have to wait to see what happened with China's SFE/SGE vaults.

Anecdotally, there are indications that LBMA Good Delivery Refineries may be struggling to supply LGD silver bars for the LBMA and COMEX. We may be very close to the silversqueeze event horizon!

One can only imagine what chaos might be unfolding in the LBMA's London vault system right now. We can only imagine because the dinosaurs at the LBMA do not provide daily/weekly reporting of their vault stock like every other market and major fund in the world.

SLV canary singing:

PSLV units:

LGD refineries:

LGD refineries part 2 (thread):

I mean that one Billionaire alone with his photo of the delivery he took, if that's real.... I mean that was probably like 6 months of their games supply. Then if you had China siphoning off real supply from the mines they didn't have anything left other than recycling in other games.

Update (all values in metric tons) (see post #197 for last month):

* SFE data through 9-29 (missing 9-30) and SGE data through 9-19 as @oriental_ghost went on vacation for Golden Week national holiday in China and has not yet posted any updates since 9-29.

The west has roughly 16,729.15 metric tons vaulted at LBMA + COMEX not owned by ETFs. Total global free float including China (SFE/SGE) is ~19,135.763 metric tons. PSLV's silver vault stock is not directly available for settling COMEX or LBMA deliveries, so it is not included in free float totals - I include it because every 1,000 ozt that PSLV acquires is an LGD silver bar that is no longer available to the LBMA or global free float for trade settlement.

In the month of September, the COMEX, SLV and PSLV all added to their silver vault stock. The SFE and SGE silver vaults both shed inventory as of the dates I that I had data. The LBMA finally reports a small decrease to their overall silver vault stock. However, SLV and other ETFs reported huge London vault inflows, so the LBMA free float took a huge hit - a little over 20% of what was there at the start of the month! If the LBMA free float continues draining at September's pace, it will be completely depleted in just under 4 months - assuming the numbers reported here are, in fact, actually liquid (some percentage of the free float might actually be owned by diamond hands and not actually available for trade).

I am now tracking the global vault stock changes every day/week for the COMEX, SFE/SGE, SLV and PSLV. Of course, there is no daily or weekly data for the LBMA because they are run by dinosaurs. The LBMA apparently thinks their monthly grand total report provides sufficient transparency to their operations.

I frequently receive comments asking why I bother compiling this data. The comments commonly claim that the numbers are a fraud or they don't matter. Whether or not the numbers are completely accurate or not, they are the only public data we have and they *are* telling a story - a story that is echoing in many ways right now. As I wrote the other day, "Folks who only watch charts and don't understand what is happening with the underlying physical are missing the whole story. They need to check their assumptions."

Sources:

LBMA: https://www.lbma.org.uk/prices-and-data/london-vault-data

LBMA ETFs:

COMEX: I am saving COMEX silver stock reports and tracking the totals in a spreadsheet now.

SGE/SFE: I am saving SFE/SGE vault totals from Xiaojun Bai's daily X tweets and tracking them in a spreadsheet now.

PSLV: I am saving Sprott's PSLV silver stock data and tracking the totals in a spreadsheet now.

Global Vault Stock - September 2025

Market | This month | Last month | Difference |

|---|---|---|---|

| LBMA (total) | 24,581 | 24,646 | -65 |

| London vaulted ETFs* | 21,152 | 20,329 | 823 |

| LBMA-ETFs (free float)* | 3,429 | 4,313 | -884 |

| COMEX | 16,509.29 | 16,118.83 | 390.46 |

| SLV NYC Vault | 3,209.14 | 3,209.14 | 0.00 |

| COMEX-SLV (free float) | 13,300.15 | 12,909.69 | 390.46 |

| SFE/SGE | *2,406.613 | 2,479.606 | -72.993 |

| PSLV | 6,216.872 | 6,065.816 | 151.056 |

* SFE data through 9-29 (missing 9-30) and SGE data through 9-19 as @oriental_ghost went on vacation for Golden Week national holiday in China and has not yet posted any updates since 9-29.

The west has roughly 16,729.15 metric tons vaulted at LBMA + COMEX not owned by ETFs. Total global free float including China (SFE/SGE) is ~19,135.763 metric tons. PSLV's silver vault stock is not directly available for settling COMEX or LBMA deliveries, so it is not included in free float totals - I include it because every 1,000 ozt that PSLV acquires is an LGD silver bar that is no longer available to the LBMA or global free float for trade settlement.

In the month of September, the COMEX, SLV and PSLV all added to their silver vault stock. The SFE and SGE silver vaults both shed inventory as of the dates I that I had data. The LBMA finally reports a small decrease to their overall silver vault stock. However, SLV and other ETFs reported huge London vault inflows, so the LBMA free float took a huge hit - a little over 20% of what was there at the start of the month! If the LBMA free float continues draining at September's pace, it will be completely depleted in just under 4 months - assuming the numbers reported here are, in fact, actually liquid (some percentage of the free float might actually be owned by diamond hands and not actually available for trade).

I am now tracking the global vault stock changes every day/week for the COMEX, SFE/SGE, SLV and PSLV. Of course, there is no daily or weekly data for the LBMA because they are run by dinosaurs. The LBMA apparently thinks their monthly grand total report provides sufficient transparency to their operations.

LBMA said:These figures provide an important insight into London's ability to underpin the physical OTC market.

I frequently receive comments asking why I bother compiling this data. The comments commonly claim that the numbers are a fraud or they don't matter. Whether or not the numbers are completely accurate or not, they are the only public data we have and they *are* telling a story - a story that is echoing in many ways right now. As I wrote the other day, "Folks who only watch charts and don't understand what is happening with the underlying physical are missing the whole story. They need to check their assumptions."

Sources:

LBMA: https://www.lbma.org.uk/prices-and-data/london-vault-data

LBMA ETFs:

COMEX: I am saving COMEX silver stock reports and tracking the totals in a spreadsheet now.

SGE/SFE: I am saving SFE/SGE vault totals from Xiaojun Bai's daily X tweets and tracking them in a spreadsheet now.

PSLV: I am saving Sprott's PSLV silver stock data and tracking the totals in a spreadsheet now.

Check this out @Voodoo :

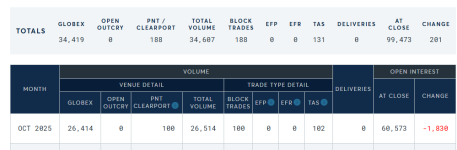

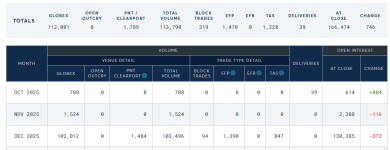

Citibank's house account bought 1,155 contracts (5.8 million oz) of silver yesterday (Oct 9). That alone would have been a single day record for silver bought during the delivery period. The fact this occurred during an inactive contract (October) is even more spectacular.

But wait, there’s more … Marex and StoneX customer accounts plus a few other players bought an additional 272 contracts (1.36 million oz) pushing the total number of contracts to 1,427 (7.14 million oz).

This 1,427 contract single day activity exceeds the TOTAL for each of the inactive month contracts during 2024. For comparison, those 2024 inactive contracts averaged 1,297 for the entire contract. So ... now a single day activity bests an entire month's activity.

Cumulative deliveries on the Oct contract now total 24.7 million oz setting a record for inactive contracts. That tops the previous high set by the Feb 2025 contract.

...

Yesterday the silver price bobbed like a cork on the water around $50/ozt. All seemed calm, but let's what played out below the surface...

PSLV

Yesterday PSLV reported no change to the units in the trust and an addition of just 913 ozt. Such a small amount could indicate they added 1 LGD bar, or it's just an adjustment after auditing all the metal they've added in the last couple of days. PSLV has had a busy week, but was quiet yesterday. Every 1,000 ozt of silver that PSLV adds to their vaults is a London Good Delivery silver bar that is not available to the COMEX or LBMA to settle contracts.

COMEX

Yesterday, COMEX activity report for 10-9 (COMEX reports activity for the previous working day) showed another 897k ozt (~28 metric tons) withdrawn from the Asahi vaults and 3.66M ozt (~114 metric tons) withdrawn overall. Additionally, Asahi moved 2.8M ozt (88 metric tons) from registered to eligible (likely in anticipation of withdrawing it?). I singled out the action in the Asahi vault because they are listed by the LBMA as a Good Delivery Refinery for silver and I assume that means they can deliver silver back to London with fewer logistical challenges (red tape, costs, etc.) than other actors.

JPM also withdrew ~1.3M ozt (39.9 metric tons) on 10-9 and that's the first activity from the JPM vaults in several days at least. JPM is the custodian for Blackrock's SLV and manages changes to SLV inventory in their London (LBMA) vault. I assume that JPM also can deliver silver back to London with fewer logistical challenges (red tape, costs, etc.) than other actors.

The buying and immediately standing for delivery on the October (non-delivery month) contract has grown massively (see previous post). Based upon the last couple of days, I expect when the silver stock report for activity on 10-10 is released on Monday, it's going to show some massive withdrawals.

SLV

My "canary in the silver mine" is still sounding alarms - indirect evidence of London's diminishing liquid free float (available silver). Yesterday, the shares available to borrow stayed near zero and the borrow fee has spiked above 15%! The spread between the rebate fee (what brokers pay shareholders to borrow shares) and the borrow fee (what brokers charge to lend shares) narrowed a bit to 4.1%.

If any of the silver being withdrawn from the COMEX manages to get deposited in the LBMA vaults over the weekend as rumors of it being airlifted have circulated, it's possible that next week we see some large batches of shares created and silver deposited in SLV. If that happens, I expect the borrow fee to drop early next week. While we wait for that, SLV reports (Blackrock reports shares / JPM reports inventory) shedding 300k shares and 272,362 ozt (~8.5 metric tons) yesterday. Someone had fun redeeming shares for physical silver.

SFE/SGE

The Oct 10 trading indicated the SGE/SFE were still trading at a discount to the LBMA/COMEX - they have some catching up to do if they want more silver from the West.

SilverStacker

Big Eyed Bug

- Messages

- 497

- Reaction score

- 325

- Points

- 108

As in owners of paper wanting actual metal ? Metal the paper pushers dont actually have ? That sort of squeeze ?Sure looks like the squeeze has begun.

So that would indicate another data point toward the upward journey of silver, which is clawing its way up to a steady $52 oz and its creating a bit of hysteria toward ownership of physical which is why my LCS's cant keep product on the shelves ; Its almost like it doesn't matter what it costs. They come in and buy without even bothering to really ask the cost. Instead they say "give me $3,000 worth of silver".

The online bullion houses are a lot stronger but even then I'm seeing more "were out" sign then usual by far.

As in:

For decades, there has been a stockpile of silver in London that has allowed bullion banks to play the COMEX short - LBMA long EFP spread trade with near impunity. The LBMA's "silver ocean" has finally been drained though and now we're seeing the lack of physical metal affecting spot and lease rates in London and wild drawdowns on COMEX silver stock in a non-delivery month as the EFP spread trade is now broken. We are still at the beginning stages of a real, physical silversqueeze. This is a fundamental shift in the underlying market that is swamping the paper trades. Technical...

Today the silver price rose slow and steady for the most part. Let's investigate what played out below the surface...

PSLV

Last week saw PSLV report large additions of units and ozts. Today PSLV starts the new week picking up where they left off last week - adding 1,649,197 units to the trust and 300,797.00 ozt (~9.3 metric tons) to the vault. Every 1,000 ozt of silver that PSLV adds to their vaults is a London Good Delivery silver bar that is not available to the COMEX or LBMA to settle contracts.

COMEX

COMEX activity report for last Friday (COMEX reports activity for the previous working day) showed another 899k ozt (~28 metric tons) withdrawn from the Asahi vaults and 2.27M ozt (~70.6 metric tons) withdrawn overall. Additionally, Asahi moved ~338k ozt (10.5 metric tons) from registered to eligible - much less that what they switched out on Thursday. Maybe Asahi is reaching the limit of what they can immediately withdraw for London? I singled out the action in the Asahi vault because they are listed by the LBMA as a Good Delivery Refinery for silver and I assume that means they can deliver silver back to London with fewer logistical challenges (red tape, costs, etc.) than other actors.

JPM also withdrew ~169k ozt (~5.3 metric tons) on 10-10 and that's almost 10% of what they withdrew on Thursday. It would seem that JPM is also reaching the limit of what they can immediately withdraw for London. JPM is the custodian for Blackrock's SLV and manages changes to SLV inventory in their London (LBMA) vault. I assume that JPM also can deliver silver back to London with fewer logistical challenges (red tape, costs, etc.) than other actors.

Based upon the reports of massive buying and immediately standing for delivery on the October (inactive, non-delivery month) contract, I had expected the silver stock report for activity on 10-10 to show some massive withdrawals, but in actuality, Friday's withdrawals were about a third less than Thursday. Maybe the October deliveries are not from traders/banks wanting to send silver to London.

SLV

My "canary in the silver mine" is still struggling - indirect evidence of London's lack of liquid free float (available silver). Today, SLV had shares available to borrow early in the morning, but when they were gone, they stayed gone. SLV shares available to borrow was zero for over 6 hours during most of the trading day. The borrowing fee stayed pretty steady though at 14.3%. The spread between the rebate fee (what brokers pay shareholders to borrow shares) and the borrow fee (what brokers charge to lend shares) also remained steady at 4.1%.

Curiously, though the shares available to borrow stayed at zero most of the day, Blackrock reports adding a whopping 11M SLV shares today while JPM reports no change (no additional silver) to the SLV silver stock (vaulted bar list). Blackrock is showing SLV silver stock at ~10M ozt more than JPM's bar stock report. Maybe JPM will report adding ~10M ozt in tomorrow's bar stock report. BTW, 10M ozt is the amount of silver that has been withdrawn from the COMEX from 10-7 to 10-10.

As you can see in the screenshot below, a miniscule amout of SLV shares to borrow were added after hours today and the borrow fee dropped to 11.33%. I can only assume the borrow fee dropped because this happened after the trading day was over.

SFE/SGE

The Oct 13 trading indicated the SGE/SFE were still trading at a discount to the LBMA/COMEX - they have some catching up to do if they want more silver from the West. The SFE silver vault continues to bleed out inventory - shedding 1.4M ozt (~44.6 metric tons) today.

Yesterday the silver price got monkey hammered overnight and spent the day recuperating. Let's investigate what played out below the surface...

PSLV

Yesterday PSLV added zero units to the trust and 391,940 ozt (~12.2 metric tons) to the vault. PSLV just continues steadily adding to its vault stock. Every 1,000 ozt of silver that PSLV adds to their vaults is a London Good Delivery silver bar that is not available to the COMEX or LBMA to settle contracts.

COMEX

COMEX silver stock report for Monday (COMEX reports activity for the previous working day) showed a whopping 3.1M ozt (~96.8 metric tons) withdrawn from the Asahi vaults and 4.5M ozt (~141.8 metric tons) withdrawn overall. Additionally, Asahi moved ~5.7M ozt (~176.5 metric tons) from registered to eligible. These are massive numbers and it seems my speculation that Asahi had reached the limit of what they can immediately withdraw for London was premature. I singled out the action in the Asahi vault because they are listed by the LBMA as a Good Delivery Refinery for silver and I assume that means they can deliver silver back to London with fewer logistical challenges (red tape, costs, etc.) than other actors.

JPM listed zero withdrawn on Monday, however, they reported moving 986k ozt from registered to eligible so maybe we'll see more withdrawn in the next report (activity for Tuesday). JPM is the custodian for Blackrock's SLV and manages changes to SLV inventory in their London (LBMA) vault. I assume that JPM also can deliver silver back to London with fewer logistical challenges (red tape, costs, etc.) than other actors.

Overall, 9.1M ozt of silver was moved from registered to eligible on Monday. This might be a COMEX record. It would seem that more silver is preparing to leave the COMEX.

The folks in London must be totally perplexed at how Americans can move nearly 100 metric tons of silver out of a single vault in a single day.

SLV

My "canary in the silver mine" is still struggling - indirect evidence of London's lack of liquid free float (available silver). Yesterday, SLV had zero shares available to borrow all day long (from 2AM on 10-14 until 1AM on 10-15). SLV has added some shares overnight and they are already disappearing. Meanwhile, the borrowing fee has spiked back up to 15.5%. The spread between the rebate fee (what brokers pay shareholders to borrow shares) and the borrow fee (what brokers charge to lend shares) has remained steady at 4.1%.

In my last report, I noted that Blackrock reported adding a whopping 11M SLV shares while JPM reported no change (no additional silver) to the SLV silver stock (vaulted bar list). Yesterday, Blackrock reports shedding 750k shares while JPM reports adding a whopping 8.1M ozt (~254 metric tons) to the bar list. It would seem that there is still around a 1M ozt difference between the shares added (9M) and the ozt added (8M) over the last couple of days. Kudos to JPM (or whoever) for moving such a huge amount over the seas so quickly.

As you can see in the screenshot below, some SLV shares to borrow were added overnight and the borrow fee has spiked to 15.5%. Even though SLV has added 10M shares (and then shed 750k shares), the shares available to borrow really hasn't (yet?) reflected increased liquidity. The rebate and borrow fees are still indicating stress.

SFE/SGE

The Oct 15 trading indicated the SGE/SFE are catching up to the LBMA/COMEX. The China spot/futures discount has narrowed to almost zero. The SFE silver vault continues to bleed out inventory - shedding another 1M ozt (~32.6 metric tons) today.

Ya that ship sailed with the Rona, never to be seen again.

- Messages

- 1,777

- Reaction score

- 2,084

- Points

- 283

SD 100 oz bars are selling fast this week. Almost 30 of them sold since Monday. last week less than 10 sold. Not accounting for anything they been buying of course. 1 oz rounds on the other hand are about the same with over 29,000 still in stock.

Miles Franklin said in an interview recently that back in July he bought a massive amount of 90% from the wholesaler who let it go cheap. 15 million worth. Said about 1/2 of it is gone already.

People I am talking to aren't happy with silver. They say it's too heavy and takes up too much space. I know 2 people who bought Liberty safes last year and loaded it to the gills with silver. They dont want to buy another safe though. I told them to dig a hole in the backyard and bury it. No one will know. Except me.

These newbs get so excited too. Everyday or every other day I get a call. Are you seeing these prices. Umm yep, been seeing them everyday for about 20 years LOL. These guys are like Hunter Biden on crack. Just keep calling the dealers to buy more.

Miles Franklin said in an interview recently that back in July he bought a massive amount of 90% from the wholesaler who let it go cheap. 15 million worth. Said about 1/2 of it is gone already.

People I am talking to aren't happy with silver. They say it's too heavy and takes up too much space. I know 2 people who bought Liberty safes last year and loaded it to the gills with silver. They dont want to buy another safe though. I told them to dig a hole in the backyard and bury it. No one will know. Except me.

These newbs get so excited too. Everyday or every other day I get a call. Are you seeing these prices. Umm yep, been seeing them everyday for about 20 years LOL. These guys are like Hunter Biden on crack. Just keep calling the dealers to buy more.

...

People ... aren't happy with silver. They say it's too heavy and takes up too much space. ...

I’m seeing offers on the bullionvault live order board of 500 and 600 ounces of silver, so there are some getting rid of silver

But clearly the big boyz are looking for lorry loads .

I’m almost starting to enjoy my silver ownership ……..

Live Order Board; Gold, Silver, Platinum | BullionVault

The live order board is where users can bid to buy Silver, Gold, Platinum, Palladium bullion from other customers and much more. View more at BullionVault >>

www.bullionvault.co.uk

But clearly the big boyz are looking for lorry loads .

I’m almost starting to enjoy my silver ownership ……..

Yesterday saw some high volatility with the silver spot price. Let's investigate what played out below the surface...

PSLV

Yesterday PSLV added 1,654,770 units to the trust and only 904 ozt to the vault (likely just an adjustment after verifying yesterday's inflow). I assume the addition of 1.6M new units means PSLV is on the hunt to add more ozt to their vault. Every 1,000 ozt of silver that PSLV adds to their vaults is a London Good Delivery silver bar that is not available to the COMEX or LBMA to settle contracts.

COMEX

COMEX silver stock report for Tuesday (COMEX reports activity for the previous working day) showed a more modest 907K ozt (~28.2 metric tons) withdrawn from the Asahi vaults and 3.5M ozt (~109.5 metric tons) withdrawn overall. Additionally, Asahi moved ~331K ozt (~10.3 metric tons) from registered to eligible. Once again it looks like the Asahi vault's outflow is slowing down. I singled out the action in the Asahi vault because they are listed by the LBMA as a Good Delivery Refinery for silver and I assume that means they can deliver silver back to London with fewer logistical challenges (red tape, costs, etc.) than other actors.

JPM listed zero withdrawn on Tuesday, however, they reported moving 59.7k ozt from registered to eligible. This is the second day in a row that JPM reports zero outflow, so maybe they are done sending metal to London? JPM is the custodian for Blackrock's SLV and manages changes to SLV inventory in their London (LBMA) vault. I assume that JPM also can deliver silver back to London with fewer logistical challenges (red tape, costs, etc.) than other actors.

Overall, 445K ozt (~13.8 metric tons) of silver was moved from registered to eligible on Tuesday - significantly less than the past few working days. Did someone turn off the spigot and the hose is just emptying out the final ozt of outflow?

SLV

My "canary in the silver mine" is very schizophrenic and signalling indirect evidence of London's lack of liquid free float (available silver). Yesterday, SLV apparently had plenty of shares available to borrow all day long and the borrow fee jumped up and down before spiking to 16.22% near the end of the day. SLV has bled out shares overnight as the borrow and rebate fees have held steady. The spread between the rebate fee (what brokers pay shareholders to borrow shares) and the borrow fee (what brokers charge to lend shares) has remained steady at 4.1%.

In my last two reports, I noted that:

1. Monday, Blackrock reported adding a whopping 11M SLV shares while JPM reported no change (no additional silver) to the SLV silver stock (vaulted bar list).

2. Tuesday, Blackrock reported shedding 750k shares while JPM reports adding a whopping 8.1M ozt (~254 metric tons) to the bar list.

As I noted last night, yesterday, one day after reporting an 8.1M inflow on the bar list, JPM reported losing the 8.1M inflow plus more. Additionally, Blackrock now reports a loss of 11M shares.

Is it Helter Skelter over there, or are they just kidding with their reporting? These are very strange reports!

SFE/SGE

The Oct 16 trading indicated the SGE/SFE prices for silver moving up with, but still lagging (at a discount to) the LBMA/COMEX. The SFE silver vault continues to bleed out inventory - shedding another 1.5M ozt (~48.1 metric tons) today.

SLV helter skelter:

- Messages

- 1,777

- Reaction score

- 2,084

- Points

- 283

Who's getting paid the 16% to borrow slv shares? The shareholders themselves. Seems like a good deal if you're a shareholder

Not usually. They should but most brokers will keep that and the shareholders have no idea anything even happened.

Who's getting paid the 16% to borrow slv shares? ...

Brokers.

Investors can lend shares to brokers at the rebate fee (12.12% currently).

Brokers lend to borrowers at the borrow fee (16.22% currently).

Brokers are pocketing a 4.1% spread on the difference.