You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Silver Demand Drivers (and vault totals)

- Thread starter pmbug

- Start date

- Featured

-

- Tags

- physical demand

Welcome to the Precious Metals Bug Forums

Welcome to the PMBug forums - a watering hole for folks interested in gold, silver, precious metals, sound money, investing, market and economic news, central bank monetary policies, politics and more.

Why not register an account and join the discussions? When you register an account and log in, you may enjoy additional benefits including no Google ads, market data/charts, access to trade/barter with the community and much more. Registering an account is free - you have nothing to lose!

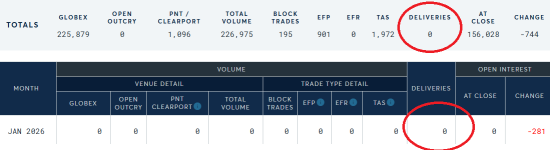

Did you ever see or figure out why the Comex stopped reporting the deliveries each day?

Viking

Yellow Jacket

Doesn't it have to go back up, if not, the Asian market will be buying hand over fist when it opens Sunday night?This way who is going to stand for delivery at $120 when spot is $87 now?

The CME Group data. The deliveries have been zero for like 2 weeks straight in every metal I checked. Gold, SIlver, Pt, even Copper

I see. I don't watch that report. You can see deliveries from the delivery notices page:

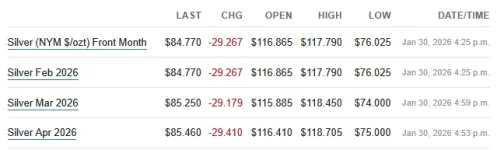

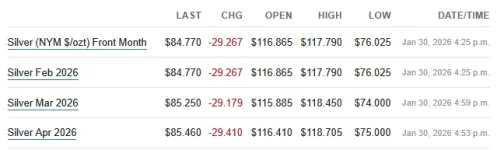

Yesterday (1-30) in silver

Yesterday silver plummeted from ~$102 to ~$75 before recovering to $85. Was it Mr. Slammy's last hurrah? We look below the surface (a thread)

23K ozt (0.7 tons) deposited in CNT

2.4M ozt (74.3 tons) withdrawn from Asahi (162K), CNT (1.1M), JPM (965K), Loomis (134K)

272K ozt (8.5 tons) moved from [E] to [R] in CNT

3.5M ozt (110.4 tons) moved from [R] to [E] in Asahi (35K), Brinks (944K), JPM (1.6M), MT&B (929K)

Heavy withdrawals continued Thursday as expected. Silver moving from [R] to [E] picked up again. Based upon the 60% [R] drain rate metric observed Oct-Dec, an average withdrawal rate of 2.5M ozt (it's been 2.9M over the last two weeks), 105M ozt [R] would be depleted in 70 working days (14 weeks - ~3.5 months)

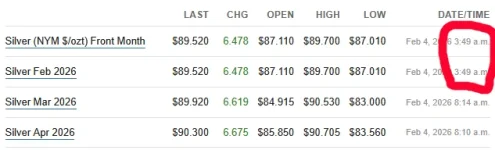

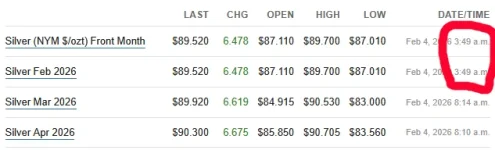

With a current spot price of $85.33, EFP spreads:

Feb26 = -$0.56 vs -$2.55 Yesterday

Mar26 = -$0.08 vs -$0.59

Apr26 = +$0.13 vs -$0.38

EFP spreads have settled with a positive shift although Feb26 EFP spread is still negative. CME margin increase on the way. That should help keep Feb26 EFP spread in the negative (so COMEX silver continues flowing to London/LBMA).

China

Per @TheMetalCharts website:

SGE $122.24 (no VAT)

$122.24 (no VAT)

SFE $114.90

$114.90

SGE closed for trading before the slam. We'll have to wait for Sunday night / Monday morning to see where it finds equilibrium.

India

Spot : $113.07 (less tax = $102.89)

MMTC-PAMP (retail) : $114.15 (less tax = $103.88)

Feb26 [SILVERM 5kg] : $105.90 (less tax = ~$99.54)

Mar26 [SILVER 30kg] : $99.04

Feb-Mar spread blew out!

4.2M Shares available

Borrow fee up from 0.60% to 0.70%

Available shares are disappearing it would seem! Will they reload Monday morning?

Blackrock: No change

JPM: No change

Did they hit they brakes? Or did they decide not to report the day's activity? I'm guessing the latter.

Zero units change

Zero ozt change

PSLV units/ozt ratio still sits at .3413 (8th day in a row). They still need to add 1.3M ozt (41.7 tons) to get back to the historical .3434 ratio. Are they having trouble sourcing the silver?

SGE ($122.24) (closed pre-slam)

SGE ($122.24) (closed pre-slam)

SFE ($114.90)

SFE ($114.90)

Retail ($103.88)

Retail ($103.88)

MCX ($99.54)

MCX ($99.54)

spot ($85.33)

spot ($85.33)

COMEX Feb26 ($84.77)

COMEX Feb26 ($84.77)

- Feb26 EFP spread still negative

- COMEX

(LBMA

(LBMA )

)

- SLV ???

???

- PSLV still needs ~1.3M ozt

Yesterday silver plummeted from ~$102 to ~$75 before recovering to $85. Was it Mr. Slammy's last hurrah? We look below the surface (a thread)

COMEX 1-29

23K ozt (0.7 tons) deposited in CNT

2.4M ozt (74.3 tons) withdrawn from Asahi (162K), CNT (1.1M), JPM (965K), Loomis (134K)

272K ozt (8.5 tons) moved from [E] to [R] in CNT

3.5M ozt (110.4 tons) moved from [R] to [E] in Asahi (35K), Brinks (944K), JPM (1.6M), MT&B (929K)

COMEX Commentary

Heavy withdrawals continued Thursday as expected. Silver moving from [R] to [E] picked up again. Based upon the 60% [R] drain rate metric observed Oct-Dec, an average withdrawal rate of 2.5M ozt (it's been 2.9M over the last two weeks), 105M ozt [R] would be depleted in 70 working days (14 weeks - ~3.5 months)

EFP spread

With a current spot price of $85.33, EFP spreads:

Feb26 = -$0.56 vs -$2.55 Yesterday

Mar26 = -$0.08 vs -$0.59

Apr26 = +$0.13 vs -$0.38

EFP Commentary

EFP spreads have settled with a positive shift although Feb26 EFP spread is still negative. CME margin increase on the way. That should help keep Feb26 EFP spread in the negative (so COMEX silver continues flowing to London/LBMA).

China

Per @TheMetalCharts website:

SGE

SFE

SGE closed for trading before the slam. We'll have to wait for Sunday night / Monday morning to see where it finds equilibrium.

India

Spot : $113.07 (less tax = $102.89)

MMTC-PAMP (retail) : $114.15 (less tax = $103.88)

Feb26 [SILVERM 5kg] : $105.90 (less tax = ~$99.54)

Mar26 [SILVER 30kg] : $99.04

Feb-Mar spread blew out!

SLV Share Lending

4.2M Shares available

Borrow fee up from 0.60% to 0.70%

Available shares are disappearing it would seem! Will they reload Monday morning?

SLV Assets

Blackrock: No change

JPM: No change

Did they hit they brakes? Or did they decide not to report the day's activity? I'm guessing the latter.

PSLV

Zero units change

Zero ozt change

PSLV units/ozt ratio still sits at .3413 (8th day in a row). They still need to add 1.3M ozt (41.7 tons) to get back to the historical .3434 ratio. Are they having trouble sourcing the silver?

Big Picture

- Feb26 EFP spread still negative

- COMEX

- SLV

- PSLV still needs ~1.3M ozt

ICYMI:

ETFs with LBMA vaulted silver stock weekly change (in tons):

through Thursday: -711.6

through Friday: -780

Friday: -68.4

weekly avg: -156 /day

The outflow slowed down to end the week/month. LBMA monthly report due on Feb 6 will likely be quite silly (showing massive increase in vault stock). I expect the piper will need to be paid in Feb-tober though.

through Thursday: -711.6

through Friday: -780

Friday: -68.4

weekly avg: -156 /day

The outflow slowed down to end the week/month. LBMA monthly report due on Feb 6 will likely be quite silly (showing massive increase in vault stock). I expect the piper will need to be paid in Feb-tober though.

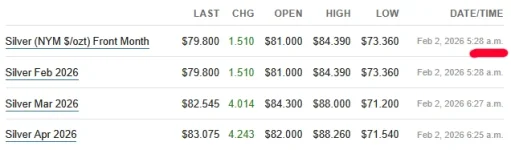

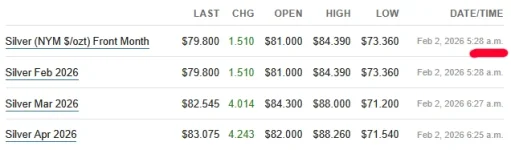

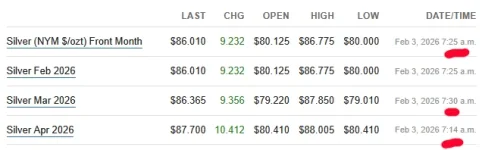

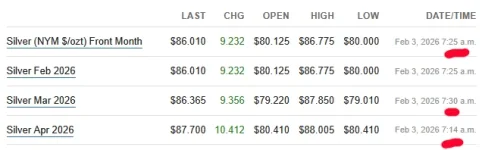

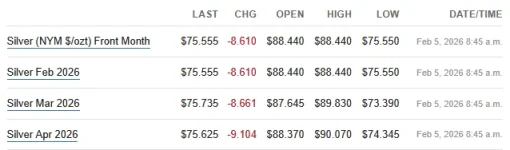

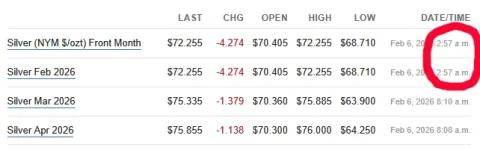

Monday morning in silver

This morning silver fell from ~$85 to the low $70s before recovering to ~$83.60. India and China have both begun trading with increased margin limits. We look below the surface (a thread)

With a current spot price of $83.67, EFP spreads:

Feb26 = -$3.87* vs -$0.56 Saturday

Mar26 = -$1.12 vs -$0.08

Apr26 = -$0.59 vs +$0.13

*Feb26 data was 1 hour old

CME hiking margins again today. Real time quote wasn't available for Feb26 when I looked. However, given the Mar26 and Apr26 EFP spreads shifting negative, it is a safe bet that Feb26 also shifted deeper negative (as I expected when margin hikes were announced). COMEX silver should continue flowing to London/LBMA.

China

SGE $104.81 (no VAT)

$104.81 (no VAT)

SFE $111.13

$111.13

SGE premium to LBMA spot = $21.14

SFE 243K ozt (7.5 tonnes)

243K ozt (7.5 tonnes)

SFE has a net inflow for the first time 2 weeks.

India

MMTC-PAMP (retail) : $95.82 (less 10% taxes = $86.23)

Feb26 [SILVERM 5kg] : $89.82 (less 7.2% taxes = ~$83.35)

Mar26 [SILVER 30kg] : $87.39

Feb-Mar spread cut in half from Friday. India markets seem to be tracking the West now instead of China.

10M Shares available

Borrow fee 0.70%

As expected, available shares reloaded this morning and ready for plunder.

SFE ($111.13)

SFE ($111.13)

SGE ($104.81)

SGE ($104.81)

Retail ($86.23)

Retail ($86.23)

spot ($83.67)

spot ($83.67)

MCX ($83.35)

MCX ($83.35)

COMEX Feb26 ($79.80) (1 hour old quote)

COMEX Feb26 ($79.80) (1 hour old quote)

- EFP spreads deeply negative (COMEX silver must flow [to LBMA])

- China held above $100

- India mirroring the West

This morning silver fell from ~$85 to the low $70s before recovering to ~$83.60. India and China have both begun trading with increased margin limits. We look below the surface (a thread)

EFP spread

With a current spot price of $83.67, EFP spreads:

Feb26 = -$3.87* vs -$0.56 Saturday

Mar26 = -$1.12 vs -$0.08

Apr26 = -$0.59 vs +$0.13

*Feb26 data was 1 hour old

EFP Commentary

CME hiking margins again today. Real time quote wasn't available for Feb26 when I looked. However, given the Mar26 and Apr26 EFP spreads shifting negative, it is a safe bet that Feb26 also shifted deeper negative (as I expected when margin hikes were announced). COMEX silver should continue flowing to London/LBMA.

China

SGE

SFE

SGE premium to LBMA spot = $21.14

SFE

SFE has a net inflow for the first time 2 weeks.

India

MMTC-PAMP (retail) : $95.82 (less 10% taxes = $86.23)

Feb26 [SILVERM 5kg] : $89.82 (less 7.2% taxes = ~$83.35)

Mar26 [SILVER 30kg] : $87.39

Feb-Mar spread cut in half from Friday. India markets seem to be tracking the West now instead of China.

SLV Share Lending

10M Shares available

Borrow fee 0.70%

As expected, available shares reloaded this morning and ready for plunder.

Big Picture

- EFP spreads deeply negative (COMEX silver must flow [to LBMA])

- China held above $100

- India mirroring the West

ICYMI:

It's interesting that the Chinese prices held up much better than India. Guess that tells us from where the real demand is emanating.

Not sure how accurate this site is but its one I've been searching for for some time.

metalcharts.org

metalcharts.org

China Silver Price Today in USD | Shanghai Premium - MetalCharts

Track the China silver price in dollars (USD) in real-time. Live SGE prices converted to US dollars for easy comparison with Western spot prices.

Yesterday (2-2) in silver

Silver fell from ~$83 to ~$76 before recovering to ~$80 before rising above $86 in the morning hours. Below the surface there are huge movements of physical (a thread)

1.2M ozt (37.6 tons) deposited in Brinks

1.4M ozt (43.5 tons) withdrawn from Asahi (541K), CNT (605K), JPM (212K) et al

862K ozt (26.8 tons) moved from [R] to [E] in Asahi (95K), Brinks (39K), CNT (268K), Delaware (79K), JPM (341K), MT&B (30K), StoneX (10K)

Relatively light withdrawals Friday (crash/turmoil day). Given the deeply negative EFP spreads throughout the day yesterday, I'm guessing the withdrawals are going to accelerate.

With a current spot price of $86.78, EFP spreads*:

Feb26 = -$0.77 vs -$3.87 Yesterday

Mar26 = -$0.41 vs -$1.12

Apr26 = +$0.92 vs -$0.59

*all futures data was 10-15 minutes old

The half life on the CME margin hike suppressing futures vs spot looks to be about a day (again). Feb26 EFP spread is still negative, but narrowing.

China

SGE $96.81 (no VAT)

$96.81 (no VAT)

SFE $96.12

$96.12

SGE > SFE

SGE premium to LBMA spot ~$10

SFE 417K ozt (13 tonnes)

417K ozt (13 tonnes)

Yesterday's inflow looks like an anomaly

India

MMTC-PAMP (retail) : $99.99 (less 10% taxes = $89.99)

Feb26 [SILVERM 5kg] : $94.60 (less 7.2% taxes = ~$87.79)

Mar26 [SILVER 30kg] : $92.29

India markets slightly elevated over the West, but far below China presently

8.8M Shares available

Borrow fee down from 0.70% to 0.67%

IB reporting a lot of activity with share borrowing now.

Blackrock: 36.3M shares

36.3M shares

JPM: 32.9M ozt (1,023.2 tons)

32.9M ozt (1,023.2 tons)

In the previous 5 weeks, with a rising spot price, SLV was shed 28.5M ozt (886.6 tons). This silver almost surely raided by APs using borrowed shares (buying the shares would have driven up the price).

Yesterday, after Friday's slam to spot price, SLV recouped the drain of the last 5 weeks and more. Seems to me like the APs took advantage of the slam to buy silver from weak hands cheaply in order to pay back their borrowed SLV shares.

Note that the SLV drain (LBMA gain) concluded at the end of January. Very convenient for LBMA monthly vault stock report to look good with SLV silver that disappeared immediately on the first trading day of February (after the cut-off reporting date).

3,437,232 units

3,437,232 units

1.1M ozt (35.5 tons)

1.1M ozt (35.5 tons)

First substantial drawdown in PSLV inventory I've seen since I started watching it closely in June 2025. Units/ozt ratio still sits at .3413. PSLV still needs to add 1.3M ozt (40.5 tons) to get back to the historical .3434 ratio. Is PSLV being raided now?

SGE ($96.81)

SGE ($96.81)

SFE ($96.12)

SFE ($96.12)

Retail ($89.99)

Retail ($89.99)

MCX ($87.79)

MCX ($87.79)

spot ($86.78)

spot ($86.78)

COMEX Feb26 ($86.01)

COMEX Feb26 ($86.01)

- Feb26 EFP spread firmly negative

- COMEX

(LBMA

(LBMA )

)

- SLV

(LBMA

(LBMA )

)

- PSLV

~~~

China/SGE night session update:

Silver fell from ~$83 to ~$76 before recovering to ~$80 before rising above $86 in the morning hours. Below the surface there are huge movements of physical (a thread)

COMEX 1-30

1.2M ozt (37.6 tons) deposited in Brinks

1.4M ozt (43.5 tons) withdrawn from Asahi (541K), CNT (605K), JPM (212K) et al

862K ozt (26.8 tons) moved from [R] to [E] in Asahi (95K), Brinks (39K), CNT (268K), Delaware (79K), JPM (341K), MT&B (30K), StoneX (10K)

COMEX Commentary

Relatively light withdrawals Friday (crash/turmoil day). Given the deeply negative EFP spreads throughout the day yesterday, I'm guessing the withdrawals are going to accelerate.

EFP spread

With a current spot price of $86.78, EFP spreads*:

Feb26 = -$0.77 vs -$3.87 Yesterday

Mar26 = -$0.41 vs -$1.12

Apr26 = +$0.92 vs -$0.59

*all futures data was 10-15 minutes old

EFP Commentary

The half life on the CME margin hike suppressing futures vs spot looks to be about a day (again). Feb26 EFP spread is still negative, but narrowing.

China

SGE

SFE

SGE > SFE

SGE premium to LBMA spot ~$10

SFE

Yesterday's inflow looks like an anomaly

India

MMTC-PAMP (retail) : $99.99 (less 10% taxes = $89.99)

Feb26 [SILVERM 5kg] : $94.60 (less 7.2% taxes = ~$87.79)

Mar26 [SILVER 30kg] : $92.29

India markets slightly elevated over the West, but far below China presently

SLV Share Lending

8.8M Shares available

Borrow fee down from 0.70% to 0.67%

IB reporting a lot of activity with share borrowing now.

SLV Assets

Blackrock:

JPM:

In the previous 5 weeks, with a rising spot price, SLV was shed 28.5M ozt (886.6 tons). This silver almost surely raided by APs using borrowed shares (buying the shares would have driven up the price).

Yesterday, after Friday's slam to spot price, SLV recouped the drain of the last 5 weeks and more. Seems to me like the APs took advantage of the slam to buy silver from weak hands cheaply in order to pay back their borrowed SLV shares.

Note that the SLV drain (LBMA gain) concluded at the end of January. Very convenient for LBMA monthly vault stock report to look good with SLV silver that disappeared immediately on the first trading day of February (after the cut-off reporting date).

PSLV

First substantial drawdown in PSLV inventory I've seen since I started watching it closely in June 2025. Units/ozt ratio still sits at .3413. PSLV still needs to add 1.3M ozt (40.5 tons) to get back to the historical .3434 ratio. Is PSLV being raided now?

Big Picture

- Feb26 EFP spread firmly negative

- COMEX

- SLV

- PSLV

ICYMI:

~~~

China/SGE night session update:

Last week in silver (in metric tons):

SGE silver vault - 11.3

11.3

SFE silver vault - 126

126

SLV London vault - 566.6

566.6

PSLV silver vault - 0.03

0.03

COMEX silver stock - 296.9

296.9

LBMA silver stock - ??? (no daily or weekly data because LBMA is run by dinosaurs)

Global net change (less LBMA):

Jan 26-30 = 1,000.77

1,000.77

Jan 19-23 = 374.4

374.4

Jan 12-16 = 446.4

446.4

Jan 5-9 = 659.7

659.7

Dec 29-Jan 2 = 160.6

160.6

...

China's SGE reported another relatively low outflow for last week - about 1/10th of the weekly outflow for previous weeks. Is China receiving silver from the LBMA? Maybe...

SGE silver price premium to LBMA spot down from the extreme highs of last week (~$20), but still elevated (~$12). Falling premium would suggest that China is receiving at least some LBMA silver.

SGE silver price premium to LBMA spot down from the extreme highs of last week (~$20), but still elevated (~$12). Falling premium would suggest that China is receiving at least some LBMA silver.

SGE (spot) price is still > SFE (futures) price, but the difference has narrowed.

SGE (spot) price is still > SFE (futures) price, but the difference has narrowed.

PSLV was again very quiet last week. The "inflow" was likely just an accounting adjustment (when they actually weigh new bar inventory, it isn't exactly 1K ozt. They have been short ~41 tons to maintain their historical units/ozt ratio for over two week now. Are they having trouble sourcing London Good Delivery silver bars? Every 1K ozt they add is a London Good Delivery bar that becomes unavailable to the LBMA for clearing OTC market trades.

Last week marks the 4th week in a row for the COMEX to drain profusely (~300+ tons). The Feb26 EFP spread was firmly negative all week, so the COMEX draining was expected as bullion banks are likely shipping COMEX silver to London.

SLV vault stock got monkey hammered last week. See here for important context on the SLV story. SLV is the emergency relief valve for the LBMA - raided for its vault stock when the LBMA gets into a pinch. It appears there is significant raiding of vault stock at several silver ETFs that maintain vault stock at the LBMA.

One can only imagine what chaos might be unfolding in the LBMA's London vault system right now. We can only imagine because the dinosaurs at the LBMA do not provide daily/weekly reporting of their vault stock like every other market and major fund in the world.

SGE silver vault -

SFE silver vault -

SLV London vault -

PSLV silver vault -

COMEX silver stock -

LBMA silver stock - ??? (no daily or weekly data because LBMA is run by dinosaurs)

Global net change (less LBMA):

Jan 26-30 =

Jan 19-23 =

Jan 12-16 =

Jan 5-9 =

Dec 29-Jan 2 =

...

China's SGE reported another relatively low outflow for last week - about 1/10th of the weekly outflow for previous weeks. Is China receiving silver from the LBMA? Maybe...

PSLV was again very quiet last week. The "inflow" was likely just an accounting adjustment (when they actually weigh new bar inventory, it isn't exactly 1K ozt. They have been short ~41 tons to maintain their historical units/ozt ratio for over two week now. Are they having trouble sourcing London Good Delivery silver bars? Every 1K ozt they add is a London Good Delivery bar that becomes unavailable to the LBMA for clearing OTC market trades.

Last week marks the 4th week in a row for the COMEX to drain profusely (~300+ tons). The Feb26 EFP spread was firmly negative all week, so the COMEX draining was expected as bullion banks are likely shipping COMEX silver to London.

SLV vault stock got monkey hammered last week. See here for important context on the SLV story. SLV is the emergency relief valve for the LBMA - raided for its vault stock when the LBMA gets into a pinch. It appears there is significant raiding of vault stock at several silver ETFs that maintain vault stock at the LBMA.

One can only imagine what chaos might be unfolding in the LBMA's London vault system right now. We can only imagine because the dinosaurs at the LBMA do not provide daily/weekly reporting of their vault stock like every other market and major fund in the world.

From the chart (quoted below), India imported:

~70 metric tons from the UK (London/LBMA)

~80 metric tons from China (SGE/SFE)

~110 metric tons from Switzerland (could be recast metal from UK or China)

~110 metric tons from UAE and "Other" which could also be indirectly from UK, China and/or COMEX

Total import was on the order of ~370 metric tons - way down from Nov/Dec.

The SGE/SFE gained 219 metric tons in December. If China also exported ~80 metric tons to India, that means China was likely a net importer (presumably from London).

The vault flows for December break down like so:

COMEX drain = 193.5 tonnes (possibly sent to London)

SFE/SGE gain = 299 tonnes (possibly imported from London)

SLV/ETFs gain = 1068 tonnes (definitely drained from London)

India gain = 70 tonnes (definitely drained from London)

Even assuming 100% of COMEX drain went to London and 100% of SFE/SGE gain did not come from London in December (which is not reasonable), the LBMA should have reported a drain of 944.5 tonnes instead of a gain of 631 tonnes. The LBMA's December report appears to have overstated their silver vault stock by at least 1,575.5 tonnes.

X = A - B + (C * D) - E - F

X = LBMA free float vault stock (end of January)

A = (27,818 Official | 24,994.5 Realistic*) LBMA vault stock (end of December)

B = (20,957 + 1,023**) ETF vault stock

C = (1,370.91) COMEX withdrawn for January

D = An estimated percentage of COMEX withdrawn that was shipped to London

E = Export to China (SGE/SFE) in January

F = Export to India in January

*Realistic

25,939 November realistic estimate - 944.5 drainCOMEX

It is unreasonable to assume that 100% of the COMEX withdrawals across the entire month were shipped to London. I think 90% for a high side conservative estimate would be reasonable. Plugging 90% in for "D" yields 1,234 metric tons.

**ETFs

SLV added 1,023 tons on Feb 2. That's 1,023 tons that end of January ETF totals won't count, but really were not LBMA free float IMO as it likely represents repayment of shares borrowed throughout January.

China

SFE silver vault drained 236 metric tons in January. SGE silver vault drained 280 metric tons in January. I think it fair to estimate that China did not export silver to London. Given the persistent SGE premium to LBMA spot, China is likely to have received silver from London. It is really difficult to estimate how much silver China may have imported from London. Let's be conservative and estimate that the LBMA exported nothing to China in January (E=0).

India

India reportedly (per Metals Focus) imported :

~480 metric tons from the UK (~1,600 tons total all sources) in October

~390 metric tons from the UK (~750 tons total all source) in November

~70 metric tons from the UK (~370 tons total all source) in December

Given that Indian silver markets have tracked China through January (at a premium to the West), it seems safe to estimate that likely did not receive much silver from the LBMA (maybe 20-30 tons is realistic?). Let's be conservative and estimate that the LBMA exported nothing to India in January (F=0).

LBMA

The following conservative estimates are upper bound base cases for LBMA vault stock assuming the LBMA exported nothing to China and India. They are likely overshooting as the LBMA probably did export at least some silver to China and/or India, but we have no idea how much yet. You can fiddle with the variables to suit your own ideas:

Feb 6 LBMA silver vault stock report will likely reflect:

Vault stock = 27,818 + (1,370.91 * 0.90) - 0 - 0 = 29,052 tons

My realistic free float estimate:

Free float = 24,994.5 - 21,980 + (1,370.91 * 0.90) - 0 - 0 = 4,248.5 (versus 3,554 tons last month)

4,248.5 metric tons is ~136.6M ozt. The LBMA ran into trouble in October when their free float was in the range of 110M ozt. As silver lease rates have been falling recently, it makes sense that the LBMA free float has some cushion at the moment.

If you want to see how ridiculous the LBMA report is on Friday, compare their report to:

29,052 tons (estimated based upon their already ridiculous report from last month)

27,173 tons (estimated using last month's realistic estimate [with import/export data])

We'll see what they say on Friday!

Final thought

I'm estimating the LBMA's *liquid* free float (136.6M ozt total FF - 110M ozt illiquid FF) for silver to be in the neighborhood of 26.6M ozt. At at spot price of $100, that's only ~$2.7B.

I don't think they even hide SLV ownership. They know and I think even count it as their OWN silver. So SLV silver IS LBMA Silver.

Yesterday (2-3) in silver

Silver fell from ~$86 to ~$85 during the day and has risen to $90 this morning. Below the surface, currents are swirling (a thread)

14K ozt (0.4 ton) deposited in CNT

1.8M ozt (57.7 tons) withdrawn from HSBC (399K), JPM (1.2M), StoneX (120K) et al

271K ozt (8.4 tons) moved from [E] to [R] in MT&B

1.2M ozt (37.9 tons) moved from [R] to [E] in Brinks (1.1M), CNT (111K)

Withdrawals almost back to 2M+/day on Monday. I actually was expecting more than that given the deeply negative Feb26 EFP spread throughout the day Monday. The COMEX->LBMA garden hose continues to flow.

Current spot price: $90.52

Feb26* = -$1.00 vs -$0.77 Yesterday

Mar26 = -$0.60 vs -$0.41

Apr26 = -$0.22 vs +$0.92

*futures data was 4+ hours old

All EFP spreads appear to have drifted a bit more negative this morning. The faucet for the COMEX->LBMA garden hose remains wide open.

China

SGE $105.59 (no VAT)

$105.59 (no VAT)

SFE $105.37

$105.37

SGE > SFE (barely!)

SGE premium to LBMA spot ~$15

SFE 849K ozt (26.4 tonnes)

849K ozt (26.4 tonnes)

Vaults premium

premium =LBMA non-delivery?

=LBMA non-delivery?

India

MMTC-PAMP (retail) : $105.75 (less 10% taxes = $95.18)

Feb26 [SILVERM 5kg] : $101.35 (less 7.2% taxes = ~$94.06)

Mar26 [SILVER 30kg] : $98.30

China >> India > LBMA/COMEX

10M Shares available

Borrow fee down from 0.67% to 0.48%

As expected with the influx of new shares yesterday, there are plenty of shares available to plunder and the borrow fee dropped a bit.

Blackrock: 3.6M shares

3.6M shares

JPM: 3.2M ozt (101.5 tons)

3.2M ozt (101.5 tons)

SLV sheds 10% of yesterday's historic inflow. The raiding continues.

1,183,374 units

1,183,374 units

200K ozt (6.2 tons)

200K ozt (6.2 tons)

Units/ozt ratio .3410

PSLV needs 1.5M ozt (46.8 tons) to get back to the historical .3434 ratio.

SGE ($105.59)

SGE ($105.59)

SFE ($105.37)

SFE ($105.37)

Retail ($95.18)

Retail ($95.18)

MCX ($94.06)

MCX ($94.06)

spot ($90.52)

spot ($90.52)

COMEX Feb26 ($89.52)

COMEX Feb26 ($89.52)

- Feb26 EFP spread firmly negative

- COMEX

(LBMA

(LBMA )

)

- SLV

(LBMA

(LBMA )

)

- PSLV

Silver fell from ~$86 to ~$85 during the day and has risen to $90 this morning. Below the surface, currents are swirling (a thread)

COMEX 2-2

14K ozt (0.4 ton) deposited in CNT

1.8M ozt (57.7 tons) withdrawn from HSBC (399K), JPM (1.2M), StoneX (120K) et al

271K ozt (8.4 tons) moved from [E] to [R] in MT&B

1.2M ozt (37.9 tons) moved from [R] to [E] in Brinks (1.1M), CNT (111K)

COMEX Commentary

Withdrawals almost back to 2M+/day on Monday. I actually was expecting more than that given the deeply negative Feb26 EFP spread throughout the day Monday. The COMEX->LBMA garden hose continues to flow.

EFP spreads

Current spot price: $90.52

Feb26* = -$1.00 vs -$0.77 Yesterday

Mar26 = -$0.60 vs -$0.41

Apr26 = -$0.22 vs +$0.92

*futures data was 4+ hours old

EFP Commentary

All EFP spreads appear to have drifted a bit more negative this morning. The faucet for the COMEX->LBMA garden hose remains wide open.

China

SGE

SFE

SGE > SFE (barely!)

SGE premium to LBMA spot ~$15

SFE

Vaults

India

MMTC-PAMP (retail) : $105.75 (less 10% taxes = $95.18)

Feb26 [SILVERM 5kg] : $101.35 (less 7.2% taxes = ~$94.06)

Mar26 [SILVER 30kg] : $98.30

China >> India > LBMA/COMEX

SLV Share Lending

10M Shares available

Borrow fee down from 0.67% to 0.48%

As expected with the influx of new shares yesterday, there are plenty of shares available to plunder and the borrow fee dropped a bit.

SLV Assets

Blackrock:

JPM:

SLV sheds 10% of yesterday's historic inflow. The raiding continues.

PSLV

Units/ozt ratio .3410

PSLV needs 1.5M ozt (46.8 tons) to get back to the historical .3434 ratio.

Big Picture

- Feb26 EFP spread firmly negative

- COMEX

- SLV

- PSLV

ICYMI:

Update: LBMA realistic vault stock estimate

When I calculated the "realistic" LBMA vault stock for December, I had estimated the LBMA would export 300 tons of silver to India. We now know they only exported ~70 tons. I forgot to update my December estimate when calculating a January estimate yesterday. So, a small adjustment is in order:

Realistic Dec25 LBMA vault stock

25,939 + 230 = 26,169

Realistic Jan26 LBMA vault stock

26,228.5 + 230 = 26,458.5

When I calculated the "realistic" LBMA vault stock for December, I had estimated the LBMA would export 300 tons of silver to India. We now know they only exported ~70 tons. I forgot to update my December estimate when calculating a January estimate yesterday. So, a small adjustment is in order:

Realistic Dec25 LBMA vault stock

25,939 + 230 = 26,169

Realistic Jan26 LBMA vault stock

26,228.5 + 230 = 26,458.5

Yesterday (2-4) in silver

Silver fell from ~$92 to ~$85 during the day, rose back to $90 in the evening and crashed to ~$75 during the night. Below the surface, currents continue swirling (a thread)

Zero deposited

3M ozt (95.4 tons) withdrawn from Asahi (1.9M), HSBC (902K), JPM (282K)

2.5M ozt (79.3 tons) moved from [E] to [R] in Loomis

1.5M ozt (48.6 tons) moved from [R] to [E] in Asahi (610K), Brinks (632K), JPM (318K)

Unusually large movement of silver to Registered [R] in the Loomis vault Tuesday. Withdrawals accelerating again as expected with deeply negative Feb26 EFP spread. The COMEX LBMA garden hose continues to flow.

LBMA garden hose continues to flow.

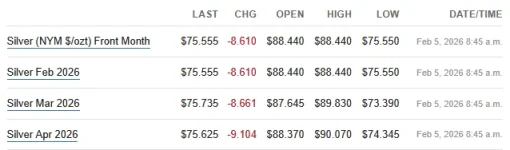

Current spot price: $76.47

Feb26 = -$0.91 vs -$1.00 Yesterday

Mar26 = -$0.73 vs -$0.60

Apr26 = -$0.84 vs -$0.22

All EFP spreads firmly negative this morning. Mar26 and Apr26 are backwardated. The faucet for the COMEX->LBMA garden hose remains wide open.

China

SGE $88.88 (no VAT)

$88.88 (no VAT)

SFE $90.78

$90.78

SFE > SGE (finally!)

SGE premium to LBMA spot ~$12.41

SFE 346K ozt (10.8 tonnes)

346K ozt (10.8 tonnes)

Why did SGE price crash? Very strange!

India

MMTC-PAMP (retail) : $89.95 (less 10% taxes = $80.96)

Feb26 [SILVERM 5kg] : $85.68 (less 7.2% taxes = ~$79.51)

Mar26 [SILVER 30kg] : $82.52

China >> India > LBMA/COMEX

10M Shares available

Borrow fee down from 0.48% to 0.44%

While available shares are plentiful and the borrow fee is low, borrowing activity remains high.

Blackrock: 2.4M shares

2.4M shares

JPM: 2.4M ozt (75 tons)

2.4M ozt (75 tons)

Shares and ozt drained at a 1:1 ratio - that is highly unusual.

No change to units

No change to ozt

Units/ozt ratio .3410

PSLV needs 1.5M ozt (46.8 tons) to get back to the historical .3434 ratio.

Big

SGE ($88.88)

SGE ($88.88)

SFE ($90.78)

SFE ($90.78)

Retail ($80.96)

Retail ($80.96)

MCX ($79.51)

MCX ($79.51)

spot ($76.47)

spot ($76.47)

COMEX Feb26 ($75.56)

COMEX Feb26 ($75.56)

- Feb26 EFP spread firmly negative

- COMEX

(LBMA

(LBMA )

)

- SLV

(LBMA

(LBMA )

)

- PSLV needs 1.5M ozt

Silver fell from ~$92 to ~$85 during the day, rose back to $90 in the evening and crashed to ~$75 during the night. Below the surface, currents continue swirling (a thread)

COMEX 2-3

Zero deposited

3M ozt (95.4 tons) withdrawn from Asahi (1.9M), HSBC (902K), JPM (282K)

2.5M ozt (79.3 tons) moved from [E] to [R] in Loomis

1.5M ozt (48.6 tons) moved from [R] to [E] in Asahi (610K), Brinks (632K), JPM (318K)

COMEX Commentary

Unusually large movement of silver to Registered [R] in the Loomis vault Tuesday. Withdrawals accelerating again as expected with deeply negative Feb26 EFP spread. The COMEX

EFP spreads

Current spot price: $76.47

Feb26 = -$0.91 vs -$1.00 Yesterday

Mar26 = -$0.73 vs -$0.60

Apr26 = -$0.84 vs -$0.22

EFP Commentary

All EFP spreads firmly negative this morning. Mar26 and Apr26 are backwardated. The faucet for the COMEX->LBMA garden hose remains wide open.

China

SGE

SFE

SFE > SGE (finally!)

SGE premium to LBMA spot ~$12.41

SFE

Why did SGE price crash? Very strange!

India

MMTC-PAMP (retail) : $89.95 (less 10% taxes = $80.96)

Feb26 [SILVERM 5kg] : $85.68 (less 7.2% taxes = ~$79.51)

Mar26 [SILVER 30kg] : $82.52

China >> India > LBMA/COMEX

SLV Share Lending

10M Shares available

Borrow fee down from 0.48% to 0.44%

While available shares are plentiful and the borrow fee is low, borrowing activity remains high.

SLV Assets

Blackrock:

JPM:

Shares and ozt drained at a 1:1 ratio - that is highly unusual.

PSLV

No change to units

No change to ozt

Units/ozt ratio .3410

PSLV needs 1.5M ozt (46.8 tons) to get back to the historical .3434 ratio.

Big

- Feb26 EFP spread firmly negative

- COMEX

- SLV

- PSLV needs 1.5M ozt

ICYMI:

One small suggestion. For the Comex section where you have the total ounces delivered could you add a quick total for their Inventory?

What do you mean - list the total stock per vault like:

Asahi 30.7M ozt

Brinks 57M ozt

...

Or broken down by Registered [R] and Eligible [E]?

Asahi 25.4M [R], 5.2M [E]

Brinks 18.6M [R], 38.3M [E]

...

It wouldn't fit in the visible character limit for an X post. I could include for posts here once in while, but that's a lot of extra typing/work!

Asahi 30.7M ozt

Brinks 57M ozt

...

Or broken down by Registered [R] and Eligible [E]?

Asahi 25.4M [R], 5.2M [E]

Brinks 18.6M [R], 38.3M [E]

...

It wouldn't fit in the visible character limit for an X post. I could include for posts here once in while, but that's a lot of extra typing/work!

I was just thinking how much total does the Comex have that day? I assumed you were getting that data from the Silver_stocks report. The individual vaults don't matter that much but perhaps the totals. IE for yesterday it is ~104 Moz Registerd, and 297 Moz Eligible. Or 400 Moz Total.

So we know that 3 Moz was withdrawn to drop the total left in Comex to 400 Moz.

So we know that 3 Moz was withdrawn to drop the total left in Comex to 400 Moz.

Yesterday (2-5) in silver

Silver tread water around $75 during the day, crashed $65 in the evening and recovered to ~$75 during the night. Below the surface, big currents moving now (a thread)

moving now (a thread)

1mo now 6.1%. Was less than 1% three days ago.

20K ozt (0.6t) deposited in StoneX [R]

2.8M ozt (87.1t) withdrawn from Asahi (1.3M), CNT (601K), MT&B (907K)

547K ozt (17t) moved from [R] to [E] in various vaults

Remaining Vault Stock = 398M ozt (103M [R], 294M [E])

Withdraw rate last 12 days = 2.69M

@ 60% [R], run rate = 103M / 1.614M = ~64 days

Withdrawals remain strong as expected with deeply negative Feb26 EFP spread. The COMEX LBMA garden hose continues to flow (for at least 3 more months *at this rate*). Mar26 is a delivery month. It's going to get very interesting.

LBMA garden hose continues to flow (for at least 3 more months *at this rate*). Mar26 is a delivery month. It's going to get very interesting.

Current spot price: $75.52

Feb26* = -$3.26 vs -$0.91 Yesterday

Mar26 = -$0.18 vs -$0.73

Apr26 = +$0.34 vs -$0.84

* data is 5 hours old

Mar26 and Apr26 are in contango again and EFP spreads for both shifted positive. Fresh data for Feb26 isn't available as I look this morning, but given Mar & Apr, I would guess it remains negative but also narrowed.

China

SGE $81.51 (no VAT)

$81.51 (no VAT)

SFE $84.25

$84.25

SGE premium to LBMA spot ~$6

SFE 2M ozt (62.5t)

2M ozt (62.5t)

India

MMTC-PAMP (retail) : $90.68 (less 10% taxes = $81.61)

Feb26 [SILVERM 5kg] : $86.63 (less 7.2% taxes = ~$80.40)

Mar26 [SILVER 30kg] : $84.17

China ~ India > LBMA/COMEX

7.5M Shares available

Borrow fee remains 0.44%

Available shares still plentiful, borrowing activity remains high.

Blackrock: 4.35M shares

4.35M shares

JPM: 3.9M ozt (122.6t)

3.9M ozt (122.6t)

SLV vault stock drain accelerating....

No change to units

200K ozt (6.2t)

200K ozt (6.2t)

Units/ozt ratio .3413

PSLV needs 1.3M ozt (40.7t) to get back to the historical .3434 ratio.

Big

SFE ($84.25)

SFE ($84.25)

Retail ($81.61)

Retail ($81.61)

SGE ($81.51)

SGE ($81.51)

MCX ($80.40)

MCX ($80.40)

spot ($75.52)

spot ($75.52)

COMEX Mar26 ($75.34)

COMEX Mar26 ($75.34)

- 1mo lease rate 6.1%

- Feb26 EFP spread firmly negative

- COMEX

(LBMA

(LBMA )

)

- SLV

(LBMA

(LBMA )

)

- PSLV needs 1.3M ozt

Silver tread water around $75 during the day, crashed $65 in the evening and recovered to ~$75 during the night. Below the surface, big currents

Lease Rate

1mo now 6.1%. Was less than 1% three days ago.

COMEX 2-4

20K ozt (0.6t) deposited in StoneX [R]

2.8M ozt (87.1t) withdrawn from Asahi (1.3M), CNT (601K), MT&B (907K)

547K ozt (17t) moved from [R] to [E] in various vaults

COMEX Run Rate

Remaining Vault Stock = 398M ozt (103M [R], 294M [E])

Withdraw rate last 12 days = 2.69M

@ 60% [R], run rate = 103M / 1.614M = ~64 days

COMEX Commentary

Withdrawals remain strong as expected with deeply negative Feb26 EFP spread. The COMEX

EFP spreads

Current spot price: $75.52

Feb26* = -$3.26 vs -$0.91 Yesterday

Mar26 = -$0.18 vs -$0.73

Apr26 = +$0.34 vs -$0.84

* data is 5 hours old

EFP Commentary

Mar26 and Apr26 are in contango again and EFP spreads for both shifted positive. Fresh data for Feb26 isn't available as I look this morning, but given Mar & Apr, I would guess it remains negative but also narrowed.

China

SGE

SFE

SGE premium to LBMA spot ~$6

SFE

India

MMTC-PAMP (retail) : $90.68 (less 10% taxes = $81.61)

Feb26 [SILVERM 5kg] : $86.63 (less 7.2% taxes = ~$80.40)

Mar26 [SILVER 30kg] : $84.17

China ~ India > LBMA/COMEX

SLV Share Lending

7.5M Shares available

Borrow fee remains 0.44%

Available shares still plentiful, borrowing activity remains high.

SLV Assets

Blackrock:

JPM:

SLV vault stock drain accelerating....

PSLV

No change to units

Units/ozt ratio .3413

PSLV needs 1.3M ozt (40.7t) to get back to the historical .3434 ratio.

Big

- 1mo lease rate 6.1%

- Feb26 EFP spread firmly negative

- COMEX

- SLV

- PSLV needs 1.3M ozt

ICYMI:

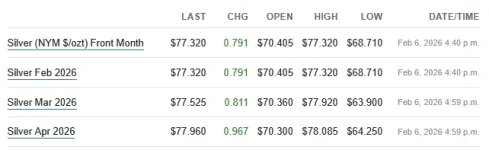

Yesterday (2-6) in silver

Silver drifted up to ~$77. Below the surface, vault stock keeps bleeding (a thread)

601K ozt (18.7t) deposited in Brinks

4.1M ozt (127.5t) withdrawn from Asahi (1.2M), CNT (772K), HSBC (452K), MT&B (1.5M), StoneX (122K)

984K ozt (30.6t) moved from [R] to [E] in Asahi (458K), CNT (383K), StoneX (141K)

Remaining Vault Stock = 394.5M ozt (102.5M [R], 292M [E])

Withdraw rate last 13 days = 2.8M

@ 60% [R], run rate = 102.5M / 1.68M = ~61 (working) days (~3 months)

Withdrawals remain strong as expected with deeply negative Feb26 EFP spread. CME hiked margins for the silver contract again, so it looks like he Feb26 EFP spread is going to stay firmly negative for a while longer.

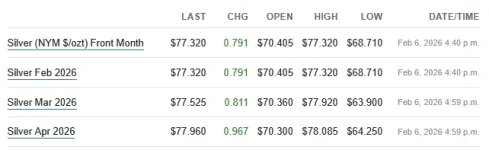

Current spot price: $77.73

Feb26 = -$0.41 vs -$3.26 Yesterday

Mar26 = -$0.20 vs -$0.18

Apr26 = +$0.23 vs +$0.34

I'm honestly surprised the EFP spreads are not more negative given the CME margin hike. Are the margin hikes losing their effectiveness at tamping down the futures?

10M Shares available

Borrow fee rose from.44% to 0.60% before settling at 0.54%

Available shares still plentiful, borrowing activity remains high.

Blackrock: 2M shares

2M shares

JPM: 1.8M ozt (56.4t)

1.8M ozt (56.4t)

SLV vault stock continues bleeding

No change to units

1.4K ozt (likely just an adjustment)

1.4K ozt (likely just an adjustment)

Units/ozt ratio .3413

PSLV needs 1.3M ozt (40.7t) to get back to the historical .3434 ratio.

Silver drifted up to ~$77. Below the surface, vault stock keeps bleeding (a thread)

COMEX 2-5

601K ozt (18.7t) deposited in Brinks

4.1M ozt (127.5t) withdrawn from Asahi (1.2M), CNT (772K), HSBC (452K), MT&B (1.5M), StoneX (122K)

984K ozt (30.6t) moved from [R] to [E] in Asahi (458K), CNT (383K), StoneX (141K)

COMEX Run Rate

Remaining Vault Stock = 394.5M ozt (102.5M [R], 292M [E])

Withdraw rate last 13 days = 2.8M

@ 60% [R], run rate = 102.5M / 1.68M = ~61 (working) days (~3 months)

COMEX Commentary

Withdrawals remain strong as expected with deeply negative Feb26 EFP spread. CME hiked margins for the silver contract again, so it looks like he Feb26 EFP spread is going to stay firmly negative for a while longer.

EFP spreads

Current spot price: $77.73

Feb26 = -$0.41 vs -$3.26 Yesterday

Mar26 = -$0.20 vs -$0.18

Apr26 = +$0.23 vs +$0.34

EFP Commentary

I'm honestly surprised the EFP spreads are not more negative given the CME margin hike. Are the margin hikes losing their effectiveness at tamping down the futures?

SLV Share Lending

10M Shares available

Borrow fee rose from.44% to 0.60% before settling at 0.54%

Available shares still plentiful, borrowing activity remains high.

SLV Assets

Blackrock:

JPM:

SLV vault stock continues bleeding

PSLV

No change to units

Units/ozt ratio .3413

PSLV needs 1.3M ozt (40.7t) to get back to the historical .3434 ratio.

Update (all values in metric tons) (see post #410 for last month):

This month I have updated the chart with a few new records. The SLV ETF drained/bled vault stock (26.6M ozt - 827t) across the entire month of January and then added 32.9M ozt (1,023t) back on the first business day of February. While that has zero effect on the total LBMA vault stock, it has a major impact on free float calculations, so I've included both end of January and Feb 2 numbers for comparison.

Additionally, after several months of double checking LBMA vault stock reports against other public data (COMEX drain, UK->China/India import/export data), it has become clear that the LBMA has overstated their vault stock for the last few months, much like they did back in 2021. Therefore, I have included my upper bound estimates for what the LBMA vault stock is more likely to be in reality.

By my estimate, the LBMA overstated December's vault stock by at least 1,649t. They appear to have improved slightly with the January report as I'm calculating that they have overstated it by a lower bound of only 1,270t.

Let's revisit my simple formula:

X = A + (C * D) - E - F

X = LBMA vault stock (current)

A = LBMA vault stock (previous)

C = COMEX withdrawn

D = An estimated percentage of COMEX withdrawn that was shipped to London

E = Export to China (SGE/SFE)

F = Export to India

I wrote previously:

"Feb 6 LBMA silver vault stock report will likely reflect:

Vault stock = 27,818 + (1,370.91 * 0.90) - 0 - 0 = 29,052 tons"

There was ample room for the LBMA to have reported an increase in total vault stock as I expect exports to China and India in January were likely very low given the indirect evidence we currently have available. They actually reported a very slight decrease though. Logically then, at least one of these things must be true:

LBMA realized they overstated the vault stock in previous months and made an adjustment to this month's report without acknowledging it

LBMA realized they overstated the vault stock in previous months and made an adjustment to this month's report without acknowledging it

LBMA received much less of the 1,370t of silver drained from the COMEX than estimated

LBMA received much less of the 1,370t of silver drained from the COMEX than estimated

LBMA exported more silver to China than estimated

LBMA exported more silver to China than estimated

LBMA exported more silver to India than estimated

LBMA exported more silver to India than estimated

LBMA just made up a number to report and it has no basis in reality

LBMA just made up a number to report and it has no basis in reality

If we give the LBMA the benefit of the doubt and assume that the first and last points are not true, then we can speculate on the other points. Essentially, the LBMA is telling us that they exported slightly more silver in January than they received from the COMEX. Given that:

there was a persistent and growing SGE (China) premium to LBMA spot across January, and

there was a persistent and growing SGE (China) premium to LBMA spot across January, and

the SGE + SFE drained 516t across January

the SGE + SFE drained 516t across January

It seems unlikely that the LBMA actually exported a significant amount to China in January.

Similarly, given that:

the Indian silver market tracked closely to China throughout January - maintaining a high premium to LBMA spot and COMEX futures

the Indian silver market tracked closely to China throughout January - maintaining a high premium to LBMA spot and COMEX futures

India's silver imports from the UK in December were only ~70t in December

India's silver imports from the UK in December were only ~70t in December

It seems unlikely that the LBMA exported a significant amount to India in January

Are we to believe that very little to none of the 1,370t of silver withdrawn from the COMEX in January was shipped to London? It's quite the puzzle and I look forward to eventually seeing the China/India/UK/USA import/export data to try and make some sense of it.

As we consider the above, there is another data point that adds color to the puzzle. Lease rates for silver were elevated (~8%) through most of January, fell to sub 1% right at the end of January and have now spiked back to ~6% again just within the last day or two. There could be several ways to interpret this activity, but I think it is likely that the LBMA member bullion banks were hoarding the majority of silver they could scrimp from the COMEX and raiding SLV throughout January and finally released the chokehold as January ended - paying back SLV on Feb 2 and likely deliveries (in earnest?) to China and India (as evidenced by falling SGE/SFE/MCX premiums). The LBMA's supposed free float at the end of January is a mirage that will be exposed much like a desert oasis that disappears as you approach it.

As a reminder, back in October, the LBMA broke down when it had somewhere in the neighborhood of 110M ozt (3,421t) of supposed free float per rough estimates given the available data. The LBMA's actual liquid free float is likely just a thin margin over the illiquid threshold.

Realistically (using my estimate and not the LBMA's impossible, overstated vault stock report), the West has an upper bound of 14,282 metric tons of free float vaulted at the LBMA + COMEX (not owned by ETFs). That's a decrease of 469 metric tons (15M ozt) from last month (again, using my estimate).

The realistic (using my LBMA estimate) upper bound total global free float (TGFF) including China (SFE/SGE) is 15,231t (a decrease of ~985t). That's a ~6% drop in one month.

A while back, I estimated that ~$36B was enough to wipe out TGFF. Today I estimate:

LBMA + COMEX only (if China enforces export controls)

14,282t = 459,177,000 ozt x $90/ozt = $41.3B

TGFF (including China)

15,231t = 489,688,000 ozt x $90/ozt = $44B

PSLV's silver vault stock is not directly available for settling COMEX or LBMA deliveries, so it is not included in the TGFF - I mention it because every 1,000 ozt that PSLV acquires is an LGD silver bar that is no longer available to the LBMA or global free float for trade settlement.

I am now tracking the global vault stock changes every day/week for the COMEX, SFE/SGE, SLV and PSLV. Of course, there is no daily or weekly data for the LBMA because they are run by dinosaurs. The LBMA apparently thinks their monthly grand total report provides sufficient transparency to their operations as they say:

I frequently receive comments asking why I bother compiling this data. The comments commonly claim that the numbers are a fraud or they don't matter. Whether or not the numbers are completely accurate or not, they are the only public data we have and they *are* telling a story - revealing the rip currents of physical demand underneath the frothy paper market trading.

Sources:

LBMA: https://www.lbma.org.uk/prices-and-data/london-vault-data

LBMA ETFs:

PMbug's LBMA Estimates:

COMEX: I am saving COMEX silver stock reports and tracking the totals in a spreadsheet now.

SGE/SFE: I am saving SFE/SGE vault totals from Xiaojun Bai's daily X tweets and tracking them in a spreadsheet now.

PSLV: I am saving Sprott's PSLV silver stock data and tracking the totals in a spreadsheet now.

Global Vault Stock (in tons) - January 2026

Market | This month | Last month | Difference |

|---|---|---|---|

| LBMA (Total) | 27,729 | 27,818 | -89 |

| ETFs (LBMA vaults) | 20,957 | 22,385 | -1,428 |

| LBMA Free Float (LBMA-ETFs) | 6,772 | 5,433 | 1,339 |

| ETFs - Feb 2 | 21,866 | 22,385 | -519 |

| LBMA Free Float - Feb 2 | 5,863 | 5,433 | 430 |

| PMBug Estimate LBMA Total | 26,459 | 26,169 | 290 |

| PMBug Estimate LBMA Free Float (Feb 2) | 4,593 | 3,784 | 809 |

| COMEX | 12,618.61 | 13,989.52 | -1,370.91 |

| SLV NYC Vault | 2,928.99 | 3,022.36 | -93.37 |

| COMEX-SLV (free float) | 9,689.62 | 10,967.16 | -1,277.54 |

| SFE/SGE | 948.733 | 1,465.263 | -516.530 |

| PSLV | 6,770.314 | 6,553.692 | 215.622 |

Special Note

This month I have updated the chart with a few new records. The SLV ETF drained/bled vault stock (26.6M ozt - 827t) across the entire month of January and then added 32.9M ozt (1,023t) back on the first business day of February. While that has zero effect on the total LBMA vault stock, it has a major impact on free float calculations, so I've included both end of January and Feb 2 numbers for comparison.

Additionally, after several months of double checking LBMA vault stock reports against other public data (COMEX drain, UK->China/India import/export data), it has become clear that the LBMA has overstated their vault stock for the last few months, much like they did back in 2021. Therefore, I have included my upper bound estimates for what the LBMA vault stock is more likely to be in reality.

LBMA Analysis

By my estimate, the LBMA overstated December's vault stock by at least 1,649t. They appear to have improved slightly with the January report as I'm calculating that they have overstated it by a lower bound of only 1,270t.

Let's revisit my simple formula:

X = A + (C * D) - E - F

X = LBMA vault stock (current)

A = LBMA vault stock (previous)

C = COMEX withdrawn

D = An estimated percentage of COMEX withdrawn that was shipped to London

E = Export to China (SGE/SFE)

F = Export to India

I wrote previously:

"Feb 6 LBMA silver vault stock report will likely reflect:

Vault stock = 27,818 + (1,370.91 * 0.90) - 0 - 0 = 29,052 tons"

There was ample room for the LBMA to have reported an increase in total vault stock as I expect exports to China and India in January were likely very low given the indirect evidence we currently have available. They actually reported a very slight decrease though. Logically then, at least one of these things must be true:

If we give the LBMA the benefit of the doubt and assume that the first and last points are not true, then we can speculate on the other points. Essentially, the LBMA is telling us that they exported slightly more silver in January than they received from the COMEX. Given that:

It seems unlikely that the LBMA actually exported a significant amount to China in January.

Similarly, given that:

It seems unlikely that the LBMA exported a significant amount to India in January

Are we to believe that very little to none of the 1,370t of silver withdrawn from the COMEX in January was shipped to London? It's quite the puzzle and I look forward to eventually seeing the China/India/UK/USA import/export data to try and make some sense of it.

As we consider the above, there is another data point that adds color to the puzzle. Lease rates for silver were elevated (~8%) through most of January, fell to sub 1% right at the end of January and have now spiked back to ~6% again just within the last day or two. There could be several ways to interpret this activity, but I think it is likely that the LBMA member bullion banks were hoarding the majority of silver they could scrimp from the COMEX and raiding SLV throughout January and finally released the chokehold as January ended - paying back SLV on Feb 2 and likely deliveries (in earnest?) to China and India (as evidenced by falling SGE/SFE/MCX premiums). The LBMA's supposed free float at the end of January is a mirage that will be exposed much like a desert oasis that disappears as you approach it.

As a reminder, back in October, the LBMA broke down when it had somewhere in the neighborhood of 110M ozt (3,421t) of supposed free float per rough estimates given the available data. The LBMA's actual liquid free float is likely just a thin margin over the illiquid threshold.

Global Free Float Observations

Realistically (using my estimate and not the LBMA's impossible, overstated vault stock report), the West has an upper bound of 14,282 metric tons of free float vaulted at the LBMA + COMEX (not owned by ETFs). That's a decrease of 469 metric tons (15M ozt) from last month (again, using my estimate).

The realistic (using my LBMA estimate) upper bound total global free float (TGFF) including China (SFE/SGE) is 15,231t (a decrease of ~985t). That's a ~6% drop in one month.

A while back, I estimated that ~$36B was enough to wipe out TGFF. Today I estimate:

LBMA + COMEX only (if China enforces export controls)

14,282t = 459,177,000 ozt x $90/ozt = $41.3B

TGFF (including China)

15,231t = 489,688,000 ozt x $90/ozt = $44B

Final Comments

PSLV's silver vault stock is not directly available for settling COMEX or LBMA deliveries, so it is not included in the TGFF - I mention it because every 1,000 ozt that PSLV acquires is an LGD silver bar that is no longer available to the LBMA or global free float for trade settlement.

I am now tracking the global vault stock changes every day/week for the COMEX, SFE/SGE, SLV and PSLV. Of course, there is no daily or weekly data for the LBMA because they are run by dinosaurs. The LBMA apparently thinks their monthly grand total report provides sufficient transparency to their operations as they say:

LBMA said:These figures provide an important insight into London's ability to underpin the physical OTC market.

I frequently receive comments asking why I bother compiling this data. The comments commonly claim that the numbers are a fraud or they don't matter. Whether or not the numbers are completely accurate or not, they are the only public data we have and they *are* telling a story - revealing the rip currents of physical demand underneath the frothy paper market trading.

Sources:

LBMA: https://www.lbma.org.uk/prices-and-data/london-vault-data

LBMA ETFs:

PMbug's LBMA Estimates:

COMEX: I am saving COMEX silver stock reports and tracking the totals in a spreadsheet now.

SGE/SFE: I am saving SFE/SGE vault totals from Xiaojun Bai's daily X tweets and tracking them in a spreadsheet now.

PSLV: I am saving Sprott's PSLV silver stock data and tracking the totals in a spreadsheet now.

Last edited:

This post may contain affiliate links for which PM Bug gold and silver discussion forum may be compensated.

Two numbers stood out like a sore thumb to me. First PSLV has become VERY important having double the silver of SLV... No wonder they are trying to short the crud out of it and have it "under perform".

Second, this crisis has and will center around China and the SGE/SFE. Selling 1/3 of the silver in a month and they will not last long.

Second, this crisis has and will center around China and the SGE/SFE. Selling 1/3 of the silver in a month and they will not last long.

... PSLV ... having double the silver of SLV...

I only listed the NYC vault total for SLV to subtract from COMEX. SLV also owned 12,594.39t of the 20,957t in the "ETFs (LBMA vaults)" at the end of January.

The problem for the bullion banks is that any silver PSLV acquires is vaulted in Canada and redemptions are once a month. It's essentially impractical for bullion banks to use it as a physical silver slush fund they way they use SLV. Any silver PSLV acquires is lost to the paper game.

Certainly, and I wouldn't recommend SLV to anyone except those wanting to trade options.

- Messages

- 560

- Reaction score

- 819

- Points

- 268

Silver is a long game, no a trader's paradise.

www.cnbc.com

www.cnbc.com

Gold bulls hold firm after historic metals sell-off — but silver could be in for a bumpier ride

Gold bulls hold firm after historic metals sell-off — but silver could be in for a bumpier ride

Gold and silver are showing tentative signs of recovery after an intense sell-off. Here's where investment banks see the metals going.