The manipulations to the paper silver market should be coming to an end shortly. CME margin raise yesterday didn't make a dent in the EFP spreads yesterday. Maybe they take effect Monday - we'll see. The short interest manipulations in China on the SFE were flagged and halted by the exchange (regulators). Meanwhile, lease rates are rising again in London signalling inventory is tight again. The physical market is about to impose it's will on the paper markets. $.02

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Silver Demand Drivers (and vault totals)

- Thread starter pmbug

- Start date

- Featured

-

- Tags

- physical demand

Welcome to the Precious Metals Bug Forums

Welcome to the PMBug forums - a watering hole for folks interested in gold, silver, precious metals, sound money, investing, market and economic news, central bank monetary policies, politics and more.

Why not register an account and join the discussions? When you register an account and log in, you may enjoy additional benefits including no Google ads, market data/charts, access to trade/barter with the community and much more. Registering an account is free - you have nothing to lose!

Viking

Yellow Jacket

Wholesale premiums have just jumped $2 to $3 to now $4 this morning

It's weird, its the big stuff that seems to be gone first. SD is out of Kilo silver bars. Apmex has a couple at like $10 over spot. Even 100 oz bars are at like $10 over spot. Meanwhile 90% can be had under spot.

Absolutely this is industrial demand, that is what I see from those numbers.

Absolutely this is industrial demand, that is what I see from those numbers.

Still, I get offered $4 under spot for my 100 Toz bar I tried to flog at our most recent coin show (yesterday).

Well that is a ~$14 spread on 100oz bar. At ~$90ish that is around 15%. I'd say that's ok considering the recent volatility and uncertainty, esp with the refiners.

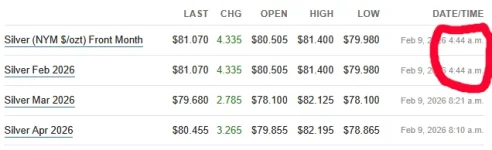

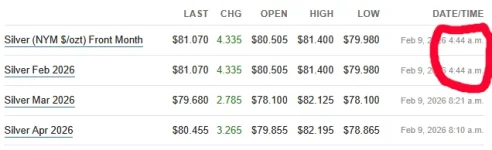

Monday morning in silver

Silver drifted up to ~$82 before dropping to $80 this morning. Let's look below the surface (a thread)

Current spot price: $80.01

Feb26* = +$1.06 vs -$0.41 Saturday

Mar26 = -$0.33 vs -$0.20

Apr26 = +$0.45 vs +$0.23

*data is 4 hours old

Feb26 data isn't real time nor useful. Mar26 shifted more negative, Apr26 shifted more positive. End of Friday CME margin hike effective today. Might need to check the Feb26 EFP spread again later....

China

SGE $87.88 (no VAT)

$87.88 (no VAT)

SFE $93.68

$93.68

SGE premium to LBMA spot ~$7

SFE 1M ozt (31.4t)

1M ozt (31.4t)

India

MMTC-PAMP (retail) : $93.55 (less 10% taxes = $84.19)

Feb26 [SILVERM 5kg] : $90.01 (less 7.2% taxes = ~$83.53)

Mar26 [SILVER 30kg] : $87.41

China > India > LBMA/COMEX

Big

SFE ($93.68)

SFE ($93.68)

SGE ($87.88)

SGE ($87.88)

Retail ($84.19)

Retail ($84.19)

MCX ($83.53)

MCX ($83.53)

spot ($80.01)

spot ($80.01)

COMEX Mar26 ($79.68)

COMEX Mar26 ($79.68)

Silver drifted up to ~$82 before dropping to $80 this morning. Let's look below the surface (a thread)

EFP spreads

Current spot price: $80.01

Feb26* = +$1.06 vs -$0.41 Saturday

Mar26 = -$0.33 vs -$0.20

Apr26 = +$0.45 vs +$0.23

*data is 4 hours old

EFP Commentary

Feb26 data isn't real time nor useful. Mar26 shifted more negative, Apr26 shifted more positive. End of Friday CME margin hike effective today. Might need to check the Feb26 EFP spread again later....

China

SGE

SFE

SGE premium to LBMA spot ~$7

SFE

India

MMTC-PAMP (retail) : $93.55 (less 10% taxes = $84.19)

Feb26 [SILVERM 5kg] : $90.01 (less 7.2% taxes = ~$83.53)

Mar26 [SILVER 30kg] : $87.41

China > India > LBMA/COMEX

Big

ICYMI:

Woa, you glossed over the EFP spreads and kinda missed the big picture. Is that accurate? That would mean the US is in backwardation.

Ok, it looks like the most active contracts are not in backwardation.

Ok, it looks like the most active contracts are not in backwardation.

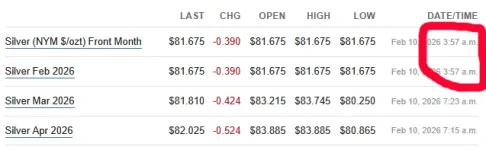

Checking right now... with spot @ $82.19, Marketwatch is reporting Feb26 contract 18 minutes behind now (better than 4 hours behind, but still a bit too skewed for meaningful analysis):

Futures:

Feb26 = $80.87

Mar26 = $81.52

Apr26 = $81.67

EFP spreads:

Feb26 = -$1.32

Mar26 = -$0.67

Apr26 = -$0.52

Futures:

Feb26 = $80.87

Mar26 = $81.52

Apr26 = $81.67

EFP spreads:

Feb26 = -$1.32

Mar26 = -$0.67

Apr26 = -$0.52

- Messages

- 45

- Reaction score

- 42

- Points

- 68

They seem to be closing up further since you posted this.Checking right now... with spot @ $82.19, Marketwatch is reporting Feb26 contract 18 minutes behind now (better than 4 hours behind, but still a bit too skewed for meaningful analysis):

Futures:

Feb26 = $80.87

Mar26 = $81.52

Apr26 = $81.67

EFP spreads:

Feb26 = -$1.32

Mar26 = -$0.67

Apr26 = -$0.52

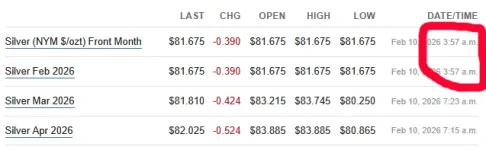

Yesterday (2-9) in silver

Silver rose from ~$80 to ~$84 during the day, fell down to ~$81 at night and has recovered to $82 this morning. Below the surface, ETFs took a day off for SuperBowl hangover (a thread)

311K ozt (9.7t) deposited mostly in CNT [R]

4.3M ozt (135.5t) withdrawn from Brinks (814K), CNT (1.8M), JPM (849K), Loomis (600K), MT&B (222K)

10K ozt (0.3t) moved from [E] to [R] in CNT

613K ozt (19.1t) moved from [R] to [E] in Brinks

Remaining Vault Stock = 390.5M ozt (102.2M [R], 288.2M [E])

Withdraw rate through 1st week of Feb = 3.2M/day

@ 60% [R], run rate = 102.2M / 1.94M = ~53 (working) days (<3 months)

Withdrawals over the first week of February (15.2M ozt) were ~40% more than the average weekly rate throughout January (10.9M ozt). The COMEX garden hose is looking more like a fire hose at the moment.

The CME switched from flat margins to percentage based margins not too long ago. This means that margin requirements for silver contracts scale with increases in the price of silver. Thus, the effects of the CME's recent margin hikes have amplified effects as the price of silver appreciates. Click here for charts and commentary

Current spot price: $82.02

Feb26* = -$0.43 vs ??? Yesterday (82.11 @ 4AM)

Mar26 = -$0.22 vs -$0.33 (82.03 @ 7:20AM)

Apr26 = -$0.05 vs +$0.45 (~82.08 @ 7:15AM)

*data is 3.5 hours old

Both Marketwatch and Barchart are reporting the same stale data for the Feb26 contract lately. I guess it is the CME that not providing timely updates these days. I've calculated the EFP spreads using the spot price at each contract's time stamp.

10M Shares available

Borrow fee fell from 0.54% to 0.28% before settling at 0.36%

Available shares still plentiful and ready for plunder. Borrowing activity appears muted yesterday.

Blackrock: no change

JPM: no change

No activity or no reporting? Superbowl hangover day?

No change to units

No change to ozt

Units/ozt ratio .3413

PSLV needs 1.3M ozt (40.7t) to get back to the historical .3434 ratio.

China

SGE $86.73 (no VAT)

$86.73 (no VAT)

SFE $91.30

$91.30

SGE premium to LBMA spot ~$5

SFE 155K ozt (4.8t)

155K ozt (4.8t)

SGE 1.4M ozt (43.2t)

1.4M ozt (43.2t)

SFE posts an inflow!

India

MMTC-PAMP (retail) : $96.11 (less 10% taxes = $86.50)

Feb26 [SILVERM 5kg] : $91.65 (less 7.2% taxes = ~$85.05)

Mar26 [SILVER 30kg] : $88.92

China > India > LBMA/COMEX

Big

SFE ($91.30)

SFE ($91.30)

SGE ($86.73)

SGE ($86.73)

Retail ($86.50)

Retail ($86.50)

MCX ($85.05)

MCX ($85.05)

spot ($82.02)

spot ($82.02)

COMEX Mar26 ($81.81)

COMEX Mar26 ($81.81)

- 1mo lease rate 6.1%

- Feb26 EFP spread still negative

- COMEX

(LBMA

(LBMA )

)

- PSLV needs 1.3M ozt

Silver rose from ~$80 to ~$84 during the day, fell down to ~$81 at night and has recovered to $82 this morning. Below the surface, ETFs took a day off for SuperBowl hangover (a thread)

COMEX 2-6

311K ozt (9.7t) deposited mostly in CNT [R]

4.3M ozt (135.5t) withdrawn from Brinks (814K), CNT (1.8M), JPM (849K), Loomis (600K), MT&B (222K)

10K ozt (0.3t) moved from [E] to [R] in CNT

613K ozt (19.1t) moved from [R] to [E] in Brinks

COMEX Run Rate

Remaining Vault Stock = 390.5M ozt (102.2M [R], 288.2M [E])

Withdraw rate through 1st week of Feb = 3.2M/day

@ 60% [R], run rate = 102.2M / 1.94M = ~53 (working) days (<3 months)

COMEX Commentary

Withdrawals over the first week of February (15.2M ozt) were ~40% more than the average weekly rate throughout January (10.9M ozt). The COMEX garden hose is looking more like a fire hose at the moment.

CME Margins

The CME switched from flat margins to percentage based margins not too long ago. This means that margin requirements for silver contracts scale with increases in the price of silver. Thus, the effects of the CME's recent margin hikes have amplified effects as the price of silver appreciates. Click here for charts and commentary

EFP spreads

Current spot price: $82.02

Feb26* = -$0.43 vs ??? Yesterday (82.11 @ 4AM)

Mar26 = -$0.22 vs -$0.33 (82.03 @ 7:20AM)

Apr26 = -$0.05 vs +$0.45 (~82.08 @ 7:15AM)

*data is 3.5 hours old

EFP Commentary

Both Marketwatch and Barchart are reporting the same stale data for the Feb26 contract lately. I guess it is the CME that not providing timely updates these days. I've calculated the EFP spreads using the spot price at each contract's time stamp.

SLV Share Lending

10M Shares available

Borrow fee fell from 0.54% to 0.28% before settling at 0.36%

Available shares still plentiful and ready for plunder. Borrowing activity appears muted yesterday.

SLV Assets

Blackrock: no change

JPM: no change

No activity or no reporting? Superbowl hangover day?

PSLV

No change to units

No change to ozt

Units/ozt ratio .3413

PSLV needs 1.3M ozt (40.7t) to get back to the historical .3434 ratio.

China

SGE

SFE

SGE premium to LBMA spot ~$5

SFE

SGE

SFE posts an inflow!

India

MMTC-PAMP (retail) : $96.11 (less 10% taxes = $86.50)

Feb26 [SILVERM 5kg] : $91.65 (less 7.2% taxes = ~$85.05)

Mar26 [SILVER 30kg] : $88.92

China > India > LBMA/COMEX

Big

- 1mo lease rate 6.1%

- Feb26 EFP spread still negative

- COMEX

- PSLV needs 1.3M ozt

ICYMI:

Last week in silver (in metric tons):

SGE silver vault - 43.2

43.2

SFE silver vault - 105.2

105.2

SLV London vault - 667.7

667.7

PSLV silver vault - 23

23

COMEX silver stock - 473.7

473.7

LBMA silver stock - ??? (no daily or weekly data because LBMA is run by dinosaurs)

Global net change (less LBMA):

Feb 2-6 = 22.6

22.6

Jan 26-30 = 1,000.77

1,000.77

Jan 19-23 = 374.4

374.4

Jan 12-16 = 446.4

446.4

Jan 5-9 = 659.7

659.7

Dec 29-Jan 2 = 160.6

160.6

...

China's SGE reported another outflow for last week. I was anticipating that the SGE might have posted an inflow given:

SGE silver price premium to LBMA spot down from the ~$20 extreme highs of 2 weeks ago to ~$12 last week to ~$5 today. Falling premium would suggest that China is receiving at least some LBMA silver.

SGE silver price premium to LBMA spot down from the ~$20 extreme highs of 2 weeks ago to ~$12 last week to ~$5 today. Falling premium would suggest that China is receiving at least some LBMA silver.

For the last two weeks, SGE (spot) price > SFE (futures) price. Today, contango has returned (SFE > SGE). This would suggest that supply is no longer extremely tight (even though that isn't what the vault stock flows are showing).

For the last two weeks, SGE (spot) price > SFE (futures) price. Today, contango has returned (SFE > SGE). This would suggest that supply is no longer extremely tight (even though that isn't what the vault stock flows are showing).

Perhaps we will see an inflow for the SGE this week (in next week's report).

PSLV posted a very unusual outflow last week - the first I've ever seen since I started watching it daily back in June of last year. Did someone actually redeem shares for physical? It looks like it.

Last week marks the 5th week in a row for the COMEX to drain profusely (~300+ tons) and the draining is accelerating (last week was ~40% higher than the average weekly drain in January). The Feb26 EFP spread was firmly negative all week, so the COMEX draining was expected as bullion banks are likely shipping COMEX silver to London.

SLV saw a massive inflow on Feb 2 and has resumed draining vault stock since. See here for more comments.

One can only imagine what chaos might be unfolding in the LBMA's London vault system right now. We can only imagine because the dinosaurs at the LBMA do not provide daily/weekly reporting of their vault stock like every other market and major fund in the world.

SGE silver vault -

SFE silver vault -

SLV London vault -

PSLV silver vault -

COMEX silver stock -

LBMA silver stock - ??? (no daily or weekly data because LBMA is run by dinosaurs)

Global net change (less LBMA):

Feb 2-6 =

Jan 26-30 =

Jan 19-23 =

Jan 12-16 =

Jan 5-9 =

Dec 29-Jan 2 =

...

China's SGE reported another outflow for last week. I was anticipating that the SGE might have posted an inflow given:

Perhaps we will see an inflow for the SGE this week (in next week's report).

PSLV posted a very unusual outflow last week - the first I've ever seen since I started watching it daily back in June of last year. Did someone actually redeem shares for physical? It looks like it.

Last week marks the 5th week in a row for the COMEX to drain profusely (~300+ tons) and the draining is accelerating (last week was ~40% higher than the average weekly drain in January). The Feb26 EFP spread was firmly negative all week, so the COMEX draining was expected as bullion banks are likely shipping COMEX silver to London.

SLV saw a massive inflow on Feb 2 and has resumed draining vault stock since. See here for more comments.

One can only imagine what chaos might be unfolding in the LBMA's London vault system right now. We can only imagine because the dinosaurs at the LBMA do not provide daily/weekly reporting of their vault stock like every other market and major fund in the world.