* bump *

www.bullionstar.com

www.bullionstar.com

Ronan Manly called out the LBMA on their bullshit and they capitulated.

In a shocking retraction, the bullion bank dominated London Bullion Market Association (LBMA) has just announced that it has been overstating LBMA silver vault holdings by a massive 3,300 tonnes of silver.

...

More:

LBMA Misleads Silver Market With False Claims

LBMA silver holdings in London vaults have been overstated by 3300 tonnes. Is this incompetence or a case of fraud?www.bullionstar.com

There is an unprecedented situation emerging in London, where the relentless hemorrhaging of one of the world’s largest stockpiles of silver is now well and truly under way.

For the last 9 months, this stockpile of silver, held in the LBMA vaults in London, has been consistently falling each and every month, and has now reached an all time low (since vault holdings records began in July 2016).

...

To put all of this into context, the Silver Institute estimates that world annual silver mining production will only be 843.2 million ozs this year. That’s 26,262 tonnes. So the LBMA vaults, with 28,506 tonnes as of the end of August 2022, now hold just less than one year’s mine supply of silver.

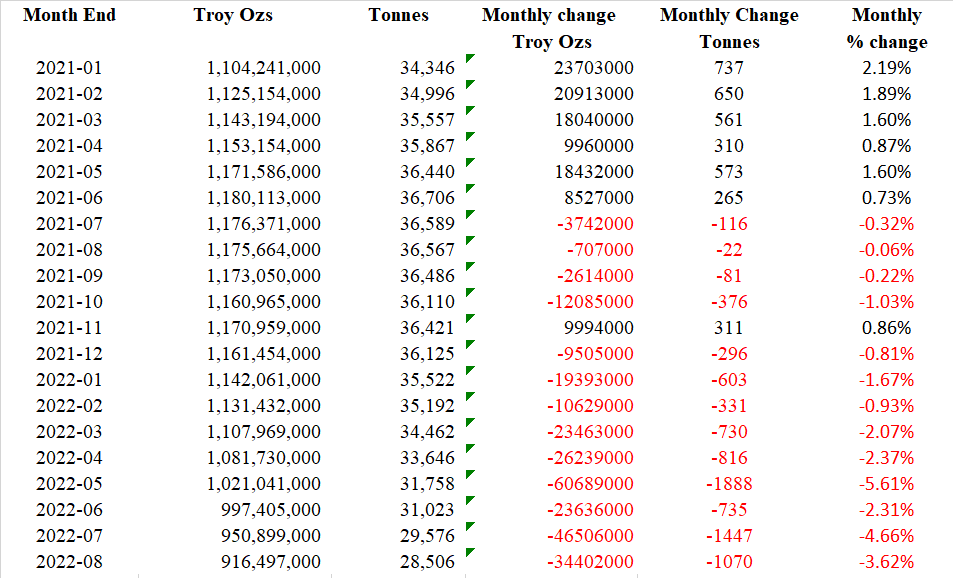

In addition, except for a blip during November 2021 in which LBMA silver inventories rose by 311 tonnes, the LBMA silver vaults have actually seen outflows for 13 of the last 14 months. This is because silver inventories in London also fell in each of the months of July, August, September and October 2021. Putting all of this together means that since the end of June 2021, the LBMA vaults in London have lost 8200 tonnes of silver (263.3 million ozs), and the vaults now hold silver representing just over one year’s mine production.

...

LBMA monthly silver vault data 2021-2022. Source:LBMA website

But that is actually only half the story, because as readers of these pages will know, a majority of the silver within the LBMA vaults is held by Exchange Traded Funds (ETFs) and is already accounted for, and is therefore not (unless it is sold out of ETFs) available to the market. Additionally, this silver in ETFs is not, as the LBMA disingenuously claims, available to “underpin the physical OTC market."

Backing this ETF silver out of the headline figure is thus even more revealing. According to the calculations of GoldCharts’R’Us, as of the end of August there were 18,110 tonnes of silver held by silver-backed ETFs which store their silver in London. This means that of the 28,506 tonnes of silver that the LBMA claims to be held in its London vaults, 63.5% of this is held in ETFs, and only 10,396 tonnes (36.4%) is not held by ETFs. This 10,396 tonnes also represents only about 40% of annual silver mining supply.

...

London Silver Inventories Plummet as Metal Exits LBMA Vaults

Silver is leaving the LBMA vaults at an astounding rate, with silver inventories now at an all time low.

Last edited:

This post may contain affiliate links for which PM Bug gold and silver discussion forum may be compensated.