Personally I think $59 is the picket fence. $60 is the trench just behind it.

Numbers do play on human psychology. It's why they price an item at $1.99 & not $2 - because the 1's is the thing that registers in ur mind & the extra $0.01 makes it a $2 that registers.

So Silver has only ever had a 5 handle in front of the price. Once it has a 6 handle in front of it, the spell of $50 + is broken & everyone knows that $60 + is the new reality.

Example is the 4 minute mile. Was said ( by scientists/doctors ) that the human body couldn't break the sub 4 minute mile. The sub 4 minute mile was broken in May 1954 & yet it was broken again in June of 1954. Why ? because the 2'nd runner knew it could be broken - Belief.

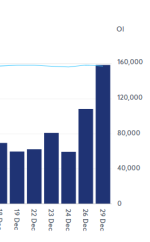

So breaking $60 Silver could cause a run towards $70 & the big/major players know that & will do all they can to stop that happening.

i think 59 is the line for now....since silver seems to climb in 5$ increments breaching 60$ implies a quick move to 65$ .......just a thought and opinion no science here LOL...... conversely a fight at 59$ can imply and facilitate a move down to ~55......also the 6 handle is just what you said

a lot of the time it's the same Brand Name company & same ingredients that is sold as a " Generic "

a lot of the time it's the same Brand Name company & same ingredients that is sold as a " Generic "