While the runup to this weekend’s G20 summit was dominated by talk of the growing divide between China and host nation India, the summit itself served to underline the growing rift between the BRICS nations and the West, which could have significant long-term impacts on the U.S. dollar and commodities in the years to come.

The first and most obvious point of dispute between the BRICS and the West was the reference to Ukraine in the G20 Leaders’ Declaration, the wrangling over which began long before the leaders arrived in New Delhi.

According to Svetlana Lukash, Russia’s G20 ‘sherpa’, this weekend was "one of the most difficult G20 summits" in the nearly 25-year-old history of the forum. "It took almost 20 days to agree on the declaration before the summit, and five days here on the spot," Lukash told Russian news agency Interfax.

...

The Leaders’ Declaration also devoted a fair amount of ink to reforming the international financial system, saying that the 21st century “requires an international development finance system that is fit for purpose, including for the scale of need and depth of the shocks facing developing countries,” and called on the international community to deliver “better, bigger and more effective MDBs [Multilateral Development Banks] by enhancing operating models, improving responsiveness and accessibility, and substantially increasing financing capacity to maximise development impact.”

It’s worth noting that the BRICS made reforming international financial institutions, including beefing up their own MDB, the New Development Bank, a major priority ahead of next year’s summit in Russia, and they are developing new payment instruments and platforms ahead of the summit.

The G20 Declaration also highlighted cross-border payments as an area of particular focus, calling on member nations to meet global targets for “faster, cheaper, more transparent and inclusive cross-border payments by 2027.”

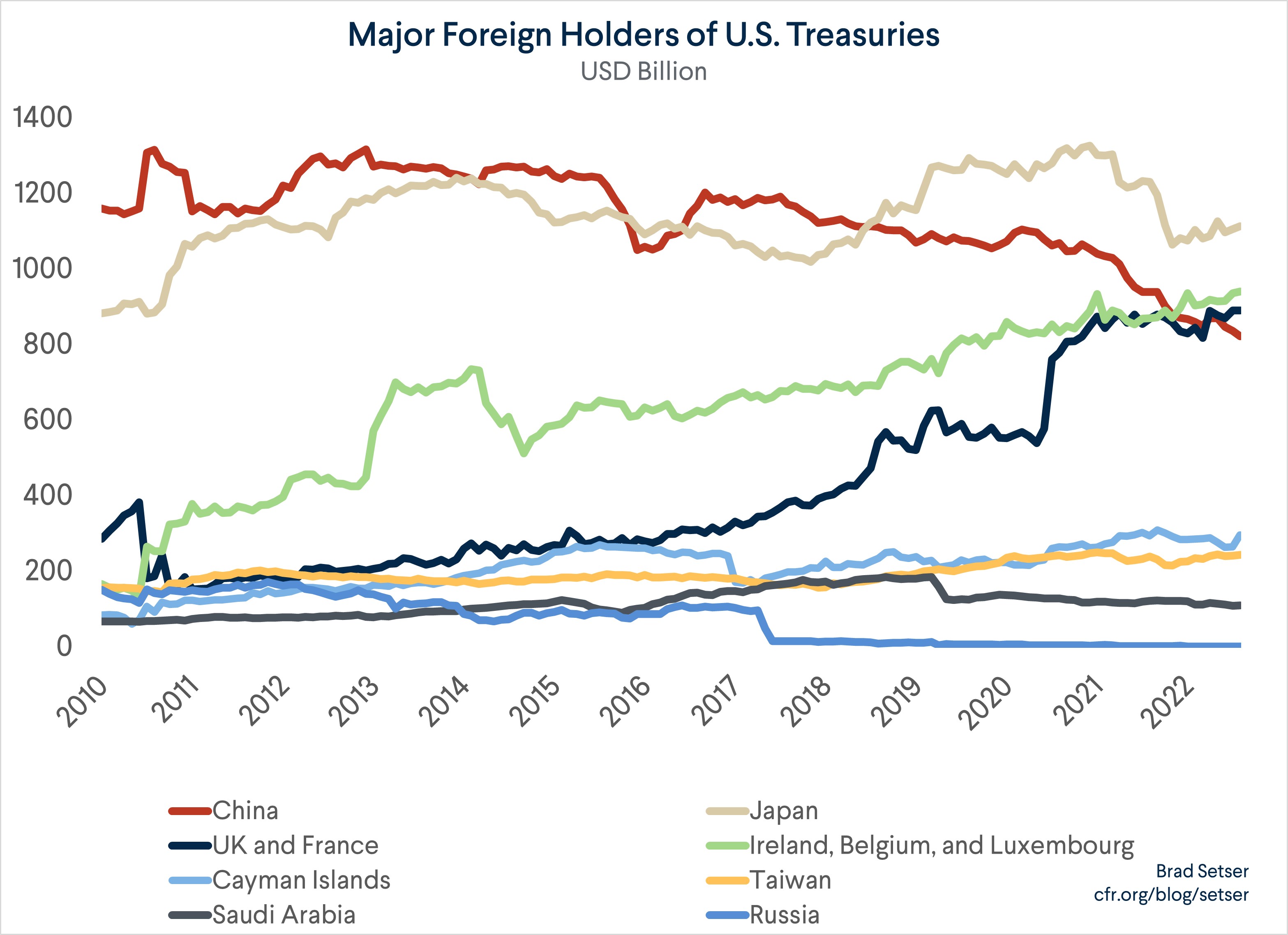

Incoming BRICS chair Russia is very motivated to accelerate the ongoing process of de-dollarization, including a new commodity-backed currency to supplant the U.S. dollar. And incoming G20 leader Lula has been the most outspoken of all BRICS members about the need for an alternative currency. The coming year may provide an unprecedented alignment between leader relationships and national economic goals combined with direction of international organizations to make de-dollarization and a new cross-border currency a reality.

...

Dollar and commodities become battlegrounds after G20 split between BRICS and the West

(Kitco News) - While the runup to this weekend’s G20 summit was dominated by talk of the growing divide between China and host nation India, the summit itself served to underline the growing rift between the BRICS nations and the West, which could have significant long-term impacts on the U.S...

www.kitco.com

It's a lot of rhetoric at the moment.