Treasury Secretary Janet Yellen has some explaining to do, according to hedge-fund titan Stanley Druckenmiller.

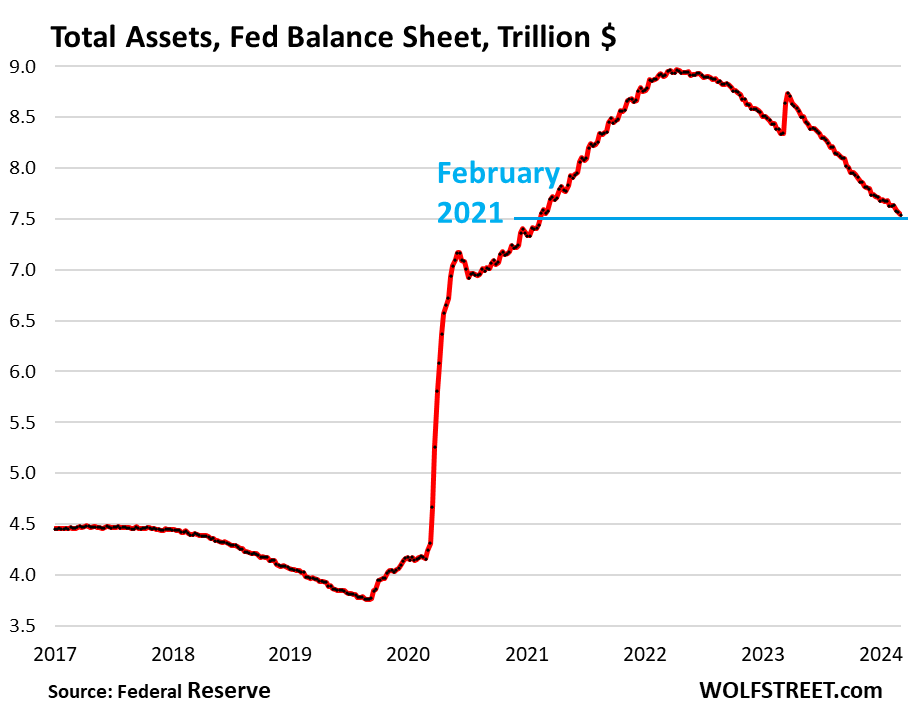

Yellen missed an important opportunity, Druckenmille says, by not issuing more long-dated Treasury bonds when interest rates were, in the shadow of COVID-19, near zero.

“Janet Yellen, I guess because political myopia or whatever, was issuing 2-years at 15 basis points … when she could have issued 10-years at 70 basis points or 30-years at 180 basis points,” the former hedge-fund manager said during a conversation with Paul Tudor Jones at the Robin Hood Investors Conference, a clip of which circulated Monday on X, the social-media platform formerly known as Twitter.

“I literally think if you go back to Alexander Hamilton, [Yellen’s approach represented] the biggest blunder in the history of the Treasury,” Druckenmiller said.

This omission seems even more egregious, according to Druckenmiller, considering that Americans refinanced their home loans at rock-bottom mortgage rates en masse, and corporations with sturdy credit ratings refinanced their debt.

“I have no idea why she hasn’t been called on this. She has no right to still be in that job.”

“When rates were practically zero, every Tom, Dick and Harry in the U.S. refinanced their mortgage … every corporation was extending their debt,” he said.

He then rattled off some alarming numbers to illustrate the consequences of not reining in spending.

“Here’s the consequences, folks. When the debt rolls over by 2033, interest expense is going to be 4.5% of GDP if rates are where they are now. By 2043 — it sounds like a long time but it is really not; it is 20 years — interest expense as a percentage of GDP will be 7%. That is 144% of all current discretionary spending,” he said.

...

To be sure, Yellen wasn’t the only Treasury secretary to preside over this latest round of near-zero interest rates. Steven Mnuchin served as Treasury secretary under Donald Trump and didn’t, leaving office in January 2021, nearly a year after the global coronavirus outbreak was formally labeled a pandemic.

...