- Messages

- 14,530

- Reaction score

- 2,948

- Points

- 238

Always enjoy reading predictions then seeing if any pan out.

5 minute read December 7, 20222:00 AM EST Last Updated 2 days ago

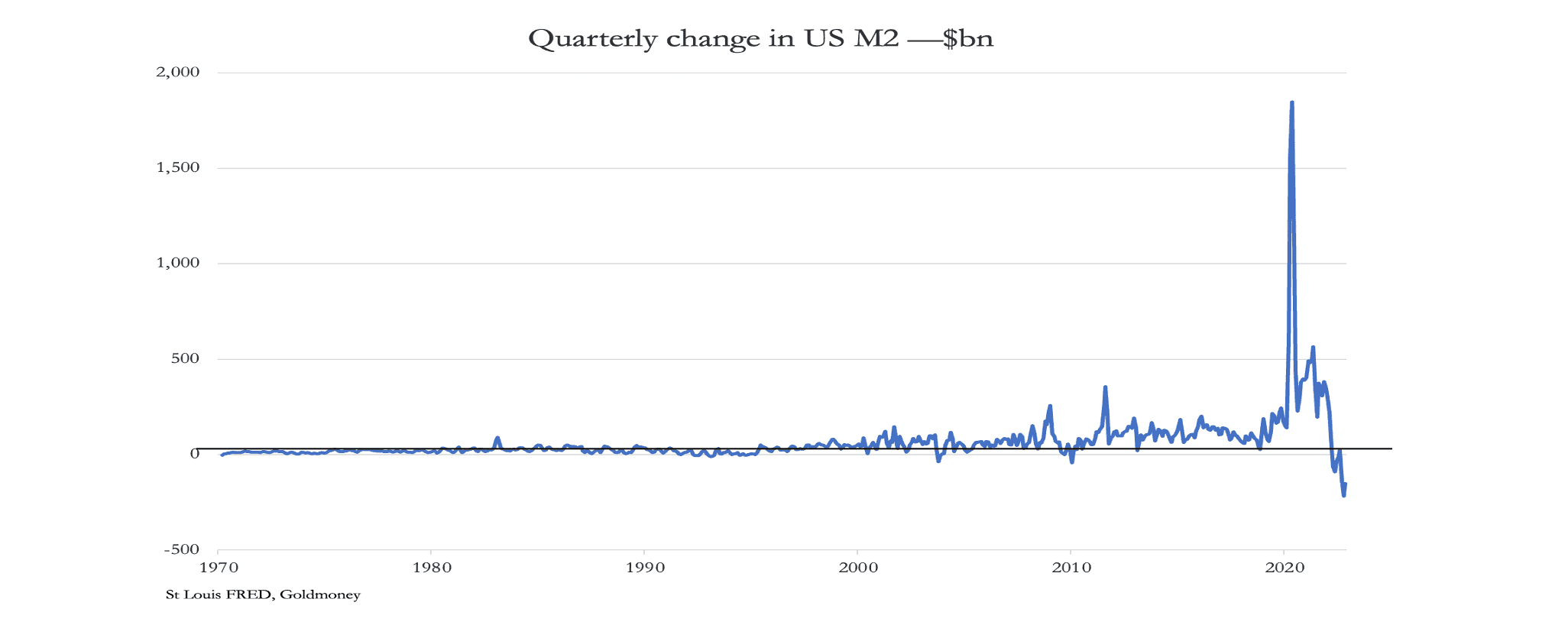

ORLANDO, Fla., Dec 6 (Reuters) - As some banks publish their semi-serious market predictions for the year ahead, the utterly wild ride that blindsided everyone in 2022 suggests that, this time around, they should perhaps indeed be taken semi-seriously.

After all, this time last year it is safe to say double-digit inflation in the West, the most aggressive U.S. monetary policy tightening cycle in 40 years, Japanese FX intervention to buy yen, and by some measures the biggest ever crash in government bonds were not consensus calls.

Full article:

www.reuters.com

www.reuters.com

5 minute read December 7, 20222:00 AM EST Last Updated 2 days ago

Column: 2023 market predictions - when the outrageous and plausible blur

By Jamie McGeeverORLANDO, Fla., Dec 6 (Reuters) - As some banks publish their semi-serious market predictions for the year ahead, the utterly wild ride that blindsided everyone in 2022 suggests that, this time around, they should perhaps indeed be taken semi-seriously.

After all, this time last year it is safe to say double-digit inflation in the West, the most aggressive U.S. monetary policy tightening cycle in 40 years, Japanese FX intervention to buy yen, and by some measures the biggest ever crash in government bonds were not consensus calls.

Full article:

2023 market predictions - when the outrageous and plausible blur

As some banks publish their semi-serious market predictions for the year ahead, the utterly wild ride that blindsided everyone in 2022 suggests that, this time around, they should perhaps indeed be taken semi-seriously.