You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

2025 Lunatic Fringe - Market and Trade Chat

- Thread starter pmbug

- Start date

Welcome to the Precious Metals Bug Forums

Welcome to the PMBug forums - a watering hole for folks interested in gold, silver, precious metals, sound money, investing, market and economic news, central bank monetary policies, politics and more.

Why not register an account and join the discussions? When you register an account and log in, you may enjoy additional benefits including no Google ads, market data/charts, access to trade/barter with the community and much more. Registering an account is free - you have nothing to lose!

- Status

- Not open for further replies.

- Messages

- 1,821

- Reaction score

- 2,151

- Points

- 283

Excellent interview with many things I have never considered.

Not many people understand Non-linear change. They only know what they've experienced, anything else is just not real.... until they may experience it.

And when you're looking to "cash in" on the big run up, who's your buyer at that point?

Anyone that wants to sell you their goods.

- Messages

- 986

- Reaction score

- 1,406

- Points

- 278

You missed the point.Anyone that wants to sell you their goods.

Keep in mind only 10% of Americans could handle an emergency expense of $500 to $999 using their savings. Meanwhile, 14% said they could manage an expense between $100 and $499, and 18% could only cover an emergency under $100.

Who's going to be buying $6000 gold?

Gold is Money. I will use it in exchange for goods.

You missed the point.

Keep in mind only 10% of Americans could handle an emergency expense of $500 to $999 using their savings. Meanwhile, 14% said they could manage an expense between $100 and $499, and 18% could only cover an emergency under $100.

Who's going to be buying $6000 gold?

Maybe the same folks that are buying at $3k (and Central banks). Also, price isn't really a barrier when fractional measures are available. If 1toz exceeds budget limitations, maybe 1/10 toz works. YMMV

- Messages

- 986

- Reaction score

- 1,406

- Points

- 278

I thought the point of my original post was pretty clear.

Then I was compelled to make a second, more detailed, effort/attempt at making it more clear.

Still, people aren't seeming to get it. I honestly don't understand why this is hard to grasp.

Many on this forum bought gold when it was cheap, some here bought cheaper than others. I think it's fair to say those who hold gold were at least somewhat "happy" to see the rise in price. The initial thought of "here's what I've been waiting for" could be a scenario of be careful what you wish for.

I'm saying maybe those folks should temper their happiness because cashing in at $6K (the number used by nickndfl) is going to be somewhat harder than cashing in at present level, which is somewhat harder than cashing in at previous levels.

Think about yourself. What was your first gold purchase? There's a better than zero chance that you did not purchase a full ounce on your first purchase. You didn't buy a full ounce because you couldn't simply couldn't buy a full ounce. You were priced out.

Personally, I didn't get into the game until the early 2000s and gold was around $400 an ounce. What I now consider a bargain price but at the time it was out of my reach.

I had other obligations and expenses and $400 could be used to accomplish more important things.

Now we're looking at $3K, and in the scenario we're discussing it's going to be $6K, that's a lot of money.

Gold has always been out of some people's reach. The higher the price goes, the more out of reach it becomes for those same people and it puts itself out of the reach of even more people who were previously on the fringe. It's pretty straightforward simple math.

I think it's also fair to say that all kinds of things, whether that be products/goods, services, whatever can and sometimes do approach a point of being beyond the price range and/or comfort level for many.

Every single day people make decisions to not get that desperately needed car repair done because they have to pay the rent. Or make the hard choice to buy groceries and forego their prescription medicines. Or even simpler things like not turning on the AC or choosing to buy hamburger instead of steak.

With gold at $6K your pool of potential buyers shrinks. I don't think this is even an argument. I think it's pretty straightforward.

Yes, there will likely always be some national bullion dealers to sell to but even they will dial back buying at higher levels and likely the spreads will become a big factor as well. I'd also argue that it's not out of the realm of possibility or even hard to imagine some especially smaller bullion dealers will close shop.

Your pool of buyers will shrink.

Who will exchange goods for gold? I'm not aware of any retailer, corporation or business exchanging their goods and or services for gold now. What leads you to believe they will when gold reaches $6K?

I'll give you that people who can currently afford to purchase gold are the likely buyers in the future at $6K. That is the most likely answer to the question. But I'd venture a guess that those same people won't be buying as much or as often. I can't substantiate that claim but it makes logical sense to speculate that will be the case.

But central banks are not now and never will be buying gold from you and your neighbors.

Also, you're making my point by bring fractionals into the argument. Even then, using your example of 1/10 toz instead of a full ounce you're looking at $600. Remember my follow up post?

only 10% of Americans could handle an emergency expense of $500 to $999 using their savings. Meanwhile, 14% said they could manage an expense between $100 and $499, and 18% could only cover an emergency under $100.

Look, I'm not wanting to or trying to make this an argument.

I just made what I thought was a very straightforward comment implying higher prices mean people get priced out. I'm not going to belabor the point. Although I feel as though I already may have.

Then I was compelled to make a second, more detailed, effort/attempt at making it more clear.

Still, people aren't seeming to get it. I honestly don't understand why this is hard to grasp.

Many on this forum bought gold when it was cheap, some here bought cheaper than others. I think it's fair to say those who hold gold were at least somewhat "happy" to see the rise in price. The initial thought of "here's what I've been waiting for" could be a scenario of be careful what you wish for.

I'm saying maybe those folks should temper their happiness because cashing in at $6K (the number used by nickndfl) is going to be somewhat harder than cashing in at present level, which is somewhat harder than cashing in at previous levels.

Think about yourself. What was your first gold purchase? There's a better than zero chance that you did not purchase a full ounce on your first purchase. You didn't buy a full ounce because you couldn't simply couldn't buy a full ounce. You were priced out.

Personally, I didn't get into the game until the early 2000s and gold was around $400 an ounce. What I now consider a bargain price but at the time it was out of my reach.

I had other obligations and expenses and $400 could be used to accomplish more important things.

Now we're looking at $3K, and in the scenario we're discussing it's going to be $6K, that's a lot of money.

Gold has always been out of some people's reach. The higher the price goes, the more out of reach it becomes for those same people and it puts itself out of the reach of even more people who were previously on the fringe. It's pretty straightforward simple math.

I think it's also fair to say that all kinds of things, whether that be products/goods, services, whatever can and sometimes do approach a point of being beyond the price range and/or comfort level for many.

Every single day people make decisions to not get that desperately needed car repair done because they have to pay the rent. Or make the hard choice to buy groceries and forego their prescription medicines. Or even simpler things like not turning on the AC or choosing to buy hamburger instead of steak.

With gold at $6K your pool of potential buyers shrinks. I don't think this is even an argument. I think it's pretty straightforward.

Yes, there will likely always be some national bullion dealers to sell to but even they will dial back buying at higher levels and likely the spreads will become a big factor as well. I'd also argue that it's not out of the realm of possibility or even hard to imagine some especially smaller bullion dealers will close shop.

Your pool of buyers will shrink.

Gold is Money. I will use it in exchange for goods.

Who will exchange goods for gold? I'm not aware of any retailer, corporation or business exchanging their goods and or services for gold now. What leads you to believe they will when gold reaches $6K?

Maybe the same folks that are buying at $3k (and Central banks). Also, price isn't really a barrier when fractional measures are available. If 1toz exceeds budget limitations, maybe 1/10 toz works. YMMV

I'll give you that people who can currently afford to purchase gold are the likely buyers in the future at $6K. That is the most likely answer to the question. But I'd venture a guess that those same people won't be buying as much or as often. I can't substantiate that claim but it makes logical sense to speculate that will be the case.

But central banks are not now and never will be buying gold from you and your neighbors.

Also, you're making my point by bring fractionals into the argument. Even then, using your example of 1/10 toz instead of a full ounce you're looking at $600. Remember my follow up post?

only 10% of Americans could handle an emergency expense of $500 to $999 using their savings. Meanwhile, 14% said they could manage an expense between $100 and $499, and 18% could only cover an emergency under $100.

Look, I'm not wanting to or trying to make this an argument.

I just made what I thought was a very straightforward comment implying higher prices mean people get priced out. I'm not going to belabor the point. Although I feel as though I already may have.

I understand your point. The pool of buyers for direct sales (marketplaces like forum buy/sell/trade or eBay) of larger items (100toz, kilo, 10toz, 1toz, etc.) will likely shrink.* However, marketplace dynamics also shift. Much like what we are seeing with silver presently, retail shops are buying silver from the public and then sending the silver on to be melted and recast in whatever form is drawing market demand (good delivery bars for the exchanges). While central banks won't be buying from the public directly, they will be demanding good delivery bars from refiners, so the public's scrap will be in demand for recycling into good delivery bars - they will be buying indirectly.

* Ironically, I could see where rising price actually increases the pool of people participating in direct sale marketplaces as folks look to avoid paper trails on their deals.

* Ironically, I could see where rising price actually increases the pool of people participating in direct sale marketplaces as folks look to avoid paper trails on their deals.

Last edited:

I would also add that the growing pool of folks on the margin unable to afford to buy gold is not an issue with gold's price. That's an issue with the USD and the Fed's inflation targeting stealing real value from the economy.

This is one of the factors I considered when I went ‘all in’ and it led me to bullionvault and goldmoney.I thought the point of my original post was pretty clear.

Then I was compelled to make a second, more detailed, effort/attempt at making it more clear.

Still, people aren't seeming to get it. I honestly don't understand why this is hard to grasp.

Many on this forum bought gold when it was cheap, some here bought cheaper than others. I think it's fair to say those who hold gold were at least somewhat "happy" to see the rise in price. The initial thought of "here's what I've been waiting for" could be a scenario of be careful what you wish for.

I'm saying maybe those folks should temper their happiness because cashing in at $6K (the number used by nickndfl) is going to be somewhat harder than cashing in at present level, which is somewhat harder than cashing in at previous levels.

Think about yourself. What was your first gold purchase? There's a better than zero chance that you did not purchase a full ounce on your first purchase. You didn't buy a full ounce because you couldn't simply couldn't buy a full ounce. You were priced out.

Personally, I didn't get into the game until the early 2000s and gold was around $400 an ounce. What I now consider a bargain price but at the time it was out of my reach.

I had other obligations and expenses and $400 could be used to accomplish more important things.

Now we're looking at $3K, and in the scenario we're discussing it's going to be $6K, that's a lot of money.

Gold has always been out of some people's reach. The higher the price goes, the more out of reach it becomes for those same people and it puts itself out of the reach of even more people who were previously on the fringe. It's pretty straightforward simple math.

I think it's also fair to say that all kinds of things, whether that be products/goods, services, whatever can and sometimes do approach a point of being beyond the price range and/or comfort level for many.

Every single day people make decisions to not get that desperately needed car repair done because they have to pay the rent. Or make the hard choice to buy groceries and forego their prescription medicines. Or even simpler things like not turning on the AC or choosing to buy hamburger instead of steak.

With gold at $6K your pool of potential buyers shrinks. I don't think this is even an argument. I think it's pretty straightforward.

Yes, there will likely always be some national bullion dealers to sell to but even they will dial back buying at higher levels and likely the spreads will become a big factor as well. I'd also argue that it's not out of the realm of possibility or even hard to imagine some especially smaller bullion dealers will close shop.

Your pool of buyers will shrink.

Who will exchange goods for gold? I'm not aware of any retailer, corporation or business exchanging their goods and or services for gold now. What leads you to believe they will when gold reaches $6K?

I'll give you that people who can currently afford to purchase gold are the likely buyers in the future at $6K. That is the most likely answer to the question. But I'd venture a guess that those same people won't be buying as much or as often. I can't substantiate that claim but it makes logical sense to speculate that will be the case.

But central banks are not now and never will be buying gold from you and your neighbors.

Also, you're making my point by bring fractionals into the argument. Even then, using your example of 1/10 toz instead of a full ounce you're looking at $600. Remember my follow up post?

only 10% of Americans could handle an emergency expense of $500 to $999 using their savings. Meanwhile, 14% said they could manage an expense between $100 and $499, and 18% could only cover an emergency under $100.

Look, I'm not wanting to or trying to make this an argument.

I just made what I thought was a very straightforward comment implying higher prices mean people get priced out. I'm not going to belabor the point. Although I feel as though I already may have.

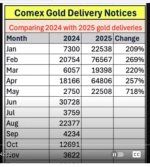

View attachment 16535

I would like to think that while there may be less buyers in total, there will always be potential buyers and internet access to those buyers. Yes ultimate safety is physical in your sunken boat but if things go bad, access to buyers could be challenging.

So if the internet fails and fiat money goes to ratshit, gold will probably not help you and your location, skills and community will be more important. Gold and silver offer advantage in a lot of scenarios but not all .

Are you able to walk away from your hard earned stash ?

- Messages

- 1,821

- Reaction score

- 2,151

- Points

- 283

You nailed it. The wholesalers will always be the buyers. Maybe they would back off if there was a rapid run up in a short period of time but the slow steady pace higher that we have been witnessing hasn't had an effect on there demand thus far.I understand your point. The pool of buyers for direct sales (marketplaces like forum buy/sell/trade or eBay) of larger items (100toz, kilo, 10toz, 1toz, etc.) on will likely shrink.* However, marketplace dynamics also shift. Much like what we are seeing with silver presently, retail shops are buying silver from the public and then sending the silver on to be melted and recast in whatever form is drawing market demand (good delivery bars for the exchanges). While central banks won't be buying from the public directly, they will be demanding good delivery bars from refiners, so the public's scrap will be in demand for recycling into good delivery bars - they will be buying indirectly.

* Irononically, I could see where rising price actually increases the pool of people participating in direct sale marketplaces as folks look to avoid paper trails on their deals.

Keep in mind that those that are running the price up on the Comex may have intentions of taking delivery. That option is always open to them unless there is no inventory available. However if there were low or no inventory available that would only make the wholesalers get more aggressive in locating some.

I thought the point of my original post was pretty clear.

Then I was compelled to make a second, more detailed, effort/attempt at making it more clear.

Still, people aren't seeming to get it. I honestly don't understand why this is hard to grasp.

Many on this forum bought gold when it was cheap, some here bought cheaper than others. I think it's fair to say those who hold gold were at least somewhat "happy" to see the rise in price. The initial thought of "here's what I've been waiting for" could be a scenario of be careful what you wish for.

I'm saying maybe those folks should temper their happiness because cashing in at $6K (the number used by nickndfl) is going to be somewhat harder than cashing in at present level, which is somewhat harder than cashing in at previous levels.

Think about yourself. What was your first gold purchase? There's a better than zero chance that you did not purchase a full ounce on your first purchase. You didn't buy a full ounce because you couldn't simply couldn't buy a full ounce. You were priced out.

Personally, I didn't get into the game until the early 2000s and gold was around $400 an ounce. What I now consider a bargain price but at the time it was out of my reach.

I had other obligations and expenses and $400 could be used to accomplish more important things.

Now we're looking at $3K, and in the scenario we're discussing it's going to be $6K, that's a lot of money.

Gold has always been out of some people's reach. The higher the price goes, the more out of reach it becomes for those same people and it puts itself out of the reach of even more people who were previously on the fringe. It's pretty straightforward simple math.

I think it's also fair to say that all kinds of things, whether that be products/goods, services, whatever can and sometimes do approach a point of being beyond the price range and/or comfort level for many.

Every single day people make decisions to not get that desperately needed car repair done because they have to pay the rent. Or make the hard choice to buy groceries and forego their prescription medicines. Or even simpler things like not turning on the AC or choosing to buy hamburger instead of steak.

With gold at $6K your pool of potential buyers shrinks. I don't think this is even an argument. I think it's pretty straightforward.

Yes, there will likely always be some national bullion dealers to sell to but even they will dial back buying at higher levels and likely the spreads will become a big factor as well. I'd also argue that it's not out of the realm of possibility or even hard to imagine some especially smaller bullion dealers will close shop.

Your pool of buyers will shrink.

Who will exchange goods for gold? I'm not aware of any retailer, corporation or business exchanging their goods and or services for gold now. What leads you to believe they will when gold reaches $6K?

I'll give you that people who can currently afford to purchase gold are the likely buyers in the future at $6K. That is the most likely answer to the question. But I'd venture a guess that those same people won't be buying as much or as often. I can't substantiate that claim but it makes logical sense to speculate that will be the case.

But central banks are not now and never will be buying gold from you and your neighbors.

Also, you're making my point by bring fractionals into the argument. Even then, using your example of 1/10 toz instead of a full ounce you're looking at $600. Remember my follow up post?

only 10% of Americans could handle an emergency expense of $500 to $999 using their savings. Meanwhile, 14% said they could manage an expense between $100 and $499, and 18% could only cover an emergency under $100.

Look, I'm not wanting to or trying to make this an argument.

I just made what I thought was a very straightforward comment implying higher prices mean people get priced out. I'm not going to belabor the point. Although I feel as though I already may have.

View attachment 16535

America is poor. No arguments there. Doesn't make the Gold argument change.

As the dollar dies Real money will VERY quickly be accepted again for goods. No one will want your shit paper. And I'm not the expert here, I'd look to someone like Rafi on this, but Money acts very different on the demand/supply curve. I'm fairly confident that the Demand for Money INCREASES as the price goes up.

Think of it from the point of view as a helpless typical American. Say a high earning but not very smart Doctor. They will have lots of toys, house, cars and DEBT. So as the price of food and interest on their debt soars what will their response be? What could they do? The only thing they really have will be their house and probably some cars, boats, whatnot. Selling assets and downsizing is likely. So they put say an RV up for sale. What will they likely want in return? Well at first, and I think we are still here but its soon approaching, they will just want more dollars. BUT as gold prices start soaring faster than say the price of their Coffee they will take note. Perhaps when they next need to dump a nice little boat they will be tempted to ask for Gold instead. Gold will also make it easier for them to payoff/rid themselves of some of that debt as well.

Last edited:

One last way to think of this dilemma. STOP thinking of Gold value in term of dollars. This will be less and less relevant. It was $500 / oz. Few cared. $3,000 would have seemed crazy high. So then you'll see $6,000 or $10,000 or maybe even parity with Bitcoin. Then you just start adding zeros as hyperinflation sets in and no one even notices how many dollars it takes. Its no longer relevant.

An interesting thought from a commenter on Moon of Alabama blog regarding Trumps focus on Middle East and Saudi in particular -

Light-bulb moment

Actually that’s it, he’s gone there to reassure them and ask them to stop converting their dollar holdings to gold, because certain Western banking interests have a short position and are starting to squeak loudly...

Light-bulb moment

Actually that’s it, he’s gone there to reassure them and ask them to stop converting their dollar holdings to gold, because certain Western banking interests have a short position and are starting to squeak loudly...

Per the US Treasury's TIC data, KSA is not a major owner of US Treasuries (17th on the list with ~126B whereas the top 3 have over 750B each) and while their total ownership of Treasuries is down slightly from September, it doesn't look like a major sell off in the grand scheme of things.

I think it more likely that the trip was attempting to secure KSA's support for the petrodollar as:

I think it more likely that the trip was attempting to secure KSA's support for the petrodollar as:

- Trump finalizes middle east foreign policy with respect to Yemen/Houthis, Israel and Iran

- Rumors abound that KSA made a deal with China to sell oil for RMB with gold convertibility

- KSA rides the BRICS-USA fence and the BRICS meeting approaches July 6

- Messages

- 19,188

- Reaction score

- 11,502

- Points

- 288

BREAKING: The US Treasury recorded a $258 billion budget surplus in April, the largest since 2021.

Total receipts were $850 billion, while total government outlays were $592 billion.

Receipts were driven by a 16% increase in individual tax payments, which totaled $460 billion.

Furthermore, Treasury reported that customs duties rose $9 billion year-over-year in April to a record $16 billion.

In the first 7 months of Fiscal Year 2025, the US budget deficit is now up $194 billion YoY, to $1.05 trillion, the third-largest on record.

The budget deficit remains a major crisis.

pmbug said:- USA credit rating downgrade

- Balloon wall of US debt about to be refinanced at higher rates

- Fed slowing QT (might restart QE?)

- Tariffs / global supply chain shocks / inflation doom

- Basel 3

- BRICS Summit "Rio Reset"

- China/KSA oil for gold backed RMB deal

- BOE running out of gold to lend LBMA

- War in the middle east

What did I miss?

pmbug said:Gold and silver both trade up from Friday's close in overnight trading in China. The SFE silver vault reports a modest inflow. The SGE silver vault reports a large outflow for last week.

Silver in China is trading at a ~7.7% premium to London. The total silver vault stock in SFE+SGE is at an 8 month low. One might think that market forces would conspire to encourage physical silver to flow to China given the circumstances.

- Messages

- 19,188

- Reaction score

- 11,502

- Points

- 288

summary... back up de truk

0:14 - Long-Term Gold Momentum and Bull Trend Since 2015

1:00 - Recent Gold Price Movements and Shallow Pullbacks

1:46 - Momentum Indicators Show No Signs of Long-Term Top

2:40 - Historical Examples of Momentum Breaking Before Price Drops

3:21 - Silver and Miners Poised to Outperform Gold

4:07 - Silver Price History and Pattern Breakout Near $35

5:26 - Technical Chart Patterns Point to Silver Breakout

6:08 - Historical Silver-to-Gold Ratio Trends

7:29 - Silver at 1% of Gold Indicates Undervaluation

8:45 - Silver Outperformance in Bull Trends

9:02 - Gold’s Historical Eightfold Moves and Silver Implications

9:50 - Miners Also Positioned for Breakout Alongside Silver

10:21 - Bloomberg Commodity Index Breakout Potential

11:44 - Commodities Reacting to Recession Fears, Then Rebounding

12:25 - Crude Oil Bear Trap and Potential Upside

13:34 - Crude Momentum Breakout Could Signal Broad Commodity Surge

14:07 - Commodity Boom Possible Even During Recession (Stagflation Reference)

THE UNTHINKABLE Is About To Happen To SILVER PRICES! – Michael Oliver

0:00 - Silver Bull Market Outlook and Silver at 2% of Gold Price0:14 - Long-Term Gold Momentum and Bull Trend Since 2015

1:00 - Recent Gold Price Movements and Shallow Pullbacks

1:46 - Momentum Indicators Show No Signs of Long-Term Top

2:40 - Historical Examples of Momentum Breaking Before Price Drops

3:21 - Silver and Miners Poised to Outperform Gold

4:07 - Silver Price History and Pattern Breakout Near $35

5:26 - Technical Chart Patterns Point to Silver Breakout

6:08 - Historical Silver-to-Gold Ratio Trends

7:29 - Silver at 1% of Gold Indicates Undervaluation

8:45 - Silver Outperformance in Bull Trends

9:02 - Gold’s Historical Eightfold Moves and Silver Implications

9:50 - Miners Also Positioned for Breakout Alongside Silver

10:21 - Bloomberg Commodity Index Breakout Potential

11:44 - Commodities Reacting to Recession Fears, Then Rebounding

12:25 - Crude Oil Bear Trap and Potential Upside

13:34 - Crude Momentum Breakout Could Signal Broad Commodity Surge

14:07 - Commodity Boom Possible Even During Recession (Stagflation Reference)

THink we got a really, really nice short squeeze setting up here into June. Both in Silver and shorted stocks.

This looks like a pretty clear Elliot Wave move in Gold. Not sure how they sat on Silver and Miners the whole run. However, I may look to hedge mine with some GLD puts.

View attachment 16359

Gold seems to be behaving and trading to actual markets. Might have seen a nice ABC correction. I'm no expert but this looks like what I remember in the textbooks.

- Status

- Not open for further replies.