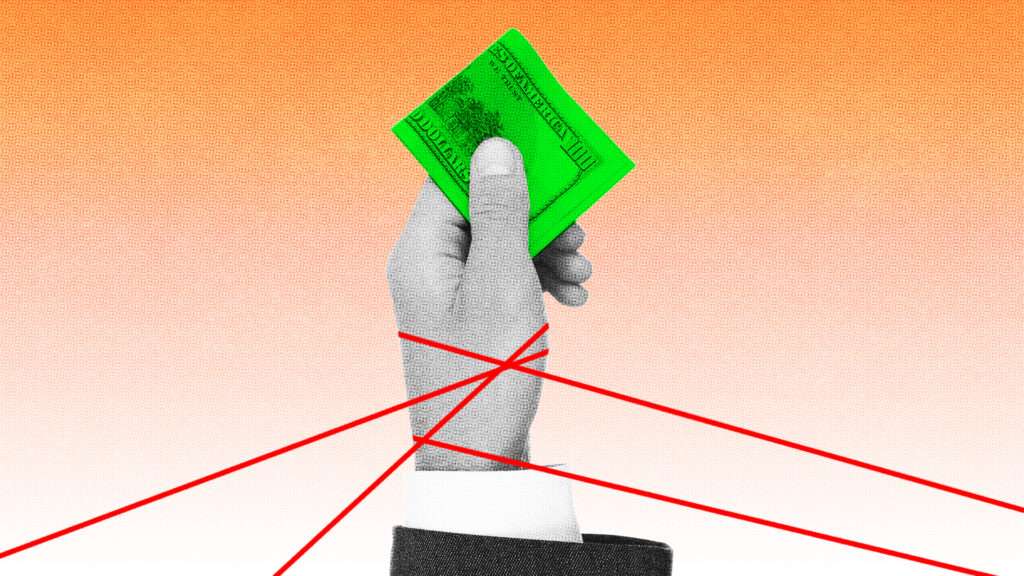

Want to support small business growth and expand investor opportunities? Then you should want to reform the "accredited investor definition," a federal rule that largely limits investment in certain private securities offerings to those who are comparatively wealthy.

Private securities offerings are a substantial portion of the capital raised by businesses. From July 1, 2021, to June 30, 2022, twice as much money was raised in this way than by all public offerings. But the Securities and Exchange Commission (SEC) prevents individuals from investing in these offerings unless they qualify as accredited investors by having a net worth of at least $1,000,000 or an annual income of at least $200,000. The SEC estimates that about 13 percent of U.S. households qualify.

There seems to be bipartisan agreement that this rule is broken. This was evident during a February hearing dedicated specifically to the accredited investor definition, and it came up again last week's House Financial Services Committee hearing on "encouraging capital formation and investment opportunity for all Americans."

It's long past time to translate that agreement into action. It's bad enough to paternalistically give the SEC the authority to decide how individuals invest their own money. But even when judged against the SEC's own goal of limiting private offerings to the financially sophisticated, the accredited investor definition is a failure.

Being wealthy is no proxy for financial sophistication. ...

This SEC rule makes it harder to invest—unless you’re already rich

The "accredited investor definition" limits investment in certain private securities offerings to those who are comparatively wealthy.

I can only assume that this would also have an impact on the SEC's current "cryptos are securities" war against the crypto industry.