Chatter about CBDCs has grown in the last few years. Central banks around the world are engaged in various projects to design, test and integrate CBDCs for future replacements of their national paper/coin currencies. In the absence of any compelling justifications, pundits proclaim CBDCs as a solution in search of a problem. However, CBDCs are being developed for important reasons. Central banks just can't openly tell the public about it. If the public really understood the issue, they would rebel. And they should rebel.

Central banks are looking to CBDCs to effect a new world order with a medium that is a bastardization of money. The USA shot their wad with the weaponization of the SWIFT system in effecting economic sanctions against Russia and Iran. The BRICS are rebelling and dollar hegemony hangs in the balance. As the SWIFT system loses it's stranglehold on global payment clearing, the BIS, IMF and others are busy developing a global CBDC framework for a new world order. This will usher in an unprecedented era of financial surveillance and control.

CBDCs are not the same thing as "crypto"

When Bitcoin was born, very few people took it seriously. But it's novel invention has sparked a revolution of growth in the development of cryptocurrency technologies. Bitcoin was designed to be strong on decentralization, but it's energy per transaction is not efficient/scalable. The blockchain technology does allow for transaction surveillance, but wallet ownership can be anonymous. Wallet interactions with know-your-customer (KYC) on-ramps and off-ramps can expose wallets and transaction histories to financial surveillance.

Lots of smart people have grappled with Bitcoin's shortcomings and that has led to the development of new blockchain technologies and advancements including various consensus algorithms (proof of stake, proof of agreement, etc.), smart contracts, block chain data storage (commonly used for NFTs, but has other uses too), sharding, zero knowledge proofs, parallel chains, etc.

The crypto space is evolving with tremendous speed. Where the big knock on Bitcoin (with respect to it's potential as a global currency) as always been it's inefficiencies with both energy and transaction commitment times, newer technologies have closed the gap and in some cases exceeded the cost and speed of legacy financial digital systems (SWIFT, ACH, CC, etc.).

Most central banks publish press releases and papers on their CBDC projects. They are working hard to develop systems that do the same thing that existing crypto systems are doing. The big difference though is that CBDC systems are closed systems (wallet creation is tightly controlled) designed for centralized control whereas cryptos are open systems (wallet creation is free and available to anyone) designed for decentralized control (with democratic systems for governance of network development and management).

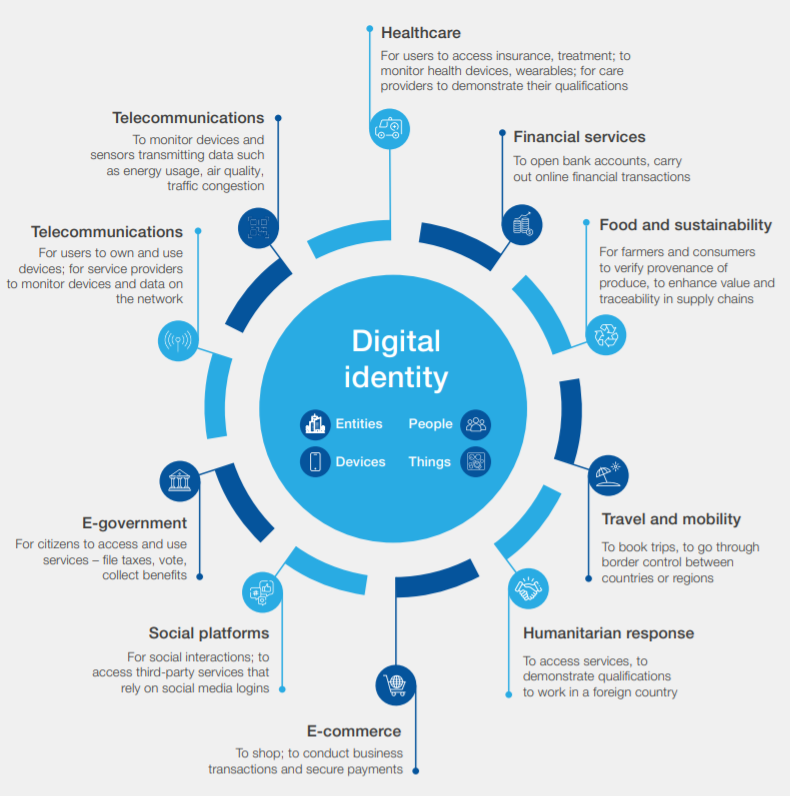

Centralized control means that the central bank controls the creation and ownership of wallets. For wholesale CBDCs (aka wCBDC), this means the central bank controls the dissemination of wallets to participating banks. For retail CBDCs (aka rCBDC), they control the dissemination of wallets to the general public. That's a huge task and in order to do it, governments are preparing to roll out digital IDs that will be integrated with CBDC wallets.

In addition to the opportunity for total financial surveillance, CBDCs can be smart technologies. They can be programmed to reject transactions with specific wallets. The central bank can shut off access to anyone, anywhere, any time. That's total financial control. If you think operation choke point or algorithmic debanking are odious today, just imagine how central bank owned AI systems in the future will decide if you are allowed to buy a loaf of bread. Better keep your social credit in the green comrade!

The War Machine

There are several ongoing developments working towards a convergence for CBDC implementation:

- Central bank CBDC development - The BIS and IMF are leading the efforts for a global blueprint

- Digital IDs - Governments all over the world are working on various projects in this space.

- War on Crypto - Governments are trying to neuter decentralized crypto adoption and use. They do not want competition.

- War on cash - From limiting access to cash (branch banking, ATM withdrawal limits), to pandemic propaganda (cash spreading disease) to algorithmic debanking, the war on cash has largely been waged quietly.

A common denominator in the war on crypto and the war on cash is the cry and focus on anti-money laundering efforts. Money laundering - whether supporting drug cartels or terrorists - is the rallying cry used to justify attacks on financial privacy. It's the fulcrum over which the balance of financial privacy/liberty and surveillance/control are being decided/justified.

The advent of decentralized crypto has opened Pandora's Box. Central banks (and governments) have glimpsed their Holy Grail. Absent an awakening amongst the people of this Earth, the world will continue marching towards a future without real money - money without counterparty entanglements.

Defend the money, defend the future

There are a few things everyone can do to prevent a dystopian CBDC future:

- Educate others - family, friends, social media strangers. Raise awareness of the issue (share this article if you like).

- Use cash - It's tempting to use a credit/debit card all the time. But metrics on the (declining) use of cash are used to shore up political support for legislation banning the use of cash. Use cash. Enjoy financial privacy while it's still available.

- Contact your representatives. Many States are currently considering legislation to ban CBDCs or promote gold/silver and crypto. Nationally, there is also the No CBDC Act. Let your representatives know that you support these bills (and oppose digital IDs).

Last edited: