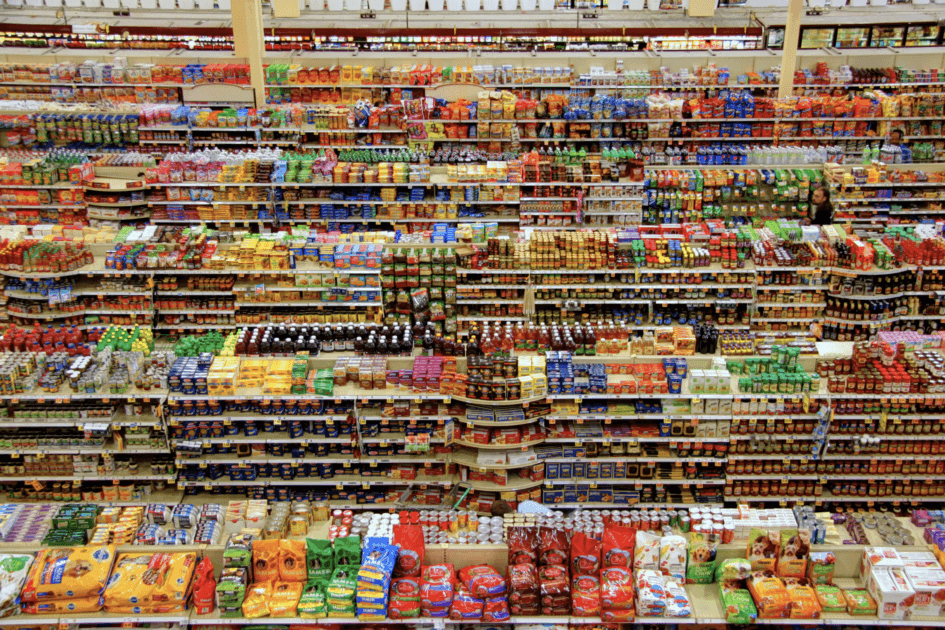

Kroger Executive Admits Company Gouged Prices Above Inflation

Updated Aug 30, 2024 at 5:00 AM EDT

Atop company leader at

Kroger has admitted during an antitrust trial the company

gouged prices on select items above

inflation levels.

While testifying to a Federal Trade Commission attorney Tuesday, Kroger's Senior Director for Pricing Andy Groff said the grocery giant had raised prices for eggs and milk beyond inflation levels.

"This is not at all surprising," Drew Powers, the founder of Illinois-based Powers Financial Group, told

Newsweek. "Companies across multiple industries have been posting record profits since the

COVID-19 crisis while consumers have faced the highest inflation in recent history. The math can only point to companies raising prices above the general level of inflation. As the old saying goes, 'Never let a good crisis go to waste.'"

More:

Kroger's senior director for pricing Andy Groff said the grocery giant had raised prices for eggs and milk beyond inflation levels.

www.newsweek.com