Any speculation on how the French Connection election is going to affect markets tomorrow? It's looking like Hollande may beat Sarkozy in the run off election. That is going to be a thorn in Germany's austerity desires. Storm clouds coalescing over the Euro?

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Welcome to the Precious Metals Bug Forums

Welcome to the PMBug forums - a watering hole for folks interested in gold, silver, precious metals, sound money, investing, market and economic news, central bank monetary policies, politics and more.

Why not register an account and join the discussions? When you register an account and log in, you may enjoy additional benefits including no Google ads, market data/charts, access to trade/barter with the community and much more. Registering an account is free - you have nothing to lose!

ancona

Praying Mantis

No way. Hollande is going to toe the line.....I practically guarantee it. He may talk a good game, and he may have won over a majority in France, but he will do what his EU masters decree. If he challenges the status quo, the market will respond by plunging, wiping a shitload of wealth off balance sheets over night, and he will be shown the light and the way. This is beyond politics now, and has become about the survival of Europe as we know it.

ancona

Praying Mantis

French election.....

Well,

The first polls are showing Hollande as the winner in France tonight. I'll bet the markets won't like it.

Who wants to bet on a market tantrum tomorrow?

Well,

The first polls are showing Hollande as the winner in France tonight. I'll bet the markets won't like it.

Who wants to bet on a market tantrum tomorrow?

How's this look???

http://www.bloomberg.com/markets/stocks/futures/

GOD BLESS & BRING OUR TROOPS HOME!!!

http://www.bloomberg.com/markets/stocks/futures/

GOD BLESS & BRING OUR TROOPS HOME!!!

swissaustrian

Yellow Jacket

- Messages

- 2,049

- Reaction score

- 0

- Points

- 0

Euro will be down.

Metals? Fear trade might drive gold up, at least in Euros, i.e. it should fall less than the Euro against the USD.

French stocks, particularly those with huge government ownership, will be down on fears of nationalization (like under Mitterand, Hollande's former boss) and/or government intervention through socialist board members.

International stocks? No clue. Maybe slightly downward. Swiss stock index (SMI) will probably be up a tiny bit due to the defensive heavyweights (Nestlé, Novartis, Roche) which are always going up when the USD strengthens against the CHF.

Greece is the joker: Is there going to be a strong anti-bailout movement in the new parliament? I doubt it, some small parties are going to be bribed to support the two establishment parties on their bailout road.

Metals? Fear trade might drive gold up, at least in Euros, i.e. it should fall less than the Euro against the USD.

French stocks, particularly those with huge government ownership, will be down on fears of nationalization (like under Mitterand, Hollande's former boss) and/or government intervention through socialist board members.

International stocks? No clue. Maybe slightly downward. Swiss stock index (SMI) will probably be up a tiny bit due to the defensive heavyweights (Nestlé, Novartis, Roche) which are always going up when the USD strengthens against the CHF.

Greece is the joker: Is there going to be a strong anti-bailout movement in the new parliament? I doubt it, some small parties are going to be bribed to support the two establishment parties on their bailout road.

swissaustrian

Yellow Jacket

- Messages

- 2,049

- Reaction score

- 0

- Points

- 0

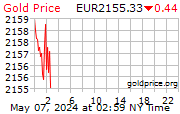

As I said above, gold is up in Euros:

Last edited: