Highlights

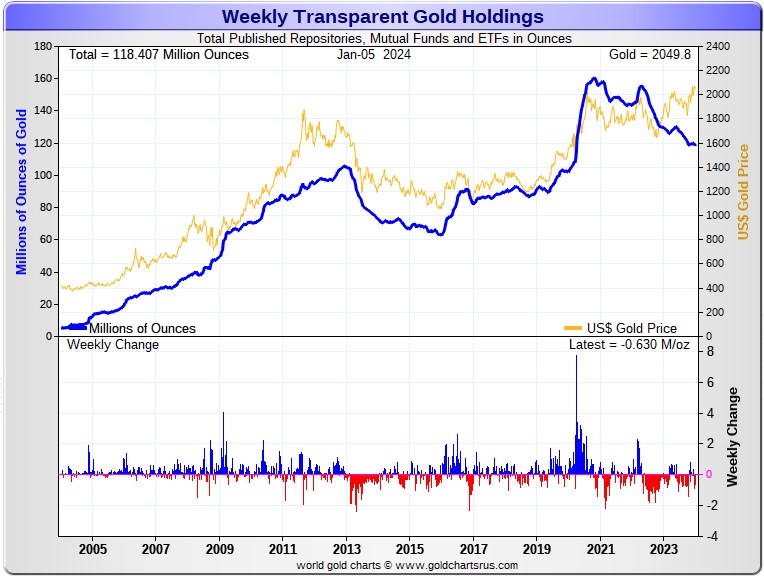

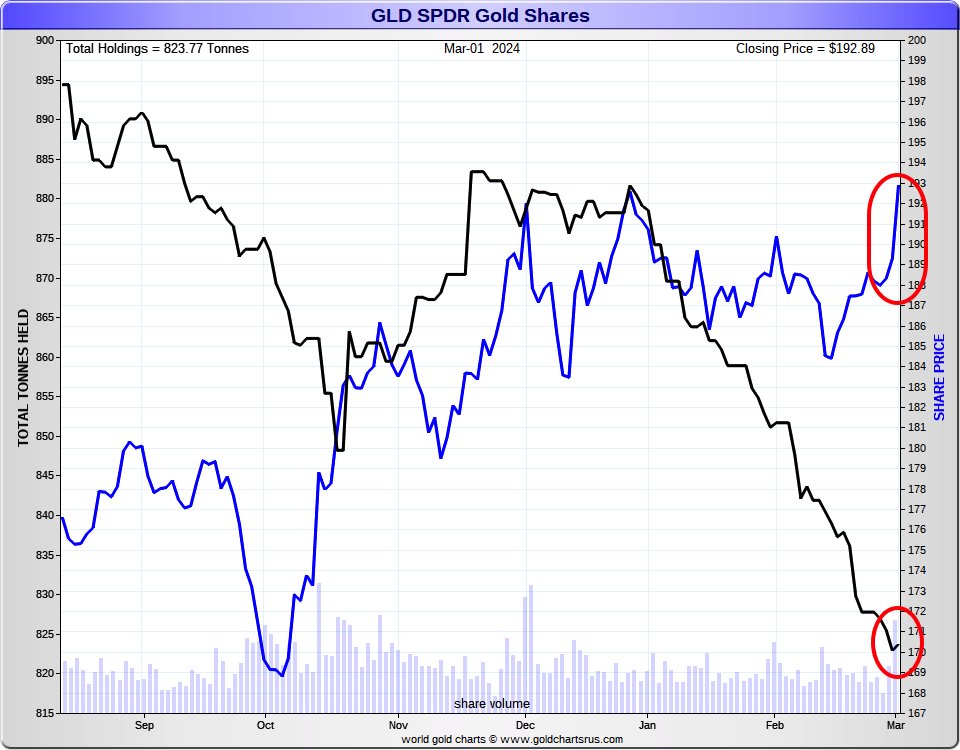

- Global gold ETFs saw a continuation of monthly outflows, despite early-April inflows spurred by the gold price strength.

- Asia led global inflows and North American funds registered positive demand; but these were dwarfed by European outflows.

- End April saw global gold ETF holdings fall to 3,079t, the lowest since February 2020. But the higher gold price in the month extended total AUM by 3% to US$229bn.

- Gold ETF trading volumes increased across all regions, with a surge in North America, indicating continued investor interest despite outflows.

...

North American funds saw their second consecutive monthly inflow, albeit small, attracting US$124mn in April. As in March, the strong gold price performance triggered in-the-money (ITM) call options of major gold ETFs, creating sizable inflows. ...

Even after accounting for these inflows, North America heads the regional outflows, losing US$4bn y-t-d, mainly due to notable outflows during January and February. But while the region’s collective holdings fell further, their AUM rose to US$117bn – the highest since April 2022, 10% below the month-end peak of US$129bn recorded in August 2020.

Europe once again led global outflows, losing US$4bn in April and representing the eleventh consecutive month of losses. Funds listed in the UK, France and Germany led outflows. ...

April compounded Europe’s y-t-d losses to nearly US$7bn, with the UK, Switzerland and Germany accounting for most of the region’s outflows. But accounting for higher prices, AUM in European funds have increased by 3% since the beginning of 2024.

April (+US$1bn) extended Asian funds’ inflow streak to 14 months. China was the main engine in the month, where gold ETFs witnessed not only record monthly inflows (+US$1bn) but also reached their highest AUM ever. And the growth in assets amounts to a stunning 36% so far in 2024. In general, a sluggish equity market, expectations of a weaker local currency, increasing promotional efforts from ETF providers’ and strong price performance were the main drivers. Pushed by China’s sizable inflows, Asian funds have, collectively, added US$2bn during the first four months of 2024; their total AUM has jumped 35% y-t-d, rising to the highest on record.

Funds in the other region saw mild outflows during the month, losing US$65mn, driven mainly by Australia and South Africa. At the end of April, the region’s y-t-d outflows amount to US$58mn, with Australia accounting for the bulk.

...