You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Gold-Silver Ratio

- Thread starter BigJim

- Start date

-

- Tags

- gold silver ratio gsr

Welcome to the Precious Metals Bug Forums

Welcome to the PMBug forums - a watering hole for folks interested in gold, silver, precious metals, sound money, investing, market and economic news, central bank monetary policies, politics and more.

Why not register an account and join the discussions? When you register an account and log in, you may enjoy additional benefits including no Google ads, market data/charts, access to trade/barter with the community and much more. Registering an account is free - you have nothing to lose!

Ratio hit 105+/1 earlier today.

So low! :rotflmbo:

Hope it continues "normalizing". I recall when the GSR was around 80/1 and everyone was saying that was so high and silver was ready for liftoff... I guess the economy opening back up again is what is giving silver a bid, but you never really know with these markets.

Fiddle & Rose

Fly on the Wall

- Messages

- 21

- Reaction score

- 6

- Points

- 3

Silver seems to have caught some wind since yesterday.

Good thing I've been buying rounds.

72.9/1

youve been watching GSR pretty closely for a long time Jim

Did you sell any gold and buy silver ?

It could still be a good move even now ...........

Im so pissed off with silver ( now only down 25% for me ) that I would rather wait till it goes parabolic again then sell thebloody stuff to buy gold (-:

Did you sell any gold and buy silver ?

It could still be a good move even now ...........

Im so pissed off with silver ( now only down 25% for me ) that I would rather wait till it goes parabolic again then sell thebloody stuff to buy gold (-:

The G/S ratio ranged between 60 and 90 (roughly) for the last 7 years. Prior to the silver boom around 2011, the ratio ranged between 50 and 80 for the prior decade (more or less). Looking at the historical chart for the last 30 years, outside of short lived spikes/valleys, the ratio seems to range steadily between 50 and 90 (seems like a huge range, but the charts show fairly steady slopes between the spikes). We are exiting a sharp spike in the ratio. It would seem that the ratio is likely to get range bound again for a while (maybe between 70 and 90?).

89.3+/1 This AM. Heading back to 90+???

Gold Silver Ratio (goldprice.org)

Gold Silver Ratio (goldprice.org)

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,608

- Points

- 298

From the Fringe 27/9/22...

GSR falling against a falling gold price... this isn't typical. Watching the last few weeks of price action I just have that feeling that there is someone stuck in silver. Bash gold to flush liquidity out in silver seems to be the game for now and really it only seems to have started working in the last few days. I think there is more to this story, I will not bat an eyelid if it results in a fast turnaround in silver in the next month or two.

GSR falling against a falling gold price... this isn't typical. Watching the last few weeks of price action I just have that feeling that there is someone stuck in silver. Bash gold to flush liquidity out in silver seems to be the game for now and really it only seems to have started working in the last few days. I think there is more to this story, I will not bat an eyelid if it results in a fast turnaround in silver in the next month or two.

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,608

- Points

- 298

Perhaps stress in forex (yen carry trades?) affecting gold but not silver at the moment?

I've noted over the years @ turning points the silver shorts bash gold to create liquidity to cover in silver while shying off further shorting silver. Gold is more liquid, easier to get out of and it is easier to create insurance positions with gold options and stocks that are 'unrelated' to the silver trading in the authorities eyes. At these times you see the GSR move ahead of price and you see relative strength in silver.

If I were a bankster that is how I would trade it, as it is I'm just a pirate so while I think like a bankster I'm free lance... LOL.

My 2c worth...

Lancers32

Often Wrong Never In Doubt

- Messages

- 1,870

- Reaction score

- 2,144

- Points

- 298

From the Fringe 27/9/22...

GSR falling against a falling gold price... this isn't typical. Watching the last few weeks of price action I just have that feeling that there is someone stuck in silver. Bash gold to flush liquidity out in silver seems to be the game for now and really it only seems to have started working in the last few days. I think there is more to this story, I will not bat an eyelid if it results in a fast turnaround in silver in the next month or two.

Somebody sure is stuck in Silver all right. All those bagholders at GIM. jk

TheRealZed

Retired Sailor

- Messages

- 3,002

- Reaction score

- 3,608

- Points

- 298

Somebody sure is stuck in Silver all right. All those bagholders at GIM. jk

Religious posting isn't allowed here dude! Solly!

Au-Myn

Fly on the Wall

87.4/1 for the weekend.

Gold Silver Ratio (goldprice.org)

Gold Silver Ratio (goldprice.org)

82.9/1 Monday AM. Ag over $20.00

Gold Silver Ratio (goldprice.org)

Gold Silver Ratio (goldprice.org)

- Messages

- 486

- Reaction score

- 879

- Points

- 193

Especially on a Monday, the usual beat it like a rented mule day.

Au-Myn

Fly on the Wall

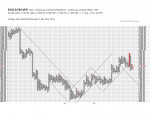

On this updated chart the completed pattern is a Triple Bottom (shaded) with the third bottom sell signal occurring at 840 following the High Pole warning.A High Pole warning on this 3 x 10 reversal - scale factor 10 Au Ag Relative Strength P & F chart. This should be interesting...

View attachment 215

81.7/1 Tonight. Down another Oz through the day.

Gold Silver Ratio (goldprice.org)

Gold Silver Ratio (goldprice.org)

Article on GSR courtesy of savvydon.

The Gold-Silver Ratio Explained - JHCB (jackhunt.com)

The Gold-Silver Ratio Explained - JHCB (jackhunt.com)

Back Up: 84.5/1 Wednesday AM

Gold Silver Ratio (goldprice.org)

Gold Silver Ratio (goldprice.org)

84.1/1 Friday Am with Au under $1700 & Ag headin' back under $20

84.2/1 For the weekend.

Back over 86/1 this AM.

Now over 87/1 3:30 Pm EST.

Now over 87/1 3:30 Pm EST.

Last edited:

Touched over 88/1 This PM.

Thurs AM 88.2/1 almost hit 89.

Thurs AM 88.2/1 almost hit 89.

Last edited:

90.2/1 Midday Friday.

91.1/1 For the weekend.

88.6/1 To start the week.

85.4/1 For the weekend.

86.4/1 to start the week.

85.3/1 Midday, midweek.

85.55/1 For the weekend. Grill some steaks or chops!!!

83.5/1 This AM.