It certainly LOOKS like Repos are piling up now (car's first). Lending is getting really restrictive but no one wants to take the Loss. Because then that shows up on your books and dealers/bankers freak out.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Real Estate and foreclosure thread

- Thread starter BackwardsEngineer

- Start date

Welcome to the Precious Metals Bug Forums

Welcome to the PMBug forums - a watering hole for folks interested in gold, silver, precious metals, sound money, investing, market and economic news, central bank monetary policies, politics and more.

Why not register an account and join the discussions? When you register an account and log in, you may enjoy additional benefits including no Google ads, market data/charts, access to trade/barter with the community and much more. Registering an account is free - you have nothing to lose!

...

Housing inflation has been stubbornly high for months, according to CPI data. But economists think it has peaked and is on the precipice of a reversal.

"I know this with about as high a degree of confidence as one could have," Mark Zandi, chief economist at Moody's Analytics, said of falling housing inflation being near at hand.

...

Why economists say it's a near certainty that housing inflation will soon fall

The consumer price index will soon reflect easing price trends in U.S. housing, economists said.

- Messages

- 36,149

- Reaction score

- 6,239

- Points

- 288

City can no longer afford life-long subsidies for lucky NYCHA tenants

If the definition of insanity involves doing the same thing repeatedly and hoping for a different result, maybe the long-troubled New York City Housing Authority, the nation’s largest, isn’t entirely insane after all.Rather than pouring yet more money into repairs of the crumbling Fulton and Elliot-Chelsea Houses, among the nation’s oldest public-housing projects, NYCHA has — boldly — decided to tear them down, as it announced Wednesday.

City can no longer afford life-long subsidies for lucky NYCHA tenants

NYCHA has boldly —decided to tear the crumbling Fulton and Elliot-Chelsea Houses down, as it announced Wednesday.

Last edited:

- Messages

- 36,149

- Reaction score

- 6,239

- Points

- 288

Federal Appeals Court Dismisses Challenge to Compulsory-Eviction Law

On Friday afternoon, the 7th U.S. Circuit Court of Appeals dismissed a lawsuit challenging an ordinance that Granite City, Illinois, used to make hundreds of low-income families homeless. Under the ordinance, the city would force private landlords to evict entire households if any member was charged with a felony anywhere within city limits.The Institute for Justice (IJ) represents two victims of Granite City’s compulsory-eviction law. For years, Debi Brumit and Andy Simpson lived in a private rental home in the city. In 2019, however, one of Debi’s adult daughters was arrested within city limits for trying to steal a van. Debi and Andy had nothing to do with the crime. They did not know the crime had happened. Debi’s daughter did not even live with them. But because the daughter sometimes spent time in their home, Granite City officials ordered the couple’s landlord to evict them—along with two of Debi’s grandchildren (at the time, a toddler and an infant). Only after IJ secured a temporary restraining order against the city were Debi and Andy able to stay in their home.

Federal Appeals Court Dismisses Challenge to Compulsory-Eviction Law - Institute for Justice

On Friday afternoon, the 7th U.S. Circuit Court of Appeals dismissed a lawsuit challenging an ordinance that Granite City, Illinois, used to make hundreds of […]

Real Estate an odd place for the decline to start.

www.zerohedge.com

www.zerohedge.com

Why AirBnB Owners Are About To Be Forced Property Sellers | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

- Messages

- 36,149

- Reaction score

- 6,239

- Points

- 288

Real Estate Newsletter Articles this Week: New Home Sales Increase in May

At the Calculated Risk Real Estate Newsletter this week: • New Home Sales increase to 763,000 Annual Rate in May • Case-Shiller: Nationa...

- Messages

- 36,149

- Reaction score

- 6,239

- Points

- 288

On the local front prices keep going up. Old neighborhood.............

www.realtor.com

www.realtor.com

www.realtor.com

www.realtor.com

3732 Morrow Dr, Bensalem, PA 19020 | realtor.com®

See photos and price history of this 3 bed, 1 bath, 936 Sq. Ft. recently sold home located at 3732 Morrow Dr, Bensalem, PA 19020 that was sold on 05/30/2023 for $310000.

3708 Cedarcrest Rd, Bensalem, PA 19020 | realtor.com®

View 1 photos for 3708 Cedarcrest Rd, Bensalem, PA 19020, a 4 bed, 2 bath, 1,209 Sq. Ft. single family home built in 1955 that was last sold on 01/20/2023.

On the local front prices keep going up. Old neighborhood.............

3732 Morrow Dr, Bensalem, PA 19020 | realtor.com®

See photos and price history of this 3 bed, 1 bath, 936 Sq. Ft. recently sold home located at 3732 Morrow Dr, Bensalem, PA 19020 that was sold on 05/30/2023 for $310000.www.realtor.com

3708 Cedarcrest Rd, Bensalem, PA 19020 | realtor.com®

View 1 photos for 3708 Cedarcrest Rd, Bensalem, PA 19020, a 4 bed, 2 bath, 1,209 Sq. Ft. single family home built in 1955 that was last sold on 01/20/2023.www.realtor.com

The stock market is still going up too? Mainly via like 5 stocks. Do you believe that too?

- Messages

- 36,149

- Reaction score

- 6,239

- Points

- 288

From Daily Mail. May not want to open with phone - lotta pics.

www.dailymail.co.uk

www.dailymail.co.uk

Billionaire 'cowboys' are buying up historic ranches across the US

Ranches across the West are rapidly being bought up by wealthy Americans looking for somewhere to park their cash.

- Messages

- 36,149

- Reaction score

- 6,239

- Points

- 288

N.J. AG corruption investigation focuses on George Norcross’ influence over Camden waterfront developments, sources say

Investigators appear focused on whether Norcross used his political influence to acquire valuable real estate by muscling out rival developers.

- Messages

- 36,149

- Reaction score

- 6,239

- Points

- 288

Real Estate Newsletter Articles this Week: Asking Rent Growth Flat Year-over-year

At the Calculated Risk Real Estate Newsletter this week: • Asking Rent Growth Flat Year-over-year • Early Look at Local Housing Markets ...

Visualizing America's 1 Billion Square Feet Of Empty Office Space | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

When ranked by Total Vacancy %, I was surprised to see that Houston isn't far behind San Francisco.

- Messages

- 36,149

- Reaction score

- 6,239

- Points

- 288

SAN DIEGO (KGTV) — A controversial new ordinance came into force on Saturday in San Diego requiring landlords to compensate renters when their lease is terminated through no fault of their own.

“This is a good step in the right direction,” said Rafael Bautista, director of the San Diego Tenants Union.

The ordinance, which was brought forward by San Diego Mayor Todd Gloria and Council President Sean Elo-Rivera gives tenants new protections that start on the first day of their lease.

www.10news.com

www.10news.com

“This is a good step in the right direction,” said Rafael Bautista, director of the San Diego Tenants Union.

The ordinance, which was brought forward by San Diego Mayor Todd Gloria and Council President Sean Elo-Rivera gives tenants new protections that start on the first day of their lease.

Controversial ordinance gives San Diego renters new rights

A controversial new ordinance came into force on Saturday in San Diego requiring landlords to compensate renters when their lease is terminated through no fault of their own.

- Messages

- 36,149

- Reaction score

- 6,239

- Points

- 288

Part 1: Current State of the Housing Market; Overview for mid-July

NOTE: I’ve been working on “Will house prices decline further later this year?”, and I’ll try to post it soon! In this 2-part overview of the housing market for mid-July, I’ll discuss new and existing home inventory and sales, house prices, mortgage rates, rents and more.

Part 2: Current State of the Housing Market; Overview for mid-July

House Prices have turned negative year-over-year, but picked up recently

SAN DIEGO (KGTV) — A controversial new ordinance came into force on Saturday in San Diego requiring landlords to compensate renters when their lease is terminated through no fault of their own.

“This is a good step in the right direction,” said Rafael Bautista, director of the San Diego Tenants Union.

The ordinance, which was brought forward by San Diego Mayor Todd Gloria and Council President Sean Elo-Rivera gives tenants new protections that start on the first day of their lease.

Controversial ordinance gives San Diego renters new rights

A controversial new ordinance came into force on Saturday in San Diego requiring landlords to compensate renters when their lease is terminated through no fault of their own.www.10news.com

Illinois did something similar. RE will do MUCH worse in these political areas.

- Messages

- 36,149

- Reaction score

- 6,239

- Points

- 288

Ohio senator raises alarm over corporate investors potentially jeopardizing middle-class housing

Jul 12, 20236:46

Some Ohio lawmakers fear new housing and rental trends will soon kill the middle class. They claim out-of-state and corporate investors are buying up Ohio homes as soon as they hit the market and then renting them for profit.

- Messages

- 36,149

- Reaction score

- 6,239

- Points

- 288

Industrial real estate cools but remains healthy

The industrial real estate market is beginning to revert back to solid pre-pandemic levels, a Cushman & Wakefield report says.

www.freightwaves.com

www.freightwaves.com

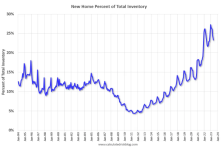

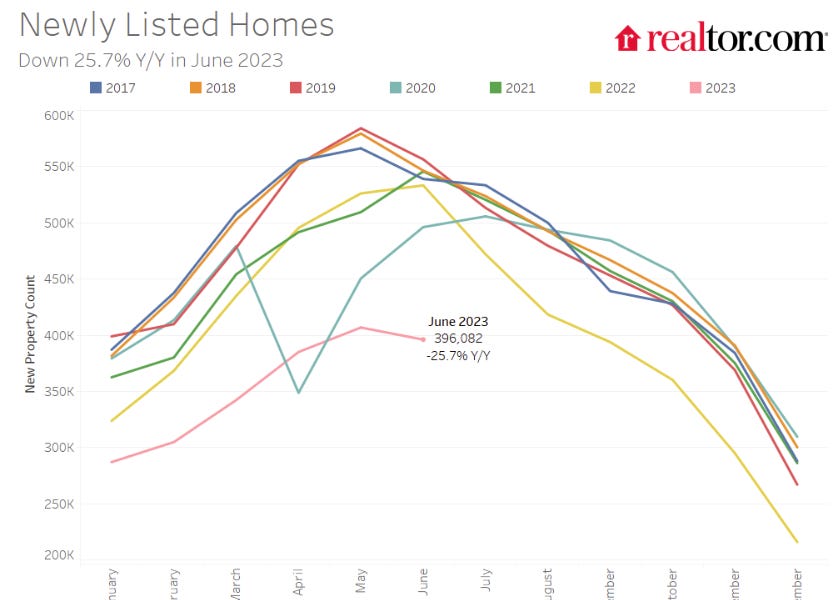

This

View attachment 9309

And This, Do Not Compute. Unless the market thinks they are all gonna get snapped up.

View attachment 9310

It is interesting that the new home sales always seemed to peak ~6 months before the recession.

As soon as I see some momentum weakness here I will be looking to short some home builders.

- Messages

- 36,149

- Reaction score

- 6,239

- Points

- 288

Another walk & talk with Michael. He's in Cali (Marina del Rey.)

Jul 21, 2023

22:35

According to data firm Attom, foreclosure activity is ramping back up to pre pandemic norms and will likely only continue to rise as folks cannot keep up with the increased cost of living. The U.S. housing market is likely to see major shifts over the next few years as mortgage rates remain high, home buying purchasing power is suppressed and more people feel the financial squeeze.

Jul 21, 2023

22:35

According to data firm Attom, foreclosure activity is ramping back up to pre pandemic norms and will likely only continue to rise as folks cannot keep up with the increased cost of living. The U.S. housing market is likely to see major shifts over the next few years as mortgage rates remain high, home buying purchasing power is suppressed and more people feel the financial squeeze.

- Messages

- 36,149

- Reaction score

- 6,239

- Points

- 288

Dan Haar: A property owner returns to CT, finds a new $1.5M house on his land. Now police are involved

For the last two years, the online land records page in the town of Fairfield has offered a “fraud alert” service. Anyone can sign up to see legal filings on their property. It’s part of the careful new world – but no one could anticipate the situation that’s unfolding on Sky Top Terrace, near Sacred Heart University.

Dr. Daniel Kenigsberg grew up in a house his parents bought on the semicircular street in 1953, when he was a 1-year-old. After medical school in New York and residency in Maryland, he and his wife raised their two children on Long Island, across the Sound from Fairfield.

Kenigsberg never lost his fondness for the town. For decades, he held on to a vacant parcel of just under a half-acre next door to his childhood home. His father had bought that land, also in 1953, directly from Eleazar Parmly Jr. -- the family that settled the area in 1716.

More:

Dan Haar: A property owner returns to CT, finds a new $1.5M house on his land. Now police are involved

A Long Island doctor’s half-acre parcel in Fairfield has been in his family for 70...

- Messages

- 36,149

- Reaction score

- 6,239

- Points

- 288

Real Estate Newsletter Articles this Week: Case-Shiller House Prices Decreased 0.5% year-over-year

At the Calculated Risk Real Estate Newsletter this week: • Case-Shiller: National House Price Index Decreased 0.5% year-over-year in May ...

- Messages

- 36,149

- Reaction score

- 6,239

- Points

- 288

Los Angeles Rent Repayment Deadline Looms, Wave Of Eviction Actions Possible

Come Tuesday, Los Angeles landlords will be looking to collect the rents that were legally withheld because of the Covid-19 pandemic.That’s when the rent debt repayment program enacted in the height of the pandemic’s first wave will come into effect. Ironically, the program – designed to help those whose jobs were shut down by the initial wave of the disease – arrives at a time where the city is again faced with an economic crisis. This time, the twin SAG-AFTRA and WGA strikes have affected the guild memberships and the ancillary businesses that rely on their work product and patronage.

More:

- Messages

- 36,149

- Reaction score

- 6,239

- Points

- 288

'Renters Are Struggling': Economists Back Tenant-Led Push for Federal Rent Control

"We have seen corporate landlords—who own a larger share of the rental market than ever before—use inflation as an excuse to hike rents and reap excess profits beyond what should be considered fair and reasonable."

www.commondreams.org

www.commondreams.org

Federal rent controls. Lol. You wanna crash the markets, that will crash the market.

Just some anecdotal information. Might have sold my condo in SoCal recently. Getting a lot of offers very well over ask and had a good bidding war. The first offer hit on the first day it was listed and it was $35k over ask. We didn’t go with it. Got multiple offers well above that one and better terms. The 7.5% mort rates are certainly not slowing down certain people. Insane how much money people have.

Just some anecdotal information. Might have sold my condo in SoCal recently. Getting a lot of offers very well over ask and had a good bidding war. The first offer hit on the first day it was listed and it was $35k over ask. We didn’t go with it. Got multiple offers well above that one and better terms. The 7.5% mort rates are certainly not slowing down certain people. Insane how much money people have.

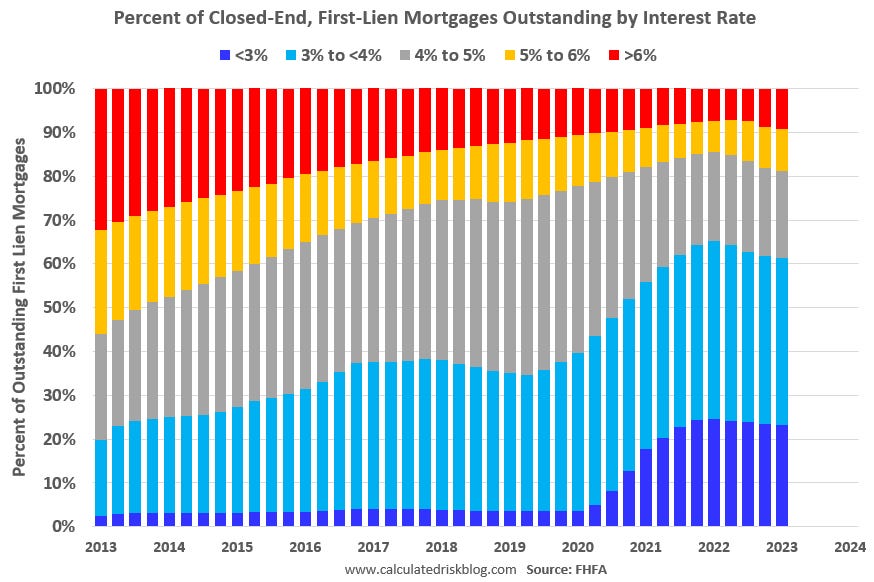

It's very odd... I don't think they even have the money. People are just buying "real things" at any price. Too me, it screams we are entering hyper-inflation and the money is dying in front of our eyes.

Single family homes will be the last one to crash. I am cashing out soon and hope to buy some vacant land somewhere after the dust settles to put a smaller home on it in some form or another. I was even considering a used yacht to live aboard until the insanity stops and also have a getaway in case of emergency.

It's very odd... I don't think they even have the money. People are just buying "real things" at any price. Too me, it screams we are entering hyper-inflation and the money is dying in front of our eyes.

Some buyers with substantial down payment. Doctor. Engineer couple. Etc. others were very desperate and had already lost offers on 3 prior homes or been looking for 3 months. We had to wave loan contingency to make things competitive and 21 day close was popping up occasionally throughout the offers. I think I’ll buy a shit load of gold and silver. I got over $50k over ask price. Large chunk to taxman for sure though.

Viking

Yellow Jacket

You could live undersea for a while.Single family homes will be the last one to crash. I am cashing out soon and hope to buy some vacant land somewhere after the dust settles to put a smaller home on it in some form or another. I was even considering a used yacht to live aboard until the insanity stops and also have a getaway in case of emergency.

Viking

Yellow Jacket

Homes are ridiculously expensive in my neighborhood. I asked a realtor how people can afford this. He said it’s a lot of old money or parents helping with a huge down payment.Some buyers with substantial down payment. Doctor. Engineer couple. Etc. others were very desperate and had already lost offers on 3 prior homes or been looking for 3 months. We had to wave loan contingency to make things competitive and 21 day close was popping up occasionally throughout the offers. I think I’ll buy a shit load of gold and silver. I got over $50k over ask price. Large chunk to taxman for sure though.

- Messages

- 36,149

- Reaction score

- 6,239

- Points

- 288

US set to unveil long-awaited crackdown on real estate money laundering

NEW YORK, Aug 10 (Reuters) - The U.S. Treasury Department will soon propose a rule that would effectively end anonymous luxury-home purchases, closing a loophole that the agency says allows corrupt oligarchs, terrorists and other criminals to hide ill-gotten gains.The long-awaited rule is expected to require that real estate professionals such as title insurers report the identities of the beneficial owners of companies buying real estate in cash to the Treasury's Financial Crimes Enforcement Network (FinCEN).

Read the rest:

US set to unveil long-awaited crackdown on real estate money laundering

The U.S. Treasury Department will soon propose a rule that would effectively end anonymous luxury-home purchases, closing a loophole that the agency says allows corrupt oligarchs, terrorists and other criminals to hide ill-gotten gains.

- Messages

- 36,149

- Reaction score

- 6,239

- Points

- 288

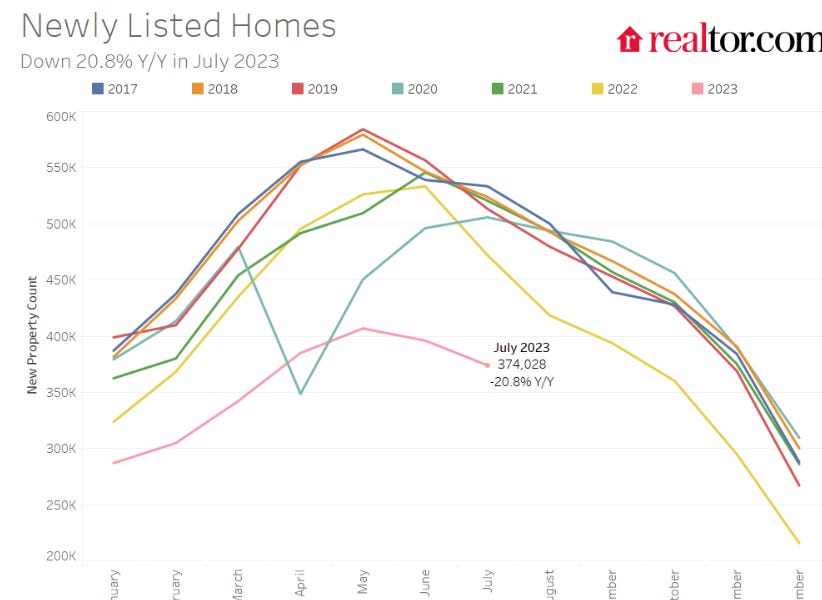

Part 1: Current State of the Housing Market; Overview for mid-August

Part 1: Current State of the Housing Market; Overview for mid-August

In this 2-part overview of the housing market for mid-August, I’ll discuss new and existing home inventory and sales, house prices, mortgage rates, rents and more. New Listings Near Pandemic Low for July Here is a graph of new listing from Realtor.com’s

- Messages

- 36,149

- Reaction score

- 6,239

- Points

- 288

A little bit of this and that in this one.

I’m 49, I live in a major metropolitan area and I have a $540,000 mortgage. I put 20% down when I purchased it several years ago. I earn six figures ($185,000 a year, excluding bonuses). I do not carry credit-card debt month-to-month, but I do rack up charges of about $1,500 or more every month. I am a single man, and live a relatively quiet life — I go to the cinema and eat out with friends as one of my few social outlets, and have given up going to the theater and concerts due to the expense.

Here’s my problem: I have 25 years left (you read that right) on my mortgage. I will never be able to pay off my mortgage before I retire at 67, and the prospect of working at this level — my job involves travel and is very stressful and, at times, uncertain — for the next 20 years is crippling. I’m already exhausted. I wake up in the morning, and my first response is, “Here we go again.” Or, on a bad day, “Oh, no.” Sometimes, it’s a struggle to get out of bed.

More;

www.marketwatch.com

www.marketwatch.com

‘Retire at 67? I’m already exhausted’: I’m 49 with 25 years left on my $540,000 mortgage. Am I doomed?

I’m 49, I live in a major metropolitan area and I have a $540,000 mortgage. I put 20% down when I purchased it several years ago. I earn six figures ($185,000 a year, excluding bonuses). I do not carry credit-card debt month-to-month, but I do rack up charges of about $1,500 or more every month. I am a single man, and live a relatively quiet life — I go to the cinema and eat out with friends as one of my few social outlets, and have given up going to the theater and concerts due to the expense.

Here’s my problem: I have 25 years left (you read that right) on my mortgage. I will never be able to pay off my mortgage before I retire at 67, and the prospect of working at this level — my job involves travel and is very stressful and, at times, uncertain — for the next 20 years is crippling. I’m already exhausted. I wake up in the morning, and my first response is, “Here we go again.” Or, on a bad day, “Oh, no.” Sometimes, it’s a struggle to get out of bed.

More;

'Retire at 67? I'm already exhausted': I'm 49 with 25 years left on my $540,000 mortgage. Am I doomed?

'I wake up in the morning, and my first response is, "Here we go again."’

Guy has probably never done a budget in his life. Five years in means he has a good interest rate. What is the problem?

Should take home at least 10 grand a month. Less the mortgage ~$2,500 less his $1,500 on CC. Leaves plenty

Should take home at least 10 grand a month. Less the mortgage ~$2,500 less his $1,500 on CC. Leaves plenty

- Messages

- 36,149

- Reaction score

- 6,239

- Points

- 288

5 real-estate investors who 'house hacked' to afford their first properties explain how the strategy works and can help anyone build wealth

Housing hacking is "the most inexpensive way to buy real estate," says one investor, who used the strategy to buy his first home in Boston.

- Messages

- 36,149

- Reaction score

- 6,239

- Points

- 288

- China’s heavily indebted property developer Evergrande Group on Thursday filed for Chapter 15 bankruptcy protection in a U.S. bankruptcy court.

- In a filing to the Manhattan bankruptcy court, the firm sought recognition of restructuring talks underway in Hong Kong, the Cayman Islands and the British Virgin Islands.

- The world’s most indebted property developer defaulted in 2021 and announced an offshore debt restructuring program in March.

China's property giant Evergrande files for bankruptcy protection in Manhattan court

The world's most indebted property developer defaulted in 2021 and announced an offshore debt restructuring program in March.

- Messages

- 36,149

- Reaction score

- 6,239

- Points

- 288

Another challenge for homebuyers: More investors are snapping up homes, and 40% of them are using cash

As mortgage rates surge and rattle home buyers, some investors have stayed more active than ever this summer, CoreLogic says.

- Messages

- 36,149

- Reaction score

- 6,239

- Points

- 288

Landlord Orders Low-Income Tenants To Pay Rent Again After Property Manager Reportedly Steals Their Checks

A former apartment manager is under investigation after she allegedly took advantage of her low-income tenants by stealing their checks and ordering them to pay again.Casey Oiler was charged with theft in Warren County, Tennessee, and is being investigated in Manchester and Decherd for stealing rent payments, WSMV 4 reported.

The three properties Oiler is accused of stealing from are owned by the Volunteer Management Company. The company recently sent a letter to its tenants that it isn't their fault that their rent payments were stolen, but they still asked residents to pay again.

More: