You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

*Sigh* Platinum takes a dump, again...

- Thread starter DoChenRollingBearing

- Start date

Welcome to the Precious Metals Bug Forums

Welcome to the PMBug forums - a watering hole for folks interested in gold, silver, precious metals, sound money, investing, market and economic news, central bank monetary policies, politics and more.

Why not register an account and join the discussions? When you register an account and log in, you may enjoy additional benefits including no Google ads, market data/charts, access to trade/barter with the community and much more. Registering an account is free - you have nothing to lose!

You can buy my Pt for hmm.... We need a decent new car. I'd say about 20 grand would get you an ounce or two. Offer is only valid for a month or so.

Police Car Light Joypixels Sticker - Police Car Light Joypixels Indicator Light - Discover & Share GIFs

Click to view the GIF

I suppose if you go to SD, BE, Bold, BGASC, Liberty, Silver Gold Bull, Money Metals Exchange, Monument Metals and KITCO you could probably score 500 oz in various sizes, but then the cat is out of the bag. Future spot price might be a bit higher with no physical inventory in NY or CA, but buying physical on the Shanghai Exchange might cost an extra $500-$1k per ounce. That's their game.

When I first started buying platinum coins only Kitco and SD had any regular inventory and little selection. Get what you want while you can folks because it will be unobtanium in < 7 years. Regular stackers will cash in at some point and then you need through Russia, South Africa or China to get more.

You can't just open a new platinum mine. It's byproduct from copper and gold mining and production cannot simply be ramped up like the petroleum industry.

Crazy talk is $20k per oz by the end of the bull run. I am cashing out before then.

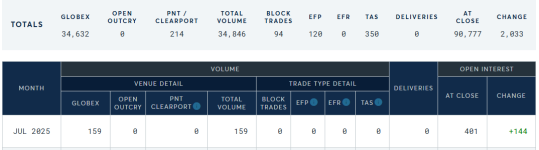

Makes sense because they were out... Managed to deliver 841 contracts in the middle of the month yesterday.

Oh my...

abrdn Physical Platinum Shares (PPLT) ETF Alert

One subject not discussed very often is the "Fails to Deliver" (FTD)

PPLT had one of the most concentrated periods from May 2025 to late June 2025 of clearing firms failing to deliver shares. (top chart)

Failure can occur when a buyer (the party with a long position) doesn't have enough money to take delivery and pay for the transaction at settlement.

A failure can also occur when the seller (the party with a short position) does not own all or any of the underlying assets required at settlement, and so cannot make the delivery.

It appears that these failures coincided with the spike in the platinum price as well as the borrowing fee (Bottom chart) to short shares. Could mean that as available physical Platinum became more expensive, the ability of authorized participants or market makers to manage share creation and redemption as well as stock lending operations became impaired or more difficult. It is possible that short positions were possibly naked at one point.

This is another risk of trading securities.

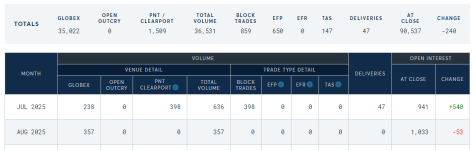

It is noteworthy and who knows how much Platinum is available out there for COMEX to hover up. They have doubled inventory in a couple weeks. But, having delivered over 4,000 contracts this month (205,950 oz in July only). They still have just under 2 months of inventory left at that pace of deliveries.

Monthly this year

__ TOTALS: |Dec- 117 |Jan- 2681 |Feb- 610 |March- 875 |April- 4928 |May- 390 |June- 1177 |July- 4124 |

Also I just noticed but Palladium is having None of this activity. They only delivered 85 contracts for Palladium. I presume that was a normal month for both not long ago.

Monthly this year

__ TOTALS: |Dec- 117 |Jan- 2681 |Feb- 610 |March- 875 |April- 4928 |May- 390 |June- 1177 |July- 4124 |

Also I just noticed but Palladium is having None of this activity. They only delivered 85 contracts for Palladium. I presume that was a normal month for both not long ago.

Last edited:

Besides reconfiguring the FED, Trump needs to change the COMEX where it is more of a delivery institution instead of a market manipulator, so we can compete with what the BRICS are setting up with Embridge.

When should the July contracts be done and they have to start Aug delivery?

Trying to read to answer my own question. Their rule says "No trades in Platinum futures deliverable in the current month shall be made after the third last business day of that month." So I'd guess it stops trading tomorrow...maybe today.

This is what Grok said when asked a similar question about the July silver contract:

Grok said:The last day for traders to decide if they want to stand for delivery on the COMEX July silver contract is the last trading day. For the July 2025 contract, this is July 29, 2025.To arrive at this date, note that COMEX silver futures trading terminates on the third last business day of the delivery month. July 2025 has 31 days and ends on a Thursday. The last three business days (Monday–Friday, with no applicable holidays affecting them) are July 29 (Tuesday), July 30 (Wednesday), and July 31 (Thursday). Thus, the third last business day is July 29. Traders can close out positions up to this date if they do not wish to proceed to delivery; open positions after this point are committed to the delivery process.

Looks like a pretty stead amount of Pt, over 1000 Aug contracts right now. Silver is just barely over that number of contracts right now.

Well, they've dumped a nice 10-15,000 contracts this morning. Had a nice $30 gain overnight and they've gotten back to red briefly. That's 50,000 ounces they don't have. It was basically a whole days worth of contracts in an hour. Desperate much?

Last edited:

Nice little pull back today with the FOMC jokers on deck. Looking for $1300 to possibly add a leveraged position.

Platinum Lease Rate Again Rises Above 21% As Platinum Shortage Intensifies

Platinum’s 1-month lease rate has risen above 20% again.

They can manipulate the paper spot price of Pt much easier than Au because the market is so small. It's only a matter of time before all the surplus physical is sent through arbitrage from west to east where it will never return. Then the paper price will not mean much because there will not be enough physical inventory to establish a nominal value.

I'm not so sure about that any more. That would be common sense but I don't think that's the way it works. They can control Gold prices. Think about that. They can price money itself... It's almost easier to control the Biggest markets with the computer algo's. Just look at the markets that they lost control over in the past decade or so. You had the Nickle market squeeze, then Cocoa prices went nuts. Those were both Physical events because they didn't have enough of the real thing when it was needed.

Seems like the physical crunch in Platinum has let up just a bit. Would be curious to see what the lease rates look like now. Anyway, This looks to be possibly getting ready for a C wave correction move. I could see this happening with a big market pullback and economic concerns. I would be backing up the truck and loading up between $1,100 and the moving average area around $1,200.

All the world needs is a declared debt crisis from a country like Japan, China or the USA to cause everything to breakdown. Then the next matter will be lots of movement to liquidity as everybody will be selling everything including PMs. After that the PM market will go parabolic in search of real price discovery.

All the world needs is a declared debt crisis from a country like Japan, China or the USA to cause everything to breakdown. ...

Will France do?

Remember, they are in business to make a profit just like the buffalo hunters and whalers of the 19th century. Eventually physical will run out. Looks like platinum will break through $1500 soon.

When the US labels silver a strategic metal it will start catching up to gold fast. Others are already front running Ag. Did they ever figure out who was the person that locked up the ASE market with a giant purchase over a year ago? Platinum market is 1/10th the size of the silver market.

When the US labels silver a strategic metal it will start catching up to gold fast. Others are already front running Ag. Did they ever figure out who was the person that locked up the ASE market with a giant purchase over a year ago? Platinum market is 1/10th the size of the silver market.

The US hasn't made a Platinum eagle in a couple years and it looks like they won't next year either.

2 days.Remember, they are in business to make a profit just like the buffalo hunters and whalers of the 19th century. Eventually physical will run out. Looks like platinum will break through $1500 soon.

When the US labels silver a strategic metal it will start catching up to gold fast. Others are already front running Ag. Did they ever figure out who was the person that locked up the ASE market with a giant purchase over a year ago? Platinum market is 1/10th the size of the silver market.

SilverStacker

Ground Beetle

- Messages

- 527

- Reaction score

- 351

- Points

- 108

Congrats to our Platinum owners. $1,576.90 right now. Your finally getting your due after hanging in there for year after year. Last Jan. it was about $936 and I was tempted but it had been flat for so long I bought gold instead. I wish I had 10 to 20 1 oz rounds of platinum bought last Jan when I had the money. But I'm glad for youze who did.

SilverStacker

Ground Beetle

- Messages

- 527

- Reaction score

- 351

- Points

- 108

Well I worked security at a metal recycle business and they sure as hell would Lap it up. Platinum was high on their list.Only issue with stacking platinum is that it's not as liquid a market as gold/silver. Finding a buyer when you want to sell (or a buyer that will give you a decent price) might be an issue.

- Messages

- 50

- Reaction score

- 49

- Points

- 88

My first post here (I know pmbug from another forum, finally joined this one to see what's going on here).Congrats to our Platinum owners. $1,576.90 right now. Your finally getting your due after hanging in there for year after year. Last Jan. it was about $936 and I was tempted but it had been flat for so long I bought gold instead. I wish I had 10 to 20 1 oz rounds of platinum bought last Jan when I had the money. But I'm glad for youze who did.

I have a small amount of Pt and Pd coins (mostly coins), acquired when I thought they were too cheap to pass up (in a sense they were; I got both more or less at their bottoms during the past 10 years). I've held onto the Pd longer than I should have (I ignored the bubble, but I did trade a ballerina for a piece of art to give to my wife - that worked out), and Pt has taken years longer to come up from it's bottom than I thought it would. But to be honest, I largely stack and hold. I almost never sell, and rarely re-balance (though I have it in my mind to convert some Ag to Au when the GSR drops), so I suppose it doesn't actually matter what the price is, as long they remain a store of wealth, even if they have been less efficient than Au. At some point I may try to trade either or both for Au, since (as pmbug notes) Au is clearly more liquid.

My first post here (I know pmbug from another forum, finally joined this one to see what's going on here).

Welcome to bugland!

SilverStacker

Ground Beetle

- Messages

- 527

- Reaction score

- 351

- Points

- 108

I have little experience with Pt but If I was holding ,and had a buyer for a good price, and the spread was right, I'd really consider selling and buying Au right now.