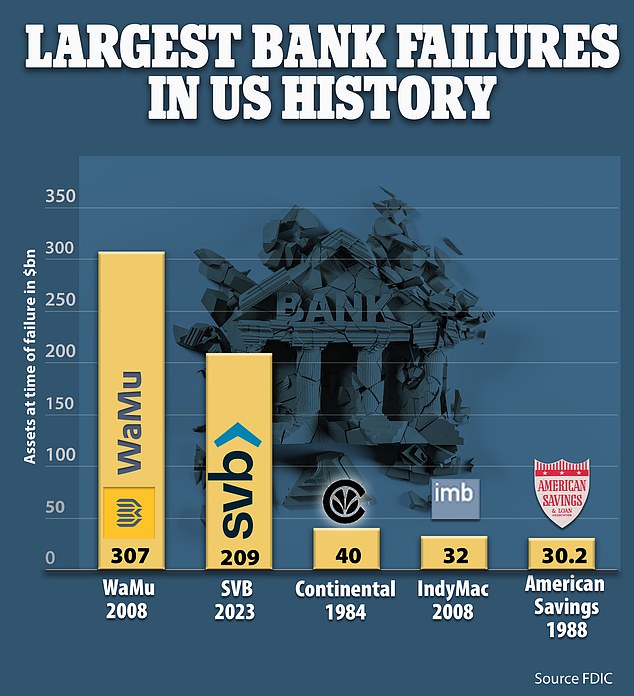

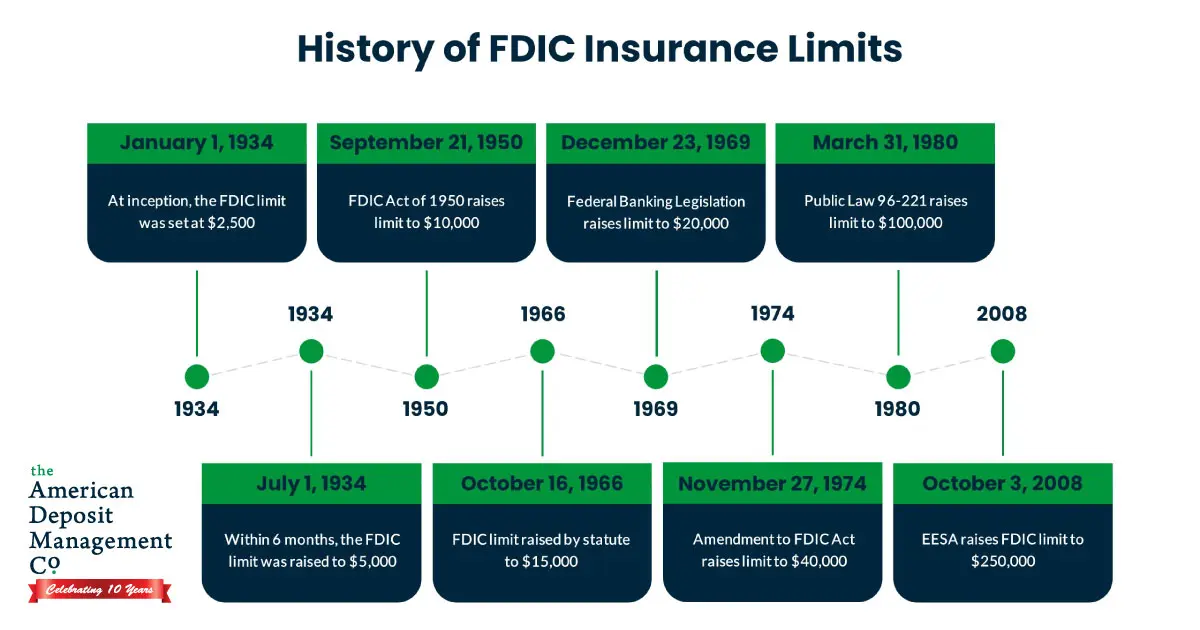

What a surprise huh? I also read that 93% of the Baanks assets exceeded the FDIC insurance maximums...ouch

Silicon Valley Bank Chief Executive Officer Greg Becker sold $3.6 million of company stock under a trading plan less than two weeks before the firm disclosed extensive losses that led to its failure.

Silicon Valley Bank Chief Executive Officer Greg Becker sold $3.6 million of company stock under a trading plan less than two weeks before the firm disclosed extensive losses that led to its failure.

While Becker may not have anticipated the bank run on Jan. 26 when he adopted the plan, the capital raise is material,” said Dan Taylor, a professor at the University of Pennsylvania’s Wharton School who studies corporate trading disclosures. “If they were in discussion for a capital raise at the time the plan was adopted, that is highly problematic.”

In December, the SEC finalized new rules that would mandate at least a 90-day cooling-off period for most executive trading plans, meaning that they can’t make trades on a new schedule for three months after they take hold.

Executives are required to start complying with those rules on April 1.

finance.yahoo.com

finance.yahoo.com

Silicon Valley Bank Chief Executive Officer Greg Becker sold $3.6 million of company stock under a trading plan less than two weeks before the firm disclosed extensive losses that led to its failure.

Silicon Valley Bank Chief Executive Officer Greg Becker sold $3.6 million of company stock under a trading plan less than two weeks before the firm disclosed extensive losses that led to its failure.

While Becker may not have anticipated the bank run on Jan. 26 when he adopted the plan, the capital raise is material,” said Dan Taylor, a professor at the University of Pennsylvania’s Wharton School who studies corporate trading disclosures. “If they were in discussion for a capital raise at the time the plan was adopted, that is highly problematic.”

In December, the SEC finalized new rules that would mandate at least a 90-day cooling-off period for most executive trading plans, meaning that they can’t make trades on a new schedule for three months after they take hold.

Executives are required to start complying with those rules on April 1.

SVB Chief Sold $3.6 Million in Stock Days Before Bank’s Failure

(Bloomberg) -- Silicon Valley Bank Chief Executive Officer Greg Becker sold $3.6 million of company stock under a trading plan less than two weeks before the firm disclosed extensive losses that led to its failure.Most Read from BloombergSilicon Valley Bank Swiftly Collapses After Tech Startups...