You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Silver Demand Drivers (and vault totals)

- Thread starter pmbug

- Start date

- Featured

-

- Tags

- physical demand

Welcome to the Precious Metals Bug Forums

Welcome to the PMBug forums - a watering hole for folks interested in gold, silver, precious metals, sound money, investing, market and economic news, central bank monetary policies, politics and more.

Why not register an account and join the discussions? When you register an account and log in, you may enjoy additional benefits including no Google ads, market data/charts, access to trade/barter with the community and much more. Registering an account is free - you have nothing to lose!

We do not have normal a normal market with silver. The price is not rising because of investment trading/demand. We are seeing the paper derivative markets breaking down and the beginnings of true price discover for physical silver. Silver is going to squeeze higher before it stabilizes.

Is it just me or is anyone else concerned with the speed in which silver is rising?

Speed... lol we just started walking now... You better buckle up butter cup.

Argentsum

Fly on the Wall

- Messages

- 11

- Reaction score

- 13

- Points

- 28

The Silver manias of 1980 and 2011 both had a point where the charts show the price action going nearly straight up. This did not last long, and the price drops were nearly as steep as the previous rises.

Maybe this time will be different.

For myself, every time silver goes up $10, I take roughly 10% off the table as cash.

...and everytime silver goes down by $10, I increase my holdings in similar fashion.

Maybe this time will be different.

For myself, every time silver goes up $10, I take roughly 10% off the table as cash.

...and everytime silver goes down by $10, I increase my holdings in similar fashion.

I know this is a dangerous statement, but this time I do believe is different, very VERY different.

Today saw silver spot climb to a new high at $54. Let's investigate what played out below the surface...

PSLV

Today PSLV added zero units to the trust and 579,580 ozt to the vault. PSLV just continues to increase their vault stock. Every 1,000 ozt of silver that PSLV adds to their vaults is a London Good Delivery silver bar that is not available to the COMEX or LBMA to settle contracts.

COMEX

COMEX silver stock report for Wednesday (COMEX reports activity for the previous working day) showed 1.5M ozt (~46.9 metric tons) withdrawn from the Asahi vaults, but only ~548.2K ozt (~17 metric tons) withdrawn overall (net). There were still heavy withdrawals of 3M ozt, but there was also a heavy deposit of ~2.5M ozt. Additionally, Asahi moved ~392K ozt (~12.2 metric tons) from registered to eligible. It seems the Asahi vault is still bleeding its stock (none of the day's deposits were in Asahi). I singled out the action in the Asahi vault because they are listed by the LBMA as a Good Delivery Refinery for silver and I assume that means they can deliver silver back to London with fewer logistical challenges (red tape, costs, etc.) than other actors.

JPM listed zero activity of any kind. This is the third day in a row that JPM reports zero outflow, so maybe they are done sending metal to London? JPM is the custodian for Blackrock's SLV and manages changes to SLV inventory in their London (LBMA) vault. I assume that JPM also can deliver silver back to London with fewer logistical challenges (red tape, costs, etc.) than other actors.

Overall, 1.1M ozt (~35.7 metric tons) of silver was moved from registered to eligible on Wednesday. It seems the COMEX is not quite done shedding vault stock.

SLV

My "canary in the silver mine" might be dead. Today JPM reported zero activity in the bar stock report (no additions or withdrawals), Blackrock reported zero activity with shares (none created or redeemed) and their were zero shares available for borrowing since 7:30AM EDT. Absolutely no activity was reported. I'm wondering if they just went dark on reporting activity?

The borrowing fee remains at 16.22% and the spread between the rebate fee (what brokers pay shareholders to borrow shares) and the borrow fee (what brokers charge to lend shares) has remained steady at 4.1%.

SFE/SGE

The Oct 16 trading report from this morning indicated the SGE/SFE prices for silver moving up with, but still lagging (at a discount to) the LBMA/COMEX. The SFE silver vault continues to bleed out inventory - shedding another 1.5M ozt (~48.1 metric tons) today.

- Messages

- 1,770

- Reaction score

- 2,071

- Points

- 283

The only shortages I am aware of are 1000 oz bars in London and 2025 silver eagles in the US. The US mint only producing 10 million is pathetic.

Refinery capacity is an issue but eventually it will get solved.

SD bullion and Miles Franklin can both probably deliver 20-40 million in silver if you really wanted it. So 40-80 million total if you have deep pockets and looking to spend. Add in the over priced Apmex and you could probably do another 30 million minimum in silver buys. If the entire US population woke up and decided to buy it would be a problem but so far they are all still asleep and most are broke anyway so cant buy.

Refinery capacity is an issue but eventually it will get solved.

SD bullion and Miles Franklin can both probably deliver 20-40 million in silver if you really wanted it. So 40-80 million total if you have deep pockets and looking to spend. Add in the over priced Apmex and you could probably do another 30 million minimum in silver buys. If the entire US population woke up and decided to buy it would be a problem but so far they are all still asleep and most are broke anyway so cant buy.

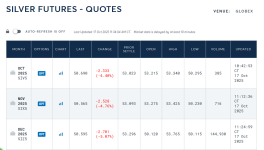

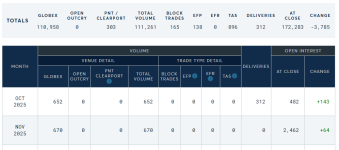

OI also expanded Oct 16 in Silver. They made 64 deliveries and OI went up 239 contracts to 322.

- Messages

- 1,770

- Reaction score

- 2,071

- Points

- 283

Trading closer to the 20 day now. Have to see if 4000 and 50 hold. If not then 3500 and 45 or wherever the 50 day is.

Today saw silver spot fall as the CME raised margins 8.5%. Let's investigate what played out below the surface...

PSLV

Today PSLV added zero units to the trust and 242 ozt to the vault (which is likely just a correction to yesterday's inflow). PSLV has been very active of late, but took a rest day today. Every 1,000 ozt of silver that PSLV adds to their vaults is a London Good Delivery silver bar that is not available to the COMEX or LBMA to settle contracts.

COMEX

COMEX silver stock report for Thursday (COMEX reports activity for the previous working day) showed 295K ozt (~9.2 metric tons) withdrawn from the Asahi vaults, and ~2.7M ozt (~84.1 metric tons) withdrawn overall. Unlike Wednesday, there were no deposits today. For the first time in many days, Asahi had no silver move from registered to eligible. I singled out the action in the Asahi vault because they are listed by the LBMA as a Good Delivery Refinery for silver and I assume that means they can deliver silver back to London with fewer logistical challenges (red tape, costs, etc.) than other actors.

JPM saw 367.1K ozt (~11.4 metric tons) withdrawn and, like Asahi, no silver moved from registered to eligible. This ends the three day inactive streak. JPM is the custodian for Blackrock's SLV and manages changes to SLV inventory in their London (LBMA) vault. I assume that JPM also can deliver silver back to London with fewer logistical challenges (red tape, costs, etc.) than other actors.

Overall, 753.6K ozt (~23.4 metric tons) of silver was moved from registered to eligible on Thursday. It seems the COMEX is not quite done shedding vault stock.

SLV

My "canary in the silver mine" came back from the dead. Today JPM reported adding 2.4M ozt (74.8 metric tons) to the silver stock while Blackrock reported adding 2.65M shares.

Even though the number of shares available to borrow was plentiful most of the day, the borrowing fee spiked to a high of 20.79%! It has remained near 20% since. The spread between the rebate fee (what brokers pay shareholders to borrow shares) and the borrow fee (what brokers charge to lend shares) has remained steady at 4.1%.

SFE/SGE

The Oct 17 trading report from this morning indicated the SGE/SFE prices for silver moving up with, but still lagging (at a discount to) the LBMA/COMEX. The SFE silver vault continues to bleed out inventory - shedding another 2M ozt (~62.1 metric tons) today. China is going to need to bid silver up higher if they want silver to flow in from the West.

The intuitive Woo world think something big is gonna happen this weekend. No idea there, I'm a real novice.

India will need as much as $21 trillion to achieve its climate goals and lift its population out of poverty, according to a draft government plan seen by Bloomberg.

...

By 2070, ... energy supply will grow from 870 million tons of oil equivalent (mtoe) in 2020 to 2250 mtoe in 2070 under a net zero scenario.

The government now sees renewables supplying 65% of its total energy mix by 2070, with nuclear accounting for 11%. Coal would provide just 4%, down from 49% in 2020.

...

... Regardless of climate targets, the country is expected to build out a huge amount of solar and wind power, alongside batteries. “India will rely heavily on electrification,” he said.

...

- Messages

- 1,770

- Reaction score

- 2,071

- Points

- 283

forget the 50 day. The 200 day is like 3200 and 36 or thereabouts. We will correct to the 200 eventually. By that time those levels could be much higher. NVDA isn't trading this far off the 200 day. Metals prices are just insane and from the looks of things that's not going to change anytime soon.Trading closer to the 20 day now. Have to see if 4000 and 50 hold. If not then 3500 and 45 or wherever the 50 day is.

Today saw silver spot bounced up and down between $52 and $52.50 for most of the day. Let's investigate what played out below the surface...

PSLV

Today PSLV added zero units to the trust and 1,574 ozt to the vault (which is about a bar and a half). PSLV has been very active of late, but took another rest day today. Every 1,000 ozt of silver that PSLV adds to their vaults is a London Good Delivery silver bar that is not available to the COMEX or LBMA to settle contracts.

COMEX

COMEX silver stock report for Friday (COMEX reports activity for the previous working day) showed 300K ozt (~9.3 metric tons) withdrawn from the Asahi vaults, and ~4.2M ozt (~132 metric tons) withdrawn overall. The vault system was quite busy Friday as they also received 1.2M ozt (~39 metric tons). For the second working day in a row, Asahi had no silver move from registered to eligible. I singled out the action in the Asahi vault because they are listed by the LBMA as a Good Delivery Refinery for silver and I assume that means they can deliver silver back to London with fewer logistical challenges (red tape, costs, etc.) than other actors.

JPM reported no withdrawals or deposits, but moved 70K ozt (~2.2 metric tons) from registered to eligible. JPM is the custodian for Blackrock's SLV and manages changes to SLV inventory in their London (LBMA) vault. I assume that JPM also can deliver silver back to London with fewer logistical challenges (red tape, costs, etc.) than other actors.

Loomis was the big loser on Friday with 3M ozt withdrawn and none deposited. Overall, 290.8K ozt (~9 metric tons) of silver was moved from registered to eligible on Friday.

SLV

My "canary in the silver mine" signalling slightly less supply stress in London. Today JPM reported adding 8.7M ozt (272.3 metric tons) to the silver stock while Blackrock reported adding 9.65M shares.

The number of shares available to borrow breached 1M today, so maybe that explains the difference between the new shares and new silver stock. The borrowing fee rose to a high of 20.33% before falling down to 16.23%. The spread between the rebate fee (what brokers pay shareholders to borrow shares) and the borrow fee (what brokers charge to lend shares) has remained steady at 4.11%.

SFE/SGE

The Oct 20 trading report from this morning indicated the SGE/SFE prices for silver moving up almost to par with the LBMA/COMEX. The SFE silver vault continues to bleed out inventory - shedding another 2M ozt (~64.2 metric tons) today. China is going to need to bid silver up higher if they want silver to flow in from the West.

pmbug said:If I understood correctly, China needed to import ~50% of their silver demand in 2024 - to the tune of 4,769 tons. If industrial demand grows by 1,500T in 2025 (and knowing that silver production and scrap recycling capacity do not scale with increased demand, that's roughly 6,200 tons of silver they need to import in 2025 (or eat up domestic surplus stock).

It puts into perspective the SFE/SGE silver vault drain that we've been seeing since July. At some point China is going to need to bid up the price of silver as they face a local silversqueeze.

Today silver spot got monkey hammered. Let's investigate what played out below the surface...

PSLV

Today PSLV added zero units to the trust and 100K ozt to the vault. Looks like PSLV managed to find some silver for the first time in 3 days. Every 1,000 ozt of silver that PSLV adds to their vaults is a London Good Delivery silver bar that is not available to the COMEX or LBMA to settle contracts.

COMEX

COMEX silver stock report for Monday (COMEX reports activity for the previous working day) showed no activity at all in the Asahi vault and just a paltry 28.7K ozt (~0.9 metric ton) moved from eligible to registered in the JPM vault. All the 2.6M ozt (~82 metric tons) withdrawal action on Monday happened in the Loomis, HSBC and CNT vaults. On Monday there was a mix of silver moving between registered and eligible with a net 636K ozt (~19.8 metric tons) moved from registered to eligible.

SLV

My "canary in the silver mine" showed continued signs of easing stress in London as the number of shares available to borrow seemingly remained plentiful all day (but are now presently back to zero) and the borrowing fee has fallen to 9.25%. The spread between the rebate fee (what brokers pay shareholders to borrow shares) and the borrow fee (what brokers charge to lend shares) has remained steady at 4.11%.

I had expected JPM and Blackrock to report more shares created and silver added to the vault, but instead JPM reported a loss of 3M ozt (~93.1 metric tons) to the silver stock while Blackrock reported a loss of 3.3M shares. Unlike the last time SLV added 8M+ ozt in a day only to lose it all the next day, today it only lost about a third of yesterday's huge addition. It would seem that the rumored 1,000 tons of silver flown to London from New York and China are restoring some liquidity in the LBMA market.

SFE/SGE

The Oct 21 trading report from this morning indicated the SGE/SFE prices for silver are now at a premium to the LBMA/COMEX. The SFE silver vault reported a massive 3.4M ozt (~106.5 metric tons) loss today. We'll see if China maintains a premium to LBMA/COMEX and if that stems the vault stock outflow.

Today silver spot got double tapped by the monkey hammer. Let's investigate what played out below the surface...

PSLV

Today PSLV added zero units to the trust and zero ozt to the vault. I think PSLV still needs to add more ozt to back recently created units. Every 1,000 ozt of silver that PSLV adds to their vaults is a London Good Delivery silver bar that is not available to the COMEX or LBMA to settle contracts.

COMEX

COMEX silver stock report for Tuesday (COMEX reports activity for the previous working day) showed no activity at all in the Asahi vault, but a withdrawal of 648K ozt (~20.2 metric tons) from the JPM vault as well as 15K ozt (~0.5 metric ton) moved from eligible to registered to eligible (partially reversing Monday's category move).

Overall, another 2.8M ozt (~88.2 metric tons) were withdrawn from Loomis, JPM and CNT vaults. Additionally, 1.8M ozt (~57 metric tons) moved from registered to eligible. The EFP spread between COMEX futures and London spot has shrunk (~ -0.54 as of the moment - down from -$2 recently), so we should expect that tomorrow's report for today's activity should show withdrawals diminishing if the silver is just being moved by profit motive alone.

SLV

My "canary in the silver mine" was a bit of a conundrum today. Shares available to borrow increased hugely all morning to a peak of 4.6M (but has now shrunk to 2.6M) while the borrowing fee has fallen to 6.13%. The spread between the rebate fee (what brokers pay shareholders to borrow shares) and the borrow fee (what brokers charge to lend shares) has remained steady at 4.11%.

The conundrum is that while available shares to borrow increased by 4.6M, JPM reported a loss of 2.5M ozt (~79 metric tons) to the silver stock while Blackrock reported a loss of 2.8M shares in the trust. In the recent past, large additions of available shares to borrow mirrored Blackrock creating new shares. That was not the case today.

SFE/SGE

The Oct 22 trading report from this morning indicated the SGE/SFE prices for silver remained at a premium to the LBMA/COMEX. The SFE silver vault reported another large 1.8M ozt (~57.7 metric tons) loss today. China will need to maintain prices at a premium to the West if they are to stop the vault stock from bleeding out.

Today silver spot treaded water. Let's investigate what played out below the surface...

PSLV

Today PSLV added zero units to the trust and 289 ozt to the vault (likely just an accounting adjustment). I think PSLV still needs to add more ozt to back recently created units. Every 1,000 ozt of silver that PSLV adds to their vaults is a London Good Delivery silver bar that is not available to the COMEX or LBMA to settle contracts.

COMEX

COMEX silver stock report for Wednesday (COMEX reports activity for the previous working day) showed no withdrawals in the Asahi vault, but 572.8K ozt (17.8 metric tons) moved from registered to eligible. There was a withdrawal of 642K ozt (~20 metric tons) from the JPM vault.

Overall, another 3M ozt (~94.7 metric tons) were withdrawn from various vaults. Additionally, 812K ozt (~25 metric tons) moved from registered to eligible. The EFP spread between COMEX futures and London spot has shrunk (~ -0.40 as of the moment - down from -$0.54 yesterday), so tomorrow's report for today's activity might show withdrawals diminishing if the silver is just being moved by profit motive alone.

SLV

My "canary in the silver mine" had another mixed signals day. Shares available to borrow continued to bounce around between 2M and 4M all day while the borrowing fee fell to 3.26%. The spread between the rebate fee (what brokers pay shareholders to borrow shares) and the borrow fee (what brokers charge to lend shares) has remained steady at 4.11%.

JPM reported a loss of 3.6M ozt (~112.9 metric tons) to the silver stock while Blackrock reported a loss of 4.55M shares in the trust. In the recent past, large additions of available shares to borrow mirrored Blackrock creating new shares. That was not the case today for the second day in a row.

SFE/SGE

The Oct 23 trading report from this morning indicated the SGE/SFE prices for silver remained at a premium to the LBMA/COMEX. The SFE silver vault reported another 910K ozt (~28.3 metric tons) loss today, but that is about half of the daily outflow or recent days. China will need to maintain prices at a premium to the West if they are to stop the vault stock from bleeding out.

Today silver spot mostly treaded water again after a little boost when the DXY fell. Let's investigate what played out below the surface...

PSLV

I'm composing this before PSLV has published their Friday data. I am not expecting any big numbers here, but I'll post an update below if I'm wrong when the report is available.

COMEX

COMEX silver stock report for Thursday (COMEX reports activity for the previous working day) showed no activty at all in the Asahi vault. There was a withdrawal of 673K ozt (~20.9 metric tons) from the JPM vault and another 696K ozt (~21.6 metric tons) from CNT vault.

Overall, another 1M ozt (~32.1 metric tons) were withdrawn (net after 392K ozt (12.2 metric tons) deposit in StoneX vault). Additionally, 293K ozt (~9.1 metric tons) moved from registered to eligible.

The EFP spread between COMEX futures and London spot has shrunk (~ -0.19 as of the moment - down from -$0.40 yesterday), and we are starting to see the withdrawn/outflow from the COMEX diminish. Thursday's 1M ozt outflow is about one third as much as the daily outflow over the last two weeks. For now, it looks like the COMEX gave the LBMA ~35M ozt (~1,086.3 metric tons) of its silver ocean back since October 3.

SLV

My "canary in the silver mine" had another mixed signals day. Shares available to borrow continued to bounce around between 2M and 4M all day while the borrowing fee fell to 2.92%. The spread between the rebate fee (what brokers pay shareholders to borrow shares) and the borrow fee (what brokers charge to lend shares) had remained steady at 4.11% for most of the last two weeks, but today it moved. The rebate fee flip flopped between negative and positive several times before settling as positive (see SLV update below for more detail). Bottom line - it appears that shares are no longer hard to borrow.

JPM reported a loss of 2M ozt (~64.9 metric tons) to the silver stock while Blackrock reported a loss of 1.75M shares in the trust. This was the third day in a row for waning shares and vault stock.

SFE/SGE

The Oct 24 trading report from this morning indicated the SGE/SFE prices for silver remained at a premium to the LBMA/COMEX for the 3rd day in a row and as a result, the SFE reports the first (tiny) inflow since the Golden Week holiday began at the end of September.

SLV update:

Last week in silver:

SGE silver vault - loses 145.4 metric tons

SFE silver vault - loses 255.1 metric tons

SLV London vault - loses 77.6 metric tons

PSLV silver vault - adds 3.1 metric tons

COMEX silver stock - loses 432.6 metric tons

LBMA silver stock - ??? (no daily or weekly data because LBMA is run by dinosaurs)

Global net change (less LBMA and SGE):

Oct 20-24 = -907.6 metric tons

Oct 13-17 = -640 metric tons

Oct 6-10 = -310.9 metric tons

Sep 28-Oct 3 = +92.5 metric tons

Sep 22-26 = +407.5 metric tons

Sep 15-19 = -41.5 metric tons

Sep 8-12 = +124.81 metric tons

Sep 1-5 = +2.45 metric tons

Aug 25-29 = +409.75 metric tons

Aug 18-22 = +230.8 metric tons

...

I started doing some daily updates this month and neglected to post these weekly views. I think they offer an important perspective though, so I'll resume them.

The LBMA apparently ran dry last month amongst massive demand for physical silver from India and the bullion banks are doing their best to return the silver ocean back from NYC to London to meet that demand. We can see massive drawdowns in the vault stock of every player (excepting PSLV which does not feed the LBMA). We assume the lion's share of the drawdowns were sent to London, but we can't know for sure because the LBMA does not provide any transparency to their operations or vault stock on a daily or weekly basis. This might change in the future as the dinosaurs at the LBMA are finally starting to get embarrassed (see below for more details).

The COMEX accelerated massive outflows last week. After a mid-week slow down, they posted a huge outflow on Friday. This in spite of the fact that backwardation and EFP spreads are normalizing (reducing any profit motive/arb for moving silver to London). We should be seeing a slowdown in the COMEX withdrawals (for shipping to London), but it isn't evident yet.

In spite of new share creation and corresponding silver addition to the vault, SLV ended up with a net loss to their vault stock for the week. It was a pretty wild week for SLV with shares available to borrow finally becoming available near the end of the week as the vault stock drained. Does this signal adequate vault stock in the LBMA to fulfill OTC trading obligations? It would seem so for now.

PSLV has been steadily adding silver to their vault stock week after week in October. Every LGD bar that PSLV acquires is 1,000 ozt that is not available to global free float for trade settlement.

The SFE and SGE (China) have reported massive outflows throughout October. Did the metal go to domestic use, or flow to London? I've read mixed comments on the issue. But the SGE has just started within the last few days trading at a premium to the LBMA, so we'll see if the SGE outflows wane now.

The LBMA's monthly vault stock "report" is due on November 7. I expect they will show a massive inflow of silver (on the order of 1,500+ tons) although how much of it was absorbed by ETFs will remain to be seen.

One can only imagine what chaos might be unfolding in the LBMA's London vault system right now. We can only imagine because the dinosaurs at the LBMA do not provide daily/weekly reporting of their vault stock like every other market and major fund in the world.

LBMA transparency?

SGE silver vault - loses 145.4 metric tons

SFE silver vault - loses 255.1 metric tons

SLV London vault - loses 77.6 metric tons

PSLV silver vault - adds 3.1 metric tons

COMEX silver stock - loses 432.6 metric tons

LBMA silver stock - ??? (no daily or weekly data because LBMA is run by dinosaurs)

Global net change (less LBMA and SGE):

Oct 20-24 = -907.6 metric tons

Oct 13-17 = -640 metric tons

Oct 6-10 = -310.9 metric tons

Sep 28-Oct 3 = +92.5 metric tons

Sep 22-26 = +407.5 metric tons

Sep 15-19 = -41.5 metric tons

Sep 8-12 = +124.81 metric tons

Sep 1-5 = +2.45 metric tons

Aug 25-29 = +409.75 metric tons

Aug 18-22 = +230.8 metric tons

...

I started doing some daily updates this month and neglected to post these weekly views. I think they offer an important perspective though, so I'll resume them.

The LBMA apparently ran dry last month amongst massive demand for physical silver from India and the bullion banks are doing their best to return the silver ocean back from NYC to London to meet that demand. We can see massive drawdowns in the vault stock of every player (excepting PSLV which does not feed the LBMA). We assume the lion's share of the drawdowns were sent to London, but we can't know for sure because the LBMA does not provide any transparency to their operations or vault stock on a daily or weekly basis. This might change in the future as the dinosaurs at the LBMA are finally starting to get embarrassed (see below for more details).

The COMEX accelerated massive outflows last week. After a mid-week slow down, they posted a huge outflow on Friday. This in spite of the fact that backwardation and EFP spreads are normalizing (reducing any profit motive/arb for moving silver to London). We should be seeing a slowdown in the COMEX withdrawals (for shipping to London), but it isn't evident yet.

In spite of new share creation and corresponding silver addition to the vault, SLV ended up with a net loss to their vault stock for the week. It was a pretty wild week for SLV with shares available to borrow finally becoming available near the end of the week as the vault stock drained. Does this signal adequate vault stock in the LBMA to fulfill OTC trading obligations? It would seem so for now.

PSLV has been steadily adding silver to their vault stock week after week in October. Every LGD bar that PSLV acquires is 1,000 ozt that is not available to global free float for trade settlement.

The SFE and SGE (China) have reported massive outflows throughout October. Did the metal go to domestic use, or flow to London? I've read mixed comments on the issue. But the SGE has just started within the last few days trading at a premium to the LBMA, so we'll see if the SGE outflows wane now.

The LBMA's monthly vault stock "report" is due on November 7. I expect they will show a massive inflow of silver (on the order of 1,500+ tons) although how much of it was absorbed by ETFs will remain to be seen.

One can only imagine what chaos might be unfolding in the LBMA's London vault system right now. We can only imagine because the dinosaurs at the LBMA do not provide daily/weekly reporting of their vault stock like every other market and major fund in the world.

LBMA transparency?

Today silver spot took a beating from CME margin raises and Mr. Slammy in the morning and then mostly treaded water again. Let's investigate what played out below the surface...

COMEX

COMEX silver stock report for Friday (COMEX reports activity for the previous working day) showed a massive 3M (96 metric ton) withdrawal in the Asahi vault. There was no withdrawal from the JPM vault and another ~602K ozt (~18.7 metric tons) each from from CNT and HSBC vaults.

Overall, another 4.4M ozt (~136.5 metric tons) were withdrawn. Additionally, 563K ozt (~17.5 metric tons) moved from registered to eligible.

The EFP spread between COMEX futures and London spot has shrunk (~ -0.02 as of the moment - down from -$0.19 Friday). We should be starting to see the withdrawn/outflow from the COMEX diminish, but that isn't what happened Friday. Thursday's 1M ozt outflow looks to be an anomaly as the outflows resumed in force on Friday.

SLV

My "canary in the silver mine" had another mixed signals day. Shares available to borrow started the day at 2.1M and just continued to shrink all day down to a low of 25K, but now back up to 50K, while the borrowing fee fell to 2.26%. The borrow and rebate fees did not move very much today even as available shares approached zero. I suspect we will see more fireworks in this data before the week is through.

JPM reported a loss of 2.5M ozt (~79 metric tons) to the silver stock while Blackrock reported a loss of 2.8M shares in the trust. This was the fifth day in a row for waning shares and vault stock.

SFE/SGE

The Oct 27 trading report from this morning indicated the SGE/SFE prices for silver remained at a premium to the LBMA/COMEX for the 4rd day in a row, however, the SFE still reported a moderate outflow. Was Friday's inflow a fluke? China needs to bid up the price of silver higher to compete for the West's silver ocean.

Yesterday silver spot rode a Mr. Slammy hangover. Let's investigate what played out below the surface...

COMEX

COMEX silver stock report for Monday (COMEX reports activity for the previous working day) showed a large 1.7M (53.2 metric ton) withdrawal in the Asahi vault and 409K (12.7 metric tons) withdrawal from the JPM vault. There was another ~2.8M ozt withdrawn across Brinks, CNT, HSBC, StoneX et al vaults.

It was all hands on deck on Monday apparently with a total 5.1M ozt (~160.3 metric tons) withdrawn. There was also 660K ozt (20.5 metric tons) deposited, mostly in CNT. Additionally, 831K ozt (~25.8 metric tons) moved from registered to eligible.

The EFP spread between COMEX futures and London spot remains near zero (~ -0.08 as of the moment). We should be starting to see the withdrawn/outflow from the COMEX diminish, but that isn't what happened Monday. Maybe we see the withdrawn/outflow diminish in this afternoon's report (for activity on Tuesday).

SLV

My "canary in the silver mine" had another mixed signals day. Shares available to borrow started the day at low 5 figures count and hit zero before increasing back up to 2.5M while the borrowing fee bounced around in a very narrow range between 2.2% and 2.3%. Overnight, even more shares became available, hitting a high of 2.9M before half of the available disappeared within the next few hours.

It looked like Blackrock had added troves of new shares to bring the avilable up from zero yesterday morning as the rebate and borrow fees barely moved with all the volatility in the available shares activity. However, JPM reported a loss of 4.2M ozt (~131.2 metric tons) to the silver stock while Blackrock reported a loss of 4.65M shares in the trust. This was the sixth day in a row now for waning shares and vault stock.

As @mypreciousilver reports (see reply below), SLV has seen a massive 25.6M shorts added in October. Discounting vault stock deposits, SLV has seen ~35M ozt (1,086 metric tons) withdrawn in the month of October. It would appear that over the last week, we are seeing SLV being raided of its silver stock. I'm guessing the borrow and rebate fees are lagging indicators (of LBMA vault stock supply stress). They should both start rising when the LBMA isn't able to provide sufficient surety to the shorts that there is metal available for them to cover their positions. SLV remains, IMO, a canary in the LBMA silver mine.

SFE/SGE

The Oct 28 trading report from this morning indicated the SGE/SFE prices for silver popped up for a large gain and it remains at a premium to the LBMA/COMEX, however, the SFE still reported a small outflow. Assuming the inflows/outflows include some lag between when trades take place and redemptions or deposits occur, I would expect to start seeing more inflows reported soon as China has maintained a premium to the West for several days now.

PSLV

PSLV has been very quiet the last few days with zero ozt added the vault stock and zero units added to the trust.

Yesterday silver spot had an early morning pop and then faded the rest of the day. Let's investigate what played out below the surface...

COMEX

COMEX silver stock report for Tuesday (COMEX reports activity for the previous working day) showed a 606.7K ozt (18.9 metric ton) withdrawal in the Asahi vault and a paltry 5K ozt withdrawal from the JPM vault. There was another ~1.8M ozt withdrawn across Brinks, Loomis, et al vaults.

A total ~2.5M ozt (~77 metric tons) was withdrawn with zero deposited. This is about half of the daily outflows that have been reported over the last few days, so it might appear as if the outflows were slowing down. However, 2.5M ozt (~78.5 metric tons) moved from registered to eligible which may be signalling more silver getting ready to be withdrawn.

The EFP spread between COMEX futures and London spot has widened (~ -$0.18 as of the moment, it was ~ -$0.08 yesterday). Looks like there might be more tightness in the LBMA silver stock than SLV would have us believe.

SLV

My "canary in the silver mine" went silent yesterday. While SLV shares available to borrow bounced between 1.6M and 2.1M most of the day, the borrow fee rose to 2.47% before falling to 1.83% and the rebate fee fell to 1.64% before rising to 2.29%. It seemed as if some tightness in the shares started to appear and was quashed.

Given that action, I was looking forward to seeing the JPM & Blackrock reporting for the day but was left disappointed as Blackrock reported no change to the shares and JPM reported no change to the vault stock. Did they simply not report the day's activity? A day with no activity reported seems to occur semi-frequently with SLV - this is the 14th time since August for JPM to report zero change for a day to the vault stock. A few times after a goose egg report, JPM has reported a massive deposit/inflow to the vault stock the next day, but most of the time, the next day just has a normal delta range of activty. I guess they just like to take "an LBMA day" once in a while and simply not report anything.

SFE/SGE

The Oct 30 trading report for the SGE/SFE prices (last night's trading) for silver closed down from the day before, but it remains at a premium to the LBMA/COMEX. The SFE silver vault finally reported a moderate inflow as I've been anticipating as China has maintained a premium to the West for several days now.

PSLV

PSLV was again quiet with zero ozt added the vault stock and zero units added to the trust.

SilverStacker

Big Eyed Bug

- Messages

- 494

- Reaction score

- 312

- Points

- 108

$49.26. Silver ? You just can't keep a good metal down, were on our way to $50 again.

Yesterday silver spot bounced back to just under $49. Let's investigate what played out below the surface...

COMEX

COMEX silver stock report for Wednesday (COMEX reports activity for the previous working day) showed a 1.5M ozt (49.1 metric ton) withdrawal in the Asahi vault and a paltry 15K ozt withdrawal from the JPM vault. There was another ~1.3M ozt withdrawn across CNT, HSBC, StoneX, et al vaults.

A total ~2.9M ozt (~89 metric tons) was withdrawn with 410K ozt (12.7 metric tons) deposited in the Manfra, Tordella and Brooks vault. This outflow more or less matches the previous day's ouflow, so it might be premature to say if the outflows are slowing down. However, only 366K ozt (~11.4 metric tons) moved from registered to eligible which may be signalling that less silver getting ready to be withdrawn.

The EFP spread between COMEX futures and London spot has blown back out (~ -$0.41 as of the moment, it was ~ -$0.18 yesterday). Looks like there might be more tightness in the LBMA silver stock than SLV would have us believe. This level of EFP spread should encourage more COMEX silver to be withdrawn and shipped to London.

SLV

My "canary in the silver mine" is again sending odd signals. SLV shares available to borrow went from 1M to 350K to 2.6M across the day. The borrow fee steadily shrunk to 1.70% and the rebate fee steadily climbed to 2.42%. It seemed as if there was no tightness in the LBMA system.

Given the action yesterday and the day before, whenever available shares got low, millions of shares would suddenly become available, I was looking forward to seeing if Blackrock added new shares. However, after the previous day's report of zero activity, yesterday Blackrock reported a loss of 700K shares and JPM reported a loss of 634K ozt (19.7 metric tons) to the vault stock. This is a very tiny outflow to be reporting considering the millions of shares that apparently were leased/borrowed over the last two days.

SFE/SGE

The Oct 31 trading report for the SGE/SFE prices (last night's trading) for silver closed back up to just under the $50 mark and it remains at a premium to the LBMA/COMEX. The SFE silver vault finally reported another, consecutive small inflow as I've been anticipating as China has maintained a premium to the West for several days now.

PSLV

PSLV was again quiet with zero ozt added the vault stock and zero units added to the trust. It's been a week since PSLV last reported new additions.

Yesterday silver spot deflated throughout the day. Let's investigate what played out below the surface...

COMEX

COMEX silver stock report for Thursday (COMEX reports activity for the previous working day) showed a 1.1M ozt (34.8 metric ton) withdrawal in the Asahi vault and no activity at all in the JPM vault. There was another ~900K ozt withdrawn from the StoneX and Delaware vaults.

A total ~2M ozt (~63.3 metric tons) was withdrawn while 1.3M ozt (41.7 metric tons) was deposited (mostly in the Manfra, Tordella and Brooks vault again for the second day in a row). This outflow is smaller than the 4-5M we have been seeing in recent days.

Maybe it's because it is the end of the month and preparations are under way for the next delivery month contract, but instead of silver being moved from registered to eligible, on Thursday, a net 783K ozt (24.4 metric tons) was moved from eligible to registered. That's net - there was ~117K ozt moved from registered to eligible in small amounts in various vaults and that is much less than what we have been seeing in recent days.

The EFP spread between COMEX futures and London spot has continued to blow out (~ -$0.51 as of the moment, it was ~ -$0.41 yesterday). It seems like there might be more tightness in the LBMA silver stock than SLV would have us believe. This level of EFP spread should encourage more COMEX silver to be withdrawn and shipped to London.

SLV

My "canary in the silver mine" is again sending odd signals. SLV shares available to borrow were plentiful in the early morning (staying above 1.5M) but tumbled in the afternoon (down to 900K by end of trading and down to 450K after hours). The borrow fee seems uncorrelated with share availability as it spiked briefly in the morning while shares were plentiful and then dropped in the afternoon as shares became more scarce. That's the opposite of what I would expect if the borrow fee were driven by supply and demand of available shares. It doesn't really make sense to me.

Yesterday, the share availability did not seem to fluctuate that much. More specifically, the share availability never jumped upwards. Once again Blackrock reported no change to shares and JPM reported no change to the vault stock. Did they take another "LBMA day" and just choose to not report anything for the second time in three days? Or was this just an accurate reflection of zero activity?

SFE/SGE

The Oct 31 trading report for the SGE/SFE prices for silver closed back up to just under the $50 mark and it remains at a premium to the LBMA/COMEX. The SFE silver vault finally reported another, consecutive small inflow as I've been anticipating as China has maintained a premium to the West for several days now.

PSLV

PSLV was again quiet with zero ozt added the vault stock and zero units added to the trust. It's been a week since PSLV last reported new additions.

Viking

Yellow Jacket

Yes. I placed a large order last week.

Yesterday silver spot deflated throughout the day. Let's investigate what played out below the surface...

COMEX

COMEX silver stock report for Friday (COMEX reports activity for the previous working day) showed no activity in the Asahi vault and a paltry 74K ozt (2.3 metric tons) withdrawal in the JPM vault. There was another ~623K ozt withdrawn from CNT, Manfra and other vaults.

A total ~698 ozt (~21.7 metric tons) was withdrawn while 599K ozt (18.6 metric tons) was deposited (all in the Loomis vault). This outflow was much smaller than what has been reported in recent days.

Did CME employees take Friday off for Halloween? There was zero silver moved between registered and eligible categories. That's the first time I've seen that in a long time!

I suspect that the COMEX withdrawals lag the EFP spread a bit as the withdrawals have slowed down after the EFP spread went to nearly zero a few days ago. But the EFP spread blew out again and now appears to be calming back down (~ -$0.23 as of the moment, it was ~ -$0.51 yesterday). If I'm correct about the lag, we can expect withdrawals to pick up again shortly even as the EFP spread heads back towards zero (if it continues to head back towards zero).

SLV

My "canary in the silver mine" had a quiet day yesterday. SLV shares available to borrow remained plentiful between 1M and 2M most of the day yesterday. The borrow fee was fairly stable rising a tiny bit before falling a bit. It would seem that, if there is any stress in the LBMA system, no one is using SLV to relieve it.

Once again Blackrock reported no change to shares and JPM reported no change to the vault stock. This is the 3rd time in 4 (working) days that this happens. Did they take another "LBMA day" and just choose to not report anything? Or was this just an accurate reflection of zero activity?

SFE/SGE

The Nov 3 trading report for the SGE/SFE prices remains at a premium to the LBMA/COMEX. The SFE silver vault reported a small inflow that covers the previous day's outflow. It looks like the SFE vaults are stemming the recent vault stock bleeding. I suspect it is largely due to the SFE/SGE prices maintaining a premium to the West, but China has also announced export controls/restrictions on silver, so this could also be having an impact.

PSLV

PSLV was again quiet with zero ozt added the vault stock and zero units added to the trust. It's been over a week since PSLV last reported new additions.

Last week in silver:

SGE silver vault - loses 74.9 metric tons

SFE silver vault - adds 0.6 metric tons

SLV London vault - loses 230 metric tons

PSLV silver vault - no change

COMEX silver stock - loses 317.8 metric tons

LBMA silver stock - ??? (no daily or weekly data because LBMA is run by dinosaurs)

Global net change (less LBMA and SGE):

Oct 27-31 = -622.1 metric tons

Oct 20-24 = -907.6 metric tons

Oct 13-17 = -640 metric tons

Oct 6-10 = -310.9 metric tons

Sep 28-Oct 3 = +92.5 metric tons

Sep 22-26 = +407.5 metric tons

Sep 15-19 = -41.5 metric tons

Sep 8-12 = +124.81 metric tons

Sep 1-5 = +2.45 metric tons

...

The COMEX slowed down slightly with the outflows last week. The outflows started the week with 4.4M ozt out on Monday and daily outflows dwindled to 98K ozt on Friday. Looking at the daily reports, the pattern would suggest that the COMEX was just about done sending silver to the LBMA in London, but EFP spreads are heading back into negative territory, so the COMEX drain might resume with vigor in the coming days.

SLV started the week with heavy silver stock drains, but ended the week with no activity reported. If the reporting is accurate (ie. JPM/Blackrock weren't "taking LBMA reporting days"), it would appear that authorized participants were winding down their raiding of SLV silver stock.

PSLV was very quiet last week with no units created and no silver added to the vault stock. As @SemperVigilant1 notes, even market interest in curious intraday shorting of PSLV stopped in the wake of Mr. Slammy's hammer a little over a week ago.

The SFE and SGE (China) have reported massive outflows throughout the first three full weeks of October, but last week, the SFE finally stopped its bleeding with a tiny inflow. The SFE/SGE trading at a premium to the West and China imposing export controls/restrictions on silver suggest that the SFE/SGE outflows should be just about over soon.

The LBMA's monthly vault stock "report" is due on November 7. I expect they will show a massive inflow of silver (on the order of 1,500+ tons). It would appear that ETFs lost a bit of their London vaulted silver stock, so any large differential between expected inflow and actual will likely represent silver bought/sent to India.

One can only imagine what chaos might be unfolding in the LBMA's London vault system right now. We can only imagine because the dinosaurs at the LBMA do not provide daily/weekly reporting of their vault stock like every other market and major fund in the world.

PSLV shorting

ETF outflows

SGE silver vault - loses 74.9 metric tons

SFE silver vault - adds 0.6 metric tons

SLV London vault - loses 230 metric tons

PSLV silver vault - no change

COMEX silver stock - loses 317.8 metric tons

LBMA silver stock - ??? (no daily or weekly data because LBMA is run by dinosaurs)

Global net change (less LBMA and SGE):

Oct 27-31 = -622.1 metric tons

Oct 20-24 = -907.6 metric tons

Oct 13-17 = -640 metric tons

Oct 6-10 = -310.9 metric tons

Sep 28-Oct 3 = +92.5 metric tons

Sep 22-26 = +407.5 metric tons

Sep 15-19 = -41.5 metric tons

Sep 8-12 = +124.81 metric tons

Sep 1-5 = +2.45 metric tons

...

The COMEX slowed down slightly with the outflows last week. The outflows started the week with 4.4M ozt out on Monday and daily outflows dwindled to 98K ozt on Friday. Looking at the daily reports, the pattern would suggest that the COMEX was just about done sending silver to the LBMA in London, but EFP spreads are heading back into negative territory, so the COMEX drain might resume with vigor in the coming days.

SLV started the week with heavy silver stock drains, but ended the week with no activity reported. If the reporting is accurate (ie. JPM/Blackrock weren't "taking LBMA reporting days"), it would appear that authorized participants were winding down their raiding of SLV silver stock.

PSLV was very quiet last week with no units created and no silver added to the vault stock. As @SemperVigilant1 notes, even market interest in curious intraday shorting of PSLV stopped in the wake of Mr. Slammy's hammer a little over a week ago.

The SFE and SGE (China) have reported massive outflows throughout the first three full weeks of October, but last week, the SFE finally stopped its bleeding with a tiny inflow. The SFE/SGE trading at a premium to the West and China imposing export controls/restrictions on silver suggest that the SFE/SGE outflows should be just about over soon.

The LBMA's monthly vault stock "report" is due on November 7. I expect they will show a massive inflow of silver (on the order of 1,500+ tons). It would appear that ETFs lost a bit of their London vaulted silver stock, so any large differential between expected inflow and actual will likely represent silver bought/sent to India.

One can only imagine what chaos might be unfolding in the LBMA's London vault system right now. We can only imagine because the dinosaurs at the LBMA do not provide daily/weekly reporting of their vault stock like every other market and major fund in the world.

PSLV shorting

ETF outflows

Yesterday silver spot deflated throughout the day. Let's investigate what played out below the surface...

COMEX

COMEX silver stock report for Monday (COMEX reports activity for the previous working day) a total ~1.1M ozt (~36.5 metric tons) was withdrawn while 1.2M ozt (37.3 metric tons) was deposited. This was the first net deposit into the COMEX vault system since October 2!

The CNT vault was particularly busy with 876K out and 598K in. That's a lot of metal moving around!

On Friday there was zero silver moved between registered and eligible categories. They seem to have made up for it on Monday as a whopping 6.2M ozt (192.9 metric tons) were moved from registered to eligible. Looks like the COMEX is not quite done sending silver to London.

The EFP spread remains in negative territory (~ -$0.34 this morning, it was ~ -$0.23 yesterday). If I'm correct about the lagging withdrawals, we can expect withdrawals to pick up again shortly (and the large registered to eligible move would seem to confirm this).

SLV

My "canary in the silver mine" had a mild day yesterday. SLV shares available to borrow remained plentiful at around 2M to 3M most of the day yesterday. The borrow fee was fairly stable early before rising a tiny bit at the end of the trading day.

Blackrock reported a small decrease of 550K shares and JPM reported a small outflow of 499K ozt (15.5 metric tons) to the vault stock. Is SLV signalling early signs of renewed stress in the LBMA's physical silver vault stock?

PSLV

PSLV was again quiet with zero ozt added the vault stock and zero units added to the trust. It's been over a week since PSLV last reported new additions.

Yesterday silver spot treaded water around $48 throughout the day. Let's investigate what played out below the surface...

COMEX

COMEX silver stock report for Tuesday (COMEX reports activity for the previous working day) says a total ~907K ozt (~28.2 metric tons) was withdrawn while 1K ozt (ie. one bar) was deposited. This withdrawn amount is comparable to yesterday's outflow.

The Delaware vault staff was probably annoyed as they had to store one LGD bar (1,069 ozt received) and remove two other LGD bars (1,903 ozt withdrawn). I wonder if they bothered with the forklift.

The vaults followed up Monday's massive 6.2M ozt (192.9 metric tons) registered to eligible move with a relatively small 495K ozt (15.4 metric tons) on Tuesday (moved from registered to eligible).

The EFP spread remains in negative territory (~ -$0.22 this morning, it was ~ -$0.34 yesterday). I was expecting to see a larger withdrawal given the negative EFP spread and the huge movement of silver to eligible, but it didn't happen on Tuesday.

SLV

My "canary in the silver mine" had a quiet day yesterday. SLV shares available to borrow started the day around 500K and ended the day around 800K. The borrow fee rose slightly throughout the trading day to a high of 1.89%. It's come back down ever so slightly to 1.85% overnight as the available shares have increased to 1.5M.

Blackrock reported another decrease of 600K shares and JPM reported an outflow of 713K ozt (22.2 metric tons) to the vault stock. It looks like SLV is starting to shed inventory again as the spot price of silver is starting to recover.

PSLV

PSLV was again quiet with zero ozt added the vault stock and zero units added to the trust. It's been over two weeks now since PSLV last reported new additions.

Last week in silver:

SGE silver vault - loses 74.9 metric tons

SFE silver vault - adds 0.6 metric tons

SLV London vault - loses 230 metric tons

PSLV silver vault - no change

COMEX silver stock - loses 317.8 metric tons

LBMA silver stock - ??? (no daily or weekly data because LBMA is run by dinosaurs)

Global net change (less LBMA and SGE):

Oct 27-31 = -622.1 metric tons

Oct 20-24 = -907.6 metric tons

Oct 13-17 = -640 metric tons

Oct 6-10 = -310.9 metric tons

Sep 28-Oct 3 = +92.5 metric tons

Sep 22-26 = +407.5 metric tons

Sep 15-19 = -41.5 metric tons

Sep 8-12 = +124.81 metric tons

Sep 1-5 = +2.45 metric tons

...

The COMEX slowed down slightly with the outflows last week. The outflows started the week with 4.4M ozt out on Monday and daily outflows dwindled to 98K ozt on Friday. Looking at the daily reports, the pattern would suggest that the COMEX was just about done sending silver to the LBMA in London, but EFP spreads are heading back into negative territory, so the COMEX drain might resume with vigor in the coming days.

SLV started the week with heavy silver stock drains, but ended the week with no activity reported. If the reporting is accurate (ie. JPM/Blackrock weren't "taking LBMA reporting days"), it would appear that authorized participants were winding down their raiding of SLV silver stock.

PSLV was very quiet last week with no units created and no silver added to the vault stock. As @SemperVigilant1 notes, even market interest in curious intraday shorting of PSLV stopped in the wake of Mr. Slammy's hammer a little over a week ago.

The SFE and SGE (China) have reported massive outflows throughout the first three full weeks of October, but last week, the SFE finally stopped its bleeding with a tiny inflow. The SFE/SGE trading at a premium to the West and China imposing export controls/restrictions on silver suggest that the SFE/SGE outflows should be just about over soon.

The LBMA's monthly vault stock "report" is due on November 7. I expect they will show a massive inflow of silver (on the order of 1,500+ tons). It would appear that ETFs lost a bit of their London vaulted silver stock, so any large differential between expected inflow and actual will likely represent silver bought/sent to India.

One can only imagine what chaos might be unfolding in the LBMA's London vault system right now. We can only imagine because the dinosaurs at the LBMA do not provide daily/weekly reporting of their vault stock like every other market and major fund in the world.

PSLV shorting

ETF outflows

I appreciate all the hard work but you're not actually measuring any real metal movement. It's all just accounting numbers. Price goes up and you get inflows and the opposite when price goes down. On net every week there isn't much real new supply. So on net there should only be small changes here and there week / week.

There have been very real and large flows as the COMEX took the LBMA's silver ocean back in Jan/Feb and started sending it back in October. We've seen the market dislocations as London/LBMA ran out of free float. SLV provides an indirect signal as to what is happening with LBMA free float. It's not a perfect information system, but there are insights to be gleaned. $.02