You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Silver Demand Drivers (and vault totals)

- Thread starter pmbug

- Start date

- Featured

-

- Tags

- physical demand

Welcome to the Precious Metals Bug Forums

Welcome to the PMBug forums - a watering hole for folks interested in gold, silver, precious metals, sound money, investing, market and economic news, central bank monetary policies, politics and more.

Why not register an account and join the discussions? When you register an account and log in, you may enjoy additional benefits including no Google ads, market data/charts, access to trade/barter with the community and much more. Registering an account is free - you have nothing to lose!

Update (all values in metric tons) (see post #282 for last month):

* London ETF numbers through Nov 27 for most ETFs, through Nov 28 for SLV.

If these numbers are to be believed (and I do not believe the LBMA number), the West has roughly 16,937 metric tons vaulted at LBMA + COMEX not owned by ETFs. That's a decrease of 661 metric tons over last month's report which might seem reasonable except for the India issue:

Given the India issue, I would have expected to see the LBMA vault stock be at least ~500 metric tons less than what they are reporting.

Accepting the LBMA numbers are real, the total global free float including China (SFE/SGE) is 18,183 metric tons (a decrease of ~911 tonnes). That's a ~4.8% drop in one month (and likely higher if I'm right about the LBMA overstating their vault stock).

PSLV's silver vault stock is not directly available for settling COMEX or LBMA deliveries, so it is not included in free float totals - I include it because every 1,000 ozt that PSLV acquires is an LGD silver bar that is no longer available to the LBMA or global free float for trade settlement. PSLV had a quiet month in November adding just 10% of what was added in October.

I am now tracking the global vault stock changes every day/week for the COMEX, SFE/SGE, SLV and PSLV. Of course, there is no daily or weekly data for the LBMA because they are run by dinosaurs. The LBMA apparently thinks their monthly grand total report provides sufficient transparency to their operations as they say:

I frequently receive comments asking why I bother compiling this data. The comments commonly claim that the numbers are a fraud or they don't matter. Whether or not the numbers are completely accurate or not, they are the only public data we have and they *are* telling a story - revealing the rip currents of physical demand underneath the frothy paper market trading.

India October import data

Sources:

LBMA: https://www.lbma.org.uk/prices-and-data/london-vault-data

LBMA ETFs:

^ and my own spreadsheet tracking of SLV inventory

COMEX: I am saving COMEX silver stock reports and tracking the totals in a spreadsheet now.

SGE/SFE: I am saving SFE/SGE vault totals from Xiaojun Bai's daily X tweets and tracking them in a spreadsheet now.

PSLV: I am saving Sprott's PSLV silver stock data and tracking the totals in a spreadsheet now.

Global Vault Stock (in tons) - November 2025

Market | This month | Last month | Difference |

|---|---|---|---|

| LBMA (total) | 27,187 | 26,255 | 932 |

| London vaulted ETFs* | 21,317 | 20,450 | 867 |

| LBMA-ETFs (free float)* | 5,870 | 5,805 | 65 |

| COMEX | 14,183.02 | 15,002.46 | -819.44 |

| SLV NYC Vault | 3,115.67 | 3,209.14 | -93.47 |

| COMEX-SLV (free float) | 11,067.35 | 11,793.32 | -725.97 |

| SFE/SGE | 1,246.077 | 1,495.854 | -249.777 |

| PSLV | 6,363.932 | 6,345.231 | 18.701 |

If these numbers are to be believed (and I do not believe the LBMA number), the West has roughly 16,937 metric tons vaulted at LBMA + COMEX not owned by ETFs. That's a decrease of 661 metric tons over last month's report which might seem reasonable except for the India issue:

- The LBMA likely overstated last month's vault stock number by at least 150 metric tons given Indian import data for October (see below for details)

- India surely was buying more silver in the month of November (they were projected to buy at least 1,000 tons)

Given the India issue, I would have expected to see the LBMA vault stock be at least ~500 metric tons less than what they are reporting.

Accepting the LBMA numbers are real, the total global free float including China (SFE/SGE) is 18,183 metric tons (a decrease of ~911 tonnes). That's a ~4.8% drop in one month (and likely higher if I'm right about the LBMA overstating their vault stock).

PSLV's silver vault stock is not directly available for settling COMEX or LBMA deliveries, so it is not included in free float totals - I include it because every 1,000 ozt that PSLV acquires is an LGD silver bar that is no longer available to the LBMA or global free float for trade settlement. PSLV had a quiet month in November adding just 10% of what was added in October.

I am now tracking the global vault stock changes every day/week for the COMEX, SFE/SGE, SLV and PSLV. Of course, there is no daily or weekly data for the LBMA because they are run by dinosaurs. The LBMA apparently thinks their monthly grand total report provides sufficient transparency to their operations as they say:

LBMA said:These figures provide an important insight into London's ability to underpin the physical OTC market.

I frequently receive comments asking why I bother compiling this data. The comments commonly claim that the numbers are a fraud or they don't matter. Whether or not the numbers are completely accurate or not, they are the only public data we have and they *are* telling a story - revealing the rip currents of physical demand underneath the frothy paper market trading.

India October import data

Sources:

LBMA: https://www.lbma.org.uk/prices-and-data/london-vault-data

LBMA ETFs:

^ and my own spreadsheet tracking of SLV inventory

COMEX: I am saving COMEX silver stock reports and tracking the totals in a spreadsheet now.

SGE/SFE: I am saving SFE/SGE vault totals from Xiaojun Bai's daily X tweets and tracking them in a spreadsheet now.

PSLV: I am saving Sprott's PSLV silver stock data and tracking the totals in a spreadsheet now.

Viking

Yellow Jacket

I know.fwiw....... 600k ozt is just over 40,000 lbs which is a typical semi-tractor trailer load weight

fwiw....... 600k ozt is just over 40,000 lbs which is a typical semi-tractor trailer load weight

I'll take Two.... Just put it on my credit will ya.

Viking

Yellow Jacket

FWIW:

Grok is responding to a different question from someone else. But it's 30,000 ozt per pallet so 600K ozt would be 20 pallets. which is one truck, exactly as @Ttazzman said.

I'm at the end of a dirt road, so I always have to time my deliveries for when it has been dry, no rain for a while. Otherwise, those trucks get stuck.

There are times when hardcore is worth more than silverI'm at the end of a dirt road, so I always have to time my deliveries for when it has been dry, no rain for a while. Otherwise, those trucks get stuck.

Yesterday silver spot spiked above $59 before falling back to the $58 to $58.50 range. Let's look below the surface...

COMEX

The COMEX silver stock report for Thursday (COMEX reports activity for the previous working day) shows 455K ozt (14.2 metric tons) withdrawn primarily from JPM (~297K ozt) and MT&B (~157K ozt). There was also 305K ozt (9.5 metric tons) deposited in Loomis (mostly).

I mentioned in my previous daily report that I found it curious that a lot of the movements in any given vault whether received/deposited or withdrawn recently were lots of (or multiples of) ~600K ozt. It turns out that the COMEX ships 1,000 ozt silver bars in stacks of 30 bars per pallet and 20 pallets (600K ozt) would be right under the max load for a 20 ton semi truck.

1.4M ozt (44 metric tons) were moved from registered to eligible in the StoneX vault.

As the EFP spread has been bouncing from negative to positive and back from overnight to day to night, I had intended to watch it a bit closer yesterday, but I failed to do so as real life interrupted my computer time. As of this morning I'm seeing the EFP spread slightly negative at -$0.06 for the front month of December. It was -$0.64 yesterday morning (and possibly positive during the trading day?!?).

India

Indian futures as of the moment are showing the MCX February contract at ~$63.42/ozt and the March contract at $63.23/ozt. The March contract is at a $0.19/ozt discount to the February contract (it was a $0.24/ozt discount yesterday when I checked). The backwardation in the Indian futures market appears to be holding steady around the $0.20/ozt to $0.25/ozt. Looks like India still wants physical silver ASAP.

SLV

SLV shares available to borrow started and ended the day at 10M shares with little variation (or activty for that matter) throughout the day (again - 5th day in a row). The borrow fee rose slightly from 0.96% to 1.01% as of this morning. It would seem that no APs are raiding their vault stock at the moment, however ...

After five consecutive days of massive additions, yesterday Blackrock reported shedding 6M shares and JPM reported shedding 5.4M ozt (169.3 metric tons) from the vault stock. That's about a one third of the gains added over the last five days. Is this a sign that AP raiding has begun again?

The LBMA is supposed to released their monthly vault stock report yesterday. As I anticipated, it did not make sense given what we know of Indian imports and buying demand. Full analysis posted here.

PSLV

PSLV reports adding 606,209 new units to the trust and zero ozt to the vault stock. I think they still need to add another ~150K ozt (prev units) + ~200K ozt (new units) = 350K ozt to the vault per all the units added recently.

- Messages

- 36,510

- Reaction score

- 6,304

- Points

- 288

Been watching some of this guy's vids for several months. Some are good, some not so good. Thought this one good. Nothing earth shattering, just an enjoyable vid with some neat art work. 15 mins long. As usual, take it fwiw and dyodd.

Silver demand is exploding worldwide — and it’s happening so fast that even major financial institutions can’t fully explain the surge. In this video, we break down why silver is suddenly becoming one of the most strategically important assets of the next decade, and why the world may be facing one of the biggest undervaluation crises in modern financial history.

Industrial demand for silver is at record highs. Solar power, electric vehicles, semiconductors, medical technology, and AI-driven infrastructure have created a level of consumption the mining sector simply can’t keep up with. For the first time, silver is no longer just a precious metal — it has become a critical industrial resource powering global technology.

Meanwhile, global silver supply has been declining for years. Many of the largest silver mines are aging, production is dropping, and new discoveries are rare. The result? A widening deficit where demand is outpacing available supply every single year. This structural imbalance is exactly what long-term investors look for before major price breakouts.

But the real story is the undervaluation crisis. Historically, silver has traded at a much closer ratio to gold. Today, that ratio is so extreme that silver would need to surge dramatically just to return to its long-term average. Every time in history this gap has closed, silver has delivered massive, fast price moves — and smart money is already betting it will happen again.

Governments and central banks are adding pressure too. With global currencies weakening and inflation eroding savings, investors are shifting into hard assets. And while gold gets the headlines, the quiet accumulation of silver is signaling where the next big opportunity lies.

As financial systems become more unstable and nations race toward renewable energy, silver sits at the intersection of technology, money, and scarcity. This combination is rare — and it’s why analysts believe silver could be one of the most explosive assets of the 2026–2030 cycle.

If you want to understand why silver demand is rising everywhere — and why this undervaluation crisis could lead to the biggest silver bull run in modern history — this video breaks it down with data, trends, and clear insights.

15:05

Why Silver Demand Is Surging Worldwide (The Undervaluation Crisis)

Dec 3, 2025Silver demand is exploding worldwide — and it’s happening so fast that even major financial institutions can’t fully explain the surge. In this video, we break down why silver is suddenly becoming one of the most strategically important assets of the next decade, and why the world may be facing one of the biggest undervaluation crises in modern financial history.

Industrial demand for silver is at record highs. Solar power, electric vehicles, semiconductors, medical technology, and AI-driven infrastructure have created a level of consumption the mining sector simply can’t keep up with. For the first time, silver is no longer just a precious metal — it has become a critical industrial resource powering global technology.

Meanwhile, global silver supply has been declining for years. Many of the largest silver mines are aging, production is dropping, and new discoveries are rare. The result? A widening deficit where demand is outpacing available supply every single year. This structural imbalance is exactly what long-term investors look for before major price breakouts.

But the real story is the undervaluation crisis. Historically, silver has traded at a much closer ratio to gold. Today, that ratio is so extreme that silver would need to surge dramatically just to return to its long-term average. Every time in history this gap has closed, silver has delivered massive, fast price moves — and smart money is already betting it will happen again.

Governments and central banks are adding pressure too. With global currencies weakening and inflation eroding savings, investors are shifting into hard assets. And while gold gets the headlines, the quiet accumulation of silver is signaling where the next big opportunity lies.

As financial systems become more unstable and nations race toward renewable energy, silver sits at the intersection of technology, money, and scarcity. This combination is rare — and it’s why analysts believe silver could be one of the most explosive assets of the 2026–2030 cycle.

If you want to understand why silver demand is rising everywhere — and why this undervaluation crisis could lead to the biggest silver bull run in modern history — this video breaks it down with data, trends, and clear insights.

15:05

Thread unrolled:

...

5/

And here’s the breakthrough discovery:

From July 2024, something shocking appeared on the charts:

Silver began moving tick-for-tick with the INR/CNY exchange rate.

This correlation has never existed in history.

Silver detached from COMEX pricing and started tracking settlement currency flows.

That is a signal of sovereign accumulation, not investor speculation.Image

6/

Why would silver suddenly track INR/CNY?

Because here’s the mechanism we uncovered:

India buys oil → pays Russia in AED

Russia converts AED → CNY

China wants AED for Gulf oil

Russia uses CNY to buy physical Silver from China

Silver becomes the reserve asset storing value from India–Russia trade outside the USD system.

This is the missing link no analyst has seen.

...

Thread by @Macrobysunil on Thread Reader App

@Macrobysunil: THREAD, We Just Discovered the Most Important Monetary Shift of the 21st Century, And Nobody Is Talking About It 1/13 ⚠️ What I’m about to lay out is not speculation. It’s a fully traceable sequence...…

INR/CNY well that's a new one and I'm gonna have to look it up.

indian rupe to china yuan renimbiINR/CNY well that's a new one and I'm gonna have to look it up.

aed is arab emirates dirham

So that somehow implies Chinese buying through India...

Or is it implying the Indian demand for physical is taking hold of the market...

Or is it implying the Indian demand for physical is taking hold of the market...

So that somehow implies Chinese buying through India...

Or is it implying the Indian demand for physical is taking hold of the market...

i assume the correlation is since india and china do a currency dance involving arab money to buy oil.......that india and china are also doing some sort of currency dance to buy silver ....thus creating a correlation of the currency ratio to silver pricing.......

seems like a stretch to me ...... but people do like to try to find squirrels in the trees and will, if they look hard enough ......

im just staying fundamental.........silver is cheap......silver is in demand.......silver supply is not keeping pace with demand...... dollars are losing purchasing power ..........seems simple to me at least till its not

So that somehow implies Chinese buying through India...

Or is it implying the Indian demand for physical is taking hold of the market...

It implies that India is buying Russian oil with Chinese silver. The petrodollar has competition from petrosilver.

How do i buy with someone else's silver? That's pretty sweet.

Yesterday silver spot tread water around $58. Let's look below the surface...

COMEX

The COMEX silver stock report for Friday (COMEX reports activity for the previous working day) shows 1.2M ozt (38.3 metric tons) withdrawn primarily from JPM (~911K ozt) and CNT (~321K ozt). There was also 305K ozt (9.5 metric tons) deposited in Loomis for the second day in a row.

It is odd to see the Asahi vault so quiet in the last few days after being so busy while the COMEX was reportedly sending lots of silver to London. Maybe they are done sending London what is left of their part of the silver ocean?

There was no movement of silver between the registered and eligible categories on Friday.

As of this morning I'm seeing the EFP spread slightly negative at -$0.08 for the front month of December. It was -$0.30 yesterday morning. I'm guessing that is not sufficient arb to make shipping silver to London profitable.

India

Indian futures as of the moment are showing the MCX February contract at ~$63.66/ozt and the March contract at $63.41/ozt. The March contract is at a $0.25/ozt discount to the February contract (it was a $0.23/ozt discount yesterday when I checked). The backwardation in the Indian futures market appears to be holding steady at around $0.20/ozt to $0.25/ozt. Looks like India still wants physical silver ASAP.

SLV

SLV shares available to borrow started and ended the day at 10M shares with little variation (or activity for that matter) throughout the day (again - 6th day in a row). The borrow fee rose slightly from 1.01% to 1.09% as of this morning. It would seem that no APs are raiding their vault stock at the moment, however ...

Yesterday Blackrock reported shedding 1.3M shares and JPM reported shedding 1.2M ozt (36.7 metric tons) from the vault stock. This comes after Friday's huge drop (6M shares / 5.4M ozt). Is this a sign that AP raiding has begun again?

PSLV

PSLV reports no new units to the trust and zero ozt to the vault stock. I think they still need to add another 350K ozt to the vault per all the units added last week.

Yesterday silver spot broke out to $61. Let's look below the surface...

COMEX

The COMEX silver stock report for Monday (COMEX reports activity for the previous working day) was very quiet with only 321K ozt (10 metric tons) withdrawn primarily from MT&B (one lonely bar was withdrawn from Delaware). There were no deposits.

There was no movement of silver between the registered and eligible categories on Monday (2nd day in a row for zero category shifts).

As of this morning I'm seeing the EFP spread back in positive territory at +$0.28 for the front month of December. It was -$0.08 yesterday morning. If it stays positive, the LBMA is going to be in big trouble in the near future...

India

Indian futures as of the moment are showing the MCX February contract at ~$65.71/ozt and the March contract at $65.51/ozt. The March contract is at a $0.20/ozt discount to the February contract (it was a $0.25/ozt discount yesterday when I checked). The backwardation in the Indian futures market continues to hold steady at around $0.20/ozt to $0.25/ozt. Looks like India still wants physical silver ASAP.

SLV

SLV shares available to borrow started and ended the day at 10M shares with little variation (or activity for that matter) throughout the day (again - 7th day in a row). The borrow fee dropped from 1.09% to 0.84% as of this morning. Seems SLV share owners are happy to lend their shares these days. Tsk tsk!

Yesterday Blackrock reported adding 3M shares and JPM reported adding 2.7M ozt (84.6 metric tons) to the vault stock. This recovers about 40% of what was shed Monday and Friday. It appears that SLV adds shares/vault stock as the spot price of silver rises. This is squeezing the LBMA's free float.

PSLV

PSLV added 4,985,207 new units to the trust and 601K ozt (18.7 metric tons) to the vault stock. I think they still need to add another 1.46M ozt to the vault per all the units added today.

Last week in silver:

SGE silver vault - gains 6.2 metric tons

SFE silver vault - gains 129.1 metric tons

SLV London vault - gains 314.7 metric tons

PSLV silver vault - gains 34.2 metric tons

COMEX silver stock - gains 4.6 metric tons

LBMA silver stock - ??? (no daily or weekly data because LBMA is run by dinosaurs)

Global net change (less LBMA):

Dec 1-5 = +488.8 metric tons

Nov 24-28 = +216.8 metric tons

Nov 17-21 = -258 metric tons

Nov 10-14 = -243 metric tons

Nov 3-7 = -252.2 metric tons

...

The COMEX's 9 week streak of weekly vault stock drains ended last week with a small, but positive gain. The EFP spread has bounced between positive and negative lately, but it seemed to have some gravity near zero, so the diminished vault stock outflows is in line with expectations.

Last week, SLV continued to add vault stock Monday-Thursday at a torrid pace (15.5M ozt / 482 metric tons) before shedding a massive lot on Friday (5.4M ozt / 169 metric tons). It looks like the daily vault stock movements for SLV are growing in magnitude. As a reminder, the SLV's gains are the LBMA's free float losses.

The SFE reports some healthy inflows for last week and the SGE broke a 10 week losing streak with a small, but positive weekly inflow. It is unclear if the LBMA might be delivering silver back to China that was rumored to have been leased/loaned, but it seems that the SGE/SFE exchanges are not sending silver to London or India presently.

Since the LBMA does not publish daily or weekly vault stock data, we are left to speculate on their inventory. Last week, the LBMA published their monthly vault stock report, and their claim does not add up when considering UK export/India import data and ETF vault stock data. See below for more detailed analysis.

Last week I said that my intuition was that we were in the eye of the hurricane - that all appeared calm but the other side of the storm is approaching. It still seems that way to me and I think it is getting closer.

One can only imagine what chaos might be unfolding in the LBMA's London vault system right now. We can only imagine because the dinosaurs at the LBMA do not provide daily/weekly reporting of their vault stock like every other market and major fund in the world.

SGE silver vault - gains 6.2 metric tons

SFE silver vault - gains 129.1 metric tons

SLV London vault - gains 314.7 metric tons

PSLV silver vault - gains 34.2 metric tons

COMEX silver stock - gains 4.6 metric tons

LBMA silver stock - ??? (no daily or weekly data because LBMA is run by dinosaurs)

Global net change (less LBMA):

Dec 1-5 = +488.8 metric tons

Nov 24-28 = +216.8 metric tons

Nov 17-21 = -258 metric tons

Nov 10-14 = -243 metric tons

Nov 3-7 = -252.2 metric tons

...

The COMEX's 9 week streak of weekly vault stock drains ended last week with a small, but positive gain. The EFP spread has bounced between positive and negative lately, but it seemed to have some gravity near zero, so the diminished vault stock outflows is in line with expectations.

Last week, SLV continued to add vault stock Monday-Thursday at a torrid pace (15.5M ozt / 482 metric tons) before shedding a massive lot on Friday (5.4M ozt / 169 metric tons). It looks like the daily vault stock movements for SLV are growing in magnitude. As a reminder, the SLV's gains are the LBMA's free float losses.

The SFE reports some healthy inflows for last week and the SGE broke a 10 week losing streak with a small, but positive weekly inflow. It is unclear if the LBMA might be delivering silver back to China that was rumored to have been leased/loaned, but it seems that the SGE/SFE exchanges are not sending silver to London or India presently.

Since the LBMA does not publish daily or weekly vault stock data, we are left to speculate on their inventory. Last week, the LBMA published their monthly vault stock report, and their claim does not add up when considering UK export/India import data and ETF vault stock data. See below for more detailed analysis.

Last week I said that my intuition was that we were in the eye of the hurricane - that all appeared calm but the other side of the storm is approaching. It still seems that way to me and I think it is getting closer.

One can only imagine what chaos might be unfolding in the LBMA's London vault system right now. We can only imagine because the dinosaurs at the LBMA do not provide daily/weekly reporting of their vault stock like every other market and major fund in the world.

Yesterday silver spot broke out to just under $62 and the bid/ask spread widened to just over $0.50 late in the day (see below). Let's look below the surface...

COMEX

The COMEX silver stock report for Tuesday (COMEX reports activity for the previous working day) was very quiet again with zero ozt withdrawn for the first time in a very long time. There was 593K ozt (18.5 metric tons) deposited in the HSBC vault.

There was 173K ozt (5.4 metric tons) moved from registered to eligible in the CNT (168K ozt) and Asahi (5K ozt) vaults.

As of this morning I'm seeing the EFP spread back in negative territory at -$0.40 for the front month of December. It was +$0.28 yesterday morning. The December EFP spread seems be very volatile lately swinging back and forth from positive to negative with high frequency. I'm assuming that this volatility would discourage bullion banks from attempting any arbitrage in moving physical silver between NYC and London.

India

Indian futures as of the moment are showing the MCX February contract at ~$66.87/ozt and the March contract at $66.72/ozt. The March contract is at a $0.15/ozt discount to the February contract (it was a $0.20/ozt discount yesterday when I checked). The backwardation in the Indian futures has weakened below the $0.20/ozt to $0.25/ozt range it had been in for the last few days.

SLV

SLV shares available to borrow started and ended the day at 10M shares with little variation (or activity for that matter) throughout the day (again - 8th day in a row). The borrow fee rose slightly from 0.84% before dropping back to 0.83% as of this morning. Seems SLV share owners are happy to lend their shares these days. Tsk tsk!

Yesterday Blackrock reported adding 3.9M shares and JPM reported adding 3.5M ozt (110 metric tons) to the vault stock. SLV has now recovered almost all that was shed on Monday and Friday. It appears that SLV adds shares/vault stock as the spot price of silver rises. This is squeezing the LBMA's free float.

PSLV

PSLV added zero new units to the trust and 700K ozt (21.8 metric tons) to the vault stock. I think they still need to add another 760K ozt to the vault per all the units added yesterday.

~~~

Bid/ask spread widened yesterday:

Yesterday silver spot touched $64 before settling around $63.50. Let's look below the surface...

COMEX

The COMEX silver stock report for Wednesday (COMEX reports activity for the previous working day) was a two trucks in and tree trucks out day with 1.7M ozt (54.9 metric tons) withdrawn from CNT (579K ozt), JPM (585K ozt) and Loomis (600K ozt) and 1.1M ozt (36.3 metric tons) deposited in HSBC (595K ozt) and StoneX (571K ozt - directly to registered) vaults. I'm guessing these withdrawals are headed to London.

There was 489K ozt (15.2 metric tons) moved from registered to eligible mostly in the MT&B vault (only 5 bars moved in the HSBC vault).

As of this morning I'm seeing the EFP spread strongly in negative territory at -$0.74 for the front month of December. It was -$0.40 yesterday morning. Yesterday the CME announced a margin raise on silver contracts effective today (see below) and it looks like that will suppress COMEX futures and exacerbate/maintain a negative EFP which should encourage bullion banks to move physical silver from NYC to London.

India

Indian futures as of the moment are showing the MCX February contract at ~$68.93/ozt and the March contract at $68.76/ozt. The March contract is at a $0.17/ozt discount to the February contract (it was a $0.15/ozt discount yesterday when I checked). The backwardation in the Indian futures has weakened below the $0.20/ozt to $0.25/ozt range it had been in for the last few days.

SLV

SLV shares available to borrow remains pegged at 10M shares with little variation (or activity for that matter) for the 9th day in a row. The borrow fee rose slightly from 0.83% before dropping back to 0.83% as of this morning. Seems SLV share owners are happy to lend their shares these days. Tsk tsk!

Yesterday Blackrock reported no change to the shares and JPM reported no change to the vault stock. Normally we see SLV adding shares/vault stock as the spot price of silver rises, so zero activity given the rise in spot was curious.

PSLV

PSLV added 688,200 new units to the trust and 100K ozt (3.1 metric tons) to the vault stock. I think they still need to add another ~900K ozt to the vault per all the units added recently.

CME margin raise

October Physical Silver Flows Revisted - The LBMA Data Doesn't Add Up

On November 7, the LBMA published their monthly silver vault stock report claiming that at the end of October they had 26,255 tons of silver in the vaults - a 1,674 ton increase over their September report.

At that time, the silver ETFs that hold their vault stock in the LBMA vaults also reported a net drain of 702 tons at the end of October versus the end of September.

The LBMA free float purportedly grew 2,386 tons from the beginning to the end of October (see this post for detailed analysis).

On Nov 27, Metals Focus reported that India had imported ~1,600 metric tons of silver in the month of October with ~480 tons coming from the UK (London/LBMA). As I said at the time, it was difficult to reconcile the Indian import numbers with the LBMA vault stock report.

Today we finally have the official UK import/export data for October (thanks to @goldfishcharts - see below and h/t to @kingkong9888 for alerting me). The UK imported 2,077 tonnes in October and exported 627.3 tonnes to India, Switzerland and the UAE. That's a net gain of 1,449.7 tonnes. The LBMA claimed that their total silver vault stock grew by 224.3 tonnes more than what was net imported.

That's an even larger discrepancy than the ~150 metric tons that I had highlighted using some conservative (ie. favorable to the LBMA) estimates on import numbers.

Is it more likely that the UK had 224.3 tonnes of 1,000 ozt London Good Delivery bars available somewhere domestically that the LBMA could acquire during a month where physical silver was so scarce that lease rates blew out to 200%, or that the LBMA overstated their silver vault stock again (they have misreported by over 3,100 tonnes (roughly 100M ozt) in the past - h/t @bullionbrief)? Did they further overstate their November silver vault stock by ~500 tonnes as I surmised recently (see this post)?

Official UK import/export data

Yesterday silver spot pulled an Icarus and flew too close to the $64.50 sun before crashing to $61 and recovering just under $62. Let's look below the surface...

COMEX

The COMEX silver stock report for Thursday (COMEX reports activity for the previous working day) was a two trucks in and six trucks out day with 3.6M ozt (111.1 metric tons) withdrawn from StoneX (1.4M ozt), JPM (593K ozt), CNT (597K ozt) and Loomis (953K ozt) and 1.1M ozt (34.7 metric tons) deposited in HSBC (597K ozt) and Loomis (513K ozt) vaults. I'm guessing these withdrawals are headed to London.

There was 220K ozt (6.8 metric tons) moved from registered to eligible in the JPM vault.

Yesterday, the EFP spread varied wildly as the LBMA spot crashed at high speed before COMEX futures followed suit causing the EFP to spike from strongly negative to solidly positive and then back to strongly negative. As of this morning, I'm seeing the Dec25 EFP spread strongly in negative territory at -$0.90. It was -$0.74 yesterday morning. It looks like the CME silver margin hike has exacerbated the negative EFP as I had guessed it would. This should encourage bullion banks to move physical silver from NYC to London.

India

Indian futures as of the moment are showing the MCX February contract at ~$66.41/ozt and the March contract at $66.14/ozt. The March contract is at a $0.27/ozt discount to the February contract (it was a $0.17/ozt discount yesterday when I checked). Looks like the backwardation in the Indian futures has widened/strengthened again.

SLV

SLV shares available to borrow remains pegged at 10M shares with little variation (or activity for that matter) for the 10th day in a row. The borrow fee rose slightly from 0.83% to 0.84% as of this morning. Seems SLV share owners are happy to lend their shares these days. Tsk tsk!

Yesterday Blackrock reported adding 700K shares and JPM reported adding 635K ozt (19.7 metric tons) to the vault stock. SLV continues to eat away at the LBMA's free float vault stock.

PSLV

PSLV added zero new units to the trust and 400K ozt (12.4 metric tons) to the vault stock. I think they still need to add another ~500K ozt to the vault per all the units added recently.

You mean the accounting is Trash? Shocked I tell you Shocked.

Samsung’s new silver solid-state batteries are poised to revolutionize EVs with an impressive 600-mile range, 9-min full charge, and 20-yr lifespan.

Current EV‘s require about 5g of silver. This revolutionary technology requires ~1kg of silver.

That’s ~643% more silver per car

I saw an AI generated Youtube video (not worth sharing) that was rehashing the Samsung battery story from last year. I looked back through the forum here to remember what was discussed back then and see that the initial story was promoted by Kevin Bambraugh - the same guy that is/was pushing Hydrograph Clean Power in what many folks are calling a scam (penny stock rug pull attempt). I'm now wondering about the veracity of the Samsung battery story.

There are certainly solid-state Ag batteries. That's clear. And they are certainly safer than the liquid Lithium batteries. However, the claims that I find highly suspect is how these suddenly extend the range of any EV. That doesn't compute. Silver is lower energy than Lithium. And solid state membranes will have worse conductivity than a liquid electrolyte. Perhaps you can build a much bigger tank in the Anode or would it be the Cathode... But charging would/should be slower.

Viking

Yellow Jacket

There are certainly solid-state Ag batteries. That's clear. And they are certainly safer than the liquid Lithium batteries. However, the claims that I find highly suspect is how these suddenly extend the range of any EV. That doesn't compute. Silver is lower energy than Lithium. And solid state membranes will have worse conductivity than a liquid electrolyte. Perhaps you can build a much bigger tank in the Anode or would it be the Cathode... But charging would/should be slower.

SAMSUNG SDI to Collaborate on All-Solid-State Battery Validation Project with BMW Group

<p style="line-height: 200%; text-align: center;"><span style="font-size: 14pt; font-weight: bold;">Samsung SDI, BMW, and Solid Power sign agreement to work together on all-solid-state batteries (ASSB)<⁄span><⁄p><br /><p style="line-height: 200%; text-align: center;"><span style="font-size...

www.samsungsdi.com

Yesterday silver spot rallied back to $64. Let's look below the surface...

COMEX

The COMEX silver stock report for Friday (COMEX reports activity for the previous working day) was a two trucks in and zero trucks out day with 1.2M ozt (37.3 metric tons) deposited in Brinks vault.

While withdrawals were non-existent on Friday, there was a lot of preparation for this week as a whopping 7.7M ozt (240.3 metric tons) moved from registered to eligible in the Asahi (3.5M ozt), Brinks (3.7M ozt), Loomis (252K ozt) and MT&B (261K ozt) vaults. I think it is likely that most of this silver will end up being withdrawn this week with a good portion of it headed to London.

I wish I could find a public chart somewhere of the EFP spread captured on an hourly timescale as my infrequent spot checks indicate it can vary wildly throughout the day, but as of this moment I'm seeing the Dec25 EFP spread strongly positive at +$0.38. It was -$0.78 yesterday morning. The January and February (non-delivery months) are at a discount to LBMA spot (negative EFP spread) and the March contract is slightly positive at a +$0.05 premium to LBMA spot.

It looks like the CME silver margin hike's exacerbated negative EFP had a really short half life of one day as it appears to be gone now. If the EFP spread stays positive, it's going to cost bullion banks a lot of pain to move COMEX silver to London. Were the bullion banks anticipating this last Friday when they did not withdraw any COMEX silver or is there just some lag between favorable (negative) EFP spreads and when the bullion banks set the dominos in motion to withdraw and ship silver to London? I'm not sure but it should become clear in the next few days if the EFP spread remains positive.

India

Indian futures as of the moment are showing the MCX February contract at ~$67.64/ozt and the March contract at $67.43/ozt. The March contract is at a $0.21/ozt discount to the February contract (it was a $0.18/ozt discount yesterday when I checked). Looks like the backwardation in the Indian futures remains persistent near $0.20/ozt. India is still hungry for immediate delivery silver.

SLV

SLV shares available to borrow remains pegged at 10M shares with little variation (or activity for that matter) for the 10th day in a row. Yesterday the borrow fee jumped from 0.84% to 1.40% before settling at 1.37%. While 1.40% isn't a huge fee in the big picture, it was a huge ~80% jump from 0.84%, so that caught my eye.

Blackrock reported shedding 1.5M shares and JPM reported shedding 1.3M ozt (42.3 metric tons) to the vault stock. This occurred while the spot price was recovering from Friday's slam (SLV usually adds silver when spot price rises). Given the ~80% bump to the borrowing fee, it seems to me that someone has started raiding SLV inventory again. I think it is very likely that the LBMA is in trouble again.

PSLV

PSLV added zero new units to the trust and zero ozt to the vault stock (they reported a minor 156 ozt adjustment). I think they still need to add another ~500K ozt to the vault per all the units added recently.

Last week in silver:

SGE silver vault - gains 21.1 metric tons

SFE silver vault - gains 133 metric tons

SLV London vault - gains 177.7 metric tons

PSLV silver vault - gains 56.1 metric tons

COMEX silver stock - loses 49.2 metric tons

LBMA silver stock - ??? (no daily or weekly data because LBMA is run by dinosaurs)

Global net change (less LBMA):

Dec 8-12 = +338.7 metric tons

Dec 1-5 = +488.8 metric tons

Nov 24-28 = +216.8 metric tons

Nov 17-21 = -258 metric tons

Nov 10-14 = -243 metric tons

...

After a 1 week anomaly, the COMEX resumes its previous 9 week streak of weekly vault stock drains. The EFP spread was negative most of last week so the COMEX drain is in line with expectations. We'll see if that continues as the EFP spread turned positive this morning.

Last week, SLV continued to add vault stock Tuesday-Friday after shedding a bit on Monday. It looks like last week SLV was just adding vault stock as investment flowed into the fund with a rising spot price. As a reminder, the SLV's gains are the LBMA's free float losses.

The SFE and SGE both saw healthy inflows last week. It would seem that some bullion banks might be repaying silver loaned for delivery to India. Is it coming from the COMEX or the LBMA (or somewhere else)?

Since the LBMA does not publish daily or weekly vault stock data, we are left to speculate on their inventory (which I did just a moment ago).

In last week's weekly report I said that I thought we were getting closer to the back wall of the eye of the hurricane. Last week's activity proved to be another calm week, but as my recent LBMA speculation attests, I think the storm is fast approaching.

One can only imagine what chaos might be unfolding in the LBMA's London vault system right now. We can only imagine because the dinosaurs at the LBMA do not provide daily/weekly reporting of their vault stock like every other market and major fund in the world.

SGE silver vault - gains 21.1 metric tons

SFE silver vault - gains 133 metric tons

SLV London vault - gains 177.7 metric tons

PSLV silver vault - gains 56.1 metric tons

COMEX silver stock - loses 49.2 metric tons

LBMA silver stock - ??? (no daily or weekly data because LBMA is run by dinosaurs)

Global net change (less LBMA):

Dec 8-12 = +338.7 metric tons

Dec 1-5 = +488.8 metric tons

Nov 24-28 = +216.8 metric tons

Nov 17-21 = -258 metric tons

Nov 10-14 = -243 metric tons

...

After a 1 week anomaly, the COMEX resumes its previous 9 week streak of weekly vault stock drains. The EFP spread was negative most of last week so the COMEX drain is in line with expectations. We'll see if that continues as the EFP spread turned positive this morning.

Last week, SLV continued to add vault stock Tuesday-Friday after shedding a bit on Monday. It looks like last week SLV was just adding vault stock as investment flowed into the fund with a rising spot price. As a reminder, the SLV's gains are the LBMA's free float losses.

The SFE and SGE both saw healthy inflows last week. It would seem that some bullion banks might be repaying silver loaned for delivery to India. Is it coming from the COMEX or the LBMA (or somewhere else)?

Since the LBMA does not publish daily or weekly vault stock data, we are left to speculate on their inventory (which I did just a moment ago).

In last week's weekly report I said that I thought we were getting closer to the back wall of the eye of the hurricane. Last week's activity proved to be another calm week, but as my recent LBMA speculation attests, I think the storm is fast approaching.

One can only imagine what chaos might be unfolding in the LBMA's London vault system right now. We can only imagine because the dinosaurs at the LBMA do not provide daily/weekly reporting of their vault stock like every other market and major fund in the world.

Yesterday silver spot bounced around between $63 and $64. Let's look below the surface...

COMEX

The COMEX silver stock report for Monday (COMEX reports activity for the previous working day) was a two trucks in and three trucks out day with ~1.2M ozt (36.5 metric tons) deposited in HSBC (813K ozt) and StoneX (353K ozt directing into the registered category) while 1.9M ozt (58.7 metric tons) were withdrawn from JPM (1.3M ozt) and HSBC (600K ozt) vaults.

Additionally, a small 60K ozt (1.9 metric tons) moved from registered to eligible in the CNT vault. Based upon Friday's registered-> eligible flow, I was expecting to see withdrawals from Asahi, Brinks, Loomis and MT&B, but that did not happen (at least, it didn't happen on Monday).

I wish I could find a public chart somewhere of the EFP spread captured on an hourly timescale as my infrequent spot checks indicate it can vary wildly throughout the day, but as of this moment I'm seeing the Dec25 EFP spread strongly negative at -$0.74. It was +$0.38 yesterday morning and looked to be around -$1.32 when I checked yesterday afternoon. The January and February (non-delivery months) are at a discount to LBMA spot (negative EFP spread) and the March contract is closely tracking LBMA spot (near zero EFP spread).

COMEX withdrawals are picking up again and the Dec25 contract continues to see large lots standing for delivery daily so it would seem that the bullion banks are taking advantage of the Dec25's negative EFP spread to send COMEX silver to London.

India

Indian futures as of the moment are showing the MCX February contract at ~$70.63/ozt and the March contract at $70.42/ozt. The March contract remains at a $0.21/ozt discount to the February contract (it was also a $0.21/ozt discount yesterday when I checked). Looks like the backwardation in the Indian futures remains persistent near $0.20/ozt. India is still hungry for immediate delivery silver.

SLV

SLV shares available to borrow remains pegged at 10M shares with little variation (or activity for that matter) for the 10th day in a row. Yesterday the borrow fee returned from 1.37% back to 0.84%. There seemed to be little activity reported in share availablility or borrowing fee (was it just the reporting, or was the market quiet?).

For the 2nd day in a row now, Blackrock reported shedding another 1.5M shares and JPM reported shedding another 1.3M ozt *net* (42.3 metric tons) to the vault stock. In what I believe is another signal of stress in the LBMA system, JPM shed 3M ozt (93.3 metric tons) in their NYC vault while adding 1.6M ozt (51 metric tons) in their London vault. The last time JPM changed the SLV's NYC vault stock was on Nov 20 (about 3 weeks ago) and prior to that ... over a decade. Back in November I speculated on what the unusual NYC vault stock change could mean:

"JPM swaps silver held in London in customer accounts to SLV. JPM swaps SLV silver in NYC into customer accounts to balance the London move. These customers may not care or be aware that "their" silver is now allocated in NYC instead of London."

Because SLV generally adds shares and vault stock as the price of silver rises, it looks like someone is raiding the SLV vault stock. I think it is very likely that the LBMA is in trouble again.

PSLV

PSLV added zero new units to the trust and zero ozt to the vault stock (they reported a minor 487 ozt adjustment). I think they still need to add another ~500K ozt to the vault per all the units added recently.

SLV NYC vault stock change speculation:

Yesterday silver spot bounced around between $66 and $67. Let's look below the surface...

COMEX

The COMEX silver stock report for Tuesday (COMEX reports activity for the previous working day) was another two trucks in and three trucks out day with ~1.1M ozt (33 metric tons) deposited in Loomis (600K ozt) and StoneX (459K ozt directly into the registered category - again) while 1.9M ozt (60.8 metric tons) were withdrawn from the JPM vault (they were busy!).

Surprisingly, no silver was moved from registered to eligible.

It's a bit early in the morning right now, but as of this moment I'm seeing the Dec25 EFP spread negative at -$0.33. It was -$0.74 when I checked yesterday morning. The January and February (non-delivery months) are at a discount to LBMA spot (negative EFP spread) and the March contract is closely tracking LBMA spot (near zero to slightly positive EFP spread).

COMEX withdrawals are picking up again and the Dec25 contract continues to see more contracts standing for delivery daily so it would seem that the bullion banks are taking advantage of the Dec25's negative EFP spread to send COMEX silver to London.

India

Indian futures as of the moment are showing the MCX February contract at ~$71.10/ozt and the March contract at $70.92/ozt. The March contract is at a $0.18/ozt discount to the February contract (it was a $0.21/ozt discount yesterday when I checked). Looks like the backwardation in the Indian futures remains persistent near $0.20/ozt. India is still hungry for immediate delivery silver.

SLV

SLV shares available to borrow remains pegged at 10M shares with little variation (or activity for that matter) for weeks now. Yesterday the borrow fee dropped from 1.37% back to 0.77%. Again, there seemed to be little activity reported in share availablility or borrowing fee (was it just the reporting, or was the market quiet?).

Blackrock reported no change in shares and JPM reported no change to the vault stock. Given the rise in silver spot, that seems strange. Was JPM unable to source silver for deposit into the SLV vault?

PSLV

PSLV added 1,564,344 new units to the trust and zero ozt to the vault stock. I think they now need to add ~1M ozt to the vault per all the units added recently.

Yesterday silver spot bounced around between $65 and $66. Let's look below the surface...

COMEX

~1.2M ozt (37.7 metric tons) deposited in CNT (495K ozt) and StoneX (717K ozt directly into registered - again for the 3rd time)

987K ozt (30.7 metric tons) were withdrawn from the JPM vault.

1.3M ozt (41.7 metric tons) were moved from registered to eligible in the Asahi (929K ozt) and StoneX (413K ozt) vaults. 342K ozt (10.6 metric tons) were moved from eligible to registered in the Brinks (10K ozt) and CNT (332K ozt) vaults.

EFP spread

With a current spot price of $65.90, I'm seeing the Dec25 EFP spread negative at -$1.27 (vs -$0.33 yesterday morning)

Jan26 and Feb26 are also negative EFP spread

Mar26 is at a slightly positive EFP spread

Commentary

COMEX withdrawals are running 1-2M ozt/day lately and the Dec25 contract continues to see more contracts standing for delivery daily so it would seem that the bullion banks are taking advantage of the Dec25's negative EFP spread to send COMEX silver to London.

Indian MCX Futures

Feb26 is at $71.10/ozt (again!)

Mar26 is at $70.89/ozt

$0.21/ozt backwardation vs $0.18/ozt yesterday

Looks like India is still hungry for immediate delivery silver.

SLV Share Lending

For the first time in several weeks, the shares available to borrow has fallen below 10M shares to 9.3M

Borrow fee moved a bit from 0.77% and settled at 0.78%

SLV share activity has finally returned

SLV Assets

Blackrock reported no change in shares

JPM reported no change to the vault stock

Day 2 of no share/stock change and now with active share borrowing. Is JPM having trouble sourcing silver for deposit into the SLV vault?

PSLV

No new units added to the trust

600K ozt (18.7 metric tons) added to the vault stock

I think they still need to add ~400K ozt to the vault stock per all the units added recently

Yesterday silver spot surged above $67. Below the surface, signs of stress for the LBMA appear to be increasing ...

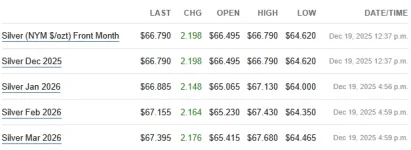

COMEX 12-18 activity

~1.2M ozt (37.2 metric tons) deposited in Loomis vault

646K ozt (20.1 metric tons) were withdrawn from the JPM vault

2M ozt (63.8 metric tons) were moved from registered to eligible in the Brinks (1.3M ozt) and CNT (742K ozt) vaults

342K ozt (10.6 metric tons) were moved from eligible to registered in the Asahi vault

EFP spread

With a current spot price of $67.01, I'm seeing the Dec25 EFP spread negative at -$0.22 (vs -$1.27 yesterday morning)

Jan26 is also negative EFP spread, but Feb26 has turned positive

Mar26 is now at a strongly positive EFP spread of $0.38

Commentary

It would seem that the flow of silver from COMEX to LBMA has slowed down a bit. COMEX withdrawals on Thursday were half of what we were seeing earlier in the week and yesterday saw a diminished number of additional Dec25 contracts standing for delivery while the Dec25 EFP spread also narrowed. If this continues, the LBMA is going to be in trouble very soon!

Indian MCX Futures

Feb26 is at $72.45/ozt

Mar26 is at $72.20/ozt

$0.25/ozt backwardation vs $0.21/ozt yesterday

Looks like India is still hungry for immediate delivery silver. Is London still delivering?

SLV Share Lending

Shares available to borrow has now fallen from 9.3M to 7.7M

Borrow fee also fell from 0.78% to 0.68%

SLV share borrowing activity seems to be picking up again. If the COMEX->LBMA flow slows down, this is likely to accelerate.

SLV Assets

Blackrock added 1.7M shares

JPM added 1.5M ozt (47.9 metric tons) to the vault stock

It looks to me like it took 3 days for JPM to complete the swap of ~1.4M ozt from SLV's NYC vault to London

SLV Comments

I posit that JPM is having difficulty sourcing LBMA vaulted silver for backing new SLV shares. If correct, we'll see more drawdowns from SLV's NYC vault as JPM swaps it for London vaulted silver. Once that well is dry, we are likely to see some real fireworks.

PSLV

No new units added to the trust

No silver added to the vault stock (just a small 788 ozt adjustment)

I think they still need to add ~400K ozt to the vault stock per all the units added recently

- Messages

- 36,510

- Reaction score

- 6,304

- Points

- 288

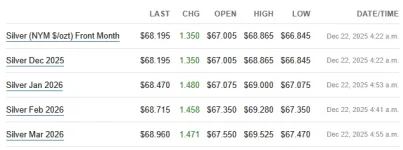

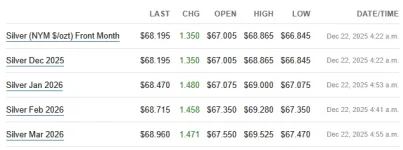

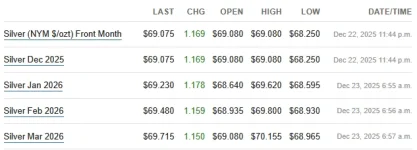

Monday morning 12-22 (USA) in silver. Folks might be distracted by holiday activities this week, but I suspect the silver market is going to provide quite the fireworks show for those who pay attention.

SGE silver rose above $71.50/ozt in overnight trading in China. The SFE silver vault now has a 4 week long streak of inflows as should be expected while China maintains premiums over the West's silver prices. I am curious how the SGE silver premium will react once China restricts access to the SGE silver market while also restricting silver exports as 2026 begins.

With a current spot price of $69.12, I'm seeing the Dec25 EFP spread negative at -$0.925 (vs -$0.22 Friday morning)

Jan26, Feb26 and even Mar26 are currently also negative EFP spread. Either Mar26 will turn positive once the futures market opens today (playing catch up to the spot market) or London is truly facing some supply stress.

Feb26 is at $74.22/ozt

Mar26 is at $74.05/ozt

$0.17/ozt backwardation vs $0.25/ozt Friday

Looks like India is still hungry for immediate delivery silver. Is London still delivering?

Shares available to borrow now back to 10M

Borrow fee is steady at 0.68%

Looks like they reloaded for the week. Will it be enough?

China

SGE silver rose above $71.50/ozt in overnight trading in China. The SFE silver vault now has a 4 week long streak of inflows as should be expected while China maintains premiums over the West's silver prices. I am curious how the SGE silver premium will react once China restricts access to the SGE silver market while also restricting silver exports as 2026 begins.

EFP spread

With a current spot price of $69.12, I'm seeing the Dec25 EFP spread negative at -$0.925 (vs -$0.22 Friday morning)

Jan26, Feb26 and even Mar26 are currently also negative EFP spread. Either Mar26 will turn positive once the futures market opens today (playing catch up to the spot market) or London is truly facing some supply stress.

Indian MCX Futures

Feb26 is at $74.22/ozt

Mar26 is at $74.05/ozt

$0.17/ozt backwardation vs $0.25/ozt Friday

Looks like India is still hungry for immediate delivery silver. Is London still delivering?

SLV Share Lending

Shares available to borrow now back to 10M

Borrow fee is steady at 0.68%

Looks like they reloaded for the week. Will it be enough?

Yesterday silver spot bounced around between $68 and $69. Below the surface, the magnitude of vault flows are increasing ...

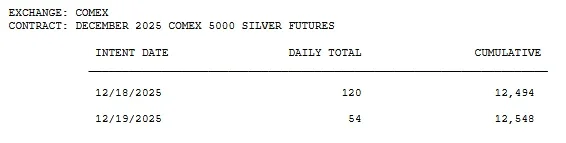

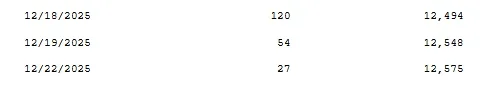

COMEX 12-19 activity

Zero silver deposited

3M ozt (95.9 metric tons) were withdrawn from the Asahi (589K ozt), CNT (600K ozt), JPM (1.2M ozt) and Loomis (600K ozt) vaults

Zero silver moved between registered and eligible categories.

EFP spread

With a current spot price of $69.70, I'm seeing the Dec25 EFP spread negative at -$0.62 (vs -$0.92 yesterday morning)

Jan26 and Feb26 are also negative EFP spread

Mar26 EFP spread is slightly positive at $0.015

Commentary

COMEX withdrawals increased bigly while Dec25 deliveries continue to shrink by half daily. I assume these withdrawals are headed to London to provide life support.

Indian MCX Futures

Feb26 is at $75.19/ozt

Mar26 is at $75.01/ozt

$0.18/ozt backwardation vs $0.17/ozt yesterday

Looks like India is still hungry for immediate delivery silver. Is London still delivering?

SLV Share Lending

Shares available is back to 10M

Borrow fee also fell from 0.68% to 0.59%

There seem to be plenty of shares available to borrow at the moment.

SLV Assets

Blackrock added a whopping 18.9M shares

JPM added a massive 17.1M ozt (533 metric tons!) to the vault stock

NGL - I didn't think the LBMA had that much ocean available.

SLV Comments

From 12-11 to 12-19, COMEX withdrawals totaled 12.1M ozt (377.3 metric tons) - not enough to cover SLV's massive 17.1M ozt inflow yesterday. Were COMEX withdrawals from November shipped by boat and just arrived? Very curious!

PSLV

No new units added to the trust

No silver added to the vault stock

I think they still need to add ~400K ozt to the vault stock per all the units added recently