You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Silver Demand Drivers (and vault totals)

- Thread starter pmbug

- Start date

- Featured

-

- Tags

- physical demand

Welcome to the Precious Metals Bug Forums

Welcome to the PMBug forums - a watering hole for folks interested in gold, silver, precious metals, sound money, investing, market and economic news, central bank monetary policies, politics and more.

Why not register an account and join the discussions? When you register an account and log in, you may enjoy additional benefits including no Google ads, market data/charts, access to trade/barter with the community and much more. Registering an account is free - you have nothing to lose!

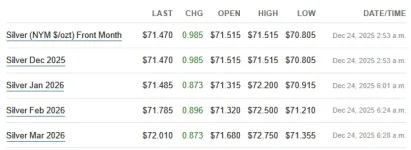

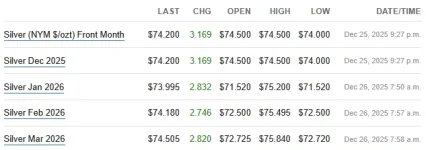

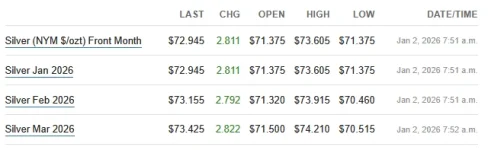

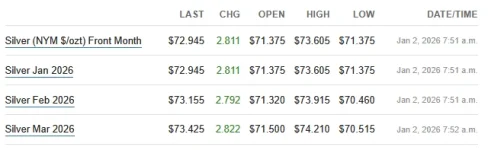

Yesterday silver spot rose above $71. Below the surface, pressure seems to be building ...

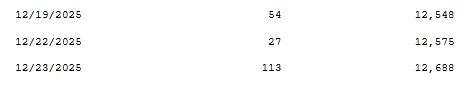

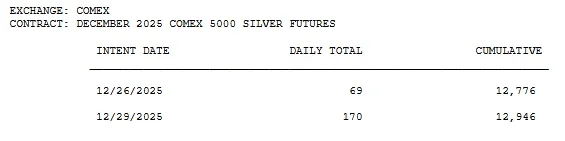

COMEX 12-22 activity

1M ozt (33.8 tonnes) deposited in Loomis (599K) and MT&B (488K)

852K ozt (26.5 tonnes) were withdrawn from the CNT (229K), JPM (598K) and StoneX (25K ozt) vaults

1.4M ozt (43.6 tonnes) moved from registered to eligible in the Asahi vault.

EFP spread

With a current spot price of $72.20, I'm seeing the Dec25 EFP spread negative at -$0.73 (vs -$0.62 yesterday morning)

Jan26 and Feb26 are also negative EFP spread

Mar26 EFP spread is now solidly negative at -$0.19

Commentary

Increasingly negative EFP spreads encourage continued COMEX withdrawals (for transport to LBMA). Asahi looks to be preparing for a large withdrawal. The Dec25 contract saw an increase in deliveries yesterday. All signs point to increasing COMEX drain.

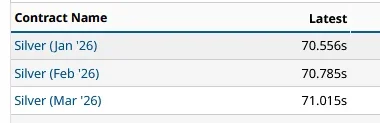

Indian MCX Futures

Feb26 is at $77.77/ozt

Mar26 is at $77.62/ozt

$0.15/ozt backwardation vs $0.18/ozt yesterday

Looks like India is still hungry for immediate delivery silver. Is London still delivering?

China SGE/SFE

SGE (spot) $78.49

SFE (futures) $78.02

Backwardation in China. Also, for the first time since I've been watching, the SFE futures for silver are greater than the Indian futures prices.

SLV Share Lending

Shares available is back to 10M

Borrow fee almost tripled from 0.56% to 1.51% before settling at 1.02%

Looks like someone borrowed a lot shares yesterday.

SLV Assets

Blackrock shed 3.4M shares

JPM shed 3M ozt (95.9 tonnes) from the vault stock

Looks like someone redeemed those borrowed shares to raid the SLV vault stock.

PSLV

No new units added to the trust

A very rare 4.6K ozt was removed from the vault stock

I think they still need to add ~405K ozt to the vault stock per all the units added recently. Are they having trouble sourcing silver? They normally back new units within a day or two, and it's been close to a week now.

Final comments

There is severe tightness in physical silver supplies everywhere but the COMEX (for now):

- Negative EFP spreads (LBMA tightness)

- Indian futures backwardation

- China futures backwardation and elevated price

- SLV share/vault stock raiding (LBMA tightness)

- PSLV delays in backing unit issuance

- Elevated lease rates (LBMA tightness)

The LBMA's November vault stock report has likely overstated the LBMA's silver stock for the second month in a row.

We now have some (preliminary, but in the ball park as per last month) silver import numbers from India. If I'm reading the chart (quoted below) correctly, India imported:

~390 metric tons from the UK (London/LBMA)

~100 metric tons from China (SGE/SFE)

~90 metric tons from Switzerland (could be recast metal from UK or China)

~170 metric tons from UAE and "Other" which could also be indirectly from UK, China and/or COMEX

Total import was on the order of ~750 metric tons, which is a bit less than the 1,000 metric tons than I had anticipated based upon prior reporting. In any event, we can now do some number crunching with this import data.

The SGE/SFE drained 243 metric tons in November. If ~100 metric tons went to India, that leaves just 143 metric tons that could possibly have been sent to London (assuming none of the drain was consumed domestically or sent to the UAE, Switzerland or "other", which is not reasonable).

The vault flows for November then break down like so:

COMEX drain = 725 tonnes (possibly sent to London)

SFE/SGE (non-Indian) drain = 143 tonnes (possibly sent to London)

SLV/ETFs gain = 867 tonnes (definitely drained from London)

India gain = 390 tonnes (definitely drained from London)

Even assuming 100% of COMEX and SFE/SGE drain went to London in November (which is not reasonable), the LBMA should have reported a loss of 389 tonnes instead of a gain of 65 tonnes. The LBMA's November report appears to have overstated their silver vault stock by at least 454 tonnes which is in line with what I estimated when the report first dropped (I said ~500 tonnes which is probably closer to the truth given reasonable assumptions).

We now have some (preliminary, but in the ball park as per last month) silver import numbers from India. If I'm reading the chart (quoted below) correctly, India imported:

~390 metric tons from the UK (London/LBMA)

~100 metric tons from China (SGE/SFE)

~90 metric tons from Switzerland (could be recast metal from UK or China)

~170 metric tons from UAE and "Other" which could also be indirectly from UK, China and/or COMEX

Total import was on the order of ~750 metric tons, which is a bit less than the 1,000 metric tons than I had anticipated based upon prior reporting. In any event, we can now do some number crunching with this import data.

The SGE/SFE drained 243 metric tons in November. If ~100 metric tons went to India, that leaves just 143 metric tons that could possibly have been sent to London (assuming none of the drain was consumed domestically or sent to the UAE, Switzerland or "other", which is not reasonable).

The vault flows for November then break down like so:

COMEX drain = 725 tonnes (possibly sent to London)

SFE/SGE (non-Indian) drain = 143 tonnes (possibly sent to London)

SLV/ETFs gain = 867 tonnes (definitely drained from London)

India gain = 390 tonnes (definitely drained from London)

Even assuming 100% of COMEX and SFE/SGE drain went to London in November (which is not reasonable), the LBMA should have reported a loss of 389 tonnes instead of a gain of 65 tonnes. The LBMA's November report appears to have overstated their silver vault stock by at least 454 tonnes which is in line with what I estimated when the report first dropped (I said ~500 tonnes which is probably closer to the truth given reasonable assumptions).

I made a mistake in my report and the true extent of the LBMA misreporting is *much* worse than I thought.

Since I included the ETFs/SLV in the net adjustment, I should have compared it against the LBMA total stock report instead of the implied free float (which discounts the ETFs/SLV).

In other words, the LBMA should have reported a loss of 389 tonnes instead of a gain of 932 tonnes.

dyodd

Congress.gov

USGS Critical minerals list:

The 2025 CML of 60 critical minerals includes

aluminum, antimony, arsenic, barite, beryllium, bismuth, boron, cerium, cesium, chromium, cobalt, copper, dysprosium, erbium, europium, fluorspar, gadolinium, gallium, germanium, graphite, hafnium, holmium, indium, iridium, lanthanum, lead, lithium, lutetium, magnesium, manganese, metallurgical coal, neodymium, nickel, niobium, palladium, phosphate, platinum, potash, praseodymium, rhenium, rhodium, rubidium, ruthenium, samarium, scandium, silicon, silver, tantalum, tellurium, terbium, thulium, tin, titanium, tungsten, uranium, vanadium, ytterbium, yttrium, zinc, and zirconium.

New additions in bold

<heh>

Somehow I'm not impressed.

What did the fake asian have to say?

Shouldn't take ten minutes to tell us that silber was one of sixty critical minerals.

Congress.gov

USGS Critical minerals list:

The 2025 CML of 60 critical minerals includes

aluminum, antimony, arsenic, barite, beryllium, bismuth, boron, cerium, cesium, chromium, cobalt, copper, dysprosium, erbium, europium, fluorspar, gadolinium, gallium, germanium, graphite, hafnium, holmium, indium, iridium, lanthanum, lead, lithium, lutetium, magnesium, manganese, metallurgical coal, neodymium, nickel, niobium, palladium, phosphate, platinum, potash, praseodymium, rhenium, rhodium, rubidium, ruthenium, samarium, scandium, silicon, silver, tantalum, tellurium, terbium, thulium, tin, titanium, tungsten, uranium, vanadium, ytterbium, yttrium, zinc, and zirconium.

New additions in bold

<heh>

Somehow I'm not impressed.

What did the fake asian have to say?

Shouldn't take ten minutes to tell us that silber was one of sixty critical minerals.

words like “supercycle” remind me of all the hype about Q and “the world must be shown” and release of epstein files et al ad nauseum.dyodd

Congress.gov

USGS Critical minerals list:

The 2025 CML of 60 critical minerals includes

aluminum, antimony, arsenic, barite, beryllium, bismuth, boron, cerium, cesium, chromium, cobalt, copper, dysprosium, erbium, europium, fluorspar, gadolinium, gallium, germanium, graphite, hafnium, holmium, indium, iridium, lanthanum, lead, lithium, lutetium, magnesium, manganese, metallurgical coal, neodymium, nickel, niobium, palladium, phosphate, platinum, potash, praseodymium, rhenium, rhodium, rubidium, ruthenium, samarium, scandium, silicon, silver, tantalum, tellurium, terbium, thulium, tin, titanium, tungsten, uranium, vanadium, ytterbium, yttrium, zinc, and zirconium.

New additions in bold

<heh>

Somehow I'm not impressed.

What did the fake asian have to say?

Shouldn't take ten minutes to tell us that silber was one of sixty critical minerals.

Obviously price is going up. But we have seen price go up before.

I still appreciate the thread, just way more cautious than i was in 2010

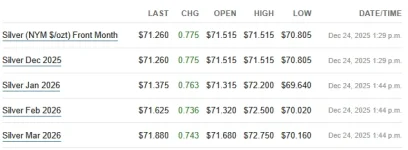

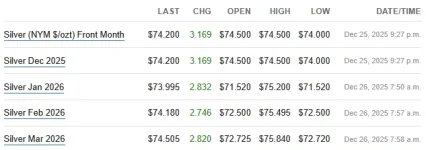

Yesterday silver spot closed just shy of $72. Below the surface, signs of distress continue ...

COMEX 12-23 activity

472K ozt (14.7 tonnes) deposited in CNT (26K) and StoneX (449K - directly into registered)

Zero was withdrawn

1.3M ozt (40.7 tonnes) moved from registered to eligible in the CNT (331K), HSBC (565K), JPM (366K) vaults.

EFP spread

With a current spot price of $71.84, I'm seeing the Dec25 EFP spread negative at -$0.58 (vs -$0.73 yesterday morning)

Jan26 and Feb26 are also negative EFP spread

Mar26 EFP spread is back to slightly positive at +$0.04

Commentary

EFP spreads lightened up yesterday. And while the COMEX was quiet with zero withdrawals, there is a lot of silver moving from registered to eligible that may get withdrawn when the holidays are over.

Indian MCX Futures

Feb26 is at $77.74/ozt

Mar26 is at $77.54/ozt

$0.20/ozt backwardation vs $0.15/ozt yesterday

Looks like India is still hungry for immediate delivery silver. Is London still delivering?

China SGE/SFE

SGE (spot) $77.38

SFE (futures) $77.30

SFE in slight backwardation in China at a $0.08 discount to SGE. It was a $0.47 discount yesterday.

SFE is back to a discount ($0.44) versus Indian MCX Feb26 futures. It was a $0.25/ozt premium yesterday.

SLV Share Lending

Shares available still showing 10M

Borrow fee has returned to 0.60% after a brief spike.

It would seem the inventory raid was just a one time thing. However...

SLV Assets

Blackrock shed 2M shares

JPM reported no change to the vault stock

The iShares page shows vault stock 1.8M less than JPM's bar report. Usually, this means the JPM bar report plays catch up a (working) day later. Was this a second tranche from the same block of shares borrowed the other day?

PSLV

No units added

No ozt removed

PSLV changed their units/ozt calculation ratio on their page from .3434 down to .3426. Is this just reflecting the current ~405K ozt deficit that I've been noting, or is it indicating that they are not planning to back the units as much as they have in the past?

Big Picture

Same as yesterday (severe tightness everywhere but COMEX):

- Indian futures backwardation

- China futures backwardation / high premium

- PSLV delay in backing unit issuance

- Negative EFP spreads (LBMA)

- SLV share/stock raiding (LBMA)

- High lease rates (LBMA)

Big Picture (China)

It looks like China is starting to experience some domestic supply shock. The price explosion and high premium over LBMA are a sign. China's government also appears to be restricting the public's access to the market. China's bullion banks that are also LBMA members will likely be trying to buy silver cheap in London to ship to China. Will London have enough?

ICYMI:

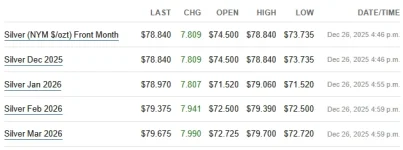

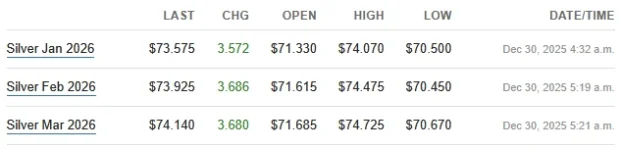

The Day After Christmas - Morning report

Western markets were closed yesterday. Global markets traded overnight. Silver up to just under $75 at the LBMA, over $82 at the SGE.

With a current spot price of $74.46, I'm seeing the Dec25 EFP spread negative at -$0.26 (vs -$0.58 yesterday morning)

Jan26 and Feb26 are also negative EFP spread

Mar26 EFP spread remains slightly positive at +$0.04

Feb26 is at $80.73/ozt

Mar26 is at $80.53/ozt

$0.20/ozt backwardation vs $0.20/ozt yesterday

Looks like India is still hungry for immediate delivery silver. Is London still delivering?

SGE (spot) $82.07

SFE (futures) $81.40

SFE $0.67 discount to SGE. It was a $0.08 discount yesterday.

SFE is back to a premium ($0.67) versus Indian MCX Feb26 futures. It was a $0.44/ozt discount yesterday.

Western markets were closed yesterday. Global markets traded overnight. Silver up to just under $75 at the LBMA, over $82 at the SGE.

EFP spread

With a current spot price of $74.46, I'm seeing the Dec25 EFP spread negative at -$0.26 (vs -$0.58 yesterday morning)

Jan26 and Feb26 are also negative EFP spread

Mar26 EFP spread remains slightly positive at +$0.04

Indian MCX Futures

Feb26 is at $80.73/ozt

Mar26 is at $80.53/ozt

$0.20/ozt backwardation vs $0.20/ozt yesterday

Looks like India is still hungry for immediate delivery silver. Is London still delivering?

China SGE/SFE

SGE (spot) $82.07

SFE (futures) $81.40

SFE $0.67 discount to SGE. It was a $0.08 discount yesterday.

SFE is back to a premium ($0.67) versus Indian MCX Feb26 futures. It was a $0.44/ozt discount yesterday.

ICYMI:

Yesterday silver spot exploded to $79. Below the surface, many strange things were happening ...

Bid-Ask Spread

The bid-ask spread widened near the end of the day. Is this a sign of illiquidity in London or did some banks just close early for the weekend?

COMEX 12-24 activity

19K ozt (0.6 tonnes) deposited in Loomis

1.6M ozt (51.1 tonnes) were withdrawn from Asahi (1.1M), MT&B (434K) and Loomis (the same 19K that was deposited!)

1.2M ozt (39.4 tonnes) moved from eligible to registered in the Asahi (625K) and Loomis (643K) vaults.

COMEX Commentary

We finally saw the ~1M ozt withdrawal from Asahi telegraphed earlier when they moved that silver from registered to eligible. I was expecting to see large withdrawals pick up again as I think the LBMA needs physical silver right now.

I can only assume the 1.2M moved to registered means they need to prepare for some January deliveries?

EFP spread

With a current spot price of $79.16, EFP spreads:

Dec25 = -$0.32 (vs -$0.26 yesterday morning)

Jan26 = -$0.19

Feb26 = +$0.22

Mar26 = +$0.52

EFP Commentary

EFP spreads went further positive yesterday. That makes it more expensive to ship silver to London. I believe that is why the CME announced margin raises for close of Monday.

Indian MCX Futures

Feb26 is at $83.66/ozt

Mar26 is at $83.40/ozt

$0.26/ozt backwardation vs $0.20/ozt yesterday

Looks like India is still hungry for immediate delivery silver. Is London still delivering?

SLV Share Lending

Shares available still showing 10M (it did dip below that yesterday with signs that shares were actively being borrowed)

Borrow fee fell slightly to 0.58% after a brief rise to 0.67%.

SLV Assets

Blackrock shed another 2M shares

JPM still no change

Day 2 shares shed and JPM reports no vault stock change. The iShares page now shows SLV vault stock 3.6M ozt less than JPM's bar report. Is JPM just not updating the bar report?

PSLV

3.3M units added

700K ozt added

PSLV units/ozt ratio has now changed from .3434 to .3426 to .3419. I don't know what ratio they are targeting, but if they are intending to maintain the historical .3434, they need to add another ~929K ozt.

Big Picture

LBMA spot chased SGE premium, but tightness remains:

- Indian futures backwardation

- China futures backwardation (public access to be restricted)

- SGE > LBMA (spot)

- PSLV units/ozt ratio falling (need more ozt)

- EFP spreads were headed positive, CME margin hikes likely to slam back negative

- SLV share/stock raiding (LBMA)

- High lease rates (LBMA)

ICYMI:

Viking

Yellow Jacket

Monday morning 12-29 (USA) in silver. The silver fireworks show week has begun ...

The bid-ask spread has narrowed from ~$0.79 on Friday to $0.06 this morning.

Silver prices held firm last night.

The Dec25 contract is off the board. With a current spot price of $75.75, EFP spreads:

Jan26 = -$1.19 vs -$0.19 Friday

Feb26 = -$0.75 vs +$0.22

Mar26 = -$0.68 vs +$0.52

As I was anticipating with the CME margin raise announcement, EFP spreads have shifted strongly negative for now. We'll have to wait until Wednesday to see if the CME silver stock report shows large withdrawals for today as silver flows from COMEX to LBMA.

Feb26 is at $82.14/ozt

Mar26 is at $81.60/ozt

$0.54/ozt backwardation vs $0.26/ozt Friday

That's a big jump - double what it's been for the last week or two. Is India having trouble getting physical silver from London and China?

Shares available currently 10M

Borrow fee starts the week at 0.68%

I expect to see SLV vault stock raided this week. We'll see.

Bid-Ask Spread

The bid-ask spread has narrowed from ~$0.79 on Friday to $0.06 this morning.

China

Silver prices held firm last night.

EFP spread

The Dec25 contract is off the board. With a current spot price of $75.75, EFP spreads:

Jan26 = -$1.19 vs -$0.19 Friday

Feb26 = -$0.75 vs +$0.22

Mar26 = -$0.68 vs +$0.52

EFP Commentary

As I was anticipating with the CME margin raise announcement, EFP spreads have shifted strongly negative for now. We'll have to wait until Wednesday to see if the CME silver stock report shows large withdrawals for today as silver flows from COMEX to LBMA.

Indian MCX Futures

Feb26 is at $82.14/ozt

Mar26 is at $81.60/ozt

$0.54/ozt backwardation vs $0.26/ozt Friday

That's a big jump - double what it's been for the last week or two. Is India having trouble getting physical silver from London and China?

SLV Share Lending

Shares available currently 10M

Borrow fee starts the week at 0.68%

I expect to see SLV vault stock raided this week. We'll see.

ICYMI:

Viking

Yellow Jacket

Viking

Yellow Jacket

SilverStacker

Ground Beetle

- Messages

- 531

- Reaction score

- 361

- Points

- 108

Well I got nervous and bought high so I'm eating crow. But I'm talking what ? Dinner money ? And I still hold physical, and there's still the law of supply and demand, and theres still the lack of production. I knew silver was going to go down but I didn't expect a crash, if indeed we have a crash coming. I'm more nervous over gold being down $156 to tell you the truth.

Anyway, it was 20 coins. I can eat that. It comes out to a loss of about $200. Like I said, lunch money. Its more the fact I fell for it again and got all excited, sure about the Asian guy. Its the score in the game that pisses me off. I knew better. But I wont be joining the ETF and paper players on the 20'th floor taking turns leaping off. Us little guys can only screw up so much.

I still think silver is the future, just not right now. I have great faith in Govt.'s screwing up economys with over-printing Monopoly money.

Anyway, it was 20 coins. I can eat that. It comes out to a loss of about $200. Like I said, lunch money. Its more the fact I fell for it again and got all excited, sure about the Asian guy. Its the score in the game that pisses me off. I knew better. But I wont be joining the ETF and paper players on the 20'th floor taking turns leaping off. Us little guys can only screw up so much.

I still think silver is the future, just not right now. I have great faith in Govt.'s screwing up economys with over-printing Monopoly money.

...

I still think silver is the future, just not right now. ...

Report back in one week.

So India is paying over $80 / oz, China is paying over $80 / oz, but they are still selling it here for $72 ish / oz. Get some.

Big thank you to Bug and everyone here.Report back in one week.

Having your collective experience allows me to see it all as entertainment rather than me base jumping with no chute.

But $100 down days in gold is still a bit shocking and a 10% drop in silver is astonishing ……

I checked the numbers of my silver and gold holdings last night cos it might be a while before we get back to that ath

And today, as we watched the numbers falling hard, I had a bit of a look around to see what land is for sale locally cos suddenly land isn’t so attractive in Blighty due to government eagerness to kill food producers and family farms . Hmmmmmm

I guess we will always have to expect the crooks running the ‘markets’ to have more tricks brewing as the old ones wear out though.

As for the comp to guess the midnight dec 30th price, well those dowsing rods and a full moon were probably the best approach after all

That's exactly it. Desperate times for Mr Slammy. Me soooo sadd.

SilverStacker

Ground Beetle

- Messages

- 531

- Reaction score

- 361

- Points

- 108

In the end the best part about all this is you still own something no matter what. Shanghai is at $83 because the Chinese have something going on over there and I'd bet the rest of the world is going to be shooting back up.

Can someone explain the retail chain of events to me ? All these online dealer could not have moved all that stock in a few hours yet everyone has the "out of stock" signs up. Are they just sitting on stock they paid high for, waiting for spot prices to rise again to sell it ? Or is the whole thing more streamlined as in they take an order and they then order from a whole seller quickly so they can't lose no matter what ?

Can someone explain the retail chain of events to me ? All these online dealer could not have moved all that stock in a few hours yet everyone has the "out of stock" signs up. Are they just sitting on stock they paid high for, waiting for spot prices to rise again to sell it ? Or is the whole thing more streamlined as in they take an order and they then order from a whole seller quickly so they can't lose no matter what ?

Actually I was seeing quite a bit in stock today. I expected nothing to be available. Sunday the bigger silver bars seemed to have mostly disappeared. Also, there was a mining CEO, Kuya i think, that was on Arcadia saying they personally received a call from Chinese firms wanting to pay over spot for Silver. I think its around the 40 min mark.

10% up and 10% down... something is properly fucked up, beyond the silver squeeze shenanigans.

Is there a trading halt? Price hasn't moved in the past 15 mins.

Futures close for an hour from 4-5pm CST. Should reopen in 45 mins.

In the end the best part about all this is you still own something no matter what. Shanghai is at $83 because the Chinese have something going on over there and I'd bet the rest of the world is going to be shooting back up.

Can someone explain the retail chain of events to me ? All these online dealer could not have moved all that stock in a few hours yet everyone has the "out of stock" signs up. Are they just sitting on stock they paid high for, waiting for spot prices to rise again to sell it ? Or is the whole thing more streamlined as in they take an order and they then order from a whole seller quickly so they can't lose no matter what ?

SD is pretty damn open about it. They claimed they had sold most of their anticipated inventory by Sat afternoon.

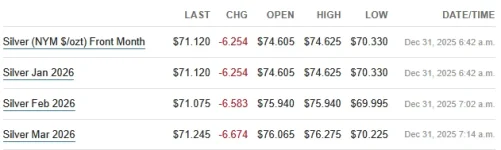

Yesterday silver spot fell to support at ~$72. Let's look below the surface ...

Bid-Ask Spread

This morning I'm seeing the bid-ask spread has narrowed from $0.06 yesterday to $0.04. Looks like the bid-ask spread is normalizing from Friday's blow out.

COMEX 12-26 activity

Zero ozt deposited

600K ozt (18.7 tonnes) withdrawn from Loomis

Zero ozt moved between eligible and registered

COMEX Commentary

The 26th was quiet. This afternoon we get the activity report for yesterday (29th). I expect to see a lot of withdrawals given the strongly negative EFP spread. Even though the Dec25 contract was off the board, there was a large 170 contracts for delivery.

EFP spread

With a current spot price of $74.49, EFP spreads:

Jan26 = -$0.92 vs -$1.19 yesterday

Feb26 = -$0.57 vs -$0.75

Mar26 = -$0.35 vs -$0.68

EFP Commentary

As expected in the wake of the CME margin raise announcement, EFP spreads shifted strongly negative, but the half life for them is short as they are already decaying (narrowing back towards zero). The Mar26 will likely be positive again by tomorrow morning or Friday.

Indian MCX Futures

Feb26 is at $82.09/ozt

Mar26 is at $81.79/ozt

$0.30/ozt backwardation vs $0.54/ozt yesterday

Perhaps yesterday's big jump was just reflective of the recent market volatility.

China

Silver establishing equilibrium in China? SGE holds $80 and contango returns even as the SFE continues to see massive drains.

Lease Rates

Given the turmoil in the silver market over the last couple of trading days, it is surprising to see that the lease rates have not changed too much from a week ago.

SLV Share Lending

Shares available currently 10M

Borrow fee jumped from 0.58% to 0.80%

The borrow fee has started to creep up, but there are still plenty of shares available to plunder.

SLV Assets

Blackrock sheds another 3M shares

JPM sheds 6.3M ozt (197.4 metric tons)

JPM catches up to Blackrock with the share/vault stock drain reporting. It appears as if the raid is on.

PSLV

Zero units added

600K ozt added

PSLV units/ozt ratio recovers to .3429. They need to add another ~329K ozt to get back to the historical .3434 ratio

Big Picture

- Negative EFP spread + SGE (spot) > LBMA (spot) = silver flowing from COMEX -> LBMA -> SGE

- Indian futures backwardation

- PSLV catching up, but still delayed adding ozt to back units

- SLV share/stock raiding ongoing 3 days now (LBMA)

- High lease rates persist (LBMA)

ICYMI:

Supposedly the OI dropped after the big plunge yesterday as well. Indicating the big banks Orchestrated that move to try and cover as much of their Arse as possible.

Yesterday silver spot held its ground around $76. Below the surface, some big things are happening ...

COMEX 12-29 activity

633K ozt (19.7 tonnes) deposited mostly in Brinks (302K in registered, 296K in eligible)

930K ozt (28.9 tonnes) withdrawn mostly from Asahi

91K ozt (2.8 tonnes) moved from registered to eligible in the Delaware vault

COMEX Commentary

I was expecting a heavy withdrawal on this report given the deeply negative EFP on Monday. Asahi did not disappoint. I'm a bit surprised there wasn't even more withdrawn from the other vaults. Maybe we see that later today in the report for Tuesday's activity.

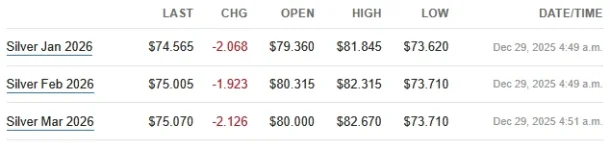

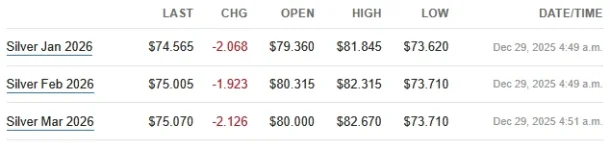

EFP spread

With a current spot price of $71.40, EFP spreads:

Jan26 = -$0.28 vs -$0.92 yesterday

Feb26 = -$0.32 vs -$0.57

Mar26 = -$0.15 vs -$0.35

EFP Commentary

EFP spreads continued to narrow as expected. Jan26 and Feb26 are in backwardation. Someone wants silver ASAP.

More CME margin hikes

Is this an attempt to crush the bull run, or a desperate measure to goose and maintain a negative EFP spread so silver can flow from COMEX to LBMA? Will China hold the line on silver price (maintaining a large premium to the West)?

Indian MCX Futures

Feb26 is at $81.85/ozt

Mar26 is at $81.03/ozt

$0.82/ozt backwardation vs $0.30/ozt yesterday

Whoa! Backwardation widened with a big jump again. Is India having trouble sourcing physical silver from London and China?

China

SGE premium to LBMA dropped. Looks like China will slow down and let the LBMA dictate the price action.

China Big Picture

In case you missed it - a thread providing an overview of the silver market in China

Lease rates

Yesterday I wrote: "... it is surprising to see that the lease rates have not changed too much from a week ago.". A few hours after I wrote that:

SLV Share Lending

Shares available currently 10M

Borrow fee jumped from 0.80% to 2.33% before settling at 1.83%

The borrow fee went from creeping up to jumping up. There are still plenty of shares available to plunder.

SLV Assets

Blackrock adds 5.3M shares

JPM adds 4.8M ozt (149.5 tonnes)

SLV appears schizophrenic adding back almost all that was lost the day before. Given the jump in the borrow fee, I can only assume that the additions would have been more if not for some share raiding.

PSLV

3.6M units added

600K ozt added

PSLV units/ozt ratio drops to .3418. They need to add another ~986K ozt to get back to the historical .3434 ratio

Big Picture

- Negative EFP spread + SGE (spot) > LBMA (spot) = COMEX -> LBMA -> SGE silver flow

- Indian futures backwardation widening

- PSLV needs ~1M ozt to back units

- SLV action signald stress at the LBMA

- Already high lease rates getting higher (LBMA)

ICYMI:

Liking the new format their PMbug. Its well done.

As for the SLV additions.... those Are quite likely the raids. Those companies would likely be AP's and therefore if they "buy" then they can probably go and request the silver.

As for the SLV additions.... those Are quite likely the raids. Those companies would likely be AP's and therefore if they "buy" then they can probably go and request the silver.

Last week in silver (in metric tons):

SGE silver vault - drains 13.6

SFE silver vault - drains 80.2

SLV London vault - gains 437.1

PSLV silver vault - gains 21.6

COMEX silver stock - drains 47.1

LBMA silver stock - ??? (no daily or weekly data because LBMA is run by dinosaurs)

Global net change (less LBMA):

Dec 22-26 = +317.8

Dec 15-19 = +149.9

Dec 8-12 = +338.7

Dec 1-5 = +488.8

...

While I'm noting that the vault stock of all listed vaults above reported a net increase, the global free float actually took a huge hit last week. China (SGE/SFE) drained. COMEX drained. LBMA drained (SLV's gain is LBMA's drain). PSLV takes more LGD silver off the table.

COMEX vault saw inflows on Mon and Tue last week before outflows Wed and Fri. The Dec25 contract is off the board and Jan26-Mar26 are all with negative EFP spreads. COMEX should continue draining in this environment.

Last week, SLV had a massive inflow on Mon, a small outflow on Tue and then was quiet the rest of the week. So far this week, SLV share borrowing fee and vault stock (inflows/outflows) are seeing some volatile swings. I think the LBMA is starting to experience stress again.

After three weeks of inflows, last week the SFE & SGE reported a outflows. The SGE/SFE flirted with contango/backwardationis last week. Is this some year end market dynamic that will settle down in the New Year or indicative of something more systemic?

One can only imagine what chaos might be unfolding in the LBMA's London vault system right now. We can only imagine because the dinosaurs at the LBMA do not provide daily/weekly reporting of their vault stock like every other market and major fund in the world.

SGE silver vault - drains 13.6

SFE silver vault - drains 80.2

SLV London vault - gains 437.1

PSLV silver vault - gains 21.6

COMEX silver stock - drains 47.1

LBMA silver stock - ??? (no daily or weekly data because LBMA is run by dinosaurs)

Global net change (less LBMA):

Dec 22-26 = +317.8

Dec 15-19 = +149.9

Dec 8-12 = +338.7

Dec 1-5 = +488.8

...

While I'm noting that the vault stock of all listed vaults above reported a net increase, the global free float actually took a huge hit last week. China (SGE/SFE) drained. COMEX drained. LBMA drained (SLV's gain is LBMA's drain). PSLV takes more LGD silver off the table.

COMEX vault saw inflows on Mon and Tue last week before outflows Wed and Fri. The Dec25 contract is off the board and Jan26-Mar26 are all with negative EFP spreads. COMEX should continue draining in this environment.

Last week, SLV had a massive inflow on Mon, a small outflow on Tue and then was quiet the rest of the week. So far this week, SLV share borrowing fee and vault stock (inflows/outflows) are seeing some volatile swings. I think the LBMA is starting to experience stress again.

After three weeks of inflows, last week the SFE & SGE reported a outflows. The SGE/SFE flirted with contango/backwardationis last week. Is this some year end market dynamic that will settle down in the New Year or indicative of something more systemic?

One can only imagine what chaos might be unfolding in the LBMA's London vault system right now. We can only imagine because the dinosaurs at the LBMA do not provide daily/weekly reporting of their vault stock like every other market and major fund in the world.

Liking the new format their PMbug. Its well done.

I'm still learning how best to organize and present the large volume of information I'm watching every day. Thanks for the positive feedback.

Yesterday silver spot held its ground above $71. Below the surface, signs of stress are percolating ...

COMEX 12-30 activity

600K ozt (18.7 tonnes) deposited in Loomis

5K ozt (one LGD bar) withdrawn from Asahi

328K ozt (10.2 tonnes) moved from registered to eligible in the CNT (297K) and Brinks (30K) vaults

COMEX Commentary

The lack of withdrawals surprised given the negative EFP. If the COMEX doesn't send more silver to London, the LBMA is going to be in real trouble soon. Unless the CME crushes the price and the LBMA recoups stock from the ETFs (like SLV) as traders flee.

EFP spread

With a current spot price of $71.59, EFP spreads:

Jan26 = -$1.13 vs -$0.28 yesterday

Feb26 = -$0.89 vs -$0.32

Mar26 = -$0.61 vs -$0.15

EFP Commentary

CME raised margins for the second time in two days (by 30%!). As expected, EFP spreads shifted deeper negative. The half life on the EFP spread shift after the previous margin hike looked to be 3 days. I expect the EFP spread will normalize again within 3 days unless the CME jacks the margins again.

Indian MCX Futures

Feb26 is at $82.21/ozt

Mar26 is at $81.52/ozt

$0.69/ozt backwardation vs $0.82/ozt yesterday

Backwardation narrowed slightly but remains elevated from the previous $0.20-$0.25 range.

Lease rates

Lease rates continued to rise yesterday. Seems the LBMA's "silver ocean" is running dry again:

SLV Share Lending

Shares available currently 10M

Borrow fee dropped 1.83% to 0.88% before rising back to 1.22%

The borrow fee is jumping around now. There are still plenty of shares available to plunder.

SLV Assets

Blackrock sheds 400K shares

JPM sheds 362K ozt (11.3 tonnes)

Given the share borrow fee jumping around, it looks like this was a small raid on SLV vault stock.

PSLV

5,150 units shed (very rare!)

700K ozt (21.8 tonnes) added

PSLV units/ozt ratio rises to .3429. They need to add another ~284K ozt to get back to the historical .3434 ratio

Big Picture

- Negative EFP spread + SGE (spot) > LBMA (spot) = COMEX

- Indian futures in backwardation

- PSLV needs ~284K ozt to back units

- SLV action signals stress at the LBMA

- Silver lease rates above 8% (LBMA)

ICYMI:

Friday morning 1-2 in silver. Is anyone working today (New Year's Hangover day)?

CME/COMEX - Yes

LBMA - Yes

SGE/SFE - No

India MCX futures - Yes

With a current spot price of $74.05, EFP spreads:

Jan26 = -$1.10 vs -$1.13 Wed

Feb26 = -$0.89 vs -$0.89

Mar26 = -$0.62 vs -$0.61

Yesterday was a holiday so little change to the EFP spread since Wednesday. Will the markets be active today or are traders taking a long weekend?

Feb26 is at $84.14/ozt

Mar26 is at $83.41/ozt

$0.73/ozt backwardation vs $0.69/ozt Wednesday

Backwardation seems to be holding at a new, wider range now. Will it grow even more as China silver export restrictions take effect?

CME/COMEX - Yes

LBMA - Yes

SGE/SFE - No

India MCX futures - Yes

EFP spread

With a current spot price of $74.05, EFP spreads:

Jan26 = -$1.10 vs -$1.13 Wed

Feb26 = -$0.89 vs -$0.89

Mar26 = -$0.62 vs -$0.61

EFP Commentary

Yesterday was a holiday so little change to the EFP spread since Wednesday. Will the markets be active today or are traders taking a long weekend?

Indian MCX Futures

Feb26 is at $84.14/ozt

Mar26 is at $83.41/ozt

$0.73/ozt backwardation vs $0.69/ozt Wednesday

Backwardation seems to be holding at a new, wider range now. Will it grow even more as China silver export restrictions take effect?

ICYMI:

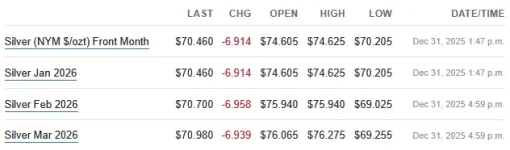

Yesterday silver spot fell from ~$74.5 to ~$71.5 before recovering to ~$72.5. Below the surface, things seemed quiet ...

COMEX 12-31 activity

351K ozt (10.9 tonnes) deposited in Brinks

4K ozt (4 LGD bars) withdrawn from Delaware

899K ozt (28 tonnes) moved from registered to eligible in the CNT (601K) and StoneX (297K) vaults

COMEX Commentary

The lack of withdrawals given negative EFP spreads surprised again. I was expecting some big withdrawals and we did not see them. Very curious!

EFP spread

With a current spot price of $72.85, EFP spreads:

Jan26 = -$2.29 vs -$1.10 yesterday

Feb26 = -$2.06 vs -$0.89

Mar26 = -$1.83 vs -$0.62

EFP Commentary

The 2nd CME margin raise was effective! EFP spreads have shifted deeply negative - deeper than we've seen since Oct/Nov. Will the COMEX resume sending silver to London now?

Indian MCX Futures

Feb26 is at $82.64/ozt

Mar26 is at $81.70/ozt

$0.94/ozt backwardation vs $0.73/ozt yesterday

Backwardation widened again. New range seems to be $0.70-$1.00. Will it widen further as China restricts silver exports?

SLV Share Lending

Shares available currently 10M

Borrow fee rose from 1.22% to 1.28% before falling to 0.71%

Looks like APs took a day off from raiding. There are still plenty of shares available to plunder.

SLV Assets

Blackrock: no change to shares

JPM: no change to vault stock

Looks like everyone took the day off.

PSLV

No change to units

No change to vault stock

PSLV units/ozt ratio sits at .3427. They need to add ~411K ozt to get back to the historical .3434 ratio

LBMA

With some generous assumptions for December:

- 100% of COMEX withdrawals = LBMA gain

- LBMA shipped 0 silver to India

- LBMA shipped 0 silver to SGE/SFE

I'm estimating that the LBMA has at most 8-10M ozt of liquid free float

Big Picture

- Negative EFP spread deepening, but COMEX not sending silver to London (yet?)

- SGE/SFE closed yesterday

- Indian futures in deeper backwardation

- PSLV needs ~411K ozt to back units

- SLV was quiet

- Silver lease rates above 8% (LBMA)

ICYMI:

The LBMA is due to report their end of December silver stock report on Thursday, Dec 8. I fully expect it to report a ridiculous number. In the meantime, we know some of the variables to the free float equation and we can play at estimating the others:

X = A - B + (C * D) + E + F

X = LBMA free float vault stock (end of December)

A = (27,187 Official | 25,866 Realistic) LBMA vault stock (end of November)

B = (22,385) ETF vault stock (end of December)

C = (692) COMEX withdrawn for December

D = An estimated percentage of COMEX withdrawn that was shipped to London

E = Import/Export to China (SGE/SFE) in December

F = Import/Export to India in December

I think it is unreasonable to assume that 100% of the COMEX withdrawals across the entire month were shipped to London. I think it would be reasonable to estimate around 90% for a high side conservative estimate. Plugging 90% in for "D" yields 623 metric tons of silver shipped from COMEX to London in December.

SFE silver vault gained 118 metric tons in December. SGE silver vault gained 131 metric tons in December. I think it fair to estimate that China did not send silver to London and is likely to have received silver from London. Given that China was experiencing strong domestic demand for physical silver, it is really difficult to estimate how much silver they might have imported from London.

China reportedly exported:

~400 metric tons to India in October

~100 metric tons to India in November

It was rumored that most of this silver was leased to LBMA members and shipped directly to India to satisfy India's OTC market purchases in London. How much of the SFE/SGE's ~250 ton gain in December was LBMA loan repayment? Was even more repaid and devoured by China's domestic demand (both industrial and investment)? We likely won't know for a couple of months until we get import/export data.

Just a gut feeling, but I think we can conservatively estimate that the LBMA sent at least 250 tons to China in December.

India reportedly imported :

~480 metric tons from the UK (~1,600 tons total all sources) in October

~390 metric tons from the UK (~750 tons total all source) in November

Back in September, Indian analysts were estimating that India would import 3,000 tons from October-December (or ~1,000 tons a month). If those estimates were accurate, India likely imported on the order of ~650 tons (all sources) in December.

London/LBMA/UK was the major source of silver imports for India in October and November and I don't see why that should suddenly change in December, so I think we can conservatively estimate that the LBMA sent at least 250-300 tons of silver to India in December.

Putting it all together, I think the following is likely a fairly realistic estimate, but you can fiddle with the variables if you disagree:

LBMA free float vault stock (end of December) = 25,866 - 22,385 + (692 * 0.90) - 250 - 300 = 3,554 tons

3,554 metric tons is 114M ozt. The LBMA ran into trouble in October when their free float was in the range of 110M ozt.

If you want to see how ridiculous the LBMA report is on Thursday, we can remove the ETFs from the equation to estimate the total vault stock. Using my estimates for the unknown variables, that would be 25,939 tons. We'll see what they say.

I'm estimating the LBMA's liquid free float to be in the neighborhood of 4M ozt. At at spot price of $80, that's only ~$320M.

X = A - B + (C * D) + E + F

X = LBMA free float vault stock (end of December)

A = (27,187 Official | 25,866 Realistic) LBMA vault stock (end of November)

B = (22,385) ETF vault stock (end of December)

C = (692) COMEX withdrawn for December

D = An estimated percentage of COMEX withdrawn that was shipped to London

E = Import/Export to China (SGE/SFE) in December

F = Import/Export to India in December

COMEX

I think it is unreasonable to assume that 100% of the COMEX withdrawals across the entire month were shipped to London. I think it would be reasonable to estimate around 90% for a high side conservative estimate. Plugging 90% in for "D" yields 623 metric tons of silver shipped from COMEX to London in December.

China

SFE silver vault gained 118 metric tons in December. SGE silver vault gained 131 metric tons in December. I think it fair to estimate that China did not send silver to London and is likely to have received silver from London. Given that China was experiencing strong domestic demand for physical silver, it is really difficult to estimate how much silver they might have imported from London.

China reportedly exported:

~400 metric tons to India in October

~100 metric tons to India in November

It was rumored that most of this silver was leased to LBMA members and shipped directly to India to satisfy India's OTC market purchases in London. How much of the SFE/SGE's ~250 ton gain in December was LBMA loan repayment? Was even more repaid and devoured by China's domestic demand (both industrial and investment)? We likely won't know for a couple of months until we get import/export data.

Just a gut feeling, but I think we can conservatively estimate that the LBMA sent at least 250 tons to China in December.

India

India reportedly imported :

~480 metric tons from the UK (~1,600 tons total all sources) in October

~390 metric tons from the UK (~750 tons total all source) in November

Back in September, Indian analysts were estimating that India would import 3,000 tons from October-December (or ~1,000 tons a month). If those estimates were accurate, India likely imported on the order of ~650 tons (all sources) in December.

London/LBMA/UK was the major source of silver imports for India in October and November and I don't see why that should suddenly change in December, so I think we can conservatively estimate that the LBMA sent at least 250-300 tons of silver to India in December.

LBMA

Putting it all together, I think the following is likely a fairly realistic estimate, but you can fiddle with the variables if you disagree:

LBMA free float vault stock (end of December) = 25,866 - 22,385 + (692 * 0.90) - 250 - 300 = 3,554 tons

3,554 metric tons is 114M ozt. The LBMA ran into trouble in October when their free float was in the range of 110M ozt.

If you want to see how ridiculous the LBMA report is on Thursday, we can remove the ETFs from the equation to estimate the total vault stock. Using my estimates for the unknown variables, that would be 25,939 tons. We'll see what they say.

Final thought

I'm estimating the LBMA's liquid free float to be in the neighborhood of 4M ozt. At at spot price of $80, that's only ~$320M.

Last edited: