The manipulations to the paper silver market should be coming to an end shortly. CME margin raise yesterday didn't make a dent in the EFP spreads yesterday. Maybe they take effect Monday - we'll see. The short interest manipulations in China on the SFE were flagged and halted by the exchange (regulators). Meanwhile, lease rates are rising again in London signalling inventory is tight again. The physical market is about to impose it's will on the paper markets. $.02

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Silver Demand Drivers (and vault totals)

- Thread starter pmbug

- Start date

- Featured

-

- Tags

- physical demand

Welcome to the Precious Metals Bug Forums

Welcome to the PMBug forums - a watering hole for folks interested in gold, silver, precious metals, sound money, investing, market and economic news, central bank monetary policies, politics and more.

Why not register an account and join the discussions? When you register an account and log in, you may enjoy additional benefits including no Google ads, market data/charts, access to trade/barter with the community and much more. Registering an account is free - you have nothing to lose!

Viking

Yellow Jacket

Wholesale premiums have just jumped $2 to $3 to now $4 this morning

It's weird, its the big stuff that seems to be gone first. SD is out of Kilo silver bars. Apmex has a couple at like $10 over spot. Even 100 oz bars are at like $10 over spot. Meanwhile 90% can be had under spot.

Absolutely this is industrial demand, that is what I see from those numbers.

Absolutely this is industrial demand, that is what I see from those numbers.

Still, I get offered $4 under spot for my 100 Toz bar I tried to flog at our most recent coin show (yesterday).

Well that is a ~$14 spread on 100oz bar. At ~$90ish that is around 15%. I'd say that's ok considering the recent volatility and uncertainty, esp with the refiners.

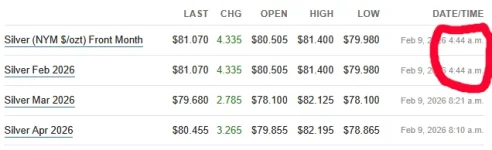

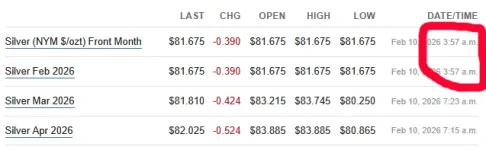

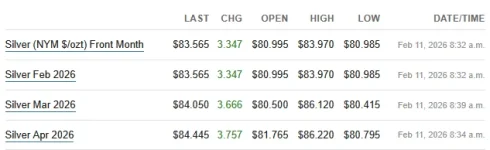

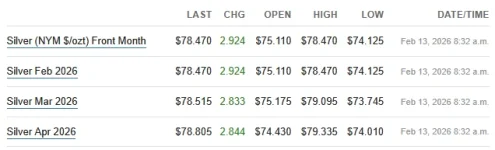

Monday morning in silver

Silver drifted up to ~$82 before dropping to $80 this morning. Let's look below the surface (a thread)

Current spot price: $80.01

Feb26* = +$1.06 vs -$0.41 Saturday

Mar26 = -$0.33 vs -$0.20

Apr26 = +$0.45 vs +$0.23

*data is 4 hours old

Feb26 data isn't real time nor useful. Mar26 shifted more negative, Apr26 shifted more positive. End of Friday CME margin hike effective today. Might need to check the Feb26 EFP spread again later....

China

SGE $87.88 (no VAT)

$87.88 (no VAT)

SFE $93.68

$93.68

SGE premium to LBMA spot ~$7

SFE 1M ozt (31.4t)

1M ozt (31.4t)

India

MMTC-PAMP (retail) : $93.55 (less 10% taxes = $84.19)

Feb26 [SILVERM 5kg] : $90.01 (less 7.2% taxes = ~$83.53)

Mar26 [SILVER 30kg] : $87.41

China > India > LBMA/COMEX

Big

SFE ($93.68)

SFE ($93.68)

SGE ($87.88)

SGE ($87.88)

Retail ($84.19)

Retail ($84.19)

MCX ($83.53)

MCX ($83.53)

spot ($80.01)

spot ($80.01)

COMEX Mar26 ($79.68)

COMEX Mar26 ($79.68)

Silver drifted up to ~$82 before dropping to $80 this morning. Let's look below the surface (a thread)

EFP spreads

Current spot price: $80.01

Feb26* = +$1.06 vs -$0.41 Saturday

Mar26 = -$0.33 vs -$0.20

Apr26 = +$0.45 vs +$0.23

*data is 4 hours old

EFP Commentary

Feb26 data isn't real time nor useful. Mar26 shifted more negative, Apr26 shifted more positive. End of Friday CME margin hike effective today. Might need to check the Feb26 EFP spread again later....

China

SGE

SFE

SGE premium to LBMA spot ~$7

SFE

India

MMTC-PAMP (retail) : $93.55 (less 10% taxes = $84.19)

Feb26 [SILVERM 5kg] : $90.01 (less 7.2% taxes = ~$83.53)

Mar26 [SILVER 30kg] : $87.41

China > India > LBMA/COMEX

Big

ICYMI:

Woa, you glossed over the EFP spreads and kinda missed the big picture. Is that accurate? That would mean the US is in backwardation.

Ok, it looks like the most active contracts are not in backwardation.

Ok, it looks like the most active contracts are not in backwardation.

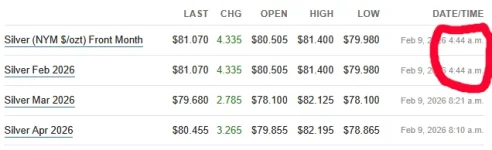

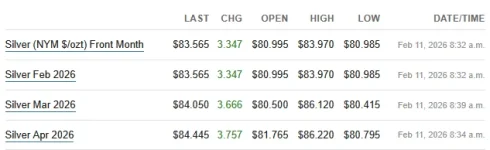

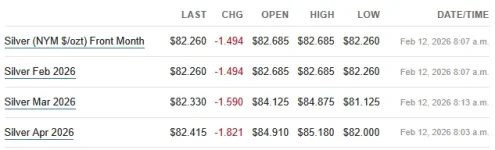

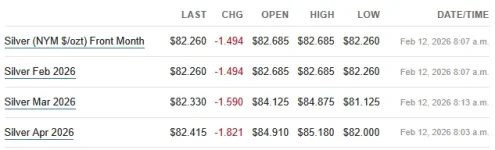

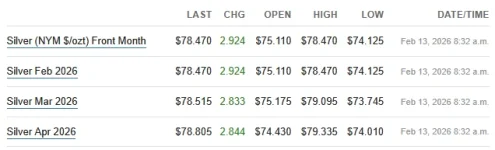

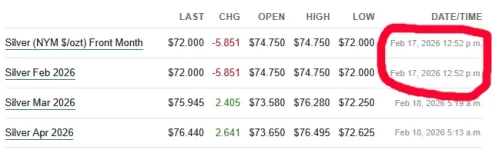

Checking right now... with spot @ $82.19, Marketwatch is reporting Feb26 contract 18 minutes behind now (better than 4 hours behind, but still a bit too skewed for meaningful analysis):

Futures:

Feb26 = $80.87

Mar26 = $81.52

Apr26 = $81.67

EFP spreads:

Feb26 = -$1.32

Mar26 = -$0.67

Apr26 = -$0.52

Futures:

Feb26 = $80.87

Mar26 = $81.52

Apr26 = $81.67

EFP spreads:

Feb26 = -$1.32

Mar26 = -$0.67

Apr26 = -$0.52

- Messages

- 46

- Reaction score

- 45

- Points

- 68

They seem to be closing up further since you posted this.Checking right now... with spot @ $82.19, Marketwatch is reporting Feb26 contract 18 minutes behind now (better than 4 hours behind, but still a bit too skewed for meaningful analysis):

Futures:

Feb26 = $80.87

Mar26 = $81.52

Apr26 = $81.67

EFP spreads:

Feb26 = -$1.32

Mar26 = -$0.67

Apr26 = -$0.52

Yesterday (2-9) in silver

Silver rose from ~$80 to ~$84 during the day, fell down to ~$81 at night and has recovered to $82 this morning. Below the surface, ETFs took a day off for SuperBowl hangover (a thread)

311K ozt (9.7t) deposited mostly in CNT [R]

4.3M ozt (135.5t) withdrawn from Brinks (814K), CNT (1.8M), JPM (849K), Loomis (600K), MT&B (222K)

10K ozt (0.3t) moved from [E] to [R] in CNT

613K ozt (19.1t) moved from [R] to [E] in Brinks

Remaining Vault Stock = 390.5M ozt (102.2M [R], 288.2M [E])

Withdraw rate through 1st week of Feb = 3.2M/day

@ 60% [R], run rate = 102.2M / 1.94M = ~53 (working) days (<3 months)

Withdrawals over the first week of February (15.2M ozt) were ~40% more than the average weekly rate throughout January (10.9M ozt). The COMEX garden hose is looking more like a fire hose at the moment.

The CME switched from flat margins to percentage based margins not too long ago. This means that margin requirements for silver contracts scale with increases in the price of silver. Thus, the effects of the CME's recent margin hikes have amplified effects as the price of silver appreciates. Click here for charts and commentary

Current spot price: $82.02

Feb26* = -$0.43 vs ??? Yesterday (82.11 @ 4AM)

Mar26 = -$0.22 vs -$0.33 (82.03 @ 7:20AM)

Apr26 = -$0.05 vs +$0.45 (~82.08 @ 7:15AM)

*data is 3.5 hours old

Both Marketwatch and Barchart are reporting the same stale data for the Feb26 contract lately. I guess it is the CME that not providing timely updates these days. I've calculated the EFP spreads using the spot price at each contract's time stamp.

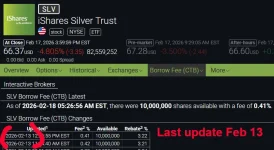

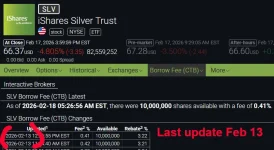

10M Shares available

Borrow fee fell from 0.54% to 0.28% before settling at 0.36%

Available shares still plentiful and ready for plunder. Borrowing activity appears muted yesterday.

Blackrock: no change

JPM: no change

No activity or no reporting? Superbowl hangover day?

No change to units

No change to ozt

Units/ozt ratio .3413

PSLV needs 1.3M ozt (40.7t) to get back to the historical .3434 ratio.

China

SGE $86.73 (no VAT)

$86.73 (no VAT)

SFE $91.30

$91.30

SGE premium to LBMA spot ~$5

SFE 155K ozt (4.8t)

155K ozt (4.8t)

SGE 1.4M ozt (43.2t)

1.4M ozt (43.2t)

SFE posts an inflow!

India

MMTC-PAMP (retail) : $96.11 (less 10% taxes = $86.50)

Feb26 [SILVERM 5kg] : $91.65 (less 7.2% taxes = ~$85.05)

Mar26 [SILVER 30kg] : $88.92

China > India > LBMA/COMEX

Big

SFE ($91.30)

SFE ($91.30)

SGE ($86.73)

SGE ($86.73)

Retail ($86.50)

Retail ($86.50)

MCX ($85.05)

MCX ($85.05)

spot ($82.02)

spot ($82.02)

COMEX Mar26 ($81.81)

COMEX Mar26 ($81.81)

- 1mo lease rate 6.1%

- Feb26 EFP spread still negative

- COMEX

(LBMA

(LBMA )

)

- PSLV needs 1.3M ozt

Silver rose from ~$80 to ~$84 during the day, fell down to ~$81 at night and has recovered to $82 this morning. Below the surface, ETFs took a day off for SuperBowl hangover (a thread)

COMEX 2-6

311K ozt (9.7t) deposited mostly in CNT [R]

4.3M ozt (135.5t) withdrawn from Brinks (814K), CNT (1.8M), JPM (849K), Loomis (600K), MT&B (222K)

10K ozt (0.3t) moved from [E] to [R] in CNT

613K ozt (19.1t) moved from [R] to [E] in Brinks

COMEX Run Rate

Remaining Vault Stock = 390.5M ozt (102.2M [R], 288.2M [E])

Withdraw rate through 1st week of Feb = 3.2M/day

@ 60% [R], run rate = 102.2M / 1.94M = ~53 (working) days (<3 months)

COMEX Commentary

Withdrawals over the first week of February (15.2M ozt) were ~40% more than the average weekly rate throughout January (10.9M ozt). The COMEX garden hose is looking more like a fire hose at the moment.

CME Margins

The CME switched from flat margins to percentage based margins not too long ago. This means that margin requirements for silver contracts scale with increases in the price of silver. Thus, the effects of the CME's recent margin hikes have amplified effects as the price of silver appreciates. Click here for charts and commentary

EFP spreads

Current spot price: $82.02

Feb26* = -$0.43 vs ??? Yesterday (82.11 @ 4AM)

Mar26 = -$0.22 vs -$0.33 (82.03 @ 7:20AM)

Apr26 = -$0.05 vs +$0.45 (~82.08 @ 7:15AM)

*data is 3.5 hours old

EFP Commentary

Both Marketwatch and Barchart are reporting the same stale data for the Feb26 contract lately. I guess it is the CME that not providing timely updates these days. I've calculated the EFP spreads using the spot price at each contract's time stamp.

SLV Share Lending

10M Shares available

Borrow fee fell from 0.54% to 0.28% before settling at 0.36%

Available shares still plentiful and ready for plunder. Borrowing activity appears muted yesterday.

SLV Assets

Blackrock: no change

JPM: no change

No activity or no reporting? Superbowl hangover day?

PSLV

No change to units

No change to ozt

Units/ozt ratio .3413

PSLV needs 1.3M ozt (40.7t) to get back to the historical .3434 ratio.

China

SGE

SFE

SGE premium to LBMA spot ~$5

SFE

SGE

SFE posts an inflow!

India

MMTC-PAMP (retail) : $96.11 (less 10% taxes = $86.50)

Feb26 [SILVERM 5kg] : $91.65 (less 7.2% taxes = ~$85.05)

Mar26 [SILVER 30kg] : $88.92

China > India > LBMA/COMEX

Big

- 1mo lease rate 6.1%

- Feb26 EFP spread still negative

- COMEX

- PSLV needs 1.3M ozt

ICYMI:

Last week in silver (in metric tons):

SGE silver vault - 43.2

43.2

SFE silver vault - 105.2

105.2

SLV London vault - 667.7

667.7

PSLV silver vault - 23

23

COMEX silver stock - 473.7

473.7

LBMA silver stock - ??? (no daily or weekly data because LBMA is run by dinosaurs)

Global net change (less LBMA):

Feb 2-6 = 22.6

22.6

Jan 26-30 = 1,000.77

1,000.77

Jan 19-23 = 374.4

374.4

Jan 12-16 = 446.4

446.4

Jan 5-9 = 659.7

659.7

Dec 29-Jan 2 = 160.6

160.6

...

China's SGE reported another outflow for last week. I was anticipating that the SGE might have posted an inflow given:

SGE silver price premium to LBMA spot down from the ~$20 extreme highs of 2 weeks ago to ~$12 last week to ~$5 today. Falling premium would suggest that China is receiving at least some LBMA silver.

SGE silver price premium to LBMA spot down from the ~$20 extreme highs of 2 weeks ago to ~$12 last week to ~$5 today. Falling premium would suggest that China is receiving at least some LBMA silver.

For the last two weeks, SGE (spot) price > SFE (futures) price. Today, contango has returned (SFE > SGE). This would suggest that supply is no longer extremely tight (even though that isn't what the vault stock flows are showing).

For the last two weeks, SGE (spot) price > SFE (futures) price. Today, contango has returned (SFE > SGE). This would suggest that supply is no longer extremely tight (even though that isn't what the vault stock flows are showing).

Perhaps we will see an inflow for the SGE this week (in next week's report).

PSLV posted a very unusual outflow last week - the first I've ever seen since I started watching it daily back in June of last year. Did someone actually redeem shares for physical? It looks like it.

Last week marks the 5th week in a row for the COMEX to drain profusely (~300+ tons) and the draining is accelerating (last week was ~40% higher than the average weekly drain in January). The Feb26 EFP spread was firmly negative all week, so the COMEX draining was expected as bullion banks are likely shipping COMEX silver to London.

SLV saw a massive inflow on Feb 2 and has resumed draining vault stock since. See here for more comments.

One can only imagine what chaos might be unfolding in the LBMA's London vault system right now. We can only imagine because the dinosaurs at the LBMA do not provide daily/weekly reporting of their vault stock like every other market and major fund in the world.

SGE silver vault -

SFE silver vault -

SLV London vault -

PSLV silver vault -

COMEX silver stock -

LBMA silver stock - ??? (no daily or weekly data because LBMA is run by dinosaurs)

Global net change (less LBMA):

Feb 2-6 =

Jan 26-30 =

Jan 19-23 =

Jan 12-16 =

Jan 5-9 =

Dec 29-Jan 2 =

...

China's SGE reported another outflow for last week. I was anticipating that the SGE might have posted an inflow given:

Perhaps we will see an inflow for the SGE this week (in next week's report).

PSLV posted a very unusual outflow last week - the first I've ever seen since I started watching it daily back in June of last year. Did someone actually redeem shares for physical? It looks like it.

Last week marks the 5th week in a row for the COMEX to drain profusely (~300+ tons) and the draining is accelerating (last week was ~40% higher than the average weekly drain in January). The Feb26 EFP spread was firmly negative all week, so the COMEX draining was expected as bullion banks are likely shipping COMEX silver to London.

SLV saw a massive inflow on Feb 2 and has resumed draining vault stock since. See here for more comments.

One can only imagine what chaos might be unfolding in the LBMA's London vault system right now. We can only imagine because the dinosaurs at the LBMA do not provide daily/weekly reporting of their vault stock like every other market and major fund in the world.

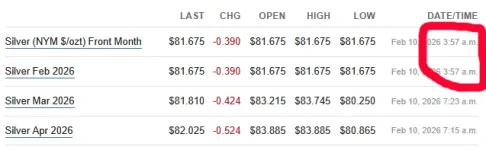

Yesterday (2-10) in silver

Silver dropped from $82 to ~$81 during the day, jumped to ~$84 at night and has risen to just under ~$86 this morning. Below the surface, silver continues flowing (a thread)

1 month lease rate dropped from ~6.1% to ~2.7%. COMEX fire hose is apparently putting out the LBMA's insufficent inventory fire (for now!).

169K ozt (5.3t) deposited mostly in Delaware

4.3M ozt (135.7t) withdrawn from Asahi (628K), CNT (678K), JPM (2.1M), Loomis (900K), Delaware (19K)

861K ozt (26.8t) moved from [R] to [E] in JPM (372K), Loomis (106K), Malca-Amit (191K), MT&B (191K)

Remaining Vault Stock = 386.3M ozt (101.4M [R], 284.8M [E])

Withdraw rate through last 5 days = 3.7M/day

@ 60% [R], run rate = 101.4M / 2.24M = ~45.2 (working) days (~2.3 months)

Withdrawals are maintaining a blistering pace now. The run rate for the COMEX fire hose at the current rolling weekly (last 5 days) pace is shrinking. The COMEX will run dry (of liquid free float) around April if this continues.

Current spot price: $84.38

Feb26 = -$0.81 vs -$0.43 Yesterday

Mar26 = -$0.33 vs -$0.22

Apr26 = +$0.06 vs -$0.05

Today we get timely data for the Feb26 contract. Feb26 and Mar26 shifted more negative, Apr26 shifted positive. COMEX fire hose will continue flowing.

10M Shares available

Borrow fee jumped from 0.36% to 0.45% before drifting back down to 0.36% again

Available shares still plentiful and ready for plunder. Borrowing activity appears muted for 2nd day in a row.

Blackrock: 900K shares

900K shares

JPM: 816K ozt (25.4t)

816K ozt (25.4t)

SLV adding stock again and lease rate down indicate COMEX silver is solving LBMA supply crisis (for now).

No change to units

288 ozt (just an adjustment)

288 ozt (just an adjustment)

Units/ozt ratio .3413

PSLV needs 1.3M ozt (40.7t) to get back to the historical .3434 ratio.

China

SGE $89.57 (no VAT)

$89.57 (no VAT)

SFE $94.27

$94.27

SGE premium to LBMA spot ~$6

SFE 602K ozt (18.7t)

602K ozt (18.7t)

SFE posts a 2nd consecutive (and larger) inflow. Is this evidence that China is receiving LBMA silver now?

India

MMTC-PAMP (retail) : $98.07 (less 10% taxes = $88.26)

Feb26 [SILVERM 5kg] : $93.24 (less 7.2% taxes = ~$86.53)

Mar26 [SILVER 30kg] : $91.13

China > India > LBMA/COMEX

Big

SFE ($94.27)

SFE ($94.27)

SGE ($89.57)

SGE ($89.57)

Retail ($88.26)

Retail ($88.26)

MCX ($86.53)

MCX ($86.53)

spot ($84.38)

spot ($84.38)

COMEX Feb26 ($83.57)

COMEX Feb26 ($83.57)

- 1mo lease rate 2.7%

2.7%

- Feb26 EFP spread still negative

- COMEX

(LBMA

(LBMA )

)

- SLV

(LBMA

(LBMA )

)

- PSLV needs 1.3M ozt

Silver dropped from $82 to ~$81 during the day, jumped to ~$84 at night and has risen to just under ~$86 this morning. Below the surface, silver continues flowing (a thread)

Lease rates

1 month lease rate dropped from ~6.1% to ~2.7%. COMEX fire hose is apparently putting out the LBMA's insufficent inventory fire (for now!).

COMEX 2-9

169K ozt (5.3t) deposited mostly in Delaware

4.3M ozt (135.7t) withdrawn from Asahi (628K), CNT (678K), JPM (2.1M), Loomis (900K), Delaware (19K)

861K ozt (26.8t) moved from [R] to [E] in JPM (372K), Loomis (106K), Malca-Amit (191K), MT&B (191K)

COMEX Run Rate

Remaining Vault Stock = 386.3M ozt (101.4M [R], 284.8M [E])

Withdraw rate through last 5 days = 3.7M/day

@ 60% [R], run rate = 101.4M / 2.24M = ~45.2 (working) days (~2.3 months)

COMEX Commentary

Withdrawals are maintaining a blistering pace now. The run rate for the COMEX fire hose at the current rolling weekly (last 5 days) pace is shrinking. The COMEX will run dry (of liquid free float) around April if this continues.

EFP spreads

Current spot price: $84.38

Feb26 = -$0.81 vs -$0.43 Yesterday

Mar26 = -$0.33 vs -$0.22

Apr26 = +$0.06 vs -$0.05

EFP Commentary

Today we get timely data for the Feb26 contract. Feb26 and Mar26 shifted more negative, Apr26 shifted positive. COMEX fire hose will continue flowing.

SLV Share Lending

10M Shares available

Borrow fee jumped from 0.36% to 0.45% before drifting back down to 0.36% again

Available shares still plentiful and ready for plunder. Borrowing activity appears muted for 2nd day in a row.

SLV Assets

Blackrock:

JPM:

SLV adding stock again and lease rate down indicate COMEX silver is solving LBMA supply crisis (for now).

PSLV

No change to units

Units/ozt ratio .3413

PSLV needs 1.3M ozt (40.7t) to get back to the historical .3434 ratio.

China

SGE

SFE

SGE premium to LBMA spot ~$6

SFE

SFE posts a 2nd consecutive (and larger) inflow. Is this evidence that China is receiving LBMA silver now?

India

MMTC-PAMP (retail) : $98.07 (less 10% taxes = $88.26)

Feb26 [SILVERM 5kg] : $93.24 (less 7.2% taxes = ~$86.53)

Mar26 [SILVER 30kg] : $91.13

China > India > LBMA/COMEX

Big

- 1mo lease rate

- Feb26 EFP spread still negative

- COMEX

- SLV

- PSLV needs 1.3M ozt

ICYMI:

Yesterday (2-11) in silver

Silver dropped from $85+ to ~$83 before closing at $84+ during the day, fell to ~$82 at night, climbed back to $84 and has drifted back lower to ~$82 this morning. Below the surface, COMEX+LBMA are bleeding (a thread)

1 month lease stabilizing at >2.5%. LBMA silver inventory isn't fully sufficient yet (to maintain normal market function).

72K ozt (2.2t) deposited in Delaware

4.8M ozt (148.5t) withdrawn from Asahi (611K), CNT (368K), HSBC (110K), JPM (2.5M), Loomis (1M), et al

3.2M ozt (101.3t) moved from [R] to [E] in Asahi (942K), Brinks (414K), CNT (485K), HSBC (20K), JPM (82K), Loomis (166K), MT&B (1.1M), StoneX (46K)

Remaining Vault Stock = 381.5M ozt (98.1M [R], 283.4M [E])

Withdraw rate through last 5 days = 4.0M/day

@ 60% [R], run rate = 98.1M / 2.45M = 40 (working) days (2 months)

Withdrawals continue to accelerate. Looks like the timetable to "Midnight" is shrinking instead of expanding.

Current spot price: $82.59

Feb26 = -$0.33 vs -$0.81 Yesterday

Mar26 = -$0.26 vs -$0.33

Apr26 = -$0.17 vs +$0.06

All EFP spreads negative this morning. The spread between the monthly contracts is collapsing (only 7 to 9 cents between each month). The COMEX fire hose should continue flowing.

10M Shares available

Borrow fee rose from 0.36% to 0.39% before drifting back down to 0.37%

Available shares still plentiful and ready for plunder. Borrowing activity appears muted for 3rd day in a row.

Blackrock: 700K shares

700K shares

JPM: 633K ozt (19.7t)

633K ozt (19.7t)

Second consecutive day for SLV to add shares and vault stock.

No change to units

No change to ozt

Units/ozt ratio .3413

PSLV needs 1.3M ozt (40.7t) to get back to the historical .3434 ratio.

China

SGE $88.67 (no VAT)

$88.67 (no VAT)

SFE $92.98

$92.98

SGE premium to LBMA spot ~$5

SFE 242K ozt (7.5t)

242K ozt (7.5t)

SFE posts a small, but 3rd consecutive inflow for the first time since mid-December.

India

MMTC-PAMP (retail) : $95.00 (less 10% taxes = $85.50)

Feb26 [SILVERM 5kg] : $91.01 (less 7.2% taxes = ~$84.45)

Mar26 [SILVER 30kg] : $88.66

The premium between China and India appears to be shrinking.

Big

SFE ($92.98)

SFE ($92.98)

SGE ($88.67)

SGE ($88.67)

Retail ($85.50)

Retail ($85.50)

MCX ($84.45)

MCX ($84.45)

spot ($82.59)

spot ($82.59)

COMEX Feb26 ($82.26)

COMEX Feb26 ($82.26)

- 1mo lease rate 2.6%

2.6%

- Feb26 EFP spread still negative

- COMEX

(LBMA

(LBMA )

)

- SLV

(LBMA

(LBMA )

)

- PSLV needs 1.3M ozt

Silver dropped from $85+ to ~$83 before closing at $84+ during the day, fell to ~$82 at night, climbed back to $84 and has drifted back lower to ~$82 this morning. Below the surface, COMEX+LBMA are bleeding (a thread)

Lease rates

1 month lease stabilizing at >2.5%. LBMA silver inventory isn't fully sufficient yet (to maintain normal market function).

COMEX 2-10

72K ozt (2.2t) deposited in Delaware

4.8M ozt (148.5t) withdrawn from Asahi (611K), CNT (368K), HSBC (110K), JPM (2.5M), Loomis (1M), et al

3.2M ozt (101.3t) moved from [R] to [E] in Asahi (942K), Brinks (414K), CNT (485K), HSBC (20K), JPM (82K), Loomis (166K), MT&B (1.1M), StoneX (46K)

COMEX Run Rate

Remaining Vault Stock = 381.5M ozt (98.1M [R], 283.4M [E])

Withdraw rate through last 5 days = 4.0M/day

@ 60% [R], run rate = 98.1M / 2.45M = 40 (working) days (2 months)

COMEX Commentary

Withdrawals continue to accelerate. Looks like the timetable to "Midnight" is shrinking instead of expanding.

EFP spreads

Current spot price: $82.59

Feb26 = -$0.33 vs -$0.81 Yesterday

Mar26 = -$0.26 vs -$0.33

Apr26 = -$0.17 vs +$0.06

EFP Commentary

All EFP spreads negative this morning. The spread between the monthly contracts is collapsing (only 7 to 9 cents between each month). The COMEX fire hose should continue flowing.

SLV Share Lending

10M Shares available

Borrow fee rose from 0.36% to 0.39% before drifting back down to 0.37%

Available shares still plentiful and ready for plunder. Borrowing activity appears muted for 3rd day in a row.

SLV Assets

Blackrock:

JPM:

Second consecutive day for SLV to add shares and vault stock.

PSLV

No change to units

No change to ozt

Units/ozt ratio .3413

PSLV needs 1.3M ozt (40.7t) to get back to the historical .3434 ratio.

China

SGE

SFE

SGE premium to LBMA spot ~$5

SFE

SFE posts a small, but 3rd consecutive inflow for the first time since mid-December.

India

MMTC-PAMP (retail) : $95.00 (less 10% taxes = $85.50)

Feb26 [SILVERM 5kg] : $91.01 (less 7.2% taxes = ~$84.45)

Mar26 [SILVER 30kg] : $88.66

The premium between China and India appears to be shrinking.

Big

- 1mo lease rate

- Feb26 EFP spread still negative

- COMEX

- SLV

- PSLV needs 1.3M ozt

ICYMI:

Yesterday (2-12) in silver

Silver crashed from ~$83 to ~$75, rose back to ~$79 at night, and drifted lower to ~$77 this morning. Below the surface, COMEX+SLV are bleeding (a thread)

Zero deposited

2.3M ozt (72.6t) withdrawn from Asahi (432K), Delaware (130K), JPM (1.1M), Loomis (50K), MT&B (597K)

5.1M ozt (158.8t) moved from [R] to [E] in Brinks (1.4M), CNT (2.3M), MT&B (538K), et al

5.1M ozt (158.8t) moved from [R] to [E] in Brinks (1.4M), CNT (2.3M), MT&B (538K), et al

Remaining Vault Stock = 379.2M ozt (93M [R], 286.2M [E])

Withdraw rate through last 5 days = 4.0M/day

@ 60% [R], run rate = 93M / 2.45M = 38 (working) days (<2 months)

38 (working) days (<2 months)

Wednesday's withdrawal was roughly half of Tuesday's total. Is it a trend (withdrawal slowing down) or anomaly? The 5.1M [R] to [E] move is huge. The run rate to "Midnight" shrunk again.

Current spot price @07:32: $78.72

Feb26 = -$0.25 vs -$0.33 Yesterday

Mar26 = -$0.20 vs -$0.26

Apr26 = +$0.09 vs -$0.17

EFP spreads shifted positive this morning. The spread between Feb26 and Mar26 contracts is just $0.05! With spreads shifting positive, the COMEX fire hose might be reduced to a garden hose.

With spreads shifting positive, the COMEX fire hose might be reduced to a garden hose.

9.5M Shares available

Borrow fee held steady at 0.39%

Available shares broke below 7M yesterday as borrowing activity appears to have heated up.

Blackrock: 2.2M shares

2.2M shares

JPM: 1.99M ozt (62t)

1.99M ozt (62t)

SLV gives back the gains of the previous two days plus more.

No change to units

No change to ozt

Units/ozt ratio .3413

PSLV needs 1.3M ozt (40.7t) to get back to the historical .3434 ratio.

China

SGE $86.86 (no VAT)

$86.86 (no VAT)

SFE $89.17

$89.17

SGE premium to LBMA spot ~$6

SFE 126K ozt (3.9t)

126K ozt (3.9t)

SFE posts a small, but 4th consecutive inflow! China markets close for a week long holiday today.

India

MMTC-PAMP (retail) : $91.87 (less 10% taxes = $82.68)

Feb26 [SILVERM 5kg] : $86.44 (less 7.2% taxes = ~$80.21)

Mar26 [SILVER 30kg] : $84.60

After shrinking a bit the day before, the premium between China and India expanded back a bit.

Big

SFE ($89.17)

SFE ($89.17)

SGE ($86.86)

SGE ($86.86)

Retail ($82.68)

Retail ($82.68)

MCX ($80.21)

MCX ($80.21)

spot ($78.72)

spot ($78.72)

COMEX Feb26 ($78.47)

COMEX Feb26 ($78.47)

- Feb26 EFP spread still negative

- COMEX

(LBMA

(LBMA )

)

- SLV

(LBMA

(LBMA )

)

- PSLV needs 1.3M ozt

Silver crashed from ~$83 to ~$75, rose back to ~$79 at night, and drifted lower to ~$77 this morning. Below the surface, COMEX+SLV are bleeding (a thread)

COMEX 2-11

Zero deposited

2.3M ozt (72.6t) withdrawn from Asahi (432K), Delaware (130K), JPM (1.1M), Loomis (50K), MT&B (597K)

COMEX Run Rate

Remaining Vault Stock = 379.2M ozt (93M [R], 286.2M [E])

Withdraw rate through last 5 days = 4.0M/day

@ 60% [R], run rate = 93M / 2.45M =

COMEX Commentary

Wednesday's withdrawal was roughly half of Tuesday's total. Is it a trend (withdrawal slowing down) or anomaly? The 5.1M [R] to [E] move is huge. The run rate to "Midnight" shrunk again.

EFP spreads

Current spot price @07:32: $78.72

Feb26 = -$0.25 vs -$0.33 Yesterday

Mar26 = -$0.20 vs -$0.26

Apr26 = +$0.09 vs -$0.17

EFP Commentary

EFP spreads shifted positive this morning. The spread between Feb26 and Mar26 contracts is just $0.05!

SLV Share Lending

9.5M Shares available

Borrow fee held steady at 0.39%

Available shares broke below 7M yesterday as borrowing activity appears to have heated up.

SLV Assets

Blackrock:

JPM:

SLV gives back the gains of the previous two days plus more.

PSLV

No change to units

No change to ozt

Units/ozt ratio .3413

PSLV needs 1.3M ozt (40.7t) to get back to the historical .3434 ratio.

China

SGE

SFE

SGE premium to LBMA spot ~$6

SFE

SFE posts a small, but 4th consecutive inflow! China markets close for a week long holiday today.

India

MMTC-PAMP (retail) : $91.87 (less 10% taxes = $82.68)

Feb26 [SILVERM 5kg] : $86.44 (less 7.2% taxes = ~$80.21)

Mar26 [SILVER 30kg] : $84.60

After shrinking a bit the day before, the premium between China and India expanded back a bit.

Big

- Feb26 EFP spread still negative

- COMEX

- SLV

- PSLV needs 1.3M ozt

ICYMI:

I like naked shorts also, but it depends on who's wearing them…

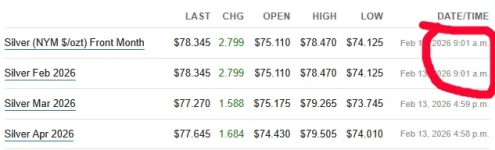

Yesterday (2-13) in silver

Silver finished about where it started just above $77. Below the surface, COMEX+SLV are still bleeding vault stock (a thread)

7.9K ozt (8 LGD bars) deposited in CNT

2.8M ozt (87.3t) withdrawn from CNT (353K), Delaware (11K), JPM (2.4M)

130K ozt (4t) moved from [R] to [E] in MT&B

Remaining Vault Stock = 376.4M ozt (92.9M [R], 283.5M [E])

Withdraw rate through last 5 days = 3.7M/day

@ 60% [R], run rate = 92.9M / 2.22M = ~42 (working) days (2 months + 2 days)

Thursday's withdrawal matched Wednesday's lower rate compared to earlier in the week. The 5 day rolling average dropped so the run rate to "Midnight" has extended a bit.

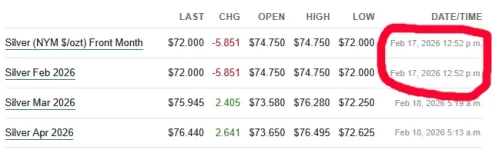

Current spot price @ 07:32: $77.36

Feb26 = ??? vs -$0.25 Yesterday

Mar26 = -$0.09 vs -$0.20

Apr26 = +$0.33 vs +$0.09

CME hasn't published updated "Last" quote for the Feb26 contract since yesterday morning. How odd! The Mar26 and Apr26 contracts shifted more positive. I can only assume the Feb26 contract is still trading within a few cents of the Mar26 contract.

10M Shares available

Borrow fee rose from 0.39% to 0.41%

Seems to be a lot of borrowing activity lately.

Blackrock: 4.7M shares

4.7M shares

JPM: 4.26M ozt (132.4t)

4.26M ozt (132.4t)

SLV drain goes into high gear!

No change to units

311 ozt (less than 1 LGD bar)

311 ozt (less than 1 LGD bar)

Units/ozt ratio .3413

PSLV inventory incurred zero material change this week. PSLV needs 1.3M ozt (40.7t) to get back to the historical .3434 ratio.

Silver finished about where it started just above $77. Below the surface, COMEX+SLV are still bleeding vault stock (a thread)

COMEX 2-12

7.9K ozt (8 LGD bars) deposited in CNT

2.8M ozt (87.3t) withdrawn from CNT (353K), Delaware (11K), JPM (2.4M)

130K ozt (4t) moved from [R] to [E] in MT&B

COMEX Run Rate

Remaining Vault Stock = 376.4M ozt (92.9M [R], 283.5M [E])

Withdraw rate through last 5 days = 3.7M/day

@ 60% [R], run rate = 92.9M / 2.22M = ~42 (working) days (2 months + 2 days)

COMEX Commentary

Thursday's withdrawal matched Wednesday's lower rate compared to earlier in the week. The 5 day rolling average dropped so the run rate to "Midnight" has extended a bit.

EFP spreads

Current spot price @ 07:32: $77.36

Feb26 = ??? vs -$0.25 Yesterday

Mar26 = -$0.09 vs -$0.20

Apr26 = +$0.33 vs +$0.09

EFP Commentary

CME hasn't published updated "Last" quote for the Feb26 contract since yesterday morning. How odd! The Mar26 and Apr26 contracts shifted more positive. I can only assume the Feb26 contract is still trading within a few cents of the Mar26 contract.

SLV Share Lending

10M Shares available

Borrow fee rose from 0.39% to 0.41%

Seems to be a lot of borrowing activity lately.

SLV Assets

Blackrock:

JPM:

SLV drain goes into high gear!

PSLV

No change to units

Units/ozt ratio .3413

PSLV inventory incurred zero material change this week. PSLV needs 1.3M ozt (40.7t) to get back to the historical .3434 ratio.

ICYMI:

Monday morning in silver

China markets on holiday this week. Silver tumbled Sunday night from $77+ to sub $75, then recovered, dipped again and recovered again. Rollercoaster is almost back to where it started at around $77. (a thread)

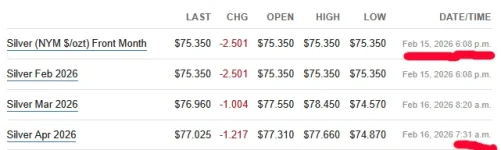

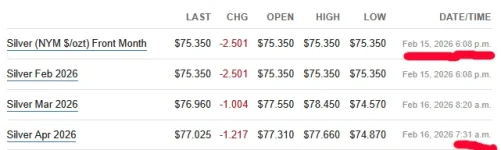

Spot price @ 07:37AM: $77.15

Feb26 = -$0.50 vs ??? Friday (spot @ 2-15 5pm: $75.85)

Mar26 = -$0.01 vs -$0.09 (spot @ 7:20AM: $76.97)

Apr26 = +$0.18 vs +$0.33 (spot @ 6:30AM: $76.85)

CME reporting for Feb26 contract still sucks. The EFP spreads for the Mar26 and Apr26 contracts appear to be tightening towards a positive gravitation point. It appears as if the Feb26 contract EFP spread is still solidly negative.

China

Closed! On holiday

India

MMTC-PAMP (retail) : $88.68 (less 10% taxes = $79.82)

Feb26 [SILVERM 5kg] : $83.59 (less 7.2% taxes = ~$77.58)

Mar26 [SILVER 30kg] : $82.29

Feb26 SILVERM - COMEX Feb26 = ~$2 (same as Friday)

Retail - Spot = $2.67 (was $3.96 Friday)

Big

SFE ($89.17) (Friday)

SFE ($89.17) (Friday)

SGE ($86.86) (Friday)

SGE ($86.86) (Friday)

Retail ($79.82)

Retail ($79.82)

MCX ($77.58)

MCX ($77.58)

spot ($77.15)

spot ($77.15)

COMEX Feb26 ($75.35) (Sunday)

COMEX Feb26 ($75.35) (Sunday)

China markets on holiday this week. Silver tumbled Sunday night from $77+ to sub $75, then recovered, dipped again and recovered again. Rollercoaster is almost back to where it started at around $77. (a thread)

EFP spreads

Spot price @ 07:37AM: $77.15

Feb26 = -$0.50 vs ??? Friday (spot @ 2-15 5pm: $75.85)

Mar26 = -$0.01 vs -$0.09 (spot @ 7:20AM: $76.97)

Apr26 = +$0.18 vs +$0.33 (spot @ 6:30AM: $76.85)

EFP Commentary

CME reporting for Feb26 contract still sucks. The EFP spreads for the Mar26 and Apr26 contracts appear to be tightening towards a positive gravitation point. It appears as if the Feb26 contract EFP spread is still solidly negative.

China

Closed! On holiday

India

MMTC-PAMP (retail) : $88.68 (less 10% taxes = $79.82)

Feb26 [SILVERM 5kg] : $83.59 (less 7.2% taxes = ~$77.58)

Mar26 [SILVER 30kg] : $82.29

Feb26 SILVERM - COMEX Feb26 = ~$2 (same as Friday)

Retail - Spot = $2.67 (was $3.96 Friday)

Big

ICYMI:

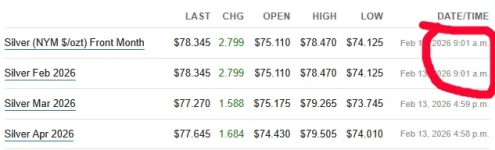

Tuesday morning in silver

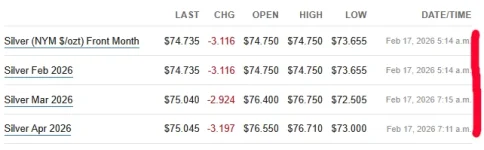

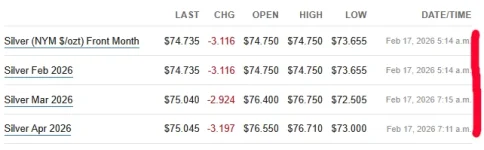

China markets on holiday this week. NYC was closed yesterday. Silver fell from $76+ to $74, then recovered, then dipped to $73, then recovered to $75 (again). Rollercoaster! (a thread)

Spot price @ 06:26AM: $75.04

Feb26 = -$0.12 vs -$0.50 Yesterday (spot @ 4:14AM: $74.86)

Mar26 = -$0.04 vs -$0.01 (spot @ 6:16AM: $75.08)

Apr26 = -$0.02 vs +$0.18 (spot @ 6:12AM: $75.07)

The EFP spreads for the 3 front months appear to be tightening towards a slightly negative gravitation point. It appears as if the Feb26 contract EFP spread is now weakly negative.

China

Closed! On holiday

India

MMTC-PAMP (retail) : $86.37 (less 10% taxes = $77.73)

Feb26 [SILVERM 5kg] : $81.38 (less 7.2% taxes = ~$75.52)

Mar26 [SILVER 30kg] : $80.15

Feb26 SILVERM - COMEX Feb26 = <$1 (tightening)

Retail - Spot = $2.69 (was $2.67 Yesterday)

Big

SFE ($89.17) (Friday)

SFE ($89.17) (Friday)

SGE ($86.86) (Friday)

SGE ($86.86) (Friday)

Retail ($77.73)

Retail ($77.73)

MCX ($75.52)

MCX ($75.52)

spot ($75.04)

spot ($75.04)

COMEX Feb26 ($74.74) (2 hours old quote)

COMEX Feb26 ($74.74) (2 hours old quote)

China markets on holiday this week. NYC was closed yesterday. Silver fell from $76+ to $74, then recovered, then dipped to $73, then recovered to $75 (again). Rollercoaster! (a thread)

EFP spreads

Spot price @ 06:26AM: $75.04

Feb26 = -$0.12 vs -$0.50 Yesterday (spot @ 4:14AM: $74.86)

Mar26 = -$0.04 vs -$0.01 (spot @ 6:16AM: $75.08)

Apr26 = -$0.02 vs +$0.18 (spot @ 6:12AM: $75.07)

EFP Commentary

The EFP spreads for the 3 front months appear to be tightening towards a slightly negative gravitation point. It appears as if the Feb26 contract EFP spread is now weakly negative.

China

Closed! On holiday

India

MMTC-PAMP (retail) : $86.37 (less 10% taxes = $77.73)

Feb26 [SILVERM 5kg] : $81.38 (less 7.2% taxes = ~$75.52)

Mar26 [SILVER 30kg] : $80.15

Feb26 SILVERM - COMEX Feb26 = <$1 (tightening)

Retail - Spot = $2.69 (was $2.67 Yesterday)

Big

ICYMI:

Even with China closed its still clear there is a VERY large buyer here still standing in and buying. They attacked what 3-5 different times over the day and just about each one was bought in the $72 range.

After all.... someone has been buying contracts and taking Huuuuge Delivery here in the US. Would be nice to know whom but they are still there.

After all.... someone has been buying contracts and taking Huuuuge Delivery here in the US. Would be nice to know whom but they are still there.

Viking

Yellow Jacket

Yesterday (2-17) in silver

China markets on holiday this week. Silver fell from ~$75 to $72 then rose overnight to just under $76. Below the surface, COMEX+SLV vault stock are

(a thread)

(a thread)

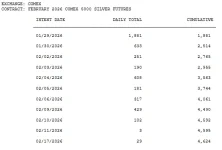

Zero ozt deposited

4.4M ozt (138.8t) withdrawn from Asahi (459K), Brinks (1M), CNT (674K), JPM (1.9M), Loomis (324K)

19K ozt (0.6t) moved from [E] to [R] in Loomis

764K ozt (23.8t) moved from [R] to [E] mostly in CNT

Remaining Vault Stock = 372M ozt (92.2M [R], 279.8M [E])

Withdraw rate through last 5 days = 3.748M/day

@ 60% [R], run rate = 92.2M / 2.25M = ~41 (working) days (2 months + 1 days)

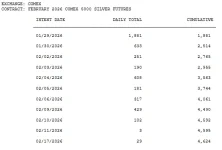

Feb26 contract cumulative deliveries = 4,624

Feb26 contract equivalent ozt = 23,120,000

Actual withdrawals in Feb ozt = 34,921,152.52

So far, withdrawals are 151% of Feb26 delivery requests!

Highly unusual!

Highly unusual!

Friday's withdrawal matched Mon & Tue high rate. The 5 day rolling average up slightly. COMEX fire hose running full blast.

Current spot price @ 05:28: $75.93

Feb26 = -$0.78 vs -$0.12 Yesterday (spot @ 12:50PM Feb17: $72.78)

Mar26 = -$0.01 vs -$0.04 (spot @ 5:20AM: $75.96)

Apr26 = +$0.32 vs -$0.02 (spot @ 5:14AM: $76.12)

CME reporting for Feb26 contract still awful. EFP spreads for Mar26 holding near zero and Apr26 now positive. With Feb26 EFP spread firmly negative, I would assume COMEX fire hose will remain at full blast. With withdrawals outpacing contract delivery requests, maybe EFP spread doesn't matter?

10M Shares available

Borrow fee remains at 0.41%

Either there was no borrowing activity yesterday, or IB just isn't reporting it.

Blackrock: 7.8M shares

7.8M shares

JPM: 7M ozt (219.8t)

7M ozt (219.8t)

Highest one day drain of SLV vault stock since October 15! Feb-tober strikes again!

No change to units

No change to ozt

Units/ozt ratio .3413

PSLV sleeping through February (no material change since Feb 5). PSLV still needs 1.3M ozt (40.7t) to get back to the historical .3434 ratio.

China

SGE/SFE closed for the week (Chinese New Year holiday)

India

MMTC-PAMP (retail) : $87.14 (less 10% taxes = $78.43)

Feb26 [SILVERM 5kg] : $82.06 (less 7.2% taxes = ~$76.15)

Mar26 [SILVER 30kg] : $81.04

Feb26 SILVERM - COMEX Feb26 = >$4

>$4

Retail - Spot = $2.50

$2.50

Big

SFE ($89.17) (Friday)

SFE ($89.17) (Friday)

SGE ($86.86) (Friday)

SGE ($86.86) (Friday)

Retail ($78.43)

Retail ($78.43)

MCX ($76.15)

MCX ($76.15)

spot ($75.93)

spot ($75.93)

COMEX Feb26 ($72.00) (~17 hours old quote)

COMEX Feb26 ($72.00) (~17 hours old quote)

- Feb26 EFP spread still negative

- COMEX

(LBMA

(LBMA )

)

- SLV

(LBMA

(LBMA )

)

- PSLV needs 1.3M ozt

China markets on holiday this week. Silver fell from ~$75 to $72 then rose overnight to just under $76. Below the surface, COMEX+SLV vault stock are

COMEX 2-13

Zero ozt deposited

4.4M ozt (138.8t) withdrawn from Asahi (459K), Brinks (1M), CNT (674K), JPM (1.9M), Loomis (324K)

19K ozt (0.6t) moved from [E] to [R] in Loomis

764K ozt (23.8t) moved from [R] to [E] mostly in CNT

COMEX Run Rate

Remaining Vault Stock = 372M ozt (92.2M [R], 279.8M [E])

Withdraw rate through last 5 days = 3.748M/day

@ 60% [R], run rate = 92.2M / 2.25M = ~41 (working) days (2 months + 1 days)

COMEX Feb26

COMEX Feb26

Feb26 contract cumulative deliveries = 4,624

Feb26 contract equivalent ozt = 23,120,000

Actual withdrawals in Feb ozt = 34,921,152.52

So far, withdrawals are 151% of Feb26 delivery requests!

COMEX Commentary

Friday's withdrawal matched Mon & Tue high rate. The 5 day rolling average up slightly. COMEX fire hose running full blast.

EFP spreads (EST)

Current spot price @ 05:28: $75.93

Feb26 = -$0.78 vs -$0.12 Yesterday (spot @ 12:50PM Feb17: $72.78)

Mar26 = -$0.01 vs -$0.04 (spot @ 5:20AM: $75.96)

Apr26 = +$0.32 vs -$0.02 (spot @ 5:14AM: $76.12)

EFP Commentary

CME reporting for Feb26 contract still awful. EFP spreads for Mar26 holding near zero and Apr26 now positive. With Feb26 EFP spread firmly negative, I would assume COMEX fire hose will remain at full blast. With withdrawals outpacing contract delivery requests, maybe EFP spread doesn't matter?

SLV Share Lending

10M Shares available

Borrow fee remains at 0.41%

Either there was no borrowing activity yesterday, or IB just isn't reporting it.

SLV Assets

Blackrock:

JPM:

Highest one day drain of SLV vault stock since October 15! Feb-tober strikes again!

PSLV

No change to units

No change to ozt

Units/ozt ratio .3413

PSLV sleeping through February (no material change since Feb 5). PSLV still needs 1.3M ozt (40.7t) to get back to the historical .3434 ratio.

China

SGE/SFE closed for the week (Chinese New Year holiday)

India

MMTC-PAMP (retail) : $87.14 (less 10% taxes = $78.43)

Feb26 [SILVERM 5kg] : $82.06 (less 7.2% taxes = ~$76.15)

Mar26 [SILVER 30kg] : $81.04

Feb26 SILVERM - COMEX Feb26 =

Retail - Spot =

Big

- Feb26 EFP spread still negative

- COMEX

- SLV

- PSLV needs 1.3M ozt

ICYMI:

Last week in silver (in metric tons):

SGE silver vault - ??? (No report yet - China on holiday)

SFE silver vault - 3.6

3.6

SLV London vault - 149.3

149.3

PSLV silver vault - 0.0007 (lol)

0.0007 (lol)

COMEX silver stock - 575.2

575.2

LBMA silver stock - ??? (no daily or weekly data because LBMA is run by dinosaurs)

Global net change (less LBMA + SGE):

Feb 9-13 = 720.8993

720.8993

Feb 2-6 = 22.6

22.6

Jan 26-30 = 1,000.77

1,000.77

Jan 19-23 = 374.4

374.4

...

China's SGE usually reports the vault stock for the previous week about this time, but as they are on Chinese New Year holiday, I don't think they are publishing the report this week. We'll have to wait until next week to see if they posted an inflow.

The SFE posted a small inflow for last week. While small, it stops the bleeding from the previous three weeks of outflows.

PSLV just posted a small 23 ozt net adjustment last week. PSLV appears to be hibernating for what's left of the winter.

Last week marks the 6th week in a row for the COMEX to drain profusely (~300+ tons) and the draining is still accelerating (last week was ~69% higher than the average weekly drain in January). The February drain is very unusual.

SLV started last week with a couple of small inflow days and then reversed the gains on Thursday and drained heavily on Friday.

One can only imagine what chaos might be unfolding in the LBMA's London vault system right now. We can only imagine because the dinosaurs at the LBMA do not provide daily/weekly reporting of their vault stock like every other market and major fund in the world.

SGE silver vault - ??? (No report yet - China on holiday)

SFE silver vault -

SLV London vault -

PSLV silver vault -

COMEX silver stock -

LBMA silver stock - ??? (no daily or weekly data because LBMA is run by dinosaurs)

Global net change (less LBMA + SGE):

Feb 9-13 =

Feb 2-6 =

Jan 26-30 =

Jan 19-23 =

...

China's SGE usually reports the vault stock for the previous week about this time, but as they are on Chinese New Year holiday, I don't think they are publishing the report this week. We'll have to wait until next week to see if they posted an inflow.

The SFE posted a small inflow for last week. While small, it stops the bleeding from the previous three weeks of outflows.

PSLV just posted a small 23 ozt net adjustment last week. PSLV appears to be hibernating for what's left of the winter.

Last week marks the 6th week in a row for the COMEX to drain profusely (~300+ tons) and the draining is still accelerating (last week was ~69% higher than the average weekly drain in January). The February drain is very unusual.

SLV started last week with a couple of small inflow days and then reversed the gains on Thursday and drained heavily on Friday.

One can only imagine what chaos might be unfolding in the LBMA's London vault system right now. We can only imagine because the dinosaurs at the LBMA do not provide daily/weekly reporting of their vault stock like every other market and major fund in the world.

In a YouTube video posted today, @RoadtoRoota claims that India Import data for January reports India imported $2B worth of silver in January. He estimates that to be ~20M ozt (622 metric tons) of silver. I have not double checked his work, but assuming that is correct or at least in the ballpark, it adds a lot of color to my previous comments on LBMA vault flow for January. If the ~1,370t of COMEX silver did go to the LBMA, and the LBMA exported similar amounts of silver to China as India, that would account for nearly all of the January COMEX silver.

Edit: That's 622t all sources. That would be just under the import total for last November:

India reportedly (per Metals Focus) imported :

~480 metric tons from the UK (~1,600 tons total all sources) in October

~390 metric tons from the UK (~750 tons total all source) in November

~70 metric tons from the UK (~370 tons total all source) in December

Source video:

Edit: That's 622t all sources. That would be just under the import total for last November:

India reportedly (per Metals Focus) imported :

~480 metric tons from the UK (~1,600 tons total all sources) in October

~390 metric tons from the UK (~750 tons total all source) in November

~70 metric tons from the UK (~370 tons total all source) in December

Source video:

Last edited:

Yesterday (2-18) in silver

China markets on holiday this week. Silver rose ~$76 to $77 then rose overnight to ~$79 before drifting back to just under $78. Below the surface, COMEX+SLV vaults still draining like

(a thread)

(a thread)

Zero ozt deposited (again!)

3.2M ozt (98.3t) withdrawn from CNT (912K), HSBC (305K), JPM (1.9M - again!)

3.4M ozt (104.6t) moved from [R] to [E] in Asahi (587K), Brinks (345K), Loomis (541K), StoneX (1.3M), et al

Remaining Vault Stock = 368.8M ozt (88.8M [R], 280M [E])

Withdraw rate through last 5 days = 3.51M/day

@ 60% [R], run rate = 88.8M / 2.1M = ~42 (working) days (2 months + 2 days)

Feb26 contract cumulative deliveries = 4,639

Feb26 contract equivalent ozt = 23,195,000

Actual withdrawals in Feb ozt = 38,082,934.46

So far, withdrawals are 164% of Feb26 delivery requests!

Highly unusual!

Highly unusual!

Tuesday's 3.2M ozt withdrawal was actually ~1M ozt less than Friday's and it brought the 5 day moving average down slightly but enough to extend the run rate estimate by 2 days. COMEX fire hose still running full blast.

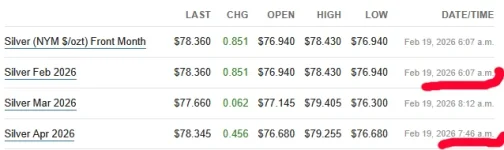

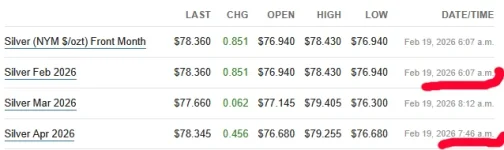

Current spot price @ 08:20: $77.95

Feb26 = -$0.24 vs -$0.78 Yesterday (spot @ 06:08: $78.60)

Mar26 = -$0.13 vs -$0.01 (spot @ 08:12: $77.79)

Apr26 = +$0.18 vs +$0.32 (spot @ 07:46: $78.17)

Feb26 EFP spread still negative. Mar26 & Apr26 shifted slightly negative. With COMEX withdrawals outpacing contract delivery requests, maybe EFP spread doesn't matter any more?

10M Shares available

Borrow fee rose from 0.41% to 0.46%

Plenty of shares available to plunder, some activity yesterday as the borrowing fee moved around a bit.

Blackrock: 6.4M shares

6.4M shares

JPM: 5.8M ozt (180.4t)

5.8M ozt (180.4t)

Day two for extreme SLV vault stock drain. The last time SLV drained this extreme was October when lease rates were ~20%. AFAIK, lease rates aren't that high right now. Very strange!

No change to units

No change to ozt

Units/ozt ratio .3413

PSLV continues sleeping through February (no material change since Feb 5). PSLV still needs 1.3M ozt (40.7t) to get back to the historical .3434 ratio.

China

SGE/SFE closed for the week (Chinese New Year holiday)

India

MMTC-PAMP (retail) : $89.03 (less 10% taxes = $80.13)

Feb26 [SILVERM 5kg] : $84.38 (less 7.2% taxes = ~$78.30)

Mar26 [SILVER 30kg] : $83.16

Feb26 SILVERM - COMEX Feb26 = -$0.06

-$0.06  (margin change working?)

(margin change working?)

Retail - Spot = $2.18

$2.18

Big

SFE ($89.17) (Friday)

SFE ($89.17) (Friday)

SGE ($86.86) (Friday)

SGE ($86.86) (Friday)

Retail ($80.13)

Retail ($80.13)

COMEX Feb26 ($78.36) (~2 hours old quote)

COMEX Feb26 ($78.36) (~2 hours old quote)

MCX ($78.30)

MCX ($78.30)

spot ($77.95)

spot ($77.95)

- Feb26 EFP spread still negative

- COMEX

(LBMA

(LBMA )

)

- SLV

(LBMA

(LBMA )

)

- PSLV needs 1.3M ozt

China markets on holiday this week. Silver rose ~$76 to $77 then rose overnight to ~$79 before drifting back to just under $78. Below the surface, COMEX+SLV vaults still draining like

COMEX 2-17

Zero ozt deposited (again!)

3.2M ozt (98.3t) withdrawn from CNT (912K), HSBC (305K), JPM (1.9M - again!)

3.4M ozt (104.6t) moved from [R] to [E] in Asahi (587K), Brinks (345K), Loomis (541K), StoneX (1.3M), et al

COMEX Run Rate

Remaining Vault Stock = 368.8M ozt (88.8M [R], 280M [E])

Withdraw rate through last 5 days = 3.51M/day

@ 60% [R], run rate = 88.8M / 2.1M = ~42 (working) days (2 months + 2 days)

COMEX Feb26

COMEX Feb26

Feb26 contract cumulative deliveries = 4,639

Feb26 contract equivalent ozt = 23,195,000

Actual withdrawals in Feb ozt = 38,082,934.46

So far, withdrawals are 164% of Feb26 delivery requests!

COMEX Commentary

Tuesday's 3.2M ozt withdrawal was actually ~1M ozt less than Friday's and it brought the 5 day moving average down slightly but enough to extend the run rate estimate by 2 days. COMEX fire hose still running full blast.

EFP spreads (EST)

Current spot price @ 08:20: $77.95

Feb26 = -$0.24 vs -$0.78 Yesterday (spot @ 06:08: $78.60)

Mar26 = -$0.13 vs -$0.01 (spot @ 08:12: $77.79)

Apr26 = +$0.18 vs +$0.32 (spot @ 07:46: $78.17)

EFP Commentary

Feb26 EFP spread still negative. Mar26 & Apr26 shifted slightly negative. With COMEX withdrawals outpacing contract delivery requests, maybe EFP spread doesn't matter any more?

SLV Share Lending

10M Shares available

Borrow fee rose from 0.41% to 0.46%

Plenty of shares available to plunder, some activity yesterday as the borrowing fee moved around a bit.

SLV Assets

Blackrock:

JPM:

Day two for extreme SLV vault stock drain. The last time SLV drained this extreme was October when lease rates were ~20%. AFAIK, lease rates aren't that high right now. Very strange!

PSLV

No change to units

No change to ozt

Units/ozt ratio .3413

PSLV continues sleeping through February (no material change since Feb 5). PSLV still needs 1.3M ozt (40.7t) to get back to the historical .3434 ratio.

China

SGE/SFE closed for the week (Chinese New Year holiday)

India

MMTC-PAMP (retail) : $89.03 (less 10% taxes = $80.13)

Feb26 [SILVERM 5kg] : $84.38 (less 7.2% taxes = ~$78.30)

Mar26 [SILVER 30kg] : $83.16

Feb26 SILVERM - COMEX Feb26 =

Retail - Spot =

Big

- Feb26 EFP spread still negative

- COMEX

- SLV

- PSLV needs 1.3M ozt

ICYMI:

Ah — lunar new year. China's out of the picture this week.