There has been some chatter on the Reditt community board Wallstreetbets that they may go to silver like they did like they did GameStop. Some want to try to screw JP Morgan, some looking for safe haven. I have been on there suggesting they buy physical and take possession not go to paper silver. I would hope other PM Buggers will do the same.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Silver on Wallstreetbets

- Thread starter Chigg

- Start date

Welcome to the Precious Metals Bug Forums

Welcome to the PMBug forums - a watering hole for folks interested in gold, silver, precious metals, sound money, investing, market and economic news, central bank monetary policies, politics and more.

Why not register an account and join the discussions? When you register an account and log in, you may enjoy additional benefits including no Google ads, market data/charts, access to trade/barter with the community and much more. Registering an account is free - you have nothing to lose!

Hey they are gonna break JP Morgan, just like we were gonna in 2011 ...........

Yeah buy silver and take posession, we'll show em.

Hopefully theyve got Max Keiser on the team

this article from Dec 2010 could be reprinted with the date changed to 2020 -

www.theguardian.com

www.theguardian.com

Yeah buy silver and take posession, we'll show em.

Hopefully theyve got Max Keiser on the team

this article from Dec 2010 could be reprinted with the date changed to 2020 -

Want JP Morgan to crash? Buy silver | Max Keiser

Max Keiser: The campaign to buy silver and force JP Morgan into bankruptcy could work, because of the liabilities accrued by its short-selling

Yes I recall reading how JPM had repositioned and were now long but they would only be doing this if silver was going to be allowed to 'find its market price' and from where I sit ( still down 15% after 10 years ) this has yet to happen ......

Mind games at every level ......... Trump's probably behind it then

Thing is though, someone must be short silver if there's approx 250 paper claims on every real ounce

Mind games at every level ......... Trump's probably behind it then

Thing is though, someone must be short silver if there's approx 250 paper claims on every real ounce

Retail sites for silver have been overwhelmed with demand for bars and coins, suggesting the frenzy that roiled commodities markets last week is spilling over into physical assets.

Dealers including Money Metals, SD Bullion, JM Bullion and Apmex said over the weekend they were unable to process orders until Asian markets opened because of unprecedented demand. Buying continued on Monday, and spot silver and futures jumped to breach $30 an ounce.

“Pretty much physical silver is almost all gone in terms of live inventory,” Tyler Wall, president and chief executive officer at SD Bullion, said in a Bloomberg TV interview. “Currently we’re seeing the premium -- the price you pay over spot to get actual physical silver in your hands -- is skyrocketing. Most stuff on our website’s at least 30% over spot and we can’t source it for much less than that right now from our wholesalers.”

...

Silver Coin Sites Seize Up as Buying Frenzy Takes Hold

Retail sites for silver have been overwhelmed with demand for bars and coins, suggesting the frenzy that roiled commodities markets last week is spilling over into physical assets.

... With the developments over the last few days of investors shifting away from paper silver and taking delivery of physical silver, the whole market construct for precious metals is changing. ...

#SilverSqueeze: Physical Silver Shortage vs. Paper Silver

Severe physical silver shortages are developing and physical silver is disconnecting with the silver paper markets.

I read the above and wondered if folks playing in the paper silver markets are really shifting away at all, or if the retail market has just been overwhelmed by WSB players. If the former, silver could really exlpode if the paper markets implode. If the latter, silver's bump is likely to be small and short lived until supply chains catch up with new demand.

Last edited:

This post may contain affiliate links for which PM Bug gold and silver discussion forum may be compensated.

Sorry about the wording of my original post. Recent health issues and new meds making it difficult to concentrate. I will admit I do not understand a lot of the intricacies of the markets, but anything that pushes price up I support.

You will get there rblong2us, my break even price is $25.50.

You will get there rblong2us, my break even price is $25.50.

A lot has been written about the silver markets with respect to manipulation, JPM, shorting, etc. I suspect that WSB peeps are expecting another Gamestop where buying eletronic units will magically create wealth.

The only way for longs to break the futures market hold on PMs is to either buy physical retail or to buy commodity contracts and insist on delivery. There needs to some sustained demand for physical to stress the system like we saw in the gold market when the Comex nearly broke and had to vacuum all of Switzerland's refining production (and backstop with LBMA inventory).

You were/are right to advise WSB peeps to buy physical. Stressing retail as has been done is starting a bottom up reaction. It will be fun if short positions get spooked and unwind.

The only way for longs to break the futures market hold on PMs is to either buy physical retail or to buy commodity contracts and insist on delivery. There needs to some sustained demand for physical to stress the system like we saw in the gold market when the Comex nearly broke and had to vacuum all of Switzerland's refining production (and backstop with LBMA inventory).

You were/are right to advise WSB peeps to buy physical. Stressing retail as has been done is starting a bottom up reaction. It will be fun if short positions get spooked and unwind.

I need an approximate US$38 per troy bounce to break even ChiggYou will get there rblong2us, my break even price is $25.50.

I timed my purchase exquisitely and was caught up in the Max Keiser 'to the moon' hype of 10 years ago ..........

Fortunately my gold purchases have covered the losses in silver (-:

And curiously, I'm not sure what I would do if silver hit $40 ......

10 years of looking at significant losses kinda makes me want to get shot of it but if it really has the potential that has been promised by so many,

perhaps another 10 years will be needed ..........

Its all good training in detachment though (-:

Dave Jerry

Banned

- Messages

- 2

- Reaction score

- 0

- Points

- 16

When we plan to invest in gold, we need a fair amount of investment, but we can start with less investment for silver. For example, a 1 oz silver bar value is less as compared to gold. In the upcoming trend, people like to use Digital Gold or investing in gold online.

... Is that it or is this just the opening salvo ?

From what I can see, retail silver got wiped out (dealers have no inventory). But there wasn't any push in the futures market. The large short orders that came in driving the price down is likely TPTB making a statement. I don't think the WSB gadflies are going to have the stamina to continue vacuuming up retail silver until the trickle up affects the futures market.

Well, I found out that the WSB silver movement created it's own Reddit room:

www.reddit.com

www.reddit.com

There are ~18.2K people participating at the moment. Reading through the posts is interesting. Looks like they might be more determined than I gave them credit for.

Reddit - Dive into anything

There are ~18.2K people participating at the moment. Reading through the posts is interesting. Looks like they might be more determined than I gave them credit for.

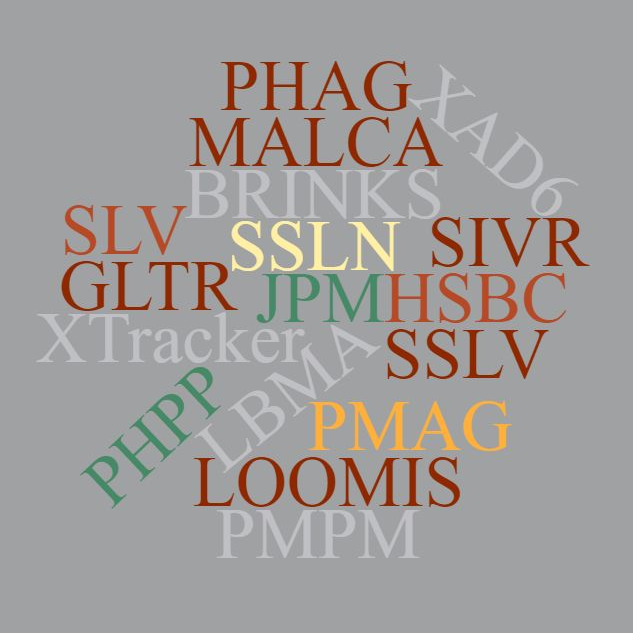

With the ongoing #SilverSqueeze and huge associated dollar inflows into silver-backed Exchange Traded Funds (ETFs), it is now time to look at which of these ETFs store their silver in the LBMA vaults in London, England, and to calculate how much physical silver these combined funds store in those London vaults.

...

Because out of the 1.08 billion ounces of silver (33,609 tonnes) that the LBMA claims is stored in the London vaults (as per latest LBMA data to end of December 2020), a whooping 83.3% or 28,007 tonnes (900.42 million ozs) is already accounted for by these ETFs. This is based on ETF holdings as of end of day 5 February 2021.

Add in another 22.22 million ozs (691.3 tonnes) of silver held by Bullion Vault (BV) and Gold Money (GM) in the same London vaults, and there are a massive 28,698 tonnes (or 922.65 million ozs) of silver accounted for in the combined ETFs and in the BV/GM holdings. That’s 85.4% of all the silver that the LBMA claims is in the London vaults.

ETFs / ETCs / Transparent holdings store 28,698 tonnes of Silver in LBMA London vaults, over 85% of all the silver in LBMA London. Sources – Provider websites

This leaves only 4,911 tonnes of silver from the LBMA total of 33,609 tonnes that is not already accounted for. That’s a mere 14.6% of total London vaulted silver stocks. The criticality of the situation was even more acute based on end of day data from 3 February 2021, when based on the same calculation approach, there was only 4,366.7 tonnes of silver in the LBMA vaults (13% of the total) that were not accounted for by silver ETF and other transparent silver holdings. On that day, a full 87% of all the silver in London was held the ETFs and other transparent holdings.

...

85% of Silver in London Already Held by ETFs

In addition to SLV, another 13 ETFs store silver in LBMA vaults, holding 85% of all the silver in London.

WallStreetSilver going to buy 5,000 tonnes of silver? That's 160,753,700 troy ounces or roughly $4,420,726,750 at $27.5/toz.

Last edited:

This post may contain affiliate links for which PM Bug gold and silver discussion forum may be compensated.

eerrr

so the approx '18200 participating at the moment' are gonna spend an average of $243 000 each

in order to purchase a non existent 5000 tonnes of silver ????

Where did the 5000 tonnes figure come from ?

so the approx '18200 participating at the moment' are gonna spend an average of $243 000 each

in order to purchase a non existent 5000 tonnes of silver ????

Where did the 5000 tonnes figure come from ?

...

Where did the 5000 tonnes figure come from ?

See BullionStar report referenced in my last post. They reported LBMA silver inventory as reported in December 2020 and ETF holdings as reported more recently (Feb 2021). Assuming LBMA didn't add any silver to the vaults from December, BullionStar estimates they had 4,366.7 tonnes that wasn't owned by ETFs, PSLV, etc. I rounded up on the assumption that the LBMA may have added to their inventories.

BTW, WallStreetSilver group now lists 21.4K participants.

So 'not accounted for' means its available i.e. for sale ?

I suppose at the right price my BV silver would be for sale though .......

For the big boyz $ 4.4 billion is not a big number but for WallStreetSilver it will be a test

Perhaps Elon could step in and buy it all (-;

I suppose at the right price my BV silver would be for sale though .......

For the big boyz $ 4.4 billion is not a big number but for WallStreetSilver it will be a test

Perhaps Elon could step in and buy it all (-;

saw this comment from Michael Ballinger

Yeah we saw premiums in physical back in the summer when things got tight but once things got moved around it all settled down again. Maybe watching premiums and GSR as per the above comment is the way ?

The Importance of Stealth Investing, And How NOT To Trade Silver

www.silverdoctors.com

I have always treated the Gold Silver ratio as the best tool for judging the longer-term health of the precious metals markets. If the GSR trends up over an extended period, it is usually an omen of trouble for both gold and silver. Since the lunacy of the Covid Crash took gold and silver to Generational Buying Opportunities in miners and metals, once silver found its footing in late April 2020, the GSR has been in a powerfully bullish descent that continues to scream “New Highs” as the year unfolds.

One of the classic trademarks of a gold market gathering steam is a silver market outperforming gold, and that it has been doing without fail

Yeah we saw premiums in physical back in the summer when things got tight but once things got moved around it all settled down again. Maybe watching premiums and GSR as per the above comment is the way ?

#SilverSqueeze causing ETFs to amend their prospectuses due to expected price volatility and inability to source sufficient physical metal.

www.bullionstar.com

www.bullionstar.com

ETF Firm Warns Buying Silver Will Harm Hedge Funds & Banks

You know the #SilverSqueeze is for real when a silver ETF panics that a surge in demand could hurt hedge funds & banks.

Last edited:

This post may contain affiliate links for which PM Bug gold and silver discussion forum may be compensated.

I was reading a bit on https://old.reddit.com/r/Wallstreetsilver/ (old, because my computer is old and new reddit doesn't work so well). Seems like there is still a good bit of enthusiasm that they are going to break the COMEX.

This was reposted on ZH after being taken down by Reddit -

www.zerohedge.com

www.zerohedge.com

considering how disparaging some of the long term gold and silver pundits are about the new wave of day traders, some of these new kids seem to be pretty well up to speed with things .........

Silver Squeeze post goes viral on WallStreetBets | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

considering how disparaging some of the long term gold and silver pundits are about the new wave of day traders, some of these new kids seem to be pretty well up to speed with things .........

The author of that piece makes some assumptions/predictions that might be a bit "koolaidish", but hopefully the thesis pans out.

AFAIK, open interest continues to decline every day until the last day before they are locked in. Harvey et al highlight large open interest positions all the time and they always shrink to nothingburgers by the last day.

u/Ditch_the_DeepState posted this a short while ago:

I did enjoy this bit:

I didn't check his numbers/math, but it's an interesting comparison.

To the moon!

...

February 2021 has had 9.95 million ounces delivered through 2-18, and there are still 1.83 million ounces in open interest. Anyone still sitting in a contract this late in the month wants delivery, so we can safely assume Feb. deliveries will end above 11 million, and closer to 12 million. ...

AFAIK, open interest continues to decline every day until the last day before they are locked in. Harvey et al highlight large open interest positions all the time and they always shrink to nothingburgers by the last day.

... March is gearing up to potentially be an earth-shattering month for delivery requests that could send silver soaring. March in the previous 3 years has averaged 26.79 million ounces delivered. If this year's month of March experienced the same 422% increase in deliveries that occurred in February, that would represent ~140 million ounces delivered. Enough to completely drain the COMEX registered stocks. If typical contract roll-forward behavior persists, we are actually on track to hit around that number. The chart below shows how March is on track to finish the month with between 30-40k contracts demanding delivery (each contract represents 5,000 oz). The chart is courtesy of u/Ditch_the_DeepState who does an awesome job with these.

...

u/Ditch_the_DeepState posted this a short while ago:

March COMEX contract open interest declines to 17,000 contracts ...

I did enjoy this bit:

...

There is another asset that has been in the news recently that is over 55k in price (WSB bans mentioning it, I'm not trying to pump it, just use it for an example). There are only ~21 million of these items that will ever be mined, and they are valued for their scarcity and deflationary tendency. For every ten of these things which shall not be named there is only one 1000oz commercial silver bar, and each bar costs roughly half of what 1 of the things that shall not be named costs.

...

I didn't check his numbers/math, but it's an interesting comparison.

...

Silver is more common than gold but spread rather thin in the earth's crust so it isn't mined directly in large quantities. It's more typically a byproduct of mining for other raw materials. The lack of dedicated silver mines means that silver today is mined at only an 8-1 ratio to gold despite naturally occurring at roughly 18.75-1 ratio. Silver is currently trading at a 66-1 ratio to gold, and gold hasn't even been rising lately. In the 2010-2011 run, we got down to a 30-1 ratio, and if people begin to worry about inflation and consider silver a monetary hedge, there's nothing stopping silver from getting to its natural ratio of 18.75-1 or even lower considering the industrial demand combined with the lower 8-1 production ratio.

These lower ratios combined with higher gold prices in the future mean that silver can realistically get above $50 in short order, possibly even above $100 and if you think the monetary system is really headed downhill, even up to the outrageous forecasts of $500+ from the likes of Patrick Karim on Twitter. Note that Patrick posts various charts all the time and his most recent forecast are $182 silver by 2023. Love your charts Patrick (give this man a follow).

...

To the moon!

As is often the case, there is a lot of hype regarding the impact the #SilverSqueeze movement might have on the delivery process at COMEX in March. The purpose of this post is not to discourage you, but instead brace you for how the month is likely to play out.

...

More: https://www.sprottmoney.com/blog/Ahead-of-March-COMEX-Silver-Deliveries-Craig-Hemke-Feb-23-2021

Yes I saw Turds post before I saw that Wall Street Bets post.

What we may be seeing is an attempt by various interests to aquire physical in the event there is a shortage ( kinda self fulfilling prophecy )

And regardless of who it is, as long as the demand for delivery continues to rise at the COMEX, then we can realistically expect price to be effected.

What we may be seeing is an attempt by various interests to aquire physical in the event there is a shortage ( kinda self fulfilling prophecy )

And regardless of who it is, as long as the demand for delivery continues to rise at the COMEX, then we can realistically expect price to be effected.

...

Surprisingly, the LBMA report acknowledges that strong inflows into silver-backed ETFs in late January and early February, if they had persisted, could have led to the LBMA London vaults running out of acceptable (good delivery) silver bars for the ETFs. ...

LBMA Acknowledges Silver Buying Frenzy & Shortage Fears

The LBMA acknowledges the Silver Squeeze and confirms the risk that London ETFs could have faced a lack of supply.

Looks like the WSB crowd wasn't able to sustain the buying long enough, but they got pretty close.

Last edited:

This post may contain affiliate links for which PM Bug gold and silver discussion forum may be compensated.

I see that theres a new attempt to 'break the morgue'

www.sprottmoney.com

www.sprottmoney.com

It will be interesting to see if it works any better than last time and might even allow me a break even moment )-:

A Time to Fight Back

It will be interesting to see if it works any better than last time and might even allow me a break even moment )-:

Ronan Manly called out the LBMA on their bullshit and they capitulated.

More:

www.bullionstar.com

www.bullionstar.com

In a shocking retraction, the bullion bank dominated London Bullion Market Association (LBMA) has just announced that it has been overstating LBMA silver vault holdings by a massive 3,300 tonnes of silver.

...

More:

LBMA Misleads Silver Market With False Claims

LBMA silver holdings in London vaults have been overstated by 3300 tonnes. Is this incompetence or a case of fraud?

Last edited:

This post may contain affiliate links for which PM Bug gold and silver discussion forum may be compensated.

...

Thursday, U.K. Royal Mint reported a 540% increase in the bullion silver bar sales compared to last year.

The Royal Mint also said that its one-ounce silver Britannia 2021 coin saw sales increase 100% between March and April, compared to last year.

...

Physical demand for silver took off in February this year after a group of traders, organized through social media, tried and failed to induce a short-squeeze in the marketplace. However, since then, analysts have said that silver demand remains strong, with investors looking to capitalize on the precious metals industrial demand as the global economy continues to recover from the COVID-19 pandemic.

...

U.K. Royal Mint sees 540% increase in silver bar demand

Kitco News' general-interest stories takes a look at what is making headlines in the marketplace and how that is impacting precious metals prices

www.kitco.com

namangarg.m

Banned

- Messages

- 2

- Reaction score

- 0

- Points

- 1

Silver Bullion Market is one of the most manipulated on earth. Any short squeeze in silver paper shorts would be EPIC. We know billion banks are manipulating gold and silver to cover real inflation.

All of the best mines for silver have already been depleted in recent years. There is a severe supply shortage developing. At the same time, demand is skyrocketing. Solar panels, electric cars, electronics and many other products need more silver than ever.

Both the industrial case and monetary case, debt printing has never been more favorable for the No. 1 inflation hedge Silver.

Inflation adjusted Silver should be at $1,000 instead of 25$.

Why not squeeze $SLV to real physical price.

Think about the Gainz. If you don't care about the gains, think about the banks like JP MORGAN you'd be destroying along the way.

Tldr- Corner the market. Gold Ventures thinks its possible to squeeze $SLV, FUCK AFTER SEEING $AG AND $GME EVEN I THINK WE CAN DO IT. BUY $SLV GO ALL IN TH GAINZ WILL BE UNLIMITED. DEMAND PHYSICAL IF YOU CAN. FUCK THE BANKS.

If the brokerages close trading on $SLV or various silver miners, we can continue to squeeze the market by purchasing physical silver at online or local silver/gold dealers. It all trickles into COMEX to squeeze supply.

All of the best mines for silver have already been depleted in recent years. There is a severe supply shortage developing. At the same time, demand is skyrocketing. Solar panels, electric cars, electronics and many other products need more silver than ever.

Both the industrial case and monetary case, debt printing has never been more favorable for the No. 1 inflation hedge Silver.

Inflation adjusted Silver should be at $1,000 instead of 25$.

Why not squeeze $SLV to real physical price.

Think about the Gainz. If you don't care about the gains, think about the banks like JP MORGAN you'd be destroying along the way.

Tldr- Corner the market. Gold Ventures thinks its possible to squeeze $SLV, FUCK AFTER SEEING $AG AND $GME EVEN I THINK WE CAN DO IT. BUY $SLV GO ALL IN TH GAINZ WILL BE UNLIMITED. DEMAND PHYSICAL IF YOU CAN. FUCK THE BANKS.

If the brokerages close trading on $SLV or various silver miners, we can continue to squeeze the market by purchasing physical silver at online or local silver/gold dealers. It all trickles into COMEX to squeeze supply.