You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

#silversqueeze

- Thread starter pmbug

- Start date

-

- Tags

- silversqueeze

Welcome to the Precious Metals Bug Forums

Welcome to the PMBug forums - a watering hole for folks interested in gold, silver, precious metals, sound money, investing, market and economic news, central bank monetary policies, politics and more.

Why not register an account and join the discussions? When you register an account and log in, you may enjoy additional benefits including no Google ads, market data/charts, access to trade/barter with the community and much more. Registering an account is free - you have nothing to lose!

That report shows the number of contracts that will stand for delivery. It doesn't indicate that delivery has already been effected.

It shows how many (of the July contracts I presume wanted or stood for delivery). Because its a July contract and June don't trade anymore. Perhaps actually delivering the metal takes a month, I don't know.

So, the 9,344 contracts that you noted are the cumulative number of July contracts that wanted delivery. It hasn't happened yet though and they all have to wait in line at the end of the month? An odd system but they wanted to make it as difficult as possible.

That's my understanding of it. Further to the point, those numbers represent contracts that made a declaration of intent. After the deadline, there could still be contracts that didn't settle or roll over. They also end up in the waiting for delivery queue as I understand it. 9344 may not be the final tally.

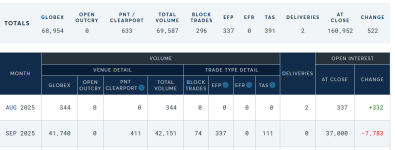

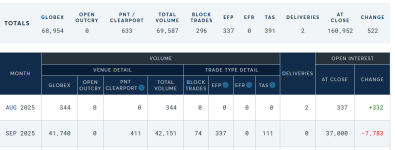

Just bumping this as we are getting towards the end of the month. Its been quite in Silver and Platinum from what I could tell this month. Gold however still went strong on deliveries. There was someone who bought here Friday wanting immediate delivery. Looks like a lot of Sep contracts are rolling out but I don't know, is 37,000 a large number for a regular delivery month?

... Looks like a lot of Sep contracts are rolling out but I don't know, is 37,000 a large number for a regular delivery month?

Is that gold or silver? Per sluicebrother's chart, gold had 4,234 contracts stand for delivery in September 2024 and silver had 5,099. So yeah, 37,000 would be huge either way if they stood for delivery.

Sorry that was Silver's delivery and OI chart.

Odd movements today. It is near the end of month and likely delivery / options expirations and notices. But the miners did not buy it at all and headed down... They are clearly fighting the Silver price.

I smell some problems cooking.

I smell some problems cooking.

I thought somebody farted?They are clearly fighting the Silver price.

I smell some problems cooking.

... Per sluicebrother's chart, ... stand for delivery in September 2024 and silver had 5,099. So yeah, 37,000 would be huge either way if they stood for delivery.

JP Morgan took most of it? Man they stink but don't put it past them to leave the other banks bagholding.

pmbug said:The tweets by @SRSroccoReport and @KingKong9888 got me curious, so I went back through my archive of COMEX silver stock reports and tabulated the withdrawn numbers for July and August and compared that against the number of contracts that stood for delivery. I will note that I missed capturing the data for July 10 and August 27, so my numbers may not be 100% accurate, but should be good enough for government work...

July 2025

* 12,154,240 toz were withdrawn

* 9,344 contracts stood for delivery representing 46,720,000 toz

* withdrawn represented ~26% of contracts that stood for delivery

August 2025

* 2,334,026 toz were withdrawn

* 2,192 contracts stood for delivery representing 10,960,000 toz

* withdrawn represented ~21.3% of contracts that stood for delivery

pmbug said:Back in December/January, when the first round of Trump tariff fears hit the market (before it was clarified that gold and silver bullion were to exempt), EFP spreads blew out and metal flowed heavily from London to New York.

Tariff fears (and EFP spreads) eased on April 2 when exemption policy was clarified. Metal still flowed into COMEX vaults, but LBMA claimed that their vaults were no longer seeing outflows.

Today their isn't any tariff fear driving the metals, but the silver EFP spread is blowing out again. This should encourage bullion banks to move physical metal from London to New York again.

Additionally, the SGE (China) premium to London is also on the rise again albeit less dramatically than the COMEX futures-London spot EFP spread. This should also be encouraging metal to flow from London to China.

It remains an open question as to just how much is left in the well (LBMA vaults). If you trust in their overall vault stock total published once a month number, they claimed to have ~4,642 metric tons of silver free float available at the start of August.

However, SLV and other ETFs have been reporting large increases (over 2,700 metric tons total) to their vault stock this month which is typically just a book entry change of ownership of metal in the London vaults (ie. they have likely been eating at the LBMA's free float all month).

Reports of silver imports from Switzerland appear to be almost two orders of magnitude less than what the ETFs were eating (just ~48 metric tons in July).

The LBMA is due to publish their once a month stock report in a few days. I will be amazed if their report doesn't reflect a drain on the available free float.

It really seems like circumstances are pointing to the LBMA running out of available silver stock in the very near future.

Platinum back to taking the lead today it seems. Looking good.

pmbug said:From December '24 through August '25, 106,106,423 ozt of silver have been withdrawn from COMEX vaults while contracts that stood for delivery represented 328,565,000 ozt.

It's possible that some actors that stood for delivery one month without actually withdrawing the silver may have sold the silver in a later month, but if we take the difference, there were 222,458,577 ozt that were "delivered" and not withdrawn.

The COMEX currently has ~200MM ozt in Registered and ~318MM ozt in Eligible vaults. The delivered but not withdrawn Dec to Aug silver represents up to (it's an upper bound) ~43% of the current silver stock in COMEX vaults.

This silver could eventually be withdrawn or resold. Meanwhile, the owner is paying storage (and possibly handling and insurance) fees while the silver sits in the COMEX vault system. Per Grok:

"Yes, if there is no intention to withdraw the silver, rolling the contract forward to a future month is generally more cost-effective than standing for delivery. Rolling involves closing the current position and opening a new one, incurring brokerage commissions (typically $50–$100 total for both legs) and the basis differential (contango or backwardation impact, often equivalent to 0.1–0.5% per month depending on market conditions). However, it allows for leveraged exposure with only margin capital tied up (around 10–20% of contract value). Standing for delivery requires full payment of the contract value (e.g., approximately $200,000 for a 5,000-oz contract at $40/oz), plus one-time delivery-related fees ($300–$500 including broker and exchange charges), and ongoing storage fees (roughly $1.50–$2.50 per contract per month, or about 0.01–0.02% annually of value). This ties up full capital, creating higher opportunity costs (e.g., forgone interest on the full amount), without the benefits of leverage. Delivery might still be preferred in scenarios like backwardation (where rolling could be costly) or to mitigate perceived counterparty risks in futures, but for pure exposure without withdrawal, rolling is more efficient. "

COMEX is much more transparent with their silver stock reporting than the dinosaurs at the LBMA, but their arcane warrant/delivery system still obscures the true picture of available stock in their vault system. Interesting times!

MEA CULPA! I made a mistake my previous post/tweet. the SLV+ETFs 2,700 tons figure is a "year to date" and not "this month" figure. SLV added roughly 250 metric tons in August. Total ETF inflows were around 541 metric tons. So it's just one order of magnitude greater than the Swiss July import figure of 48 metric tons. Still significant, but not as dramatic as I had incorrectly stated.

So Rob Gottlieb posted on X that the current EFP spread blowout in silver is due to lingering tariff uncertainty because Trump never did issue that Executive Order that he proclaimed was forthcoming on social media. I questioned him about it and he responded:

A Section 232 investigation is conducted under the authority of the Trade Expansion Act of 1962, as amended. The purpose of the investigation is to determine the effect of imports on the national security. Investigations may be initiated based on an application from an interested party, a request from the head of any department or agency, or may be self-initiated by the Secretary of Commerce.

The Secretary’s report to the President, prepared within 270 days of initiation, focuses on whether the importation of the article in question is in such quantities or under such circumstances as to threaten to impair the national security. The President can concur or not with the Secretary’s recommendations, and take action to “adjust the imports of an article and its derivatives” or other non-trade related actions as deemed necessary.

...

Quantum tariffs. Maybe here, maybe there, or maybe not. We just don't know.

COMEX silver stock report for activity on 9-2 shows 2.164MM ozt withdrawn and 0 received. Also, a massive 8.257MM ozt were moved from registered to eligible (no longer available for settling trades/deliveries). That's ~4.3% of the registered stock. We'll see if today is just an anomaly, but that seems like some significant movements.

So it looks like they've got a little middle of the night 8pm smack started. The miners, especially the small ones gave it away today. All it will end up doing is give us a nice retest of the $40 breakout.

Taking a closer look at this EFP spread thing (between spot and futures or London and NYC depending). This does NOT look like it has much to do with tariffs at all. It IS an indication of problems delivering physical Silver in my opinion. Look at where the ~delivery notice for each month falls. Notice a trend? I do. It also looks like this month was a bigger problem but its also a delivery month.

I think your chart is looking at too large a picture. The tariff uncertainty is something that has resurfaced very recently - like in just the last few days. I guess whatever direction the Trump admin had given to Customs or whoever for not imposing tariffs on precious metals had a short window of effect. I'm not 100% clear on why it came back suddenly, but it's fact that Trump never signed an executive order clarifying the issue as promised. I'm watching the COMEX silver stock report daily to see if there is evidence to support the claim that imports/inflows are stopping. Yesterday's report was supportive of the assertion.

Tariffs don't jump up and down right at the end of the month. Now, perhaps its tariffs causing the shortage or delivery problems, but I think that its much more likely just subterfuge.

Tariffs don't jump up and down right at the end of the month. ...

The issue wasn't tariffs being adjusted up and down. It's whether or not they applied to gold and silver - whether they were exempt or not. Rhetoric from the administration: exempt. Report from department that actually implements tariffs: not exempt. I suppose recent judicial rulings might also be playing a part in the uncertainty on tariff requirements.

Sure, but none of that occurs regularly at the end of the month... Just doing the math here and that just seems like random explanations to explain movements during the day.

Again, you are taking comments that were describing an imminent situation, applying them to a large window of time encompassing months and then concluding the comments have no merit because they don't fit your data set. No one claimed they would. The EFP spreads didn't start blowing out again until just a few days ago.

Ya, right during the Comex delivery days. Specifically, the 7,702 contracts delivered on 8/28. Look at the EFP spreads. It literally started surging the evening of 08/27. I don't have the specific delivery dates going back the rest of that period though. See post #369 above.

More evidence that the metal demand is All coming from Bankers and Industry while Retail is selling (cause they are Broke and Dumb). ...

August update (situation has intensified apparently):

... Business is brisk right now. Uh

8:22 incredibly brisk. Uh the uh refineries

8:26 and wholesalers are pinched right now,

8:29 not for funds, but for time. So, we're

8:33 hearing um examples of them expanding

8:36 their operational hours. Uh they're

8:39 gonna one specifically is now working

8:42 through the weekends uh expanding their

8:45 uh normal eight hour days just to handle

8:48 all the incoming material. Ton literally

8:52 thousands of pounds of silver are being

8:54 delivered to these folks on a regular

8:57 basis. Uh one shipment uh the other day

9:00 that the FedEx brought in was 4,000 lbs

9:03 of silver and one ground shipment to a

9:06 refinery. That's one uh and uh it's just

9:11 pouring in. Gold seems to be relatively

9:15 uh par for the course with the amount

9:17 that's coming in and payable ounces. Uh

9:19 for what I'm being told, it's just the

9:21 massive influx of silver that has hit

9:25 the uh refineries and wholesalers. I

9:28 belong to several uh professional forums

9:31 where dealers are uh try to sell or

9:35 attempt to sell uh goods to other

9:37 dealers. Uh and we're seeing uh silver

9:40 lots, just generic 999 bullion lots

9:43 going unsold at 50 cents on their spot.

9:46 That's two other dealers. So that just

9:48 tells you uh what is going on. There's

9:51 such an influx of material and it's

9:54 literally just uh it's just getting

9:55 burned. ...

Ya, right during the Comex delivery days. Specifically, the 7,702 contracts delivered on 8/28. Look at the EFP spreads. It literally started surging the evening of 08/27. I don't have the specific delivery dates going back the rest of that period though. See post #369 above.

This is staying interesting. Note that the EFP spread has come back but is staying elevated right now.

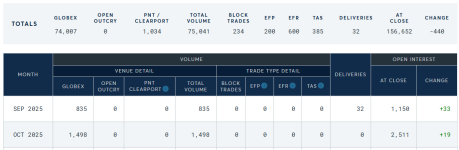

It also looks like they are having a little trouble delivering the last 2 days. For Friday there were over 1,000 contracts still open and they delivered 32. Will have to pay attention here.

If you listen to Peter Schiff he will tell you even though the DOW and S&P 500 are making new all time highs they are both in a bear market in gold terms. Back in the 90s you needed 40 ounces of Au to buy the Dow while now it's < 15. Think about that!

Real estate is also less expensive in gold terms and falling more rapidly.

Real estate is also less expensive in gold terms and falling more rapidly.

Yes, we should see a giant deflationary collapse in the fourth turning. The only question is it in Both Real and Nominal terms (unlikely) or just Real terms (ie in Gold/Silver).

pmbug said:Is SLV is the canary in the silver mine?

On August 14, the Saudi central bank's 13F filing disclosed that they had invested in SLV to the tune of 932,000 shares / $30.58MM. This may have sparked additional institutional investment interest in SLV.

On August 18, SLV added a massive 9,172,079 troy ounces (285.2 metric tons) to their vaulted stock. When SLV adds, it really just takes ownership of silver bars already in LBMA vaults, reducing LBMA free float vault stock.

By Sep 2 (from Aug 18), SLV vault stock has run down ~2.5MM troy ounces (~77.75 metric tons) and then back again to be up ~300K troy ounces (~9.3 metric tons).

On Sep 3, @GottliebRo53311 et al report that the Exchange for Physical (EFP) spread for silver (COMEX futures - LBMA spot) is blowing out again (it blew out back in Dec/Jan when the original tariff fears started) due to continued uncertainty regarding tariff exemptions. I dug deep into the issue and found that the Harmonized Tariff Schedule (HTS) schedule clearly lists silver as "free" or zero tariff, so I don't believe tariff fears are or were driving the EFP spread, but viral social media chatter can affect markets all the same.

From Sep 3-9, SLV has reported consecutive daily drawdowns on their vaulted stock totaling 9,545,311.20 troy ounces (~296.9 metric tons).

On Sep 5, the LBMA published it's pathetic, monthly silver stock "report" consisting of a single grand total of vaulted silver in the LBMA vault system. Per their report, and public disclosures from ETFs that vault their silver in the LBMA system, we deduce the supposed free float in the LBMA system at ~4,313 metric tons. However, the LBMA has misreported their vault stock by 3,000 tons in the past and there is some reason to wonder about the veracity of their current reporting (see magical metal mystery).

On Sep 8, the pool of available SLV shares for borrowing fell from 1.6MM to a low of 250K before recovering slightly to 400K. The lease rate has spiked above 5%.

It seems reasonable to conclude that the drawdown in SLV vault stock since Sep 3 is indicative of someone raiding SLV for physical silver. They have raided it to the tune of nearly 300 tons so far. That doesn't happen in a market where physical is readily available.

Has the LBMA run dry? Is free float actually zero? Will the FT publish a report on T+## delivery for silver sometime soon?

Last edited: