The European Commission wants to make it easier for commercial lenders to hold stablecoins and tokenized assets, after lawmakers pushed to discourage crypto holdings as part of a wider banking reform.

A leaked document seen by CoinDesk seeks to moderate the tough position taken by the European Parliament, which in January sought to anticipate global standards by saying banks should be required to issue one euro of capital for each euro of crypto they hold.

Lawmakers from the European Union (EU) have said they want to see the “prohibitive” restrictions to stop crypto turmoil from spilling over into the commercial banking system. Their plan includes giving crypto a 1,250% risk weight, implying a maximum possible capital requirement imposed on lenders who wish to hold digital assets.

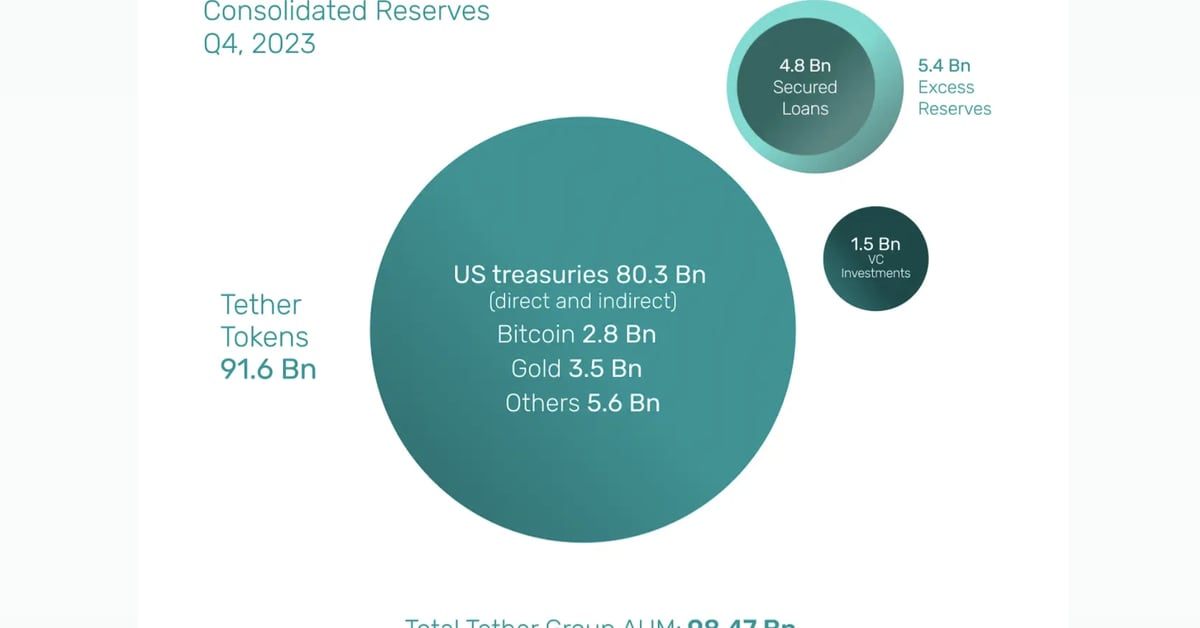

The commission's proposal, undated but issued following an April 18 meeting among negotiators, is to bring that down to a 250% risk weight for any stablecoin whose value is tied to non-fiat assets such as gold.

Tokenized assets and stablecoins based on fiat currencies such as the U.S. dollar would be treated the same as the underlying instrument, unless there’s an extra credit or market risk, the document added.

That’s in line with the bloc’s forthcoming Markets in Crypto Assets regulation, MiCA, set to take effect in July 2024, which will regulate stablecoin issuers and require them to hold appropriate reserves.

...

EU Banks Could Access Stablecoins More Easily Under Leaked Plans

The European Commission's plans could moderate a push from Parliament to discourage crypto holdings as it debates new capital requirements for banks.